DEALER MANAGEMENT SYSTEM MARKET KEY INSIGHTS:

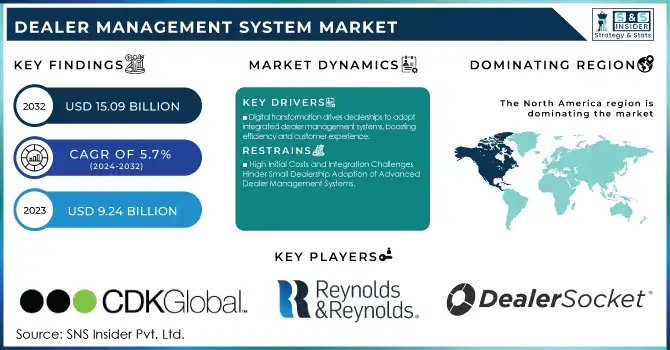

The Dealer Management System Market Size was valued at USD 9.24 Billion in 2023 and is expected to reach USD 15.09 Billion by 2032 and grow at a CAGR of 5.7% over the forecast period 2024-2032.

To Get More Information on Dealer Management System Market - Request Sample Report

The Dealer Management System (DMS) market has experienced significant growth over the past decade, A Dealer Management System is an integrated and streamlined approach towards most of the functions in a dealership that involve inventory management, sales, customer relationship management, accounting, and service management through some technological, economic, and business-related factors. Such systems have been designed to enhance the efficiency of dealerships, improve customer satisfaction, and increase profitability.

Consolidation at dealerships remained strong and was nearly at 250 dealership transactions during the first half of the year, though this was continued through 2023, as market activity began to wind down. Dealing acquisitions reached a 19% increase from the prior year during 2023, a sign that restructuring continues within the industry. This consolidation amplifies the demand for Dealer Management Systems (DMS), as multi-location dealership groups require sophisticated, integrated software that manages such operations, inventory, and customer relationships. These DMS solutions are crucial for dealing with the efficiency of such rapid industry changes.

MARKET DYNAMICS

KEY DRIVERS:

- Digital Transformation Drives Dealership Adoption of Integrated Dealer Management Systems for Enhanced Efficiency and Customer Experience

The automotive market continues digitizing, and dealerships now manage their business dealings with a Dealer Management System. Dealerships integrate sales, inventory, CRM, and service management under one platform, as the demand for seamless digital services remains. Using such an integrated approach enables dealerships to maximize the efficiency of their operations, engage their customers better, and make data-driven decisions.

For example, cloud-based DMS solutions are popular because they help dealerships scale easily by reducing overhead costs while serving customers better in-store and online. According to recent statistics, more than 60% of auto dealers deploy cloud-based DMS solutions, which means such solutions are fast becoming integral in implementing omnichannel experiences. This capability also assists in the monitoring and analysis of real-time data, thus enabling dealerships to optimize their inventory levels better. By doing this, it helps inform better decisions and rapidly addresses the fulfillment of requirements by customers. This is crucial because these same consumers are shifting towards online and omnichannel customer experiences during a purchase. A study indicates that 80% of car buyers have begun their journey online, but they expect a seamless flow from digital touchpoints to physical ones. It would be at the center of DMS platforms to play this role by supporting the dealerships as they work through the transformation of new expectations from the market and pressure competition.

- Cloud Adoption Fuels the Growth of Dealer Management Systems, Enabling Scalability and Operational Efficiency for Dealerships of All Sizes

The widespread adoption of cloud computing has significantly impacted the Dealer Management System market. Dealerships can use DMS solutions hosted in the cloud to have the same flexibility by accessing their management tools from anywhere while also cutting down on expensive on-premise hardware and maintenance. Apart from the immediate advantage of access, this transition to the cloud allows for seamless updates, greater data security, and scalability for the growth of a business. Cloud-based platforms enable dealerships regardless of size to easily integrate advanced features that could only be afforded by larger organizations with larger wallets. With the growing adoption of cloud technology, DMS platforms are being made more available to a new entry within the larger dealership tier, allowing smaller operations to access the same level of ease of operation that their larger cousins have long enjoyed. Driven primarily by cloud adoption, DMS is unleashing cost-effective, scalable, and efficient solutions for dealerships of any size. IT costs can be slashed by 66% with examples of cloud cost reduction mainly in computing, storage, and networking. In particular, DMS platforms can achieve compute cost savings of 63%, networking cost savings of 66%, and storage cost savings of 69% by leveraging cloud services such as AWS. As a result, this economic benefit is demystifying sophisticated tools like real-time inventory management and data analytics which were only in the reach of the bigger dealerships, and giving access to dealers of all sizes to such too.

RESTRAIN:

- High Initial Costs and Integration Challenges Hinder Small Dealership Adoption of Advanced Dealer Management Systems.

This is the high initial cost of implementing a DMS, especially for small dealerships. These costs could include the purchase of software licenses, integrating the system, and training the employees on how to properly use the new system. In addition, integrating DMSs from a dealership into its existing systems, such as the one dealing with legacy inventory or financial programs, can be complex and time-consuming. It would be too expensive for smaller dealerships to afford, even though running a DMS would bring several long-term benefits because all costs have to fit into their budget.

Integration of legacy systems with modern DMSs is highly challenging for small dealerships, which is mainly due to high initial costs and the complexity of upgrading a system. In a recent report, it has been estimated that 40% of companies face challenges in integrating their legacy infrastructure. It has been further stated that integration costs are normally 20-30% higher than the standard installation costs of systems. This can cost approximately USD 100,000 for a small dealership with system upgrades and integration of existing platforms with training for the staff. This is very expensive and time-consuming, sometimes up to 6-12 months to be operational, which further stretches the time taken to make it operational.

KEY MARKET SEGMENTATION

BY END-USER

The agriculture segment accounted for the largest revenue share of 20% in 2023, with robust investments in technology aimed at increasing operation efficiency. Companies are introducing new solutions such as automated farm management systems and advanced agricultural DMS to streamline inventory management, financial tracking, and supply chain operations. Notable players such as John Deere and AG Leader Technology have integrated DMS solutions with precision farming technologies, enhancing productivity and cost efficiency.

The transportation and Logistics Segment is expected to register the highest growth at a CAGR of 8.54% during the forecast period as clients would be in need of effective supply chain management and fleet operation. Such key players include SAP and Oracle, who have rolled out cloud-based solutions meant for logistic implementation, focusing on real-time tracking, predictive analytics, and route optimization. Thus, such developments have increased operational efficiency and customer service within the sector.

BY DEPLOYMENT TYPE

The on-premises deployment segment in the DMS market accounted for the highest revenue share of 60% in 2023. It is driven by the preference for local control over sensitive data and enhanced security measures. Companies like CDK Global and Fujitsu are improving their on-premises solutions to ensure dealerships obtain a more customizable and robust package of automotive and equipment handling capabilities. The on-premises DMS platforms enable managers to run complex tasks- dealing with inventory, sales, and service effectively without third-party hosting.

The Cloud deployment segment in the Dealer Management System (DMS) market is growing with the fastest CAGR during the forecasted period as dealerships increasingly shift toward cloud-based solutions that give them scalability, flexibility, and cost-effectiveness. Companies like Reynolds and Reynolds and Dealertrack have released cloud-based DMS solutions with features such as real-time reporting, enhanced data security, and improved customer relationship management.

REGIONAL ANALYSIS

In 2023, North America accounted for the largest market share for DMS market owing to the developed automotive industry, advanced technology uptake, and the immense presence of key players in the region such as CDK Global, and Reynolds. High demand from cloud-based DMS platforms also constitutes a strong growth driver since the system allows scalability and better customer service. In addition to this, the DMS usage by the dealerships in North America is also on the rise with such dealerships using DMS for inventory management, customer relationship management, and sales. The significant cybersecurity breach at CDK Global, which is one of the leaders of DMS providers to the automotive dealerships has affected more than 15,000 dealerships. Relating this to market relevance, growing cybersecurity risks determine a higher demand for the North American DMS sector, thus requiring higher priorities to be placed on DMS development and security in North America.

The Asia Pacific region is emerging as the fastest-growing Dealer Management Systems market for 2023, with an estimated CAGR of 7.45% during the forecast period. Growth from expanding dealership networks, increasing vehicle sales, and the increased adoption of digital technologies in automotive sectors across China, India, and Japan are driving this rapid growth. Major global DMS providers, including Auto-IT and Reynolds and Reynolds, have focused on Asia Pacific by introducing cloud-based localized solutions to fill high demand in this region for dealer management efficiency. Dealerships in the region increasingly adopt DMS to track their inventory, manage customer relationships, and identify trends in data, thereby boosting operational efficiency and customer satisfaction, which is being driven by a growing middle class and rising vehicle ownership. Such growth momentum is going to be further supported by investments in global and regional DMS providers along with this shift towards digitalization.

Do You Need any Customization Research on Dealer Management System Market - Inquire Now

Key Players

Some of the major players in the Dealer Management System Market are:

-

CDK Global (CDK DMS, CDK Pro)

-

Reynolds and Reynolds (Reynolds and Reynolds DMS, Reynolds and Reynolds eCRM)

-

DealerSocket (DealerSocket DMS, DealerSocket CRM)

-

Auto/Mate (Auto/Mate DMS, Auto/Mate CRM)

-

Dominion Dealer Solutions (Dominion DMS, Dominion CRM)

-

PBS Systems (PBS DMS, PBS CRM)

-

Quorum Information Technologies (Quorum DMS, Quorum CRM)

-

Auto-IT (Auto-IT DMS, Auto-IT CRM)

-

Dealertrack (Dealertrack DMS, Dealertrack CRM)

-

Autosoft (Autosoft DMS, Autosoft CRM)

-

VinSolutions (VinSolutions DMS, VinSolutions CRM)

-

Frazer Computing (Frazer DMS, Frazer CRM)

-

Auto/Mate Dealership Systems (Auto/Mate DMS, Auto/Mate CRM)

-

Adam Systems (Adam DMS, Adam CRM)

-

Autovance (Autovance DMS, Autovance CRM)

-

Xtime (Xtime Service Scheduling, Xtime Inventory Management)

-

ProMax (ProMax DMS, ProMax CRM)

-

DealerBuilt (DealerBuilt DMS, DealerBuilt CRM)

-

Votenza (Votenza DMS, Votenza CRM)

-

Autosoft DMS (Autosoft DMS, Autosoft CRM)

RECENT TRENDS

-

In June 2024, ABS Canada partnered with PBS Systems to make available for students advanced dealer management software as part of their curriculum. This allowed students to learn and train on leading-edge dealership software that would train them to get hands-on experience in the tools applied in the auto dealership industry, and thus equip them for eventual positions in the sector.

-

In July 2024, CDK Global's dealership software system was restored after suffering a cyber-attack that temporarily put services out of commission. The outage affected several dealership operations using the CDK DMS. This quick turnaround reinforces the case for cybersecurity and system reliability in ensuring dealership services remain uninterrupted especially since the consolidation of software will play an ever more vital role in the sale and servicing of vehicles in dealerships' operations.

-

In May 2024, the new CEO was slated to be Kurt Adams, appointed by IPC. With previous leadership over numerous tech firms, he was going to be assigned this new role to lead the company in its next phase of growth. With exposure to various forms of transformative projects and strategic development, he is expected to bring fresh insight and innovation into the operation that has come to be known as IPC. The appointment of Adams had come to the fore as the focal point in the advancement of the company's dealer management systems and increasing global expansion.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 9.24 Billion |

| Market Size by 2032 | US$ 15.09 Billion |

| CAGR | CAGR of 5.7 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Deployment Type (On-Premises, Cloud) • By End User (Transportation and Logistics, Agriculture, Construction, Oil & Gas, Mining, Marine, Motor Sports, Other End Users) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | CDK Global, Reynolds, DealerSocket, Auto/Mate, Dominion Dealer Solutions, PBS Systems, Quorum Information Technologies, Auto-IT, Dealertrack, Autosoft, VinSolutions, Frazer Computing, Auto/Mate Dealership Systems, Adam Systems, Autovance, Xtime, ProMax, DealerBuilt, Votenza, Autosoft DMS |

| Key Drivers | • Digital Transformation Drives Dealership Adoption of Integrated Dealer Management Systems for Enhanced Efficiency and Customer Experience • Cloud Adoption Fuels the Growth of Dealer Management Systems, Enabling Scalability and Operational Efficiency for Dealerships of All Sizes |

| Restraints | • High Initial Costs and Integration Challenges Hinder Small Dealership Adoption of Advanced Dealer Management Systems |