Microcatheters Market Overview:

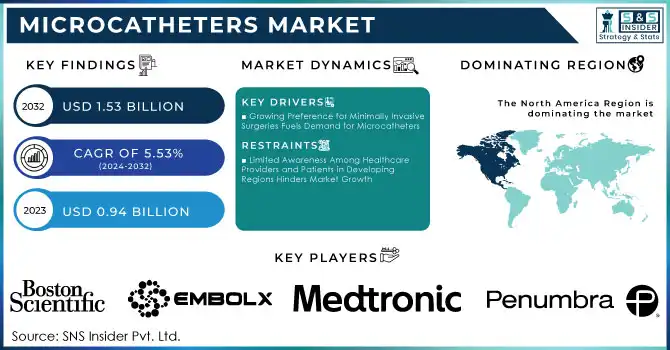

The Microcatheters Market was valued at USD 0.94 billion in 2023 and is expected to reach USD 1.53 billion by 2032, growing at a CAGR of 5.53% from 2024-2032.

Get more information on Microcatheters Market - Request Sample Report

The microcatheters market is experiencing robust growth, primarily driven by the increasing prevalence of chronic diseases that require minimally invasive solutions. These diseases, including cardiovascular and neurovascular conditions, have heightened the demand for precision tools like microcatheters, which offer safer and more effective treatment options. For example, in the United States alone, approximately 805,000 people suffer heart attacks annually, with 605,000 being first-time cases and 200,000 recurrent cases. This growing burden underscores the need for advanced microcatheter technology, such as improved flexibility and superior navigability, enhancing their performance in complex procedures. As these innovations align with the global shift toward minimally invasive techniques, the market is positioned to grow steadily, creating new opportunities for manufacturers and healthcare providers alike.

The rising demand for microcatheters is tightly linked to their essential role in advanced medical procedures, such as embolization and thrombectomy, which rely on precision and reliability. These procedures have become increasingly common as healthcare providers prioritize patient safety and faster recovery times, driving the adoption of microcatheters across diverse applications. This trend is further supported by the expansion of healthcare systems in emerging markets, where improved access to advanced medical devices is fueling widespread adoption. As awareness grows about the clinical benefits of these tools, the market is set to expand further, bridging gaps in healthcare delivery worldwide.

Future opportunities in the microcatheters market stem from ongoing innovations aimed at addressing evolving clinical needs and improving patient outcomes. Manufacturers are focusing on creating highly specialized microcatheters for specific applications, such as neurovascular interventions, ensuring better precision and efficiency. These advancements are increasingly supported by the integration of cutting-edge technologies, like real-time imaging and AI-guided navigation, which are transforming the landscape of minimally invasive procedures. As these developments gain momentum, supported by favorable healthcare policies and rising global investments, the microcatheters market is set to thrive, marking a new era of technological progress and accessibility.

Microcatheters Market Dynamics

Drivers

- Growing Preference for Minimally Invasive Surgeries Fuels Demand for Microcatheters

Minimally invasive procedures, including angioplasty, embolization, and stent delivery, are becoming increasingly popular due to their numerous advantages over traditional open surgeries. These techniques offer shorter recovery times, reduced hospital stays, less pain, minimal scarring, and lower risks of post-operative complications. The demand for such procedures is rising globally, driven by the growing burden of chronic conditions such as cardiovascular diseases, neurovascular disorders, and cancer. Additionally, advancements in imaging and surgical technologies have enhanced the precision and success rates of minimally invasive interventions. As microcatheters play a pivotal role in these procedures, their market is experiencing robust growth, particularly in regions with advanced healthcare systems and aging populations.

- Rising Chronic Disease Burden and Aging Population Propel Demand for Microcatheters

The increasing prevalence of chronic diseases, including cardiovascular and neurological disorders, is contributing to the growing use of microcatheters in advanced medical procedures. Conditions such as aneurysms, arterial blockages, strokes, and neurovascular complications are becoming more common, driving the need for precise interventional tools like microcatheters. Similarly, the aging global population, which is more susceptible to vascular diseases such as atherosclerosis and peripheral artery disease, is further fueling the demand for minimally invasive diagnostic and therapeutic solutions. Microcatheters play a crucial role in managing these conditions by facilitating accurate and efficient treatment with minimal patient discomfort. As healthcare systems worldwide adapt to meet these challenges, the market for microcatheters continues to expand, supported by advancements in medical technology and procedural techniques.

Restraints

- Limited Awareness Among Healthcare Providers and Patients in Developing Regions Hinders Market Growth

The adoption of microcatheters in emerging markets faces significant challenges due to limited awareness among healthcare providers and patients. Many physicians in these regions may not be familiar with the advanced applications of microcatheters in minimally invasive procedures for cardiovascular, neurovascular, and other conditions. Additionally, patients are often unaware of the benefits, such as reduced recovery time and lower risk of complications, which can lead them to opt for traditional surgical methods. This knowledge gap is further compounded by limited access to training programs and inadequate exposure to innovative medical technologies in these regions. As a result, the market potential for microcatheters remains underutilized in developing economies, despite the growing burden of chronic diseases and an increasing need for advanced healthcare solutions.

- High Costs of Advanced Microcatheters Limit Accessibility in Emerging Markets

The high cost of microcatheters, particularly advanced or custom-designed models, poses a significant challenge to their widespread adoption. These devices are often expensive to manufacture, leading to high prices that healthcare providers in low-income and developing regions struggle to afford. Budget constraints in hospitals and clinics further exacerbate the issue, forcing many to prioritize more affordable alternatives over cutting-edge medical technologies. For patients, the lack of sufficient insurance coverage or reimbursement policies in these regions makes procedures involving microcatheters financially inaccessible. As a result, despite the growing prevalence of chronic diseases and the demand for minimally invasive treatments, the adoption of microcatheters remains limited in emerging markets, hindering their potential to improve healthcare outcomes globally.

Microcatheters Market Segmentation Analysis

By Application

In 2023, the Cardiovascular segment held the largest revenue share of about 43% in the microcatheters market due to the increasing prevalence of cardiovascular diseases such as coronary artery disease and myocardial infarction. The demand for minimally invasive procedures, such as angioplasty and stenting, has surged, driving the adoption of advanced microcatheters. Additionally, well-established healthcare infrastructure and supportive reimbursement policies in developed countries have further solidified this segment's dominance.

The Neurovascular segment is projected to grow at the fastest CAGR of 7.13% from 2024 to 2032, driven by the rising incidence of strokes, aneurysms, and other neurological disorders. Innovations in microcatheter design, enabling precise and safe neurovascular interventions, have significantly enhanced their demand. Furthermore, increasing awareness and improved access to neurovascular care in emerging markets are fueling the rapid expansion of this segment.

By Product

In 2023, the Aspiration Microcatheters segment dominated the market with a revenue share of about 36%, driven by their effectiveness in treating thrombotic and embolic conditions. These devices are widely used for clot removal in critical procedures such as stroke management and cardiovascular interventions. The rising incidence of thrombosis and continuous advancements in aspiration technology have further strengthened their leading position in the market.

The Steerable Microcatheters segment is projected to grow at the fastest CAGR of 7.86% from 2024 to 2032, due to their exceptional maneuverability and precision in navigating complex vascular systems. Their increasing use in neurovascular and peripheral vascular procedures highlights their critical role in addressing intricate clinical challenges. Technological innovations improving flexibility and control, along with growing adoption in emerging markets, are driving their rapid growth.

By End-use

In 2023, the Hospitals and Clinics segment led the microcatheters market with a revenue share of about 63%, primarily due to their capacity to perform high volumes of complex procedures such as cardiovascular and neurovascular interventions. These facilities are equipped with advanced infrastructure, specialized departments, and skilled professionals, making them the preferred choice for critical treatments. Additionally, supportive reimbursement policies further enhance their dominance in the market.

Ambulatory Surgical Centers (ASCs) are projected to grow at the fastest CAGR of 6.72% from 2024 to 2032, driven by the rising demand for affordable, minimally invasive procedures. ASCs offer shorter recovery times, reduced costs, and greater convenience for patients, making them an attractive alternative to hospitals. With the increasing adoption of advanced technologies and a focus on same-day surgeries, ASCs are rapidly emerging as a key growth segment in the market.

By Design

The Dual Lumen Microcatheters segment dominated the microcatheters market in 2023 with a revenue share of about 64% and is projected to grow at the highest CAGR of 6.02% from 2024 to 2032. This dominance is attributed to their versatility in performing complex procedures, such as simultaneous diagnostic and therapeutic applications in cardiovascular and neurovascular interventions. Their ability to improve procedural efficiency and reduce operative time has made them indispensable in minimally invasive techniques. Additionally, ongoing advancements in dual lumen technology and their expanding use in emerging markets are driving their rapid growth, supported by the rising prevalence of chronic diseases requiring precision-based treatments.

Microcatheters Market Regional Outlook

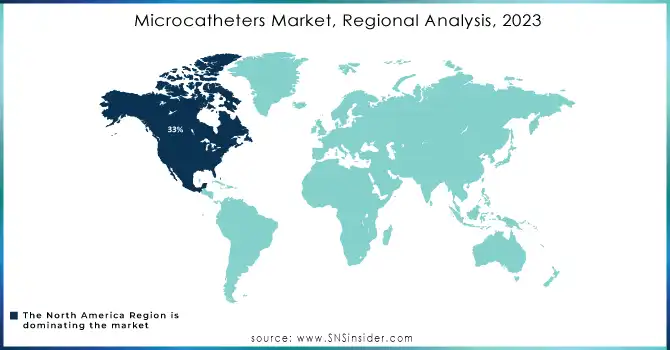

In 2023, North America dominated the microcatheters market with a revenue share of approximately 33%, driven by its well-established healthcare infrastructure and high prevalence of chronic diseases such as cardiovascular and neurovascular disorders. The region benefits from the strong adoption of advanced medical technologies, robust reimbursement frameworks, and significant investments in minimally invasive procedures. Additionally, the presence of leading market players and ongoing research in microcatheter innovation further solidified its leadership position.

The Asia Pacific is expected to grow at the fastest CAGR of 7.73% from 2024 to 2032, fueled by increasing healthcare investments and a rising burden of chronic diseases in countries like China and India. The growing demand for minimally invasive procedures, coupled with improving access to advanced healthcare technologies, is driving market expansion. Furthermore, supportive government initiatives and the emergence of medical tourism in the region are accelerating the adoption of microcatheters across a wider patient base.

Need any customization research on Microcatheters Market - Enquiry Now

Recent Developments

-

March 1, 2024, Boston Scientific Corporation received FDA approval for its AGENT™ Drug-Coated Balloon, the first coronary drug-coated balloon in the U.S., designed to treat coronary in-stent restenosis and reduce the risk of recurrence.

- February 29, 2024, Embolx received FDA clearance for its Soldier High Flow Microcatheter, designed for vascular interventions. This microcatheter combines advanced ultra-thin wall technology with a smaller profile and enhanced flow rates, improving precision in localized drug delivery

Key Players in the Microcatheters Market

-

Asahi Intecc USA, Inc. (Corsair Pro, Caravel)

-

Boston Scientific Corporation (Direxion Torqueable, Renegade HI-FLO)

-

Cook Medical (Cantata, Beacon Tip Torcon NB Advantage)

-

Embolx, Inc. (Sniper Balloon Occlusion, Pressure-Directed)

-

Medtronic plc (Phenom, Echelon)

-

Merit Medical System, Inc. (SwiftNINJA, Embosphere Microspheres)

-

Penumbra, Inc. (RED 62 Reperfusion, BENCHMARK 071)

-

Reflow Medical, Inc. (Wingman Crossing, Spex)

-

Stryker Corporation (Excelsior SL-10, AXIOM Peripheral)

-

Teleflex Corporation (Turnpike Spiral, Turnpike Gold)

-

Terumo Corporation (Progreat, Glidecath)

-

Transit Scientific (XO Cross 35, XO Cross 14)

-

Surmodics, Inc. (Sublime, Pounce Thrombectomy System)

-

BioCardia Inc. (Helix Biotherapeutic Delivery, Morph Universal Deflectable)

-

Cardinal Health, Inc. (Rad Board Accessories, CE-Approved Microcatheters)

-

Johnson & Johnson (Duo Guide, DuraStar Balloon)

-

Lepu Medical Technology (Beijing) Co., Ltd. (Hunter, Leopard)

-

Becton, Dickinson and Company (Halo, Accura Percutaneous)

-

Kaneka Corporation (Kaneka Balloon, Ikazuchi Zero Balloon)

-

AngioDynamics, Inc. (AngioJet ZelanteDVT, Uni*Fuse)

-

Baylis Medical Company, Inc. (NaviCross, VersaCross Transseptal Solution)

-

Acandis GmbH (NeuroSlider, NeuroBridge)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 0.94 Billion |

| Market Size by 2032 | USD 1.53 Billion |

| CAGR | CAGR of 5.53% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Delivery Microcatheters, Diagnostic Microcatheters, Aspiration Microcatheters, Steerable Microcatheters) • By Design (Single Lumen Microcatheters, Dual Lumen Microcatheters) • By Application (Cardiovascular, Neurovascular, Peripheral Vascular, Oncology, Other Applications) • By End-Use (Hospitals and Clinics, Ambulatory Surgical Centers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Asahi Intecc USA, Inc., Boston Scientific Corporation, Cook Medical, Embolx, Inc., Medtronic plc, Merit Medical System, Inc., Penumbra, Inc., Reflow Medical, Inc., Stryker Corporation, Teleflex Corporation, Terumo Corporation, Transit Scientific, Surmodics, Inc., BioCardia Inc., Cardinal Health, Inc., Johnson & Johnson, Lepu Medical Technology (Beijing) Co., Ltd., Becton, Dickinson and Company, Kaneka Corporation, AngioDynamics, Inc., Baylis Medical Company, Inc., Acandis GmbH. |

| Key Drivers | • Growing Preference for Minimally Invasive Surgeries Fuels Demand for Microcatheters • Rising Chronic Disease Burden and Aging Population Propel Demand for Microcatheters |

| Restraints |

• Limited Awareness Among Healthcare Providers and Patients in Developing Regions Hinders Market Growth • High Costs of Advanced Microcatheters Limit Accessibility in Emerging Markets |