Micro Flute Paper Market Size:

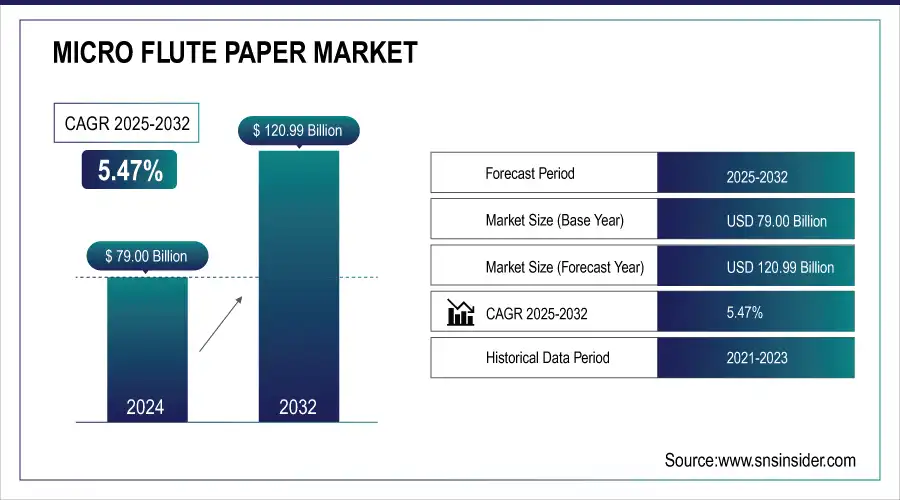

The Micro Flute Paper Market size was USD 79.00 billion in 2024 and is expected to Reach USD 120.99 billion by 2032 and grow at a CAGR of 5.47% over the forecast period of 2025-2032.

Get E-PDF Sample Report on Micro Flute Paper Market - Request Sample Report

The micro flute paper market is witnessing notable growth due to its increasing adoption across various industries for lightweight, sustainable, and protective packaging solutions. Micro flute paper, known for its fine fluting and exceptional strength-to-weight ratio, is widely used in packaging applications, including consumer goods, electronics, food, and beverages. Its recyclability and eco-friendly attributes make it a preferred choice as companies shift toward sustainable packaging to meet environmental regulations and consumer preferences.

The market is driven by the rising demand for durable yet lightweight packaging materials that ensure product safety during transportation and storage. Additionally, the surge in e-commerce has amplified the need for protective packaging, further boosting the demand for micro flute paper. Innovations in packaging design, such as printed and customizable micro flute paper packaging, are also contributing to its growing popularity among brands aiming to enhance customer experience and branding. Trends in the market include advancements in manufacturing processes to improve the durability and visual appeal of micro flute paper. The increasing emphasis on circular economy practices has led to a focus on the use of recycled raw materials in production. Moreover, the food and beverage sector's rising adoption of micro flute paper for packaging delicate and temperature-sensitive items underscores its versatility.

Market Size and Forecast:

-

Market Size in 2024 USD 79.00 Billion

-

Market Size by 2032 USD 120.99 Billion

-

CAGR CAGR of 5.47% From 2025 to 2032

-

Base Year 2024

-

Forecast Period 2025-2032

-

Historical Data 2021-2023

Key Micro Flute Paper Market Trends:

-

Rising adoption of eco-friendly packaging materials due to bans on single-use plastics and stricter environmental regulations.

-

Growing demand for lightweight yet durable packaging driven by the rapid expansion of the global e-commerce sector.

-

Increasing investments in sustainable materials and advanced manufacturing processes to enhance product efficiency.

-

Advancements in printing technologies boosting customization and branding opportunities in packaging.

-

Strong consumer preference for biodegradable and recyclable packaging aligning with corporate sustainability goals.

Micro Flute Paper Market Growth Drivers:

-

The growing demand for eco-friendly, biodegradable, and recyclable packaging, driven by sustainability initiatives and regulatory mandates, is propelling the growth of the micro flute paper market.

The micro flute paper market is experiencing significant growth, driven by the rising global demand for sustainable packaging solutions. With increasing awareness of environmental issues and stringent regulations against single-use plastics, businesses are shifting toward eco-friendly alternatives like micro flute paper. Its biodegradable and recyclable properties make it a preferred choice for industries aiming to align with green initiatives and meet consumer expectations for sustainable practices. The market is further fueled by trends such as the growing e-commerce sector, where lightweight yet durable packaging is crucial. Advancements in printing technologies have enhanced the customization and branding potential of micro flute paper, increasing its appeal. According to market trends, the sector is projected to grow at a healthy CAGR, supported by increasing investments in sustainable materials and innovations in manufacturing processes. As companies prioritize sustainability, micro flute paper is poised to become a cornerstone of eco-friendly packaging solutions.

Micro Flute Paper Market Restraints:

-

The micro flute paper market faces profitability challenges due to volatile paper pulp prices driven by supply chain disruptions, global demand shifts, and strict environmental regulations.

The volatility in raw material prices, particularly paper pulp, poses a significant challenge for the micro flute paper market. Factors such as supply chain disruptions, fluctuating global demand, and stringent environmental regulations contribute to price instability. Natural disasters, geopolitical tensions, and labor shortages can further exacerbate these fluctuations, making it difficult for manufacturers to maintain consistent production costs.

For businesses operating in this sector, these unpredictable price shifts directly impact profitability and force companies to adjust pricing strategies, often leading to higher costs for end-users. Small and medium enterprises (SMEs) are particularly vulnerable, as they lack the financial flexibility to absorb sudden price increases. Additionally, the emphasis on sustainable practices has led to stricter regulations on raw material sourcing, adding further pressure. Addressing these challenges requires robust supply chain management, strategic sourcing, and investments in alternative materials to mitigate the impact of raw material price volatility.

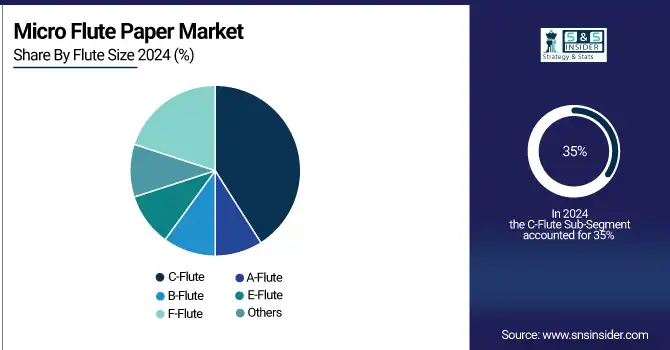

Micro Flute Paper Market Segment Analysis:

By Flute Size

The C-Flute segment dominated with the market share over 35% in 2024, primarily due to its exceptional versatility and extensive use in various packaging applications. Known for its optimal balance of cushioning and structural strength, C-Flute is highly effective in protecting products during shipping and handling. Its thickness and durability make it ideal for creating sturdy boxes, ensuring product safety and maintaining packaging integrity. Additionally, C-Flute is widely favored for display packaging, as it provides ample surface area for branding and printing while maintaining a robust structure. These characteristics make it a preferred choice across industries, reinforcing its dominance in the market.

By Application

The Food and Beverages segment dominated with the market share over 32% in 2024. This dominance can be attributed to the high demand for sustainable and lightweight packaging materials in the food and beverage industry. Micro flute paper is widely used for packaging food products like bakery items, ready-to-eat meals, and beverages, owing to its strength, cushioning properties, and eco-friendliness.

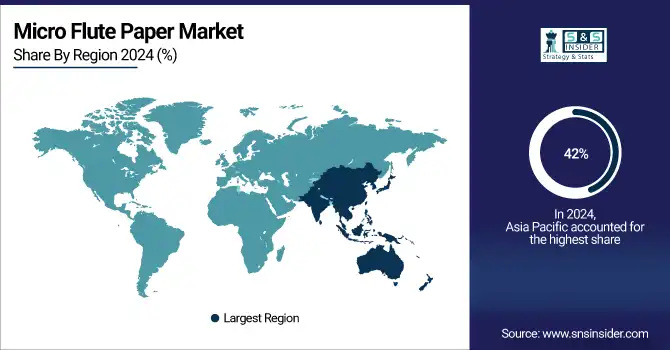

Micro Flute Paper Market Regional Analysis:

Asia Pacific Micro Flute Paper Market Insights

The Asia-Pacific region dominated with the market share over 42% in 2024, driven by its robust packaging industry and rapidly expanding e-commerce sector. Countries like China and India are key players, with numerous manufacturers catering to both domestic and global demand. The region's strong production capabilities, combined with the growing consumer demand for sustainable and eco-friendly packaging solutions, support its dominance. Additionally, Asia-Pacific’s large population and thriving retail sector further fuel the need for lightweight, cost-effective, and environmentally responsible packaging. These factors collectively contribute to the region's continued market leadership in micro flute paper production and consumption.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

North America Micro Flute Paper Market Insights

North America is experiencing rapid growth in the Micro Flute Paper Market, primarily due to the increasing demand for eco-friendly and sustainable packaging solutions. With heightened awareness about environmental concerns, industries are shifting toward recyclable and biodegradable materials, making micro flute paper a popular choice. The retail and foodservice sectors, which require durable yet lightweight packaging, are expanding quickly, further driving market demand. Additionally, technological advancements in paper manufacturing and innovative designs are improving the quality and efficiency of micro flute paper, making it an attractive option for packaging needs.

Europe Micro Flute Paper Market Insights

Europe is witnessing strong growth in the micro flute paper market, driven by stringent environmental regulations, rising sustainability initiatives, and increasing demand for eco-friendly packaging. The thriving e-commerce sector and consumer preference for recyclable, lightweight solutions further accelerate adoption, while advancements in paperboard manufacturing enhance market competitiveness.

Latin America (LATAM) and Middle East & Africa (MEA) Micro Flute Paper Market Insights

The LATAM and MEA micro flute paper markets are growing steadily, fueled by rising industrialization, expansion of retail and e-commerce, and increasing awareness of sustainable packaging. Government initiatives promoting eco-friendly practices, coupled with demand for cost-effective, lightweight packaging materials, are creating opportunities for market players across these emerging regions.

Micro Flute Paper Market Key Players:

Some of the major key players of the Micro Flute Paper Market

-

Novolex Holdings (Sustainable packaging solutions, paper-based packaging products)

-

Smurfit Kappa (Corrugated packaging, lightweight micro flute boards)

-

Van Genechten Packaging (Folding cartons, micro flute packaging for food and beverages)

-

DS Smith Plc (Recyclable packaging solutions, micro flute corrugated boxes)

-

Mondi Group (Eco-friendly corrugated packaging, specialty kraft paper)

-

Olmuksan International Paper (Corrugated boxes, micro flute packaging materials)

-

International Paper (Industrial packaging, lightweight corrugated boards)

-

Stora Enso (Renewable packaging materials, corrugated micro flute boards)

-

Netpak (Custom packaging, micro flute paperboard solutions)

-

WestRock Paper LLC (High-performance corrugated packaging, micro flute containers)

-

Acme Corrugated Box Co. Inc. (Custom corrugated boxes, specialty micro flute products)

-

Klabin SA (Corrugated packaging, lightweight fluted boards)

-

Georgia-Pacific (Corrugated sheets, micro flute packaging materials)

-

Nine Dragons Paper Holdings Limited (Recycled paper products, micro flute boards)

-

Oji Holdings Corporation (Eco-friendly packaging solutions, micro flute boards)

-

Cascades Inc. (Sustainable packaging products, lightweight micro flute boards)

-

Graphic Packaging International (Folding cartons, micro flute packaging for food service)

-

Pratt Industries (Recycled corrugated packaging, micro flute boxes)

-

BillerudKorsnäs (Renewable paperboard, micro flute packaging solutions)

-

Rengo Co., Ltd. (Corrugated packaging materials, lightweight micro flute boards)

Competitive Landscape for Micro Flute Paper Market:

Stora Enso is a global leader in renewable packaging solutions, actively engaged in the micro flute paper market with sustainable, lightweight, and recyclable products. Leveraging its expertise in paper and biomaterials, the company provides eco-friendly alternatives for e-commerce, retail, and food packaging, aligning with global sustainability trends and reducing environmental impact.

In 2023, Stora Enso inaugurated a new corrugated packaging manufacturing facility in De Lier, Netherlands. This facility is part of the Packaging Solutions division's Business Unit Western Europe, which was recently acquired by the De Jong Packaging Group.

Mondi Group is a leading player in sustainable packaging, offering eco-friendly micro flute paper solutions designed for durability, lightweight performance, and recyclability. The company focuses on innovative corrugated and specialty kraft products, supporting e-commerce, retail, and food industries while aligning with global sustainability goals and reducing reliance on single-use plastics.

In January 9, 2025, Mondi announced it will showcase its sustainable paper offerings at Paris Packaging Week 2025, including the newly introduced 350 g/m² grammage for perfume packaging. The company will highlight its PERGRAPHICA, IQ BOARD, and IQ GRASS + PACKAGING papers, all designed to support luxury brands in their sustainability initiatives.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 79.00 Billion |

| Market Size by 2032 | USD 120.99 Billion |

| CAGR | CAGR of 5.47% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Nylon 6, 6 Resin, Nylon 6, 6 Fiber, Adipate Esters, Polyurethane, and Others), • By Application (Plasticizers, Wet Paper Resins, Unsaturated Polyester Resins, Food Additives, Synthetic Lubricants, Coatings, and Other Applications) • By End-user Industry (Food and Beverage, Personal Care, Electrical and Electronics, Textiles, Pharmaceuticals, Automotive, Packaging, Consumer Goods, and Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles |

Novolex Holdings, Smurfit Kappa, Van Genechten Packaging, DS Smith Plc, Mondi Group, Olmuksan International Paper, International Paper, Stora Enso, Netpak, WestRock Paper LLC, Acme Corrugated Box Co. Inc., Klabin SA, Georgia-Pacific, Nine Dragons Paper Holdings Limited, Oji Holdings Corporation, Cascades Inc., Graphic Packaging International, Pratt Industries, BillerudKorsnäs, Rengo Co., Ltd. |