Military Drone Market Report Scope & Overview:

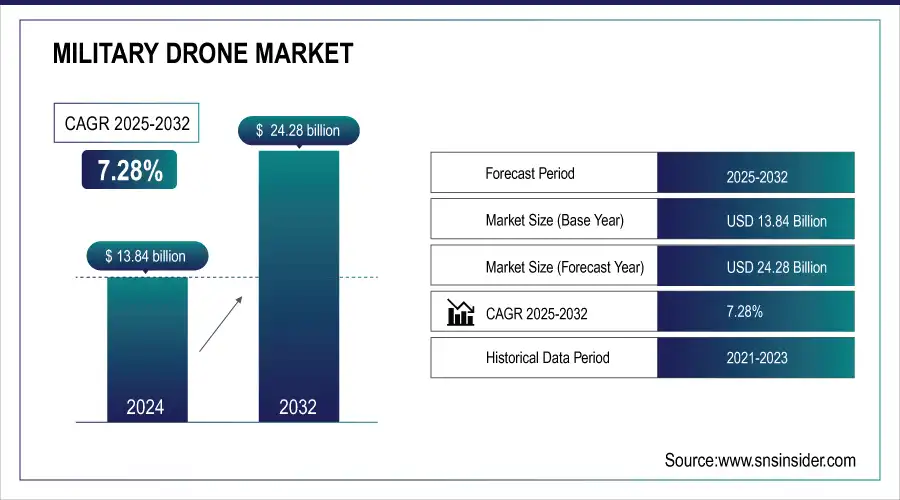

The Military Drone Market Size was valued at USD 13.84 billion in 2024 and is expected to reach USD 24.28 billion by 2032 and grow at a CAGR of 7.28% over the forecast period 2025-2032.

The use of Unmanned Aerial Vehicles (UAVs) in defense is rising, spanning surveying, combat, and monitoring. This trend is set to drive demand for military UAVs, fueled by increased defense spending worldwide. Artificial Intelligence (AI) integration plays a crucial role in modernizing military drone technologies, enabling precise autonomous target selection. The global market sees growth through significant investments in AI and autonomous systems, advancing drone technologies. Ongoing research and development yield innovations, enhancing capabilities and adoption of modernized UAVs equipped with multiple sensor systems, air-to-air missiles, and Communication Intelligence Sensors. Autonomous high-altitude military drone development, incorporating AI, signifies a potential robust expansion in the global military unmanned aircraft market.

Ask For Sample of Military Drone Market: Sample Report

Military Drone Market Size and Forecast:

-

Market Size in 2024: USD 13.84 Billion

-

Market Size by 2032: USD 24.28 Billion

-

CAGR: 7.28% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Key Military Drone Market Trends:

-

Rising adoption of semi-autonomous and fully autonomous UAVs for surveillance and strike missions.

-

Increasing demand for Hybrid/VTOL drones for flexible takeoff and landing in confined areas.

-

Advanced ISR capabilities with EO/IR cameras, LiDAR, and radar payloads.

-

Preference for long-endurance, high-payload fixed-wing drones for strategic operations.

-

Focus on cybersecurity and encrypted control systems to prevent UAV hacking.

-

Rapid market growth in Asia Pacific, Middle East, and Latin America due to defense modernization.

-

Integration of swarming and networked UAVs for coordinated operations.

-

Government funding and defense modernization programs driving UAV deployment.

Military Drone Market Drivers:

-

Growing government expenditure on defence and military services

The key factor driving the military drones market is increasing government spending in the defence and military sectors. These drones UAVs, often called drones, have evolved to become indispensable tools of today's warfare and serve a large number of vital operational tasks. As a result, the global market for military drones is expected to be driven by increased government spending on defence.

Military Drone Market Restraints:

-

The high cost of advanced military drones

Over the last decade, there has been remarkable growth and innovation in the world's military drones market. Unmanned aerial vehicles (UAVs), also referred to as drones, are becoming an indispensable tool for today's armed forces because they offer a broad range of capabilities, from surveillance and reconnaissance to precise attacks. However, the high costs associated with advanced models have emerged as a significant obstacle to the potential benefits of military drones.

-

Insufficiently trained personnel to operate the drone.

Military Drone Market Opportunities:

-

Use of unmanned aerial vehicles in military operations for the delivery of cargo

There are a number of new military applications that allow unmanned aerial vehicles to be used. The use of Unmanned Air Vehicles for the delivery of military goods is one such application. In the field of battle, drones can be used to resupply troops. From the commercial sector, where drones are used by companies such as Amazon to deliver goods to their customers, the idea of using unmanned aerial vehicles for cargo delivery in the military industry originated. Currently, road convoys carry much of the military's supply and are vulnerable to hostile attack. On the other hand, UAVs use aerial routes which may be changed in order to reduce the risk of enemy attack on convoys. High risks for soldiers in convoys are also eliminated through the use of Unmanned Air Vehicles to transport military cargo. Compared to conventional road convoys, the use of unmanned aerial vehicles will be more efficient and safer.

Military Drone Market Challenges:

-

Issues related to the safety and security of unmanned aerial vehicles

The military is increasingly concerned about the security of unmanned aerial vehicles (UAVs) during combat operations due to their susceptibility to cyberattacks. Whether UAVs are remotely piloted or operating autonomously, hackers can potentially infiltrate flight control systems, manipulate navigation, and take over mission-critical functions. Such vulnerabilities threaten operational integrity, compromise sensitive data, and endanger both personnel and mission objectives. To mitigate these risks, defense organizations are investing in secure communication protocols, encryption technologies, and robust cybersecurity frameworks. Strengthening UAV resilience against hacking is essential to ensure reliable performance, maintain tactical advantage, and safeguard national security during modern warfare operations.

Military Drone Market Segmentation Analysis:

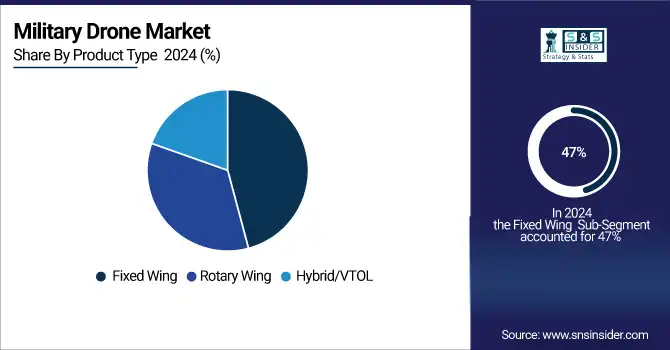

By Product Type, Fixed-Wing Dominates While Hybrid/VTOL Drives Rapid Growth in Military Drones

Based on Product Type, the fixed-wing segment dominates with 47% of revenue in 2024 due to its long endurance, high payload capacity, and ability to conduct strategic ISR and strike missions. This dominance drives manufacturers to invest in advanced avionics and aerodynamics, improving flight stability and sensor integration. Consequently, the segment’s robust development enhances the overall military drone market by enabling large-scale, long-duration surveillance and combat operations, increasing operational efficiency and justifying higher procurement budgets globally. The Hybrid/VTOL segment is growing at a CAGR of 13.66% due to its versatility in vertical takeoff and landing, reduced runway dependency, and ability to carry moderate payloads over extended distances. These capabilities prompt rapid product development in propulsion systems and flight control software. As a result, the segment’s growth contributes significantly to the military drone market by enabling flexible deployment in diverse terrains and conflict zones, expanding operational scenarios, and meeting evolving defense requirements with adaptable UAV platforms.

By Range, VLOS Leads Revenue Share, EVLOS Emerges as Fastest-Growing Range Segment

The VLOS segment holds 53% of revenue in 2024, driven by the segment’s simplicity, lower cost, and rapid deployment for tactical surveillance missions. This encourages investment in lightweight frames, enhanced battery life, and intuitive control interfaces. As a consequence, VLOS drones reinforce the military drone market by providing accessible, reliable UAV solutions for frontline troops, boosting adoption rates, accelerating mission-readiness, and facilitating smaller-scale reconnaissance without requiring complex communication infrastructure or extended-range technology investments. The EVLOS segment is expanding at a CAGR of 13.71%, fueled by the need for longer operational ranges and standoff reconnaissance without line-of-sight limitations. This stimulates the development of advanced communication links, satellite integration, and autonomous navigation systems. Consequently, the segment’s rapid growth strengthens the military drone market by enabling extended missions, reducing operational risk to personnel, and supporting strategic ISR, target acquisition, and electronic warfare applications in remote or hostile environments, creating higher-value UAV deployments globally.

By Operation Mode, Remotely Piloted UAVs Dominate Market; Semi/Full Autonomy Accelerates Growth

The Remotely Piloted segment commands 47% of revenue in 2024 due to established control protocols, operator familiarity, and proven reliability in surveillance and strike operations. These factors drive product development in secure communication links, precision control software, and redundancy systems. As a result, this segment underpins the military drone market by ensuring dependable UAV performance, reducing operational risks, enabling large-scale deployment, and fostering procurement by defense agencies that prioritize proven, manually supervised aerial platforms. The Semi-Autonomous / Fully Autonomous segment is experiencing the highest CAGR as AI-enabled decision-making reduces pilot workload, enhances mission adaptability, and enables real-time response in contested environments. This trend accelerates product development in onboard sensors, machine learning algorithms, and autonomous navigation. Consequently, this segment propels military drone market growth by expanding operational efficiency, supporting complex missions without direct human control, and driving innovation toward next-generation UAV systems capable of independent surveillance, target engagement, and networked battlefield operations.

Military Drone Market Regional Analysis:

North America Dominates the Military Drone Market in 2024

North America holds an estimated 39.9% market share in 2024 in the military drone market, primarily driven by substantial defense budgets, advanced R&D programs, and strategic investments in ISR, surveillance, and precision strike capabilities. The presence of leading UAV manufacturers such as Northrop Grumman, GA-ASI, and Lockheed Martin accelerates technological innovation, including long-endurance drones, high-payload platforms, and autonomous systems. These developments enhance operational efficiency, strengthen national security, and increase adoption across military branches, solidifying North America’s dominance in the global military drone market.

Get Customized Report as per Your Business Requirement - Request For Customized Report

-

United States Leads North America’s Military Drone Market

The U.S. dominates due to its substantial defense budget, robust drone R&D programs, and presence of major manufacturers like Northrop Grumman, GA-ASI, and Lockheed Martin. Military drones are heavily used for intelligence, surveillance, reconnaissance (ISR), and precision strikes, supporting consistent demand. Strategic modernization programs and government-backed procurement further strengthen the U.S. market position. Advanced autonomous capabilities, long-endurance UAVs, and high payload platforms cement the U.S. as the top contributor to North America’s Military Drone Market in 2024.

Asia Pacific is the Fastest-Growing Region in the Military Drone Market in 2024

The Military Drone Market in Asia Pacific is projected to grow at a CAGR of 15.4% from 2025 to 2032, driven by rising geopolitical tensions, defense modernization programs, and the increasing need for long-range intelligence, surveillance, and reconnaissance (ISR) operations. This growth stimulates development in advanced UAV platforms, autonomous systems, and payload capabilities. Nations are investing heavily in indigenous production, strategic procurement, and R&D to enhance operational readiness, strengthen border security, and maintain tactical superiority, accelerating the adoption of military drones across the region.

-

India Leads Asia Pacific’s Military Drone Market

India dominates due to rising defense budgets, strategic focus on indigenous UAV development, and modernization of surveillance and strike capabilities. The country emphasizes collaboration with global drone manufacturers while investing in domestic production to meet operational needs. Continuous upgrades in payload capacity, endurance, and autonomous functionalities are driving demand. Government initiatives, border security requirements, and military modernization programs further accelerate market growth, establishing India as the leading military drone market in Asia Pacific.

Europe Military Drone Market Insights, 2024

Europe shows steady growth in the Military Drone Market in 2024, fueled by defense modernization, cross-border security concerns, and investments in ISR and combat UAV systems. Germany’s advanced defense and aerospace industries enhance UAV adoption, increasing market penetration and operational capabilities.

-

Germany Leads Europe’s Military Drone Market

Germany dominates due to its established aerospace and defense sector, advanced engineering capabilities, and commitment to integrating UAVs into military operations. Military drones are deployed for surveillance, reconnaissance, and electronic warfare, supporting national security priorities. Strong R&D investments, government-backed procurement programs, and collaborations with European drone manufacturers strengthen Germany’s position. Focus on technological innovation and high-quality UAV development ensures Germany remains Europe’s top contributor to the military drone market in 2024.

Middle East & Africa and Latin America Military Drone Market Insights, 2024

The Military Drone Market in the Middle East & Africa and Latin America is experiencing growth in 2024, driven by regional security concerns and the modernization of defense capabilities. In the Middle East, countries like Saudi Arabia and the UAE lead with investments in ISR, surveillance, and precision strike UAVs to address geopolitical conflicts. In Latin America, Brazil and Mexico dominate through military modernization programs, border security enhancements, and procurement of tactical and long-endurance drones. Rising defense budgets and strategic partnerships continue to support increasing UAV adoption in both regions.

Competitive Landscape for the Military Drone Market:

Northrop Grumman Corporation

Northrop Grumman Corporation is a U.S.-based global leader in defense technology, specializing in military unmanned aerial vehicles (UAVs), surveillance systems, and autonomous platforms. With decades of expertise, the company designs, engineers, and produces high-end fixed-wing and rotary drones, including the renowned RQ-4 Global Hawk and MQ-8 Fire Scout. Northrop Grumman operates direct-to-government, managing design, production, and support services from its Virginia and California facilities. Its role in the military drone market is critical, providing advanced ISR, long-endurance surveillance, and precision strike capabilities to support national defense objectives and strategic operations.

-

In 2024, Northrop Grumman previewed its next-generation Global Hawk Block 30 variant, featuring enhanced sensor integration, extended flight endurance, and upgraded autonomous mission capabilities to meet evolving military requirements.

General Atomics Aeronautical Systems, Inc. (GA-ASI)

General Atomics Aeronautical Systems, Inc. (GA-ASI) is a U.S.-based leader in remotely piloted and autonomous UAV systems, specializing in platforms like the MQ-9 Reaper and MQ-1 Predator. The company focuses on designing, developing, and manufacturing high-performance drones for ISR, precision strike, and tactical operations. GA-ASI operates through government contracts, providing full lifecycle support, including training, maintenance, and software upgrades. Its role in the military drone market is pivotal, offering proven, versatile UAVs that enhance battlefield awareness, operational efficiency, and strategic decision-making.

-

In 2024, GA-ASI launched an upgraded MQ-9 Reaper with improved payload capacity, advanced sensors, and AI-enabled flight management to strengthen operational capabilities across global defense missions.

Lockheed Martin Corporation

Lockheed Martin Corporation is a U.S.-based aerospace and defense leader, specializing in unmanned aerial vehicles, advanced sensors, and autonomous warfare technologies. With decades of experience, the company develops fixed-wing, rotary, and optionally piloted drones, including the RQ-170 Sentinel and Stalker XE UAVs. Lockheed Martin delivers integrated solutions directly to government agencies, offering mission planning, sensor integration, and lifecycle support. Its role in the military drone market is significant, providing high-precision UAVs that enhance ISR, strike, and electronic warfare operations for modern defense strategies.

-

In 2024, Lockheed Martin unveiled the Stalker XE tactical UAV equipped with improved stealth features, AI-assisted navigation, and enhanced real-time data link capabilities for critical military missions.

Israel Aerospace Industries (IAI)

Israel Aerospace Industries (IAI) is an Israel-based pioneer in unmanned aerial vehicle technology, specializing in strategic and tactical drones such as Heron, Eitan, and Harop. The company designs, develops, and integrates high-performance UAV systems with advanced sensors, autonomous functions, and combat capabilities. IAI operates globally, providing full support including mission planning, maintenance, and training to defense forces. Its role in the military drone market is vital, delivering versatile UAV platforms that support long-endurance ISR, precision strike, and operational flexibility across diverse conflict environments.

-

In 2024, IAI introduced the Eitan Block 5 UAV, featuring extended flight range, enhanced payload capacity, and integrated electronic warfare systems for advanced military operations.

-

Northrop Grumman Corporation - Company Financial Analysis

Military Drone Market Key Players:

-

Northrop Grumman Corporation

-

General Atomics Aeronautical Systems, Inc. (GA-ASI)

-

Lockheed Martin Corporation

-

Israel Aerospace Industries (IAI)

-

Elbit Systems Ltd.

-

Teledyne FLIR LLC

-

Raytheon Technologies Corporation

-

Boeing (Insitu Inc.)

-

BAE Systems plc

-

Thales Group

-

Textron Systems

-

SAAB Group

-

Shield AI Inc.

-

Baykar (Baykar Makina)

-

Turkish Aerospace Industries (TAI)

-

AeroVironment, Inc.

-

Kratos Defense & Security Solutions, Inc.

-

Aviation Industry Corporation of China (AVIC)

-

Anduril Industries

-

Skydio

| Report Attributes | Details |

| Market Size in 2024 | US$ 13.84 Bn |

| Market Size by 2032 | US$ 24.28 Bn |

| CAGR | CAGR of 7.28% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Fixed Wing – D, Rotary Wing, Hybrid/VTOL – F) • By Range (Visual Line of Sight (VLOS) – D, Extended Visual Line of Sight (EVLOS) – F, Beyond Line Of Sight (BLOS)) • By Operation Mode (Remotely Piloted – D, Semi-Autonomous / Fully Autonomous – F, Optionally Piloted) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Northrop Grumman Corporation, General Atomics Aeronautical Systems, Inc. (GA-ASI), Lockheed Martin Corporation, Israel Aerospace Industries (IAI), Elbit Systems Ltd., Teledyne FLIR LLC, Raytheon Technologies Corporation, Boeing (Insitu Inc.), BAE Systems plc, Thales Group, Textron Systems, SAAB Group, Shield AI Inc., Baykar (Baykar Makina), Turkish Aerospace Industries (TAI), AeroVironment, Inc., Kratos Defense & Security Solutions, Inc., Aviation Industry Corporation of China (AVIC), Anduril Industries, Skydio |