Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Report Scope & Overview:

Get More Information on Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market - Request Sample Report

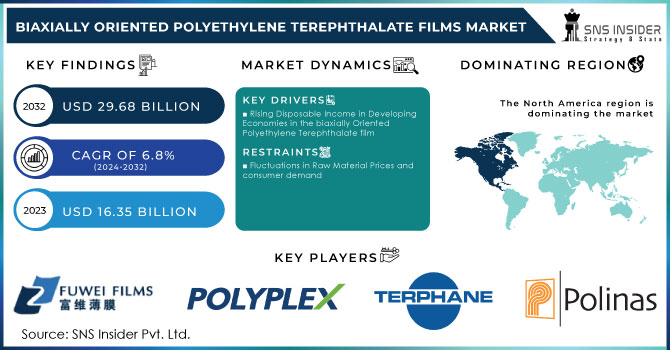

The Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market size was valued at USD 16.7 billion in 2023 and is expected to reach USD 28.4 billion by 2032 and grow at a CAGR of 6.1% over the forecast period of 2024-2032.

The Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market is characterized by dynamic factors such as increasing demand for lightweight, durable, and recyclable materials across diverse applications like food packaging, electronics, and industrial sectors. Recent advancements in film technologies and a growing preference for high-performance materials drive innovation in the market. Companies are focusing on expanding their production capacities and launching specialized products to meet evolving consumer demands. For instance, in January 2025, Polyplex Corporation announced an investment of Rs 558 crore for a new BOPET film manufacturing plant, showcasing its commitment to catering to rising global demand. Similarly, SRF Limited in November 2020 announced plans to set up a second BOPP film production line with an investment of Rs 424 crore, highlighting the trend of capacity expansion to strengthen market presence.

Manufacturers are also emphasizing the development of value-added and environmentally friendly film solutions. Uflex, in February 2024, emphasized its growing portfolio of value-added BOPET films in its quarterly update, underlining the importance of innovation for market differentiation. In October 2023, a new production plant for biaxially oriented plastic films was inaugurated in Binh Duong, Vietnam, further reflecting the industry's focus on regional expansion and technological advancements. Additionally, efforts to develop unique product offerings were evident in April 2018, when Uflex's Flex Films division introduced a soft-touch BOPET film, catering to niche applications requiring a tactile appeal. These developments demonstrate how companies are leveraging innovation, capacity expansion, and regional diversification to address the increasing demand and enhance their market competitiveness.

Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Dynamics:

Drivers:

-

Growing Preference for Lightweight, Durable, and Versatile Packaging Materials Fuels the Demand for BOPET Films Across Industries

Biaxially Oriented Polyethylene Terephthalate (BOPET) films are gaining significant attention due to their lightweight, durable, and versatile nature, which makes them ideal for various industries. In particular, packaging industries are leveraging BOPET films because of their excellent tensile strength, high tear resistance, and flexibility. The packaging of food and beverages, personal care products, and electronics has increasingly adopted BOPET films due to their ability to protect products while extending shelf life. BOPET films also provide excellent barrier properties, making them resistant to moisture, oxygen, and UV radiation, which is a critical feature for preserving product integrity. With the increasing need for packaging that not only protects products but also offers a premium appearance, BOPET films have found an expanded application range, including flexible packaging and pouches. Their transparent and glossy finish makes them an attractive option for retailers aiming to showcase products. As industries worldwide seek solutions that offer both strength and aesthetics in packaging, BOPET films are expected to continue driving demand, particularly as the trend toward premium packaging in the food, beverage, and electronics sectors intensifies.

-

Increasing Demand for Sustainable and Recyclable Packaging Solutions Drives the Growth of BOPET Films

-

Expansion of End-User Industries, Particularly in Emerging Economies, Drives the BOPET Films Market's Growth

Restraint:

-

High Production Costs and Technological Barriers Limit the Widespread Adoption of BOPET Films in Cost-Sensitive Industries

BOPET films face a key restraint in high production costs, which can make them less appealing for cost-sensitive industries. The production involves complex technologies, including biaxial orientation, requiring specialized machinery and expertise. Post-production processes like metallization, coating, and lamination also add to the cost. For industries focused on low-cost packaging, such as budget consumer goods, BOPET films may not be the preferred choice due to their higher costs. While they offer performance and sustainability benefits, their cost remains a barrier to widespread adoption. Manufacturers are working on process optimization and economies of scale to reduce costs, but this remains a challenge.

Opportunity:

-

Rising Demand for Value-Added and Customizable BOPET Films Presents New Growth Avenues in Packaging

-

Growing Demand for Electronic and Industrial Applications Presents Significant Expansion Potential for BOPET Films

While BOPET films have traditionally been used in the packaging industry, there is an increasing opportunity for their application in electronics and industrial sectors. In the electronics industry, BOPET films are used in capacitors, touchscreens, and other flexible electronic components due to their excellent dielectric properties, heat resistance, and mechanical strength. The rise of wearable electronics, flexible displays, and renewable energy technologies like solar panels has opened new growth avenues for BOPET films. As these industries evolve and demand high-performance materials, BOPET films, with their superior electrical and mechanical properties, are poised to capture a larger share of these expanding markets. Additionally, BOPET films' ability to withstand extreme temperatures and environmental conditions makes them an ideal choice for industrial applications, such as insulation materials and protective coatings. The expansion of these industries presents significant growth opportunities for BOPET film manufacturers, providing a path to diversify and enter new markets.

Challenge:

-

Challenges in Addressing the Environmental Impact of BOPET Films Amid Growing Demand for Sustainability

The environmental impact of BOPET film production presents a significant challenge. While recyclable, their manufacturing is energy-intensive and relies on petrochemicals, contributing to a high carbon footprint. As demand for greener alternatives increases, manufacturers must focus on reducing energy use, improving recycling rates, and developing more sustainable options. Educating consumers on recyclability and enhancing recycling systems are essential to meet growing sustainability expectations.

Sustainability Initiatives and Environmental Impact in the BOPET Films Market

| Company/Initiative | Sustainability Focus | Environmental Impact | Key Actions |

|---|---|---|---|

| Polyplex Corporation Ltd. | Development of eco-friendly BOPET films | Reduced carbon footprint and energy usage in production | Investment in energy-efficient production processes |

| Uflex Ltd. | Introduction of recyclable BOPET films | Reduction of non-recyclable waste and increased recyclability | Launch of recyclable BOPET films for packaging |

| Mitsubishi Polyester Film, Inc. | Focus on reducing waste and energy consumption | Lower emissions and reduced environmental pollution | Implementing advanced recycling techniques for BOPET films |

| Garware Polyester Ltd. | Sustainable film production and packaging solutions | Reduction in plastic waste and enhanced recyclability | Use of renewable energy sources in manufacturing plants |

| Fuwei Films (Holdings) Co., Ltd. | Production of biodegradable and recyclable BOPET films | Decrease in environmental footprint through better recyclability | Development of BOPET films with recycled PET content |

The BOPET films market is increasingly focused on sustainability initiatives aimed at reducing the environmental impact of production and disposal. Companies are adopting measures like introducing recyclable films, improving energy efficiency in production, and developing biodegradable alternatives. For example, Polyplex Corporation Ltd. has invested in energy-efficient production processes, while Uflex Ltd. has launched recyclable BOPET films to reduce plastic waste. Mitsubishi Polyester Film, Inc. and Garware Polyester Ltd. are both enhancing recycling capabilities and using renewable energy in their operations. Fuwei Films (Holdings) Co., Ltd. is focusing on creating biodegradable and recyclable BOPET films, aligning with global sustainability efforts. These initiatives aim to lower the carbon footprint, enhance recyclability, and contribute to a circular economy.

Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Segments

By Product Type

In 2023, Thin Films dominated the Biaxially Oriented Polyethylene Terephthalate (BOPET) films market, capturing approximately 70% of the market share. The preference for thin films can be attributed to their exceptional mechanical properties, including flexibility, strength, and lightweight characteristics, making them ideal for a variety of applications, particularly in flexible packaging. These films are widely utilized in food packaging, labels, and electronic applications due to their excellent barrier properties against moisture, oxygen, and light. The rising demand for sustainable and efficient packaging solutions has further propelled the use of thin BOPET films, as they allow for reduced material usage while maintaining durability and performance. Moreover, advancements in printing technologies have enhanced the aesthetic appeal of thin films, making them increasingly popular for branded packaging. Leading manufacturers are investing in innovations to produce thinner films that meet specific requirements for various applications, ensuring that the thin films segment continues to thrive in response to market needs. Overall, the advantages of thin films, combined with evolving consumer preferences, have solidified their position as the frontrunner in the BOPET films market.

By Thickness

The Below 15 Micron segment dominated the BOPET films market in 2023, capturing 37.2% of the market share, driven by its extensive application in lightweight packaging solutions. Films within this thickness range are particularly favored in industries requiring efficient and cost-effective packaging materials. Their lightweight nature not only reduces shipping costs but also enhances consumer convenience, making them ideal for various applications such as food packaging, labels, and wraps. The growing emphasis on sustainability has led manufacturers to seek materials that provide excellent barrier properties without excessive weight. Additionally, below 15-micron BOPET films offer superior mechanical strength, durability, and clarity, making them suitable for high-quality print applications. This thickness range aligns well with the global trend toward reducing packaging waste and improving recyclability. With increasing consumer demand for eco-friendly and innovative packaging solutions, manufacturers are focusing on optimizing the production processes of below 15-micron BOPET films to enhance performance while minimizing environmental impact. As a result, this segment's prominence is expected to continue, reflecting the broader industry shift toward lightweight and sustainable packaging options.

By Application

In 2023, the Labels segment dominated the Biaxially Oriented Polyethylene Terephthalate (BOPET) films, holding 31% of the market share, reflecting a growing demand for high-performance labeling solutions. BOPET films are widely recognized for their exceptional printability, durability, and resistance to various environmental factors, making them ideal for use in a wide range of labeling applications. The segment's growth is driven by the increasing demand for innovative packaging and labeling solutions across diverse industries, including food and beverages, cosmetics, and electronics. Brands are increasingly adopting BOPET films for labels due to their ability to withstand moisture and UV exposure while maintaining visual appeal. Moreover, the trend towards personalization and customization in product packaging has further fueled the demand for versatile BOPET films in labels, as they can be easily printed with vibrant colors and intricate designs. With the rise of e-commerce and online shopping, the need for attractive and informative labels has become even more crucial. As companies prioritize branding and customer engagement, the labels segment is expected to continue to thrive, reinforcing the significant role of BOPET films in modern packaging solutions.

By End Use Industry

The Food and Beverages industry dominated the Biaxially Oriented Polyethylene Terephthalate (BOPET) films market in 2023, accounting for 42% of the market share, underscoring the critical role of these films in modern food packaging solutions. BOPET films are highly valued in this sector for their excellent barrier properties, which protect food products from moisture, oxygen, and light, ultimately extending shelf life and maintaining product quality. As consumer preferences shift toward convenient, ready-to-eat, and packaged food products, the demand for effective and reliable packaging solutions has surged. BOPET films are increasingly being used for applications such as snack packaging, microwaveable meals, and flexible pouches, where durability and protection are paramount. Additionally, the industry is witnessing a growing emphasis on sustainability, prompting manufacturers to develop recyclable and eco-friendly BOPET films that align with environmental standards. The food and beverages sector also benefits from technological advancements in printing and packaging, which enhance the visual appeal and functionality of BOPET films. As the global demand for packaged food continues to rise, the prominence of the food and beverages industry in the BOPET films market is expected to strengthen further, driven by innovation and evolving consumer trends.

Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Regional Analysis

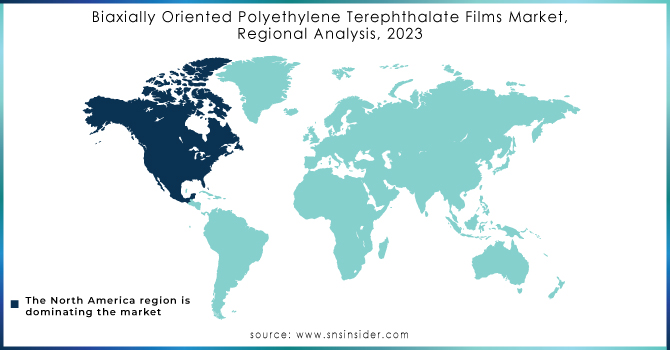

In 2023, the Asia-Pacific region dominated the Biaxially Oriented Polyethylene Terephthalate (BOPET) films market, accounting for approximately 38.3% of the market share. The region's growth can be attributed to the rapid expansion of the packaging industry, especially in countries like China, India, and Japan. China, as the largest producer and consumer of BOPET films, has seen a significant increase in demand for flexible packaging solutions driven by the booming e-commerce sector and consumer goods market. The country’s advancements in manufacturing technology and infrastructure have also bolstered its position as a leading exporter of BOPET films. India has emerged as a prominent player in the region, with a rising middle-class population and increasing urbanization contributing to greater demand for packaged food and beverages. The implementation of initiatives aimed at promoting sustainable packaging solutions further fuels market growth, as manufacturers are investing in BOPET films that offer excellent barrier properties while being recyclable. Japan, known for its high-quality packaging standards, continues to adopt BOPET films for various applications, including electronics and pharmaceuticals, thereby reinforcing the region's dominance in the global market. Additionally, increasing environmental regulations are prompting industries in these countries to shift towards sustainable packaging solutions, thus enhancing the adoption of BOPET films across various sectors.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

-

DuPont Teijin Films U.S. Limited (Mylar, Melinex, Kaladex)

-

Ester Industries Limited (BOPET Films, Specialty Polyester Films, Metalized Films)

-

Fatra A.S. (BOPET Packaging Films, Technical BOPET Films, Metallized Films)

-

Fuwei Films (Holdings) Co., Ltd. (High Gloss Films, Heat Sealable Films, Matte Films)

-

Garware Polyester Ltd (Garfilm, Suncontrol Films, Laminating Films)

-

Jiangsu Xingye Polytech Co., Ltd. (Packaging Films, Electrical Insulation Films, Optical Films)

-

Jindal Poly Films Ltd. (BOPET Films, Metallized Films, Coated Films)

-

Kolon Industries, Inc. (SHINYLITE, KOLON Films, Clear Films)

-

Mitsubishi Polyester Film, Inc. (Hostaphan, Diafoil, Lumirror)

-

POLİNAS Plastik Sanayi ve Ticaret A.S. (Polinas BOPET Films, Metallized Films, Barrier Films)

-

Polyplex Corporation Ltd. (Sarafil, Saracote, Saralam)

-

RETAL Industries Ltd. (RETAL BOPET Films, RETAL Metallized Films, RETAL Barrier Films)

-

SRF Limited (PET Films, Lumirror, Electrical Insulation Films)

-

Sumilon Industries Ltd. (Sumilon BOPET Films, Metallized Films, Coated Films)

-

Terphane LLC (Terphane Films, Sealphane, Barrier Films)

-

Toray Plastics (America), Inc. (Lumirror, Torayfan, Barrialox)

-

Uflex Ltd. (Flexpet, Flexmetpro, Flexfresh)

-

Futamura Chemical Co. Ltd. (OPET Films, Matte Films, Barrier Films)

-

TOYOBO CO. LTD. (Cosmolight, Toyobo BOPET Films, Clear Films)

Recent Developments

-

January 2025: Polyplex Corporation announced a ₹558 crore investment to build a new BOPET film manufacturing plant, aiming to meet the growing global demand for BOPET films.

-

February 2024: Uflex reported strong demand for its value-added BOPET films, highlighting the company's focus on innovation to maintain its market position amid a positive outlook for the packaging industry.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 16.7 Billion |

| Market Size by 2032 | US$ 28.4 Billion |

| CAGR | CAGR of 6.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product Type (Thin Films, Thick Films) •By Thickness (Below 15 Micron, 15-30 Micron, 30-50 Micron, Above 50 Micron) •By Application (Labels, Tapes, Wraps, Bags & Pouches, Laminates, Others) •By End Use Industry (Food and Beverages, Cosmetics & Personal Care, Electrical & Electronics, Pharmaceuticals, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Fuwei Films (Holdings) Co., Ltd., Polyplex, Mitsubishi Polyester Film, Inc., Terphane, POLİNAS, Fatra, A.S., Sumilon Industries Ltd., Jiangsu Xingye Polytech Co., Ltd., Polyplex, Jindal Poly Films Ltd., Garware Polyester Ltd., SRF Limited, DuPont Teijin Films U.S. and other key players |

| Key Drivers | •Increasing Demand for Sustainable and Recyclable Packaging Solutions Drives the Growth of BOPET Films •Expansion of End-User Industries, Particularly in Emerging Economies, Drives the BOPET Films Market's Growth |

| Restraints | •High Production Costs and Technological Barriers Limit the Widespread Adoption of BOPET Films in Cost-Sensitive Industries |