Cloud Content Delivery Network Market Report Scope & Overview:

Get More Information on Cloud Content Delivery Network Market - Request Sample Report

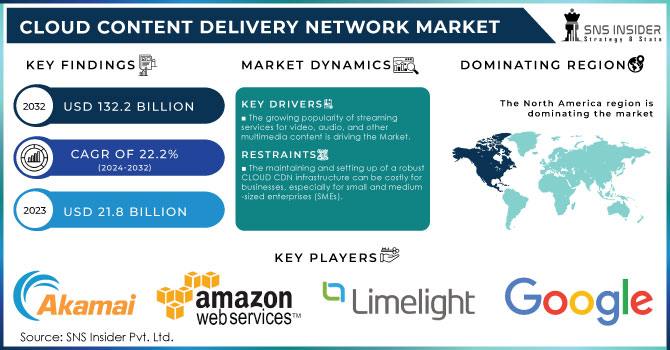

The Cloud Content Delivery Network Market Size was valued at USD 21.8 Billion in 2023 and is expected to reach USD 132.2 Billion by 2032 and grow at a CAGR of 22.2% over the forecast period 2024-2032.

The global cloud content delivery network market is expected to grow due to the increasing demand for enhancing online content delivery and the growing number of internet users around the world. According to the latest government statistics, over 60% of the global population had access to the internet in 2023, with an annual growth rate of 4%. Governments in many countries are promoting the adoption of cloud in public welfare including education, healthcare, and public services. The US government announced the Federal Cloud Computing Strategy in 2022 to modernize IT usage spectrum. Also, it makes great use of CDN to optimize data delivery and reduce latency in the cloud. Moreover, according to the Digital Strategy 2030 of EU plans of ensuring 75% of EU enterprises utilize cloud services by the end of 2030, will make the cloud CDN market to proliferate. Increased demand for streaming services from the internet and higher internet utilization has been major reasons for the home working population to be associated with the rise in demand for cloud CDN market.

The Cloud CDN market is growing due to increased data exchange on high-speed networks and remote work trends. Media and entertainment industries extensively use Cloud CDN solutions for audio and video content delivery, driven by the demand for high-quality content. OTT and VOD services are fueling this growth. Opportunities abound for cloud CDN providers, although challenges include high costs and data travel times. Major players such as Amazon Web Services are innovating to address latency and cost issues, collaborating with others for cross-platform CLOUD CDNs.

Market Dynamics

Drivers:

-

The growing popularity of streaming services for video, audio, and other multimedia content is driving the Market.

-

The people gaining access to high-speed internet globally, there is a growing in online content consumption, helps to increased demand for CLOUD CDN services.

-

The increase in use of smartphones and tablets for accessing online content is driving the need for mobile CLOUD CDN solutions to optimize content delivery.

The increased adoption of high-speed internet connections worldwide fuels the growth in online content consumption, resulting in increased cloud Content Delivery Network services demand. With the growing number of individuals gaining access to high-quality, reliable, and fast internet connectivity, they are able to stream high-definition videos, engage in online gaming, and access large-scale digital services. Thus, as the International Telecommunication Union reports global internet access has exceeded 66% in 2023 with more than 5.3 billion people being connected and has significantly increased compared to the previous years. Moreover, government reports in countries like South Korea and the U.S. suggest that the global average internet speed increased by 24% 24% year-over-year.

The growth of internet accessibility is especially notable in underdeveloped regions, promoting higher video streaming, online gaming, and cloud access. The Cisco Global Cloud Index highlights that by 2024, video streaming is expected to represent 82% of all internet traffic, up from 76 percent in 2019 and argues that this growth is driven by consumer demand for more streaming content as well as online viewing, such as video communications, online learning and extended reality. However, with the increasing content volume consumed globally, such high levels of content consumption require quick and efficient systems to ensure optimal performance and timely delivery. As a result, the growth of cloud range hosting services has been especially impacted by the cloud CDN efforts to reduce delivery latency and optimize high-quality service.

Restraints:

-

Security threats such as DDoS attacks and data breaches increase a challenge for CLOUD CDN providers in ensuring the integrity and confidentiality of content delivered through their networks.

-

The maintaining and setting up of a robust CLOUD CDN infrastructure can be costly for businesses, especially for small and medium-sized enterprises (SMEs).

-

Integrating CLOUD CDN services with existing IT infrastructure and applications can be complex and time-consuming, requiring specialized expertise and resources.

Establishing and sustaining a strong CLOUD CDN infrastructure is expensive for many businesses, particularly for small and medium-sized enterprises (SMEs). This cost includes initial setup expenses, maintenance, and upgrades to improve optimal performance and scalability. SMEs face challenges related to budget constraints and may find it challenging to allocate resources for such infrastructure investments. they may opt for alternative solutions or depend on external CLOUD CDN providers to mitigate the financial burden while still benefiting from efficient content delivery services.

Opportunities:

-

The growing over-the-top (OTT) streaming services presents significant opportunities for CLOUD CDN providers to offer tailored solutions for content delivery.

-

The Growing adoption of Internet of Things (IoT) devices, such as smart home devices and connected vehicles creates opportunities for CLOUD CDN providers.

-

The Organizations are increasingly adopting hybrid and multi-cloud strategies, creating opportunities for CLOUD CDN providers to offer integrated solutions that optimize content delivery across multiple cloud environments.

Market Segmentation

By Type

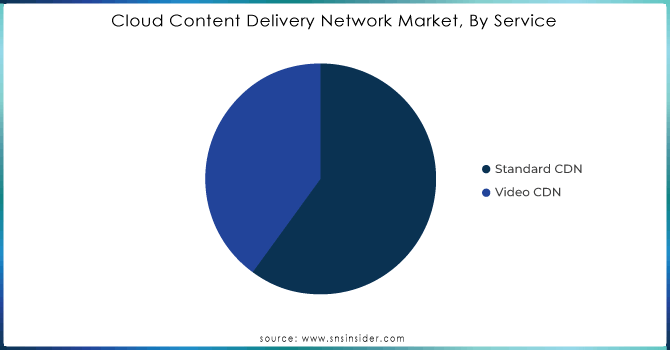

The video CDN segment dominated the market with held revenue share of more than 61%, driven by the Increase in online video streaming demand. Video CDNs, specialized for high-quality video delivery, leverage global server networks and adaptive bitrate streaming for efficient content distribution, meeting user expectations for seamless streaming experiences. As businesses recognize the importance of video CDNs in enhancing user satisfaction, the segment is expected to grow significantly. Additionally, the standard CDN segment is growing with highest CAGR, benefiting from the adoption of high-speed networks and efficient content caching strategies for improved performance and reduced costs.

Get Customized Report as per Your Business Requirement - Request For Customized Report

By Organization Size

The large-scale organizations dominated the market in 2023, accounting for more than 67% of the market share. This segment is expected to continue its dominance in the coming years. The market dominance of large organizations can be attributed to the extensive infrastructure and global operations of large corporations, which require high-speed content delivery solutions to facilitate their customers across different geographies. large organizations are moving towards cloud technologies at a faster pace than small and medium enterprises. For instance, the Department of Commerce in the U.S. stated that 72% of large enterprises in the U.S. used cloud services, such as CDNs, in 2023, while only 45% of the SMEs adapted to the cloud. This trend is being propelled by the high data traffic generated by large organizations, thus necessitating more advanced CDN solutions to manage the vast content as well as the data while maintaining low latency and ensuring excellent user experiences. Furthermore, this size of the organization often has the financial capability to integrate CDN services into the company’s cloud services, which reinforces their dominance in the sector.

By Vertical

The media and entertainment segment dominated the market with held revenue share of more than 38%, driven by the shift to digital distribution and the Growing demand for streaming and VOD services. CLOUD CDN providers are focusing on delivering high-quality content across various devices and enhance user experiences and revenue for the industry. the Online gaming segment is expected to grow with a highest CAGR during the forecast period, driven by increased demand for online gaming and the need for optimized experiences due to higher resolutions and file sizes.

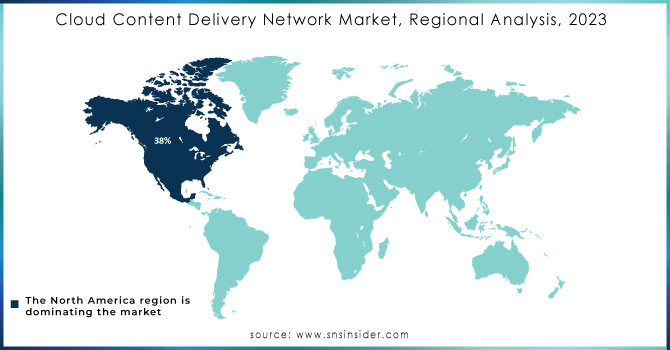

Regional Analysis | North America Dominates the Market in 2023

In 2023, North America was the leader in the cloud content delivery network market with a share of approximately 38%. The region’s dominance can be attributed to its advanced digital infrastructure, high penetration and speed of the internet, and the presence of the major content delivery network providers such as Akamai Technologies, Amazon Web Services (AWS), and Cloudflare. According to government statistics, more than 93% of households in the U.S. had access to broadband internet in 2023, which has fuelled the demand for cloud-based content delivery services. Additionally, the U.S. government has played a key role in boosting cloud CDN adoption through policies like the Cloud Smart strategy, which promotes cloud migration across federal agencies, and investments in 5G infrastructure, which enhances the speed and efficiency of content delivery. Meanwhile, the Canadian government has introduced “Innovation and Skills Plan,” aiming to embrace more businesses to adopt digitization. Considering the massive support cloud CDN receives in North America from the public sectors, the area will persist as the leader in the market.

The Asia Pacific Region is growing with the rapid CAGR, driven by strong growth in emerging economies such as India and China. The region benefits from a growing consumer market, particularly in online gaming. Initiatives such as digital India support increasing networking infrastructure, boosting cloud CDN adoption.

Key players

-

Akamai Technologies (Akamai Intelligent Edge Platform, Kona Site Defender, Akamai Ion)

-

Amazon Web Services (AWS) (Amazon CloudFront, AWS Global Accelerator)

-

Cloudflare, Inc. (Cloudflare CDN, Cloudflare Argo)

-

Google Cloud Platform (GCP) (Google Cloud CDN, Google Cloud Armor)

-

Microsoft Azure (Azure CDN, Azure Traffic Manager)

-

Fastly (Fastly CDN, Fastly Image Optimizer, Fastly Compute@Edge)

-

Limelight Networks (now Edgio) (Limelight CDN, EdgeFunctions)

-

Verizon Communications, Inc. (Edgecast) (Edgecast CDN, Edgecast Streaming)

-

StackPath (StackPath CDN, Edge Computing)

-

CDNetworks (CDNetworks Global CDN, Cloud Security Solutions)

-

KeyCDN (KeyCDN Delivery, KeyCDN Real-time Logging)

-

Alibaba Cloud (Alibaba Cloud CDN, DCDN (Dynamic Content Delivery Network))

-

Tencent Cloud (Tencent Cloud CDN, Tencent Anti-DDoS, Tencent EdgeOne)

-

Imperva (Imperva CDN, Imperva DDoS Protection)

-

CacheFly (CacheFly Global CDN, CacheFly Ultra Low Latency Streaming)

-

G-Core Labs (G-Core Labs CDN, G-Core Labs Cloud)

-

Bunny.net (Bunny CDN, Bunny Optimizer)

-

Leaseweb (Leaseweb CDN, Leaseweb Load Balancer)

-

OnApp (OnApp CDN, OnApp Storage)

-

Medianova (Medianova CDN, Medianova Cloud Encoding)

Others in final report

| Report Attributes | Details |

| Market Size in 2023 | USD 21.8 Bn |

| Market Size by 2032 | USD 132.2 Bn |

| CAGR | CAGR of 22.2% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Core Solution (Web Performance Optimization, Media Delivery, Cloud Security) • By Type (Standard/Non-Video CDN, Video CDN) • By Adjacent Service (Cloud Storage, Analytics and Monitoring, Application Program Interface (APIs), CDN Network Design, Support and Maintenance, Others) • By Organization Size (Small and Medium Businesses, Large Enterprises) • By Vertical (Advertising, Media & Entertainment, Online gaming, E-commerce, Education, Government, Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) ca) |

| Company Profiles | Akamai Technologies, Inc., Google, Inc., Limelight Networks, Inc., Amazon Web Services, Inc., Alibaba Cloud, Microsoft Azure, Cloudflare, Inc., StackPath, Verizon Communications, Inc., Tencent Cloud, CLOUD CDNetworks |

| Key Drivers | • The growing popularity of streaming services for video, audio, and other multimedia content is driving the Market. • The people gaining access to high-speed internet globally, there is a growing in online content consumption, helps to increased demand for CLOUD CDN services. |

| Market restrain | • Security threats such as DDoS attacks and data breaches increase a challenge for CLOUD CDN providers in ensuring the integrity and confidentiality of content delivered through their networks. • The maintaining and setting up of a robust CLOUD CDN infrastructure can be costly for businesses, especially for small and medium-sized enterprises (SMEs). |