Marine Electric Vehicle Market Report Scope & Overview:

To get more information on Marine Electric Vehicle Market - Request Free Sample Report

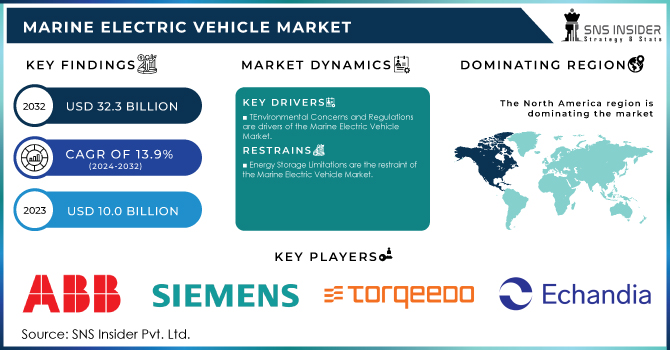

The Marine Electric Vehicle Market Size was valued at USD 10.0 billion in 2023 and is expected to reach USD 32.3 billion by 2032 and grow at a CAGR of 13.9% over the forecast period 2024-2032.

Marine electric vehicles (EVs) are zero-emission transportation systems powered by renewable energy sources (RES). When compared to fossil-fuel-powered maritime vessels, these vehicles require less maintenance, have lower operating expenses, and are more environmentally benign. Marine EVs are also suited for wildlife trips since they lessen waves, boost speed, and produce less noise. Furthermore, a substantial movement in preference from diesel-powered to hybrid electric boats is favourably boosting marine EV sales for both commercial and recreational purposes.

Because of expanding shipping demand and growing environmental concerns, there is a greater need for low and zero-emission vessels (ZEVs). This, together with the rising trend of digitization and automation, as well as the depletion of fossil fuels, is one of the major drivers driving the growth of the marine EV industry. Furthermore, rising discretionary incomes are fuelling sales of seagoing enclosed yachts, ferries, workboats, personal submarines, scuba sea scooters, and autonomous underwater vehicles (AUVs). This is also backed by the expanding travel and tourist industry, which is boosting the use of surface boats for leisure and recreational purposes.

The push for cleaner and more sustainable transportation solutions has driven interest in electrification across industries, including marine transportation. Stringent emissions regulations and policies aimed at reducing the carbon footprint of maritime activities have encouraged the adoption of electric propulsion systems. Improvements in battery technology, energy storage, and electric motor efficiency have made electric propulsion more feasible for marine applications.

Over the long term, electric propulsion systems can offer operational cost savings through reduced fuel consumption and maintenance requirements. Short-distance passenger ferries have been a primary focus for electrification due to their predictable routes and relatively short operating ranges. Electric propulsion is becoming popular among boaters looking for quieter, emission-free, and lower-maintenance alternatives to traditional gasoline-powered engines. Electric propulsion systems are being explored for various cargo and workboats operating in ports, harbours, and inland waterways.

Scientific research vessels often prioritize low emissions and quiet operation, making electric propulsion an attractive option. The development of charging or refuelling infrastructure for electric marine vehicles, especially for larger vessels, can be a challenge. Range limitations due to the energy density of batteries can be a concern for vessels that need to operate over longer distances.

MARKET DYNAMICS

DRIVERS:

-

Many countries and international organizations set emission reduction targets for the shipping industry

-

Environmental Concerns and Regulations are drivers of the Marine Electric Vehicle Market.

Concerns about climate change and air quality have led to increased pressure on industries to reduce their carbon footprint. Maritime transportation, traditionally reliant on fossil fuels, has faced scrutiny due to its emissions. Stringent regulations, such as emissions caps and fuel efficiency standards, have encouraged the maritime industry to explore cleaner alternatives like electric propulsion to meet these requirements.

RESTRAIN:

-

The size and weight of batteries can be a challenge for vessels with limited space available for energy storage.

-

Energy Storage Limitations are the restraint of the Marine Electric Vehicle Market.

Electric marine vehicles, especially those with higher power requirements and longer operational ranges, may face range limitations due to the energy density and weight of available batteries. This could impact their ability to operate over extended distances without frequent recharging.

OPPORTUNITY:

-

The shift towards cleaner and more sustainable transportation solutions offers a significant opportunity for electric marine vehicles.

-

Innovation and Technological Advancement is an opportunity for the Marine Electric Vehicle Market.

Continued advancements in battery technology, energy storage, electric motors, and power electronics can lead to more efficient and powerful electric propulsion systems, overcoming some of the current limitations.

CHALLENGES:

-

The maritime industry is subject to strict safety regulations and certification standards.

-

Initial Costs are the challenges of the Marine Electric Vehicle Market.

The initial capital cost of purchasing electric marine vehicles and setting up the required charging infrastructure can be higher compared to traditional vessels with internal combustion engines.

IMPACT OF RUSSIAN UKRAINE WAR

Russia launched a large-scale invasion of Ukraine, marching its borders with some 150,000 troops. At the time, the global economy was on its path to recovering and regaining its pre-pandemic strength. However, this onslaught not only harmed Ukraine's and Russia's economies, but also those of nearby European nations such as Moldova, Hungary, Poland, Slovakia, and Romania; the United Kingdom is no exception. Aside from the human tragedy and death toll, this also had an impact on the e-mobility sector in the UK and other European nations due to their reliance on Russia for raw materials and energy required for the progress of electric cars. The United Kingdom manufactured 2.8 million electric commercial cars. The UK economy is distinct from that of the EU, although they are inextricably linked. The EU has awarded the United Kingdom 4.8 billion pounds for automotive sector innovation.

Aside from its global fame, it is not without its difficulties. The Russia-Ukraine war is the most significant obstacle it will confront during its growth. In the Ukraine-Russia war, the Marine Electric Vehicle Market gained less profit up to 1.2-1.8%

IMPACT OF ONGOING RECESSION

According to conventional wisdom, inflation is beneficial to commodities because it correlates with robust economic activity, which stimulates demand. Higher prices result when marginal supply costs rise and supply tries to keep up. However, the advantages may be fleeting. Higher inflation leads to higher interest rates, which dampens economic growth. Furthermore, there is a significant negative relationship between the US dollar and commodities prices. At a high level, robust US activity raises commodities prices. This causes inflation, which leads to increased US interest rates, which dampens demand.

waxed poetic about metals-intensive EVs' revolutionary need for mined commodities. Forecasts for EV penetration has just been revised to reflect the remarkable surge in sales expected in 2021. Battery electric vehicle (BEV) and plug-in hybrid (PHEV) passenger car sales are expected to quadruple over the next five years, from just under 9% of the worldwide total in 2021. Commercial BEV/PHEV sales will expand at a similar rate, growing from 6% of total sales in 2021 to 13% in 2026. In the ongoing recession, the marine electric market is gaining profit up to 4.2-4.6%.

KEY MARKET SEGMENTATION

By Vehicle Type

-

Plug-In Hybrid Electric

-

Battery Electric

-

Hybrid Electric

By Platform

-

Underwater

-

On-water

By Craft Application

-

Personal Tourist Submarine

-

Leisure Tourist Surface Boat

-

Military

-

Autonomous Underwater Vehicle

-

Work Boat

-

Others

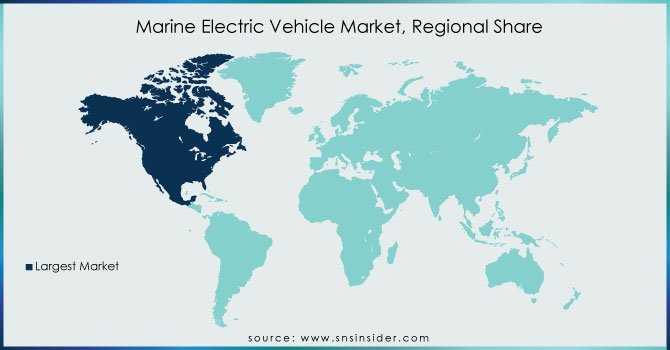

REGIONAL ANALYSIS

North America: The marine electric vehicle market in North America is well-established, owing to rigorous pollution rules, technical improvements, and government incentives. Adoption is highest in the United States and Canada, with an emphasis on electric ferries, leisure boats, and research vessels.

Europe: Europe had the greatest market share in 2023 and is expected to have the fastest CAGR during the forecast period. The market is expected to see favourable conditions as a result of trade activity and marine vessel electrification. This tendency is backed by an increase in defence spending as a result of rising geopolitical tensions, which force major economies to bolster their military capabilities. In addition, increased R&D expenditure by leading players and OEMs in order to develop superior electrical solutions to fulfil future sustainable and operational needs will boost the market.

Asia Pacific: For the marine electric vehicle industry, the Asia-Pacific area provides a considerable potential opportunity. Countries such as Japan, China, and South Korea are spending extensively on R&D, infrastructure development, and incentives to encourage electric propulsion in the marine industry. Electric passenger ferries, recreational boats, and small commercial vessels are becoming popular in the region.

Need any customization research on Marine Electric Vehicle Market - Enquiry Now

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

The Major Players are ABB Ltd., Siemens AG, Torgeedo GmbH, Echandia Marine AB, Rolls-Royce Holdings pic, BAE Systems, Wärtsilä Corporation, Saft Batteries, General Electric Company, Leclanché SA and other players

RECENT DEVELOPMENT

In 2021: To minimise traffic and pollution, the Bangkok Metropolitan Authority has committed to building 12 new zero-emission all-electric boats.

In 2021: Sumitomo Corporation and Corvus Energy formed a partnership to create zero-emission solutions for Japanese ships.

In 2021: Fassmer, a leader in the production of composite boats, collaborated with Toqee to introduce the Fassmer CIT-E Ferry, a totally electric ferry for public transportation.

| Report Attributes | Details |

| Market Size in 2023 | US$ 10.0 Bn |

| Market Size by 2032 | US$ 32.3 Bn |

| CAGR | CAGR of 13.9% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Vehicle Type (Plug-In Hybrid Electric, Battery Electric, Hybrid Electric) • By Platform (Underwater and On-water) • By Craft Application (Personal Tourist Submarine, Leisure Tourist Surface Boat, Military, Autonomous Underwater Vehicle (AUV), Work Boat, others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | ABB Ltd., Siemens AG, Torgeedo GmbH, Echandia Marine AB, Rolls-Royce Holdings pic, BAE Systems, Wärtsilä Corporation, Saft Batteries, General Electric Company, Leclanché SA |

| Key Drivers | • Many countries and international organizations set emission reduction targets for the shipping industry • Environmental Concerns and Regulations are drivers of the Marine Electric Vehicle Market. |

| Market Restraints | • The size and weight of batteries can be a challenge for vessels with limited space available for energy storage. • Energy Storage Limitations are the restraint of the Marine Electric Vehicle Market. |