Graphic Design Software Market Report Scope & Overview:

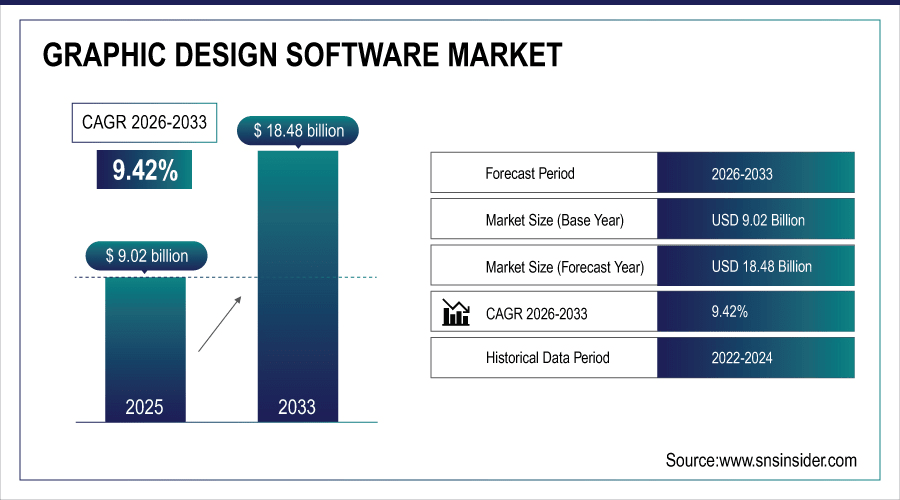

The Graphic Design Software Market Size was valued at USD 9.02 Billion in 2025E and is expected to reach USD 18.48 Billion by 2033 and grow at a CAGR of 9.42% over the forecast period 2026-2033.

The Graphic Design Software Market is experiencing significant growth due to the rapid digitalization across industries and the increasing demand for visually compelling content. Businesses, marketing agencies, and freelancers are leveraging graphic design software to create professional-quality visuals for branding, advertising, social media, and web development. The proliferation of cloud-based design tools, which enable real-time collaboration and remote accessibility, has further accelerated adoption, allowing teams to work efficiently across geographies. Additionally, the rise of small and medium-sized enterprises (SMEs) adopting design software for in-house marketing and promotional activities has expanded the market base substantially. According to study, over 60% of professional design teams now use cloud-based graphic design software for collaborative projects.

To Get More Information On Graphic Design Software Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 9.02 Billion

-

Market Size by 2033: USD 18.48 Billion

-

CAGR: 9.42% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Graphic Design Software Market Trends

-

Growing adoption of cloud-based design platforms enabling real-time teamwork globally.

-

Shift toward flexible subscription-based software pricing increasing user accessibility widely.

-

Designers increasingly leveraging tools remotely from multiple geographic locations efficiently.

-

Integration of AI features simplifies repetitive design tasks for users.

-

Non-professional users adopting design tools due to AI-driven simplicity.

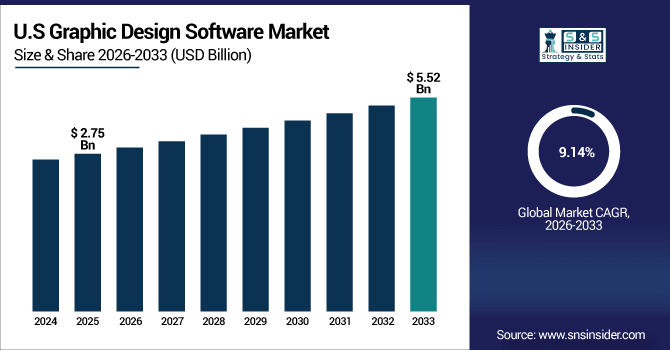

The U.S. Graphic Design Software Market size was USD 2.75 Billion in 2025E and is expected to reach USD 5.52 Billion by 2033, growing at a CAGR of 9.14% over the forecast period of 2026-2033, driven by advanced technology adoption, widespread cloud-based software use, strong digital marketing demand, skilled designers, and subscription-based models, supporting high-quality visual content creation and continuous market expansion.

Graphic Design Software Market Growth Drivers:

-

Cloud-Based Design Tools Fuel Collaboration and Boost Market Growth Rapidly

The growing adoption of cloud-based graphic design software is a primary driver of market growth. Cloud platforms allow designers, marketing agencies, and businesses to collaborate in real time, irrespective of geographic location. Teams can share projects, assets, and feedback instantly, which reduces project turnaround time and enhances productivity. Additionally, cloud solutions eliminate the need for heavy local computing infrastructure, making professional-grade design tools more accessible to small businesses, freelancers, and educational institutions. The flexibility, scalability, and subscription-based pricing models of cloud software are fueling adoption across industries, contributing significantly to overall market expansion.

Adoption of cloud-based design tools contributes to ~25–30% of overall market growth annually.

Graphic Design Software Market Restraints:

-

High Premium Software Costs Limit Adoption Among Small Users

Despite the market growth, the high cost of premium graphic design software remains a major restraint. Tools like Adobe Creative Cloud and Autodesk require expensive subscriptions or licenses, which can be a barrier for startups, freelancers, or educational users in developing regions. Additionally, frequent software updates and add-on costs increase the total cost of ownership. This financial barrier limits the adoption of advanced software solutions, causing a segment of potential users to rely on free or low-cost alternatives, which can slow down revenue growth for major market players.

Graphic Design Software Market Opportunities:

-

AI Integration in Design Tools Enhances Productivity and Expands Market

The integration of artificial intelligence (AI) and automation presents a significant opportunity for the Graphic Design Software Market. AI-powered features, such as auto-layouts, color palette suggestions, image recognition, and generative designs, can drastically reduce the time required for repetitive tasks. Designers can focus on creativity while AI handles routine processes, improving productivity and design quality. Moreover, AI integration can attract non-professional users, such as small business owners or content creators, who seek easy-to-use tools without extensive design expertise. This technological advancement is expected to expand the user base and drive revenue growth across regions.

Projects completed with AI assistance see a ~20% increase in perceived design quality according to internal surveys.

Graphic Design Software Market Segmentation Analysis:

-

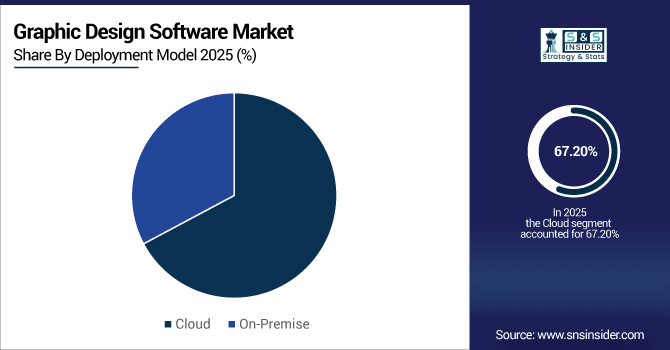

By Deployment Model: In 2025, Cloud the market 67.20%, with Cloud is the fastest-growing segment with a CAGR 11.04%.

-

By Product Type: In 2025, Vector Design led the market with share 35.60%, while UI/UX & Prototyping are the fastest-growing segment with a CAGR 10.02%.

-

By Licensing & Pricing: In 2025 Subscription led the market with share 42.30%, while Freemium the fastest-growing segment with a CAGR 10.81%.

-

By End Use: In 2025, Advertising & Marketing Agencies led the market with share 38.04%, while Education & Students is the fastest-growing segment with a CAGR 10.02%.

By Deployment Model, Cloud Leads Market with Fastest Growth

In the Graphic Design Software Market, the Cloud deployment model both leads the market and exhibits the fastest growth. Cloud-based platforms offer real-time collaboration, remote accessibility, and seamless integration with other productivity tools, making them highly preferred by businesses, marketing agencies, and freelance designers. The flexibility of subscription-based pricing, reduced reliance on local computing infrastructure, and scalability for small and medium-sized enterprises further drive adoption. Additionally, the growing trend of remote work and global team collaborations has accelerated cloud deployment, positioning it as a key contributor to overall market expansion while transforming how design projects are executed across industries.

By Product Type, Vector Design Leads Market and UI/UX & Prototyping Fastest Growth

In the Graphic Design Software Market, the Vector Design segment currently leads, driven by its widespread use in branding, advertising, and digital media projects due to precision, scalability, and compatibility with multiple platforms. Vector tools are preferred by professionals for creating logos, illustrations, and marketing visuals, contributing significantly to market revenue. Meanwhile, the UI/UX & Prototyping segment is witnessing the fastest growth, fueled by increasing demand for app and web development, digital product design, and interactive interfaces. The surge in startups, digital agencies, and mobile applications is driving rapid adoption of UI/UX tools, making this segment a key growth engine for the market.

By Licensing & Pricing, Subscription Leads Market while Freemium is Fastest Growth

In the Graphic Design Software Market, the Subscription licensing model leads the market, driven by its flexibility, predictable costs, and widespread adoption among businesses, freelancers, and educational institutions. Subscription plans allow users to access the latest software updates and cloud-based collaboration tools without large upfront investments, enhancing affordability and convenience. Meanwhile, the Freemium model is witnessing the fastest growth, attracting individual creators, small businesses, and students who seek access to professional-grade tools with minimal initial cost. The rising popularity of freemium offerings, combined with easy upgrade options to paid plans, is expanding the user base and fueling overall market growth.

By End Use, Advertising & Marketing Agencies Lead Market and Education & Students Fastest Growth

In the Graphic Design Software Market, Advertising and Marketing Agencies currently lead, driven by their extensive use of design software for branding, promotional campaigns, social media content, and digital marketing initiatives. These agencies require professional-grade tools for high-quality visual creation, which contributes significantly to overall market revenue. At the same time, the Education and Students segment is witnessing the fastest growth, fueled by increasing adoption in schools, universities, and e-learning platforms. Affordable software options, cloud accessibility, and freemium models enable students and educators to leverage advanced design tools, expanding the user base and driving rapid growth in this segment across regions.

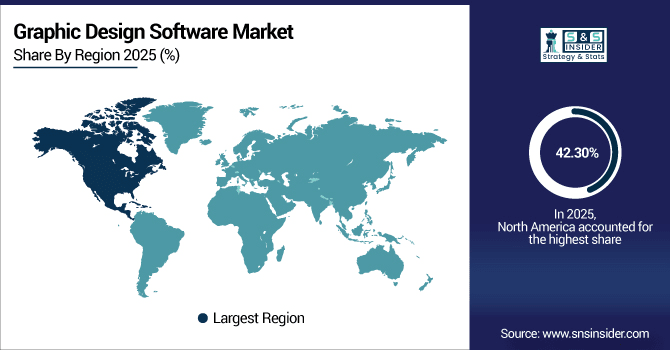

Graphic Design Software Market Regional Analysis:

North America Graphic Design Software Market Insights:

The Graphic Design Software Market in North America held the largest share 42.30% in 2025, due to the presence of leading software providers, widespread digital adoption, and a mature creative industry ecosystem. The region benefits from high demand across advertising agencies, digital marketing firms, media houses, and educational institutions. Cloud-based solutions and subscription licensing models are widely adopted, enabling real-time collaboration and cost-effective access to professional tools. Additionally, the growing integration of AI and automation in design software enhances productivity and attracts both professional and non-professional users. Technological advancements, coupled with strong IT infrastructure, position North America as a key driver of market growth.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Dominates Graphic Design Software Market with Advanced Technological Adoption

The U.S. dominates the Graphic Design Software Market, driven by advanced technological adoption, widespread cloud-based tools, AI integration, strong creative industries, and high demand from businesses, agencies, and educational institutions.

Asia-Pacific Graphic Design Software Market Insights

In 2025, Asia-Pacific is the fastest-growing region in the Graphic Design Software Market, projected to expand at a CAGR of 10.81%, driven by rapid digitalization, expanding startup ecosystems, and increasing adoption of creative tools among SMEs and freelancers. The region is witnessing rising demand for cloud-based design software, subscription models, and AI-powered features. Growth in mobile applications, e-learning content, digital marketing, and social media campaigns is boosting the need for UI/UX and prototyping tools. Affordable software options, improved internet infrastructure, and a growing creative workforce are contributing to significant market expansion, positioning Asia-Pacific as a key hub for innovation and accelerated adoption of graphic design solutions.

China and India Propel Rapid Growth in Graphic Design Software Market

China and India drive rapid growth in the Graphic Design Software Market, fueled by rising digital adoption, increasing SME usage, growing demand for cloud-based tools, and expanding creative and tech-savvy user base.

Europe Graphic Design Software Market Insights

Europe holds a significant share in the Graphic Design Software Market, driven by a strong presence of creative agencies, corporate design teams, and growing digital marketing initiatives. The adoption of cloud-based and subscription-based design software is rising, enabling real-time collaboration and enhanced productivity. Demand for UI/UX, vector, and raster design tools is increasing as businesses focus on digital transformation and brand visibility. Additionally, emphasis on innovative design solutions and integration of AI-powered features supports efficiency and creative output. Robust IT infrastructure, high digital literacy, and supportive policies contribute to Europe’s steady market growth and technological advancement in design solutions.

Germany and U.K. Lead Graphic Design Software Market Expansion Across Europe

Germany and the U.K. lead Graphic Design Software Market expansion in Europe, driven by strong digital adoption, advanced creative industries, widespread cloud-based tool usage, and growing demand for innovative design solutions.

Latin America (LATAM) and Middle East & Africa (MEA) Graphic Design Software Market Insights

Latin America and the Middle East & Africa are emerging markets in the Graphic Design Software Market, experiencing steady growth driven by increasing digital adoption, expanding startups, and rising demand for creative content across businesses and educational institutions. Cloud-based and subscription software solutions are gaining popularity due to affordability, scalability, and ease of remote collaboration. The growing need for UI/UX design, social media content, and marketing visuals is further fueling adoption. Additionally, improving IT infrastructure, rising digital literacy, and supportive policies in both regions are enabling SMEs, freelancers, and corporate design teams to leverage professional-grade tools. These factors collectively position LATAM and MEA as key growth regions globally.

Graphic Design Software Market Competitive Landscape

Maxon is a leading provider of 3D design and rendering software, offering tools for motion graphics, visual effects, and animation. Its professional-grade solutions support creative industries globally, and recent brand unification and product innovations enhance workflow efficiency, collaboration, and accessibility, reinforcing Maxon’s influence in the rapidly growing graphic design software market.

-

In Sept 2025, Maxon introduced a unified product logo system to strengthen its ecosystem identity and improve brand recognition across professional design tools.

Dassault Systèmes specializes in 3D design, modeling, and digital twin solutions, catering to engineering, manufacturing, and creative sectors. By integrating advanced visualization, collaboration, and AI tools, the company enables precise, scalable design workflows. Its software innovations contribute to the professional segment, supporting growth in specialized graphic design and 3D modeling markets.

-

In Feb 2025, Dassault Systèmes partnered with Apple to integrate Vision Pro into its software, launching “3DLive” for real-time 3D model collaboration and early-stage manufacturing issue detection.

Canva provides a cloud-based, user-friendly design platform widely adopted by businesses, educators, and individuals. With generative AI tools, templates, and collaborative features, Canva empowers non-professional and professional users to create high-quality visuals efficiently. Continuous innovation and AI integration position Canva as a key driver of market expansion in graphic design software.

-

In Oct 2024, Canva introduced new AI enhancements including “Dream Lab” for text-to-image generation, improved Magic AI tools, real-time reaction stickers, interactive charts, and expanded royalty-free assets, boosting collaboration and content creation.

Graphic Design Software Market Key Players:

Some of the Graphic Design Software Market Companies are:

-

Adobe

-

Canva

-

Corel

-

Affinity (Serif)

-

Autodesk

-

Maxon

-

Dassault Systèmes

-

Freepik

-

VistaCreate

-

Marq (Lucidpress)

-

Kittl

-

Inkscape

-

GIMP

-

Procreate

-

Sketch

-

Microsoft

-

Penpot

-

Krita

-

Photopea

-

Figma.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 9.02 Billion |

| Market Size by 2033 | USD 18.48 Billion |

| CAGR | CAGR of 9.42% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Vector Design, Raster, Page Layout, 3D Design & Rendering, UI/UX & Prototyping) • By Deployment Model (Cloud, On-Premise) • By Licensing & Pricing (Subscription, Perpetual License, Freemium, Open-Source, Enterprise) • By End-User (Advertising & Marketing Agencies, Publishers & Print Media, Web & App Designers, In-House Corporate Design Teams, Education & Students, Small Businesses) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Adobe, Canva, Corel (Alludo), Affinity (Serif), Autodesk, Maxon, Dassault Systèmes, Freepik, VistaCreate, Marq (Lucidpress), Kittl, Inkscape, GIMP, Procreate, Sketch, Microsoft, Penpot, Krita, Photopea, Figma., and Others. |