Micro Mobile Data Center Market Size & Overview:

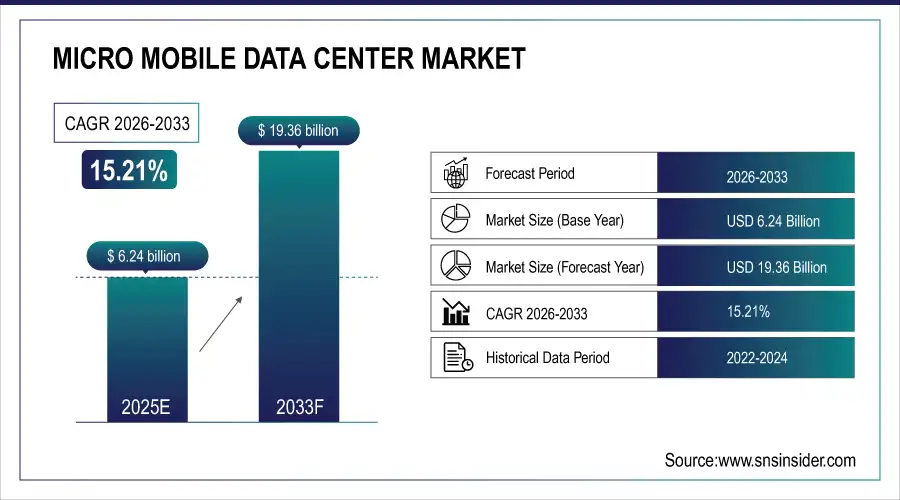

Micro Mobile Data Center Market was valued at USD 6.24 billion in 2025E and is expected to reach USD 19.36 billion by 2033, growing at a CAGR of 15.21% from 2026-2033.

The market growth is driven by rising demand for faster, localized data processing, expanding edge computing deployments, and increasing reliance on IoT, AI, and real-time analytics across industries. Growing adoption of modular and portable data center solutions in remote, temporary, and harsh environments further supports market expansion. The need for scalable, energy-efficient, and quickly deployable infrastructure is accelerating enterprise investments, strengthening the overall demand for micro mobile data center solutions.

Micro Mobile Data Center Market Size and Forecast

-

Market Size in 2025E: USD 6.24 Billion

-

Market Size by 2033: USD 19.36 Billion

-

CAGR: 15.21% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get More Information on Micro Mobile Data Center Market - Request Sample Report

Micro Mobile Data Center Market Trends

-

Rising need for low-latency data processing at network edges is driving the micro mobile data center market.

-

Growing adoption of edge computing for IoT, AI, and real-time analytics is boosting demand.

-

Expansion of remote, harsh, and space-limited deployments is fueling preference for compact, plug-and-play data center units.

-

Advancements in modular design, cooling technologies, and power efficiency are enhancing performance and scalability.

-

Increasing focus on data sovereignty and secure on-site processing is shaping market adoption.

-

Surge in digital transformation across telecom, BFSI, industrial, and retail sectors is strengthening deployment.

-

Partnerships among IT infrastructure providers, cloud vendors, and system integrators are accelerating innovation and global rollout.

Micro Mobile Data Center Market Growth Drivers:

-

Rising demand for localized and faster data processing accelerating rapid adoption of micro mobile data centers across diverse digital ecosystems

Growing demand for localized and latency-free data processing is increasing the adoption of micro mobile data centers across enterprise and industrial environments. Organizations deploying IoT, AI, and real-time analytics need compact, edge-ready systems that deliver faster, secure, and uninterrupted operations closer to data sources. This shift reduces network congestion, enhances application performance, and supports mission-critical workloads requiring instant response. Micro data centers also eliminate dependency on large centralized facilities while enabling scalable and distributed computing architectures. As digital transformation accelerates, enterprises increasingly rely on these portable solutions to handle high-volume, time-sensitive processes with improved reliability and operational efficiency.

Micro Mobile Data Center Market Restraints:

-

Limited standardization and interoperability concerns reducing flexibility and slowing deployment across multi-vendor micro mobile data center environments

Lack of standardized architecture, interface compatibility, and unified management protocols creates interoperability challenges when integrating micro mobile data centers with multi-vendor systems. Organizations operating complex digital ecosystems often struggle to ensure seamless communication between networking, security, cooling, compute, and power components. This lack of consistency increases integration risks, operational inefficiencies, and additional customization costs. Variations in form factors, environmental ratings, and performance specifications further complicate procurement and deployment decisions. As companies prefer solutions supporting plug-and-play scalability, these standardization gaps restrict broader adoption and slow market growth, especially in hybrid and geographically distributed IT environments.

Micro Mobile Data Center Market Opportunities:

-

Growing acceleration of edge computing ecosystems creating strong deployment opportunities for advanced micro mobile data center architectures

Growth in edge computing adoption across industries presents major opportunities for micro mobile data centers, as enterprises increasingly require localized processing environments for AI, IoT, robotics, automation, and analytics. The shift toward real-time decision-making and reduced reliance on centralized cloud systems supports demand for compact, modular, and secure computing units. These facilities enable scalability, rapid deployment, and tailored configurations suitable for diverse verticals. As 5G, autonomous operations, smart factories, and connected devices expand, micro mobile data centers become essential for achieving ultra-low latency, improved resilience, and decentralized processing, unlocking significant market expansion potential.

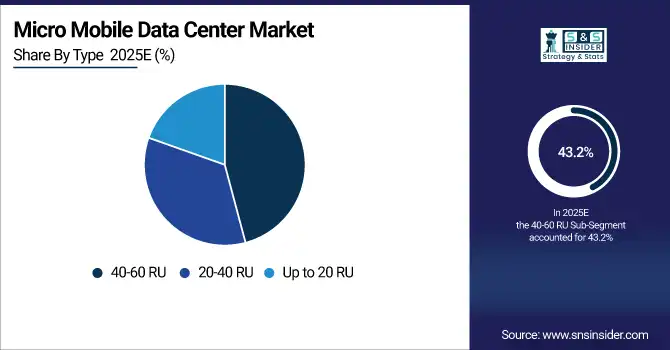

Micro Mobile Data Center Market Segment Analysis

By Type

The 40-60 RU segment dominated the market in 2025, capturing over 43.2% share due to its substantial capacity to support larger facilities. Major players like Schneider Electric, Vertiv Group Corp., and IBM provide micro mobile data centers that accommodate more than 40 RU. In June 2022, Huawei unveiled its FusionCube micro data center solution, which integrates computing, storage, and networking capabilities. This solution includes advanced cooling technology and is designed for easy deployment in edge environments, optimizing energy consumption and reducing overall operational costs

On the other hand, the 20-40 RU segment is projected to grow at fastest CAGR during the forecast period. This growth is driven by the rising demand for compact micro mobile data centers that feature advanced capabilities such as board cooling, continuous UPS, and integrated storage systems. To meet this demand, various companies are introducing 20-40 RU micro mobile data centers. For example, In March 2024, Huawei introduced the FusionEdge Mini Data Center, designed to provide robust computing and storage capabilities in a compact form factor. This mini data center complies with NEMA and IP standards, ensuring high protection against dust and moisture, making it suitable for deployment in challenging environments.

By Industry Vertical

The government and defense sector dominated the market, accounting for over 28.3% of revenue in 2025, and is expected to sustain this lead throughout the forecast period. This segment's expansion is fueled by the increasing adoption of advanced technologies, such as 5G and AI, in government operations, along with a growing demand for mobile data centers in the defense sector. Numerous companies are now launching mobile micro data centers tailored specifically for government and defense applications. A notable example is Zella DC's introduction of the Zella Fort, a ready-to-use, self-contained data storage solution designed to cater to the specific requirements of the military.

In addition, the IT and telecom segment is forecasted to achieve the highest CAGR during the forecast period. This growth is largely attributed to the rising demand for micro mobile data centers in this sector, driven by improved data security and lower latency, which are expected to play a crucial role in market expansion in the years ahead.

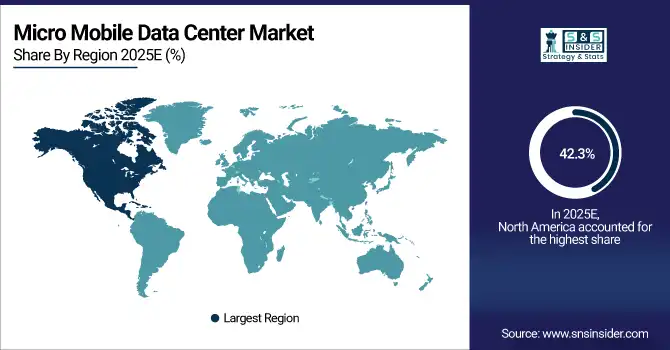

Micro Mobile Data Center Market Regional Analysis

North America Micro Mobile Data Center Market Insights

In 2025, North America dominated the market and accounting for a revenue share of more than 42.3%. This expansion can be ascribed to the widespread usage of complex technical systems and data centers across many industries, as well as to the early acceptance of cutting-edge technology. The main drivers of market expansion in this area are the early adoption of mini mobile data centers and significant expenditures in technological advances. Additionally, the growing use of mini mobile data centers in industries like BFSI, healthcare, and education helps to the expansion of the regional market.

Do You Need any Customization Research on Micro Mobile Data Center Market - Enquire Now

Asia Pacific Micro Mobile Data Center Market Insights

Asia Pacific is anticipated to grow at the highest CAGR during the forecast period. The rise of the retail industry, which is expected to have a beneficial effect on the uptake of mini mobile data centers, can be ascribed to the market growth throughout the region. Additionally, it is anticipated that government initiatives like Digital India, which aims to make the country a digitally enabled nation, will encourage the growth of micro data centers in India.

Europe Micro Mobile Data Center Market Insights

Europe is witnessing significant adoption of micro mobile data centers due to the growing need for edge computing, low-latency data processing, and support for IoT and AI applications. Enterprises are increasingly deploying modular and portable solutions in remote, industrial, and urban locations to enhance operational efficiency. Strong focus on energy-efficient and sustainable IT infrastructure, coupled with government initiatives promoting digital transformation, is further driving the growth of micro mobile data center deployments across the region.

Middle East & Africa and Latin America Micro Mobile Data Center Market Insights

Middle East & Africa and Latin America are witnessing gradual adoption of micro mobile data centers driven by expanding digital infrastructure and increasing demand for localized, low-latency computing. Industries such as oil & gas, telecom, and defense are deploying portable, modular solutions in remote and harsh environments. Growing investments in smart city projects, renewable energy integration, and edge computing initiatives are further accelerating the deployment of micro mobile data centers across these regions.

Micro Mobile Data Center Market Competitive Landscape:

Vertiv Group Corp.

Vertiv Group Corp. designs, builds, and services critical digital infrastructure solutions, including data-center hardware, power management systems, and thermal management technologies. The company focuses on delivering highly reliable, scalable, and energy-efficient solutions for edge, enterprise, and hyperscale deployments. Vertiv integrates AI-driven monitoring and modular architectures to optimize performance, reduce operational costs, and accelerate deployment timelines for modern IT and edge-compute workloads.

-

2024: Vertiv introduced the SmartAisle 3 micro-modular data-center system with built-in AI for monitoring, power/cooling management, and up to 120 kW IT load, targeting edge, healthcare, transport, and small deployments.

-

2024: Vertiv launched MegaMod CoolChip, a prefabricated high-density modular data center solution with liquid cooling, enabling AI-compute-ready infrastructure deployment up to 50% faster than traditional onsite builds.

Schneider Electric

Schneider Electric is a global leader in energy management and automation, providing integrated hardware, software, and services for data centers, industry, and infrastructure. Its EcoStruxure platform delivers intelligent, modular, and energy-efficient solutions, including prefabricated and high-density modular data centers. Schneider emphasizes sustainability, rapid deployment, and scalability, enabling enterprises to meet increasing demands from AI, edge computing, and cloud workloads while optimizing power, cooling, and operational efficiency.

-

2025: Schneider Electric expanded EcoStruxure Data Center Solutions with a prefabricated modular pod combining high-density racks, busway power, and direct-to-chip liquid cooling for AI and accelerated compute workloads.

-

2025: Schneider opened Data Center & Microgrid testing labs at its Global R&D Centre (Andover, MA) to accelerate development and validation of compact, efficient power and infrastructure solutions.

Siemens AG

Siemens AG delivers advanced digital infrastructure, energy management, and automation solutions worldwide. Its modular and prefabricated data-center technologies enable rapid, scalable deployment for enterprise, edge, and AI workloads. Siemens integrates sustainable, high-efficiency designs with medium-voltage power systems and turnkey infrastructure, helping organizations accelerate IT deployments while optimizing operational costs, energy usage, and system reliability. Siemens also partners with data-center providers to deliver customized, scalable modular solutions for modern computing needs.

-

2025: Siemens unveiled a next-generation modular edge data center solution — turnkey, prefabricated, and optimized for rapid deployment, scalability, and sustainability, targeting edge and AI workloads.

-

2024: Siemens signed a multi-year agreement with Compass Datacenters to supply custom modular medium-voltage power skid solutions for faster, cost-effective deployment of micro/modular data centers.

Hewlett Packard Enterprise (HPE)

Hewlett Packard Enterprise (HPE) provides IT infrastructure, software, and services to support modern data-center, edge, and hybrid cloud environments. HPE specializes in modular, containerized, and energy-efficient designs, integrating compute, storage, and networking with innovative cooling and power-reuse technologies. Its solutions target rapid deployment, operational efficiency, and sustainability, helping enterprises manage AI, cloud, and edge workloads while optimizing energy consumption and supporting decarbonization initiatives in the data-center sector.

-

2024: HPE partnered with Danfoss to deliver a modular data-center solution with integrated heat-recovery modules, enabling energy-efficient, containerized deployments that reuse excess heat and reduce overall power consumption.

Key Players

Some of the Micro Mobile Data Center Market Companies

-

Vertiv Group Corp.

-

IBM Corporation

-

Huawei Technologies Co., Ltd.

-

Dell Technologies

-

Cisco Systems, Inc.

-

EdgeConneX

-

Micro Focus International

-

NetApp, Inc.

-

Fujitsu Limited

-

Hewlett Packard Enterprise (HPE)

-

Rittal GmbH & Co. KG

-

Nlyte Software

-

Siemens AG

-

Mproof

-

Supermicro Computer, Inc.

-

Acer Group

-

ScaleMatrix

-

Centrica Business Solutions

| Report Attributes | Details |

| Market Size in 2025E | US$ 6.24 billion |

| Market Size by 2033 | US$ 19.36 billion |

| CAGR | CAGR of 15.21% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Up to 20 RU, 20-40 RU, 40-60 RU) • By Industrial Vertical (BFSI, IT & Telecom, Government & Defense, Oil & Gas, Manufacturing, Others) • By Organization Size (Small & Medium Enterprise, Large Enterprise) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Schneider Electric, Vertiv Group Corp.,IBM Corporation, Huawei Technologies Co., Ltd., Dell Technologies, Cisco Systems, Inc., EdgeConneX, Zella DC, Micro Focus International, NetApp, Inc. |