Pneumatic Tube System Market Report Scope & Overview:

The Pneumatic Tube System Market size was valued at USD 2.43 Billion in 2023 and is expected to reach USD 4.44 Billion by 2032 and grow at a CAGR of 7.40% over the forecast period 2024-2032. The pneumatic tube system market is witnessing significant growth, driven by the increasing demand for efficient and automated transportation of materials in various sectors, including healthcare, retail, and manufacturing. These systems utilize compressed air to propel capsules through a network of tubes, facilitating rapid and reliable transport of documents, medications, and other small items over short distances. Recent trends in the pneumatic tube system market reflect advancements in technology and an emphasis on operational efficiency. One of the key trends is the integration of smart technology, allowing for real-time tracking and monitoring of capsule movements. This feature enhances the reliability of the systems and minimizes delays in critical environments like hospitals, where timely delivery of medications and lab specimens is vital. Additionally, the adoption of energy-efficient solutions is gaining traction, with manufacturers focusing on minimizing energy consumption while maximizing performance.

To Get More Information on Pneumatic Tube System Market - Request Sample Report

The healthcare sector remains a dominant driver of growth, as hospitals and medical facilities increasingly adopt pneumatic tube systems to streamline their internal logistics and reduce wait times. Moreover, the retail industry is also leveraging these systems to improve customer service by facilitating quick transactions and managing inventory effectively. Another trend is the rise in customization options, as organizations seek tailored solutions that meet their specific operational needs. Furthermore, as urbanization and population density increase, the demand for efficient material handling solutions is expected to grow, presenting ample opportunities for market players. With ongoing innovations and a shift toward automation, the pneumatic tube system market is poised for sustained growth, addressing the evolving logistical challenges across various industries.

MARKET DYNAMICS

DRIVERS

- The rising trend of automation in healthcare facilities boosts the demand for pneumatic tube systems, which improve the efficiency of transporting medical supplies, specimens, and medications.

The growing need for automation in healthcare suggests a major change in the approach to health care facilities, which seeks to improve productivity, keep costs down and provide staff care. Automated systems are crucial when healthcare providers look to improve efficiencies and tackle issues such as a staffing shortage or an increasing patient volume. Pneumatic tube systems have become an important part of this automation wave and are a reliable way to transport medical supplies, specimens and medications throughout healthcare facilities without the use of human personnel.

These systems consist of a network of tubes which use air pressure to transport the items from one place to another in order to reduce manual time consumption. Pneumatic tube systems improve all-around efficiency by diminishing the frequency with which staff carry out mundane tasks while giving them more time to invest in their most important aspect of patient care, patient-to-staff interaction. Moreover, the quick time-to-delivery allows essential items to be delivered on time and is especially important in emergency cases. Pneumatic tube systems, besides raising efficiency helped to guarantee safety and precision in medical item handling as well. Human factors risk associated with manual transportation are minimized while the integrity of sensitive specimens and medications is maintained. This increasing integration of innovation in healthcare facilities for improved operational aspects is likely to influence the demand generation of pneumatic tube systems as part of a more global automation wave which focuses on efficiency, safety as well as high quality patient care. This constant enhancement in healthcare logistics will result in transformation of the mode of operations within medical facilities everywhere.

- Pneumatic tube systems enhance patient safety by reducing the likelihood of human errors in transporting essential medical items, leading to better overall care quality.

The need for improved patient safety and care is a pivotal factor driving the adoption of pneumatic tube systems in healthcare facilities. In medical environments, the accuracy and speed of transporting critical items such as blood samples, medications, and medical supplies are essential for effective patient treatment. Traditional methods, which often rely on manual transport, inherently carry the risk of human error. Mistakes in labeling, delivery delays, or misplacing items can lead to severe consequences, including incorrect treatments, delayed diagnoses, or even life-threatening situations for patients.

Pneumatic tube systems offer a reliable alternative by automating the transportation process. These systems swiftly move items through a network of tubes, significantly reducing the potential for human error. Automated transport ensures that specimens and medications reach their intended destinations quickly and efficiently, which is particularly crucial in emergency situations. Additionally, these systems enhance the overall workflow within healthcare facilities, allowing staff to focus more on direct patient care rather than logistical challenges. By minimizing delays and ensuring the integrity of transported items, pneumatic tube systems contribute to a more streamlined operational process, ultimately enhancing the quality of care provided to patients. Moreover, their integration into hospital information systems allows for real-time tracking of items, further ensuring accountability and accuracy in the transportation process. This combination of speed, reliability, and reduced human error reinforces the significance of pneumatic tube systems in fostering improved patient safety and care quality within healthcare settings.

RESTRAIN

- High initial investment costs for pneumatic tube systems can discourage smaller healthcare facilities from adopting this technology due to the significant financial burden of installation and setup.

High initial investment costs represent a significant barrier to the adoption of pneumatic tube systems, particularly for smaller healthcare facilities. The installation of these systems requires substantial capital expenditure, which includes the costs of purchasing the necessary equipment, materials, and technology, as well as the expenses associated with installation and integration into existing infrastructure. For smaller hospitals or clinics operating on limited budgets, this high upfront cost can be daunting. Moreover, pneumatic tube systems require specialized installation and may necessitate structural modifications to the facility, such as the installation of tubing and other components throughout the building. This complexity adds to the financial burden, often making it unfeasible for smaller organizations that may prioritize immediate operational needs over long-term investments. Additionally, the ongoing maintenance and operational costs can further strain the budgets of these facilities, as they must allocate resources for regular servicing, repairs, and potential upgrades to keep the systems running efficiently.

MARKET SEGMENTATION ANALYSIS

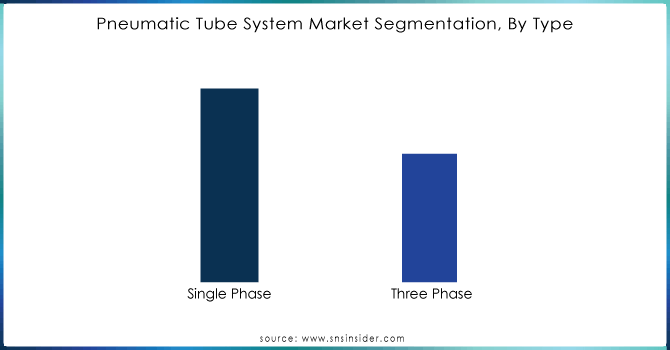

By Type

The single-phase pneumatic tube system segment led the industry with the largest revenue share of 62.30% in 2023, Single-phase power transfer switches are perfect for smaller setups and buildings that don't need the high power and capacity of three-phase systems. This allows them to be a cost-efficient option for small hospitals, clinics, pharmacies, and small to medium-sized businesses.

Do You Need any Customization Research on Pneumatic Tube System Market - Inquire Now

By End Use

The medical & healthcare segment dominated the PTS market in 2023 with a revenue share of 52.06%. PTS greatly decrease the amount of time required for transporting medical specimens, medications, and documents in comparison to manual methods. This quickness is crucial for prompt diagnoses and treatments, especially in urgent scenarios, improving overall patient care.

REGIONAL ANALYSIS

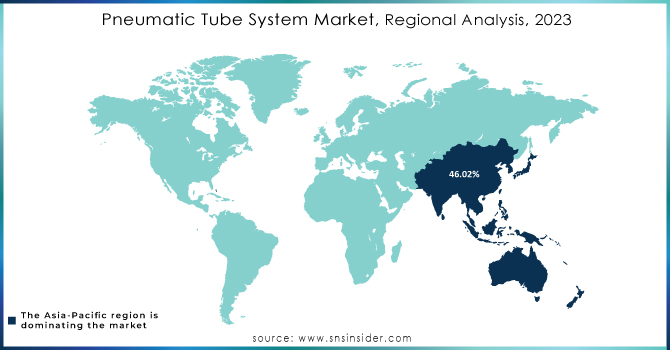

Asia Pacific had the highest market share of 46.02% in 2023. The increasing demand in this region is fueled by urbanization, industrialization, and the expansion of healthcare infrastructure. China, Japan, and India are experiencing a rise in the use of POS systems in hospitals, financial institutions, and retail industries to enable quicker and safer transportation of goods and documents. The emphasis on smart city projects and the requirement for effective logistics solutions are driving the increased use of advanced PTS technologies in this area.

KEY PLAYERS

Some of the major key players of Pneumatic Tube System Market

- Swisslog Holding AG: (Pneumatic tube systems, automation solutions)

- Siemens AG: (Pneumatic tube systems, industrial automation solutions)

- Evacuation Technologies International, Inc.: (Pneumatic tube systems, transportation solutions)

- FESTO AG & Co. KG: (Pneumatic components, automation technology)

- Pevco Systems International Inc.: (Pneumatic tube systems, transport solutions)

- Cashcom International Inc.: (Pneumatic tube systems, cash handling solutions)

- Aerocom GmbH: (Pneumatic tube systems, transport systems)

- GATT Automation GmbH: (Pneumatic transport systems, automation solutions)

- SAF Automation GmbH: (Pneumatic systems, automation solutions)

- TCM International A/S: (Pneumatic tube systems, logistics solutions)

- DEMAG Cranes & Components GmbH: (Pneumatic tube systems, lifting equipment)

- Monorail Systems: (Pneumatic transport systems, monorail solutions)

- Tornado Systems: (Pneumatic tube systems, delivery solutions)

- Vacu-duct Systems: (Pneumatic tube systems, material handling solutions)

- Duluth Trading Company: (Pneumatic tube systems, delivery solutions)

- Legrand: (Pneumatic tube systems, electrical and cable management solutions)

- Atex Systems: (Pneumatic tube systems, transport solutions)

- DHL Supply Chain: (Pneumatic tube systems, logistics solutions)

- Komatsu Ltd.: (Pneumatic systems, industrial automation solutions)

- Hitachi, Ltd.: (Pneumatic tube systems, automation solutions)

RECENT DEVELOPMENTS

In March 2024: Swisslog Healthcare and Cisco Systems have partnered to create IoT-enabled pneumatic tube systems for hospitals, with the goal of improving the monitoring and safety of medical samples and pharmaceuticals.

In January 2024: Aerocom introduced a new rapid pneumatic tube system designed for large-scale industrial and healthcare facilities, with the ability to transport items at speeds reaching 25 meters per second.

Januray 2023: Quirepace now provides Intralogistics solutions for NHS beyond just Pneumatic Tube; as part of NHS Pathology services reconfiguration, both NHS and external lab providers have acknowledged the special capabilities of the Unicar ETV system, which can transport items up to 15kg that are not suitable for PTS.

May 2023: KGMU Trauma Center is planning to implement a pneumatic tube system for transporting pathology test samples from the wards to the laboratory.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.43 Billion |

| Market Size by 2032 | USD 4.44 Billion |

| CAGR | CAGR of 7.40% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By System Type (Single Phase, Three Phase) • By End-use (Medical & Healthcare, Commercial, Industrial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Swisslog Holding AG, Siemens AG, Evacuation Technologies International, Inc., FESTO AG & Co. KG, Pevco Systems International Inc., Cashcom International Inc., Aerocom GmbH, GATT Automation GmbH, SAF Automation GmbH, TCM International A/S, DEMAG Cranes & Components GmbH, Monorail Systems, Tornado Systems, Vacu-duct Systems, Duluth Trading Company, Legrand, Atex Systems, DHL Supply Chain, Komatsu Ltd., Hitachi, Ltd. |

| Key Drivers | • The rising trend of automation in healthcare facilities boosts the demand for pneumatic tube systems, which improve the efficiency of transporting medical supplies, specimens, and medications. • Pneumatic tube systems enhance patient safety by reducing the likelihood of human errors in transporting essential medical items, leading to better overall care quality. |

| RESTRAINTS | • High initial investment costs for pneumatic tube systems can discourage smaller healthcare facilities from adopting this technology due to the significant financial burden of installation and setup. |