Mobile Edge Computing (MEC) Market Size & Overview:

To Get More Information on Mobile Edge Computing (MEC) Market - Request Sample Report

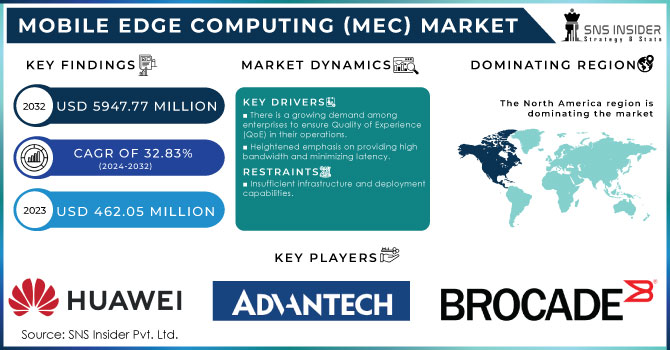

Mobile Edge Computing (MEC) Market size was valued at USD 462.05 million in 2023 and is expected to grow to USD 5947.77 million by 2030 and grow at a CAGR of 32.83 % over the forecast period of 2024-2032.

The demand for low latency, high bandwidth applications in autonomous vehicles, smart cities, Internet of Things has increased the need for these MEC technologies. According to the report of the U.S. Federal Communications Commission 2023, mobile data traffic has seen a surge of 35% over the past year, and with that, a projection states that by the end of 2027, 77% of all data will be processed at the network edge. Governments have also started to bring in policies and budget allocations for the quick implementation of these MEC infrastructures. A digital infrastructure report for the year 2023 by the European Commission highlighted an investment of €1.5 billion across its member states for the development of its edge computing. Bringing the data closer and streaming directly to the user’s device, is an efficient way to decrease latency and improve the EDGE server’s bandwidth. The government of India under the Digital India mission also has plans to extend its edge computing technologies to rural areas to get the 5G infrastructure with a budget of INR 2000 crores. The increase in government investments is seen as a significant driver of the mobile edge computing market. Mobile edge computing is deemed necessary for many sectors where real-time data needs to be acted on and responded to appropriately, quick processing is necessary, and circulation of the data frequently is analyzed.

Mobile edge computing is gaining importance because today, many smart devices and connected technologies are being used, and a substantial 5G network is being established worldwide. The technology is set up primarily at cellular base stations which makes it easier to develop applications and deploy them fast. Customer services are also provided to the end-user from the same cellular base stations. Many major organizations believe that mobile edge computing technology is transforming their processes and is gaining great importance helping them alter the way their businesses run to gain a competitive advantage. Banks, auto manufacturers, and wind-farm operators are among the organizations that are rapidly adopting mobile edge computing technology to enhance their processes and gain real-time insights. The significant growth in the mobile edge computing market is due to its increasing demand from companies that are gaining a competitive advantage in markets.

Mobile Edge Computing (MEC) Market Dynamics

Drivers

-

Increased use of real-time applications such as AR/VR, IoT, and autonomous vehicles, MEC enables processing closer to the user, reducing latency and enhancing performance.

-

Rapid 5G deployment is driving MEC adoption by facilitating higher speeds and improved network capacity, MEC is crucial for managing the massive data generated by 5G-enabled devices.

-

Expanding IoT ecosystems require efficient data processing and low-latency solutions, MEC supports real-time analytics at the network edge, improving IoT operations.

The main driver of the Mobile Edge Computing market is the increasing demand for low-latency applications. With the development of sectors such as augmented reality, virtual reality, autonomous vehicles, and the Internet of Things, there are applications requiring immediate performance. MEC technology is vital for minimizing data processing latency by moving it closer to the target user, usually to the edge of the networking system, rather than relying on cloud servers. For example, autonomous vehicles need to make decisions at a moment’s notice, processing data from dozens of sensors, cameras, and ultrasonic systems in real time multiple times per second. MEC guarantees that even a millisecond delay in data prediction, loading, or transmission can be reduced. A recent survey found that 75 percent of AR and VR applications require less than 20 milliseconds of latency to create a high-performance user interface.

The number of IoT systems, which is anticipated to reach 29.4 billion connected devices by 2030, necessitates real-time data processing. Applications of MEC in real-time analytics, data display, and processing in various ways in healthcare, manufacturing, and smart cities will lead to quicker decision-making processes. The real-time remote monitoring of patients in healthcare is only possible with MEC and enables the immediate processing of diagnostic information and timely treatment. Companies like Nokia and Vodafone have already launched edge computing solutions to improve AR-based maintenance in manufacturing, offering real-time instructions to engineers on the shop floor. This showcases how MEC is being adopted across industries to meet the growing demand for ultra-reliable low-latency communications, driving its rapid expansion and innovation in various real-time applications.

Restraints:

-

Implementing MEC requires significant infrastructure upgrades, making it expensive for smaller enterprises. High capital expenditure may slow down adoption rates, particularly in developing regions.

-

The distributed nature of MEC increases exposure to cyber threats at the edge nodes, ensuring robust security measures across edge environments is complex and challenging.

The Mobile Edge Computing market has one major restraint, which is security and privacy concerns. MEC brings the data processing closer to the edge nodes which are close to the end-users. MEC decentralizes the data processing and brings them closer to the end-users. This, however, brings a need to have strong security protocols for each and every edge, device, and server in the MEC network. These edge nodes and devices act as entry points for cyberattacks which will compromise the device at the entry point and also the devices close to that entry point. Managing such a vast network of entry points is more sophisticated and extravagant than securing a centralized cloud. Moreover, local processing of data is more susceptible to risks than centralized data processing. This is because of the possibility of unauthorized access to the data and the minimal protection that the edge devices might have. Security privacy and secure communications channels between the devices and the edge network have additional points. These concepts are unique to the MEC and can only be solved by coming up with solutions like advanced encryption and security solutions that are tailored to the MEC.

Opportunities

-

The realm of Augmented Reality (AR) and Virtual Reality (VR) is rapidly expanding, presenting enterprises with exciting opportunities in the emerging Mobile Edge Computing (MEC) application areas.

-

Introducing a novel revenue stream for service providers.

Mobile Edge Computing (MEC) Market Segment analysis

By Organization Size

Large enterprises emerged as the leading force in the mobile edge computing market. The large enterprises segment accounted for a substantial share of 65% in 2023. The high market share can be attributed to several factors such as the growing demand for high-performance computing and superior data processing capabilities. In addition, large organizations require improved operational efficiencies in large-scale operations. The adoption of MEC technologies is driven by large enterprises’ need to support complex applications such as AI, ML, and real-time analytics. In 2023, government statistics by the U.S. Department of Commerce indicated that large enterprises invested an average of $50 million in MEC technologies. The investment pattern is higher than the estimates of small and medium-sized enterprises. The high investment in MEC indicates a paradigm shift where large organizations are leveraging technology to improve the customer experience and supply chain operations.

By Industry Vertical

In 2023, the mobile edge computing market was dominated by the IT and telecom sectors. IT and telecom, driven by increased deployment of 5G networks and the demand for enhanced data processing capabilities closer to the network’s edge. Based on government data collected by the U.S. Federal Communications Commission, the telecommunications industry invested about $29 billion in 5G infrastructure as of 2023, with a proportion of 35% of these budgets set aside for MEC solutions. This growth is mainly attributed to the increasing need for ultra-low latency services to facilitate real-time applications, including augmented reality virtual reality, and the Internet of Things. Besides, the adoption by the sector is driven by the expansion of 5G networks, which require edge computing applications. The technology aids in optimizing the bandwidth while allowing users to enjoy seamless and high-speed IT and telecom services. In addition, revenues are increasingly being realized from the sector through the use of edge computing solutions. Notably, the government-sponsored 5G projects in China led to the increased adoption of MEC solutions in telecom. According to the Ministry of Industry and Information Technology, the country recorded a growth of 78% in MEC-based 5G stations in 2023.

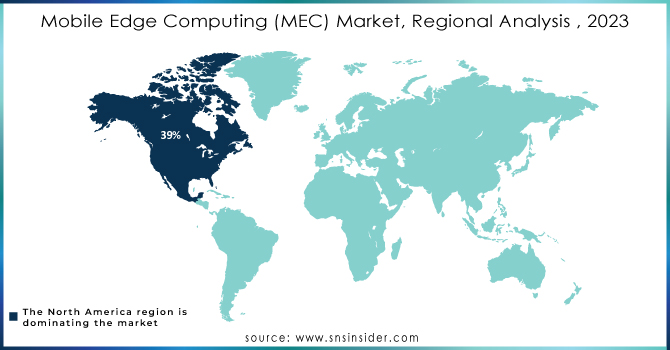

Regional Dominance

North America led the mobile edge computing market in 2023 and held 39% of the market share. The deployment of 5G technologies across North America and significant governmental support provided to the region for developing edge computing infrastructure are the factors that have contributed to this regional dominance. The U.S. Federal Communications Commission reported that around 210,000 small cell sites were set up across the United States by the end of 2022, which is a 25% increase from 2022; many of these sites were equipped with MEC capabilities. Moreover, the U.S. government verifiably supported this process by launching the Broadband Equity, Access, and Deployment program and allocating $42.5 billion for broadening the internet, including edge computing, in underserved areas. The Canadian administration also actively participated, funding 5G and the edge computing establishment across the country with CAD 1.2 billion. Collectively, these factors alongside the extensive development of the region’s IT and telecom sectors have led to North America’s leading role in the MEC market.

Asia Pacific is expected to grow at the highest CAGR during the projection period. Because of the companies that actively support the design of cloud solutions with integrated edge computing characteristics that will enhance the multi-access edge computing architecture for commercial use. A vivid example of such a commitment is the presentation of the Asia-Pacific region’s first multi-access cloud computing edge for gaming by Bridge Mobile Pte. Ltd., a business alliance of 33 major mobile telecommunications companies. This development showcases the region's commitment to pushing the boundaries of technology and providing cutting-edge solutions to meet the evolving needs of consumers and businesses alike.

Do You Need any Customization Research on Mobile Edge Computing (MEC) Market - Enquire Now

Latest Developments by Key Players

February 2023, Verizon announced a partnership with Amazon Web Services to improve its MEC offerings by incorporating AWS Wavelength into the operator’s 5G Ultra-Wideband network. The U.S. Department of Commerce has reported that the project is expected to enable ultra-low latency applications for various industries, such as gaming, AR/VR, and autonomous driving.

In July 2023, ADLINK Technology Inc., The company has announced the launch of the SuperCAT, the company’s latest software-defined EtherCAT motion controller. The new product reveal is not only a display of the firm’s proficiency in the field of motion control technology but also a reflection of the commitment to keeping up with the new solutions in the context of multi-access edge computing.

In August 2023, AT&T has announced the launch of its MEC platform for enterprise customers in cooperation with Microsoft Azure. According to the report, the U.S. Federal Communications Commission noted that the scheme is expected to improve real-time data processing and analytics supporting businesses, particularly in manufacturing, retail, and healthcare.

November 2023, NTT DOCOMO: The service provider has announced the deployment of MEC services across Japan in cooperation with the Ministry of Internal Affairs and Communications. The information was published in November, and the deployment is within the framework of the Japanese government’s “Beyond 5G” vision designed to implement high-class MEC solutions and speed up IoT and smart city initiatives throughout the country.

Key Players

-

Amazon Web Services (AWS) (AWS Wavelength, AWS Greengrass)

-

Microsoft Corporation (Azure Edge Zones, Azure IoT Edge)

-

Google Cloud (Anthos, Edge TPU)

-

IBM (IBM Edge Application Manager, IBM Watson IoT Platform)

-

Cisco Systems, Inc. (Cisco Edge Fog Fabric, Cisco Ultra Cloud Edge)

-

Hewlett Packard Enterprise (HPE) (HPE Edgeline, HPE GreenLake)

-

Nokia (Nokia MEC, Nokia 5G Edge)

-

Ericsson (Ericsson Edge Gravity, Ericsson Distributed Cloud)

-

Intel Corporation (Intel Smart Edge, Intel Network Builders)

-

VMware, Inc. (VMware Edge Cloud, VMware Tanzu)

-

Radisys Corporation (Radisys MEC, Radisys MediaEngine)

-

Mavenir (Mavenir MEC, Mavenir Cloud RAN)

-

AT&T Inc. (AT&T MEC, AT&T Network Edge)

-

ZTE Corporation (ZTE MEC Solution, ZTE Edge Computing Platform)

-

Huawei Technologies Co., Ltd. (Huawei MEC Solution, Huawei CloudEdge)

-

Aviat Networks (Aviat MEC, Aviat Cloud Services)

-

Dell Technologies (Dell Edge Gateway, Dell EMC VxRail)

-

Orange Business Services (Orange MEC, Orange 5G Edge)

-

Siemens AG (Siemens MindSphere, Siemens Industrial Edge)

-

EdgeConneX (EdgeConneX Edge Data Centers, EdgeConneX EDC) and others

| Report Attributes | Details |

| Market Size in 2023 | USD 462.05 million |

| Market Size by 2032 | USD 5947.77 million |

| CAGR | CAGR of 32.83 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware. Software, Service) • By Technology(4G, 5G, Wi-Max) • By Application(Location-based Services, Video Surveillance, Unified Communication, Optimized Local Content Distribution, Data Analytics, Environmental Monitoring) • By Organization Size(Large Enterprises, Small and Medium-sized Enterprises (SMEs)) • By Industry Vertical(Media & Entertainment, Retail, IT & Telecom, Healthcare, BFSI, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles |

Amazon Web Services (AWS), Microsoft Corporation, Google Cloud, IBM, Cisco Systems, Inc., Hewlett Packard Enterprise (HPE), Nokia, Ericsson, Intel Corporation, VMware, Inc., Radisys Corporation, Mavenir, AT&T Inc. , ZTE Corporation , Huawei Technologies Co., Ltd. |

| Key Drivers | • There is a growing demand among enterprises to ensure Quality of Experience (QoE) in their operations. • Heightened emphasis on providing high bandwidth and minimizing latency. |

| Market Opportunities | •The realm of Augmented Reality (AR) and Virtual Reality (VR) is rapidly expanding, presenting enterprises with exciting opportunities in the emerging Mobile Edge Computing (MEC) application areas.

•Introducing a novel revenue stream for service providers. |