Mobile POS Market Report Scope & Overview:

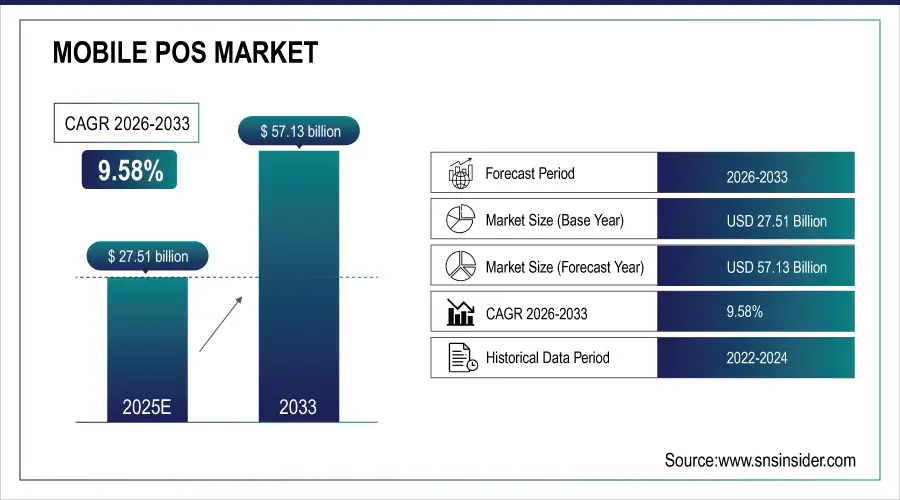

The Mobile POS Market Size is valued at USD 27.51 Billion in 2025E and is expected to reach USD 57.13 Billion by 2033 and grow at a CAGR of 9.58% over the forecast period 2026-2033.

The Mobile POS Market analysis, due to businesses increasingly adopt mobile and cloud-based payment solutions to enhance customer experience and streamline transactions. With the rise of smartphones and tablets, merchants especially small and medium-sized enterprises (SMEs), restaurants, retail shops, and service providers are shifting from traditional cash registers and fixed POS systems to flexible mobile POS terminals.

According to study, over 60% of small and medium-sized merchants are estimated to be transitioning from fixed POS systems to mobile POS solutions to improve flexibility and reduce hardware costs.

Market Size and Forecast:

-

Market Size in 2025: USD 27.51 Billion

-

Market Size by 2033: USD 57.13 Billion

-

CAGR: 9.58% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Mobile POS Market - Request Free Sample Report

Mobile POS Market Trends:

-

Rapid growth of contactless, QR-based, and mobile wallet payments boosts mPOS adoption.

-

Small and medium enterprises increasingly replace traditional POS with flexible mobile POS systems

-

Cloud-based reporting, analytics, and inventory management becoming standard features in mPOS platforms

-

Rising smartphone penetration and affordable devices accelerate mobile-first payment acceptance.

-

Growing demand for portable checkout solutions in retail, food service, and hospitality sectors

-

Expansion of mobile POS adoption across emerging markets with improving digital payment infrastructure

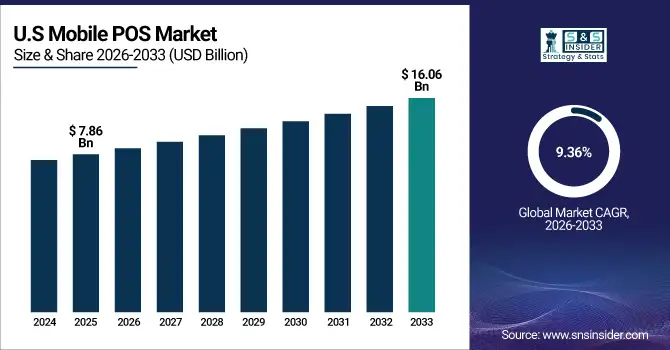

The U.S. Mobile POS Market size is USD 7.86 Billion in 2025E and is expected to reach USD 16.06 Billion by 2033, growing at a CAGR of 9.36% over the forecast period of 2026-2033,

The U.S. mobile POS market is growing rapidly due to widespread digital payment adoption, advanced retail infrastructure, and high e-commerce penetration. Contactless payments, cloud-based POS solutions, and integration with analytics and loyalty programs drive strong adoption across retail and hospitality sectors.

Mobile POS Market Growth Drivers:

-

Cashless Payment Boom Accelerates Adoption of Mobile POS Solutions

A significant driver for the mobile POS market growth is the rapid increase in cashless payments and digital transaction adoption across retail, hospitality, and service industries. The widespread use of smartphones, contactless cards, QR codes, and mobile wallets has transformed how consumers pay for goods and services. Mobile POS systems allow merchants to accept payments anytime and anywhere, improving checkout speed and customer convenience. Small and medium-sized businesses, street vendors, and pop-up stores are increasingly adopting mPOS solutions due to their low setup costs, portability, and ease of integration with digital payment platforms. This shift toward cashless economies is significantly accelerating mPOS adoption.

Smartphone-enabled POS solutions represent nearly 65% of new POS installations among small merchants

Mobile POS Market Restraints:

-

Security Risks and Network Dependence Challenge Mobile POS Market Expansion

The risk of data breaches, fraud, and dependency on stable internet connectivity are posing some challenges to market growth. Mobile POS systems process sensitive customer payment data, making them potential targets for cyberattacks if security protocols are not properly implemented. In addition, mPOS functionality often relies on continuous network availability; poor internet connectivity in remote or underdeveloped areas can disrupt transactions and reduce reliability. These concerns may limit adoption among security-conscious enterprises and in regions with weak digital infrastructure.

Mobile POS Market Opportunities:

-

Merging Economies and Smart Features Unlock New Mobile POS Growth

A major opportunity lies in the expansion of mobile POS adoption in emerging economies and the integration of advanced value-added features. Rapid urbanization, growing smartphone penetration, and increasing acceptance of digital payments in regions such as Asia-Pacific, Latin America, and Africa are creating new demand for mPOS solutions. Additionally, modern mobile POS platforms now offer inventory management, customer analytics, loyalty programs, and cloud-based reporting, making them more attractive to merchants seeking all-in-one business management tools. These developments present significant growth potential for mPOS providers to expand their footprint.

Merchants adopting feature-rich mPOS platforms report 30–40% improvement in operational efficiency.

Mobile POS Market Segmentation Analysis:

-

By Component: In 2025, Software led the market with a share of 46.85%, while Services is the fastest-growing segment with a CAGR of 11.62%.

-

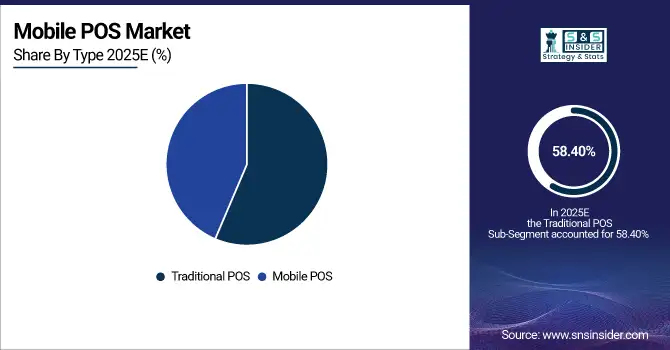

By Type: In 2025, Traditional POS led the market with a share of 58.40%, while Mobile POS is the fastest-growing segment with a CAGR of 12.15%.

-

By Deployment Mode: In 2025, On-Premise led the market with a share of 527.51%, while Cloud-Based is the fastest-growing segment with a CAGR of 13.08%.

-

By End-User: In 2025, Retail & E-commerce led the market with a share of 44.92%, while Transportation & Logistics is the fastest-growing segment with a CAGR of 10.47%.

By Type, Traditional POS Lead Market and Mobile POS Fastest Growth

In 2025, Traditional POS segment leads the market, supported by its established presence in large retail chains, supermarkets, and fixed-location businesses. These systems offer stability, robust transaction handling, and long-term reliability, making them the preferred choice for high-volume environments. Many enterprises continue to maintain traditional POS infrastructure alongside digital upgrades, sustaining its market leadership.

Mobile POS is the fastest-growing segment, fueled by increasing adoption among small retailers, food services, and pop-up stores. Its portability, lower cost, and ease of deployment make it ideal for dynamic sales environments, accelerating growth across emerging and developed markets.

By Component, Software Lead Market and Services Fastest Growth

In 2025, Software dominated the mobile POS market, as it forms the core of mobile POS systems by enabling transaction processing, inventory management, analytics, and customer engagement. Retailers and service providers increasingly rely on advanced POS software for real-time reporting, payment integration, and omnichannel functionality. Continuous upgrades, security enhancements, and compatibility with multiple devices have reinforced software’s dominant position across small, medium, and large enterprises.

Services represent the fastest-growing segment, driven by rising demand for installation, system integration, customization, training, and ongoing technical support. As businesses adopt more complex mobile POS ecosystems, reliance on managed and professional services is growing rapidly to ensure seamless deployment and operational efficiency.

By Deployment Mode, On-Premise Lead Market and Cloud-Based Fastest Growth

In 2025, On-premise deployment largest segment share to the market, as many enterprises prioritize data control, security, and system customization. Large retailers and organizations with legacy infrastructure favor on-premise solutions to maintain operational continuity and compliance with internal IT policies.

Cloud-based deployment is the fastest-growing segment, driven by scalability, cost-efficiency, and remote accessibility. Businesses increasingly adopt cloud POS solutions for automatic updates, real-time analytics, and seamless integration with digital payment platforms, supporting rapid market expansion.

By End-User, Retail & E-commerce Lead Market and Transportation & Logistics Fastest Growth

In 2025, Retail & e-commerce segment lead the mobile POS market, accounting for the largest share of mobile POS adoption. High transaction volumes, omnichannel sales strategies, and demand for enhanced customer experience make POS systems essential across physical and digital retail environments.

Transportation & logistics is the fastest-growing segment, as mobile POS solutions are increasingly used for on-the-go payments, delivery confirmation, ticketing, and fleet operations. The need for mobility, real-time billing, and digital record-keeping is driving rapid adoption in this sector.

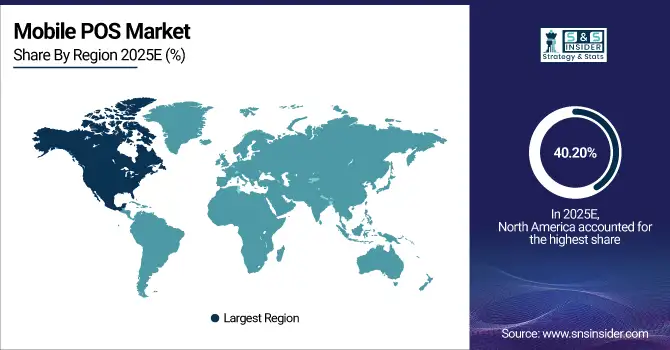

Mobile POS Market Regional Analysis:

North America Mobile POS Market Insights:

The North America dominated the Mobile POS Market in 2025E, with over 40.20% revenue share, due to high adoption of digital payment solutions and advanced retail infrastructure. Widespread use of smartphones, tablets, and cloud-based systems enables rapid deployment of mobile POS solutions across retail, hospitality, and service sectors. Strong demand for contactless payments, omnichannel retailing, and real-time transaction management supports growth. Continuous innovation, integration with analytics and CRM tools, and strong presence of POS solution providers further strengthen the region’s market position.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Mobile POS Market Insights

The U.S. and Canada lead mobile POS adoption with advanced retail infrastructure, high digital payment usage, and strong e-commerce growth. Contactless payments, cloud-based solutions, and integration with analytics and loyalty programs drive widespread deployment across retail and hospitality sectors.

Asia Pacific Mobile POS Market Insights:

The Asia-Pacific region is expected to have the fastest-growing CAGR 10.47%, driven by rapid digitalization, expanding retail and hospitality sectors, and increasing adoption of mobile payments. Growth in small and medium enterprises, rising smartphone penetration, and demand for cost-effective payment solutions accelerate adoption. The shift toward cashless transactions, growth of e-commerce, and expansion of cloud-based POS platforms support market expansion. Government initiatives promoting digital payments and growing consumer preference for convenient checkout experiences further fuel growth.

China and India Mobile POS Market Insights

China and India are rapidly adopting mobile POS solutions due to growing smartphone penetration, expanding retail and e-commerce sectors, and increasing digital payment adoption. Small businesses and SMEs increasingly leverage mobile POS for efficient, cashless transactions.

Europe Mobile POS Market Insights

Europe shows steady growth in the mobile POS market, supported by increasing adoption of contactless payments and strong regulatory frameworks for digital transactions. Retailers and service providers use mobile POS systems to enhance customer experience, reduce checkout times, and support omnichannel operations. Demand from hospitality, transportation, and event management sectors contributes to adoption. Integration with inventory management, analytics, and loyalty programs, along with focus on data security and compliance, supports sustained market growth.

Germany and U.K. Mobile POS Market Insights

Germany and the U.K. show steady mobile POS growth, supported by contactless payment adoption, regulatory frameworks for digital transactions, and demand from retail, hospitality, and service sectors for enhanced operational efficiency and customer experience.

Latin America (LATAM) and Middle East & Africa (MEA) Mobile POS Market Insights

Latin America and the Middle East & Africa show steady growth in the mobile POS market, driven by expanding retail networks, rising smartphone penetration, and increasing adoption of digital and cashless payments. Small businesses and informal retailers in Latin America increasingly use mobile POS solutions to improve transaction efficiency and financial inclusion, supported by e-commerce growth, fintech partnerships, and mobile banking. In the Middle East & Africa, demand is fueled by expanding retail and hospitality sectors, tourism growth, smart city initiatives, and government-led digital transformation programs. Despite infrastructure and regulatory challenges, improving connectivity, fintech investments, and preference for contactless payments support long-term market expansion across both regions.

Mobile POS Market Competitive Landscape:

Square, Inc. is a leading provider of mobile point-of-sale (mPOS) solutions for small to medium-sized businesses. Its ecosystem includes hardware like card readers and terminals, and software for payments, inventory, and analytics. Square emphasizes simplicity, affordability, and seamless integration with online and offline sales channels. With a focus on innovation, security, and user-friendly platforms, Square enables merchants to accept payments anywhere, manage operations efficiently, and enhance the customer experience in the mobile POS market.

-

In May 2025, Square launched the Square Handheld, a compact POS device with tap‑to‑pay, barcode scanner, inventory features and seven industry‑specific modes, aimed at restaurants and small retailers to speed checkout and improve mobility.

Shopify Inc. offers a comprehensive mobile POS solution integrated with its e-commerce platform, enabling retailers to manage in-store and online sales through a unified system. Its mobile POS devices and apps support payments, inventory tracking, and analytics. Shopify emphasizes seamless omnichannel experiences, scalability, and ease of use for merchants of all sizes. By combining cloud-based software with intuitive hardware, Shopify strengthens retail operations, enhances customer engagement, and drives adoption in the mobile POS market.

-

In April 2025, Shopify released Shopify POS version 10, a major redesign improving in‑store workflows, enhanced Tap‑to‑Pay/offline functionality, and better integration with e‑commerce and inventory systems for omnichannel retailers.

Verifone Systems, Inc. provides mobile POS devices, payment terminals, and software solutions for retail, hospitality, and service industries. Its products support secure, contactless, and EMV-compliant transactions while integrating with inventory and analytics systems. Verifone focuses on reliability, security, and innovation in mPOS technologies, enabling businesses to streamline operations and accept payments anywhere. With a footprint and robust partner ecosystem, Verifone remains a key player driving the growth and adoption of mobile POS solutions.

-

In February 2025, Verifone partnered with fintech firms in Southeast Asia to build cloud‑based mobile payment infrastructure and expand mobile POS acceptance for retailers and service businesses.

Mobile POS Market Key Players:

Some of the Mobile POS Market Companies

-

Square, Inc.

-

PayPal Holdings, Inc.

-

Shopify Inc.

-

Verifone Systems, Inc.

-

Clover Network, LLC

-

Worldline

-

PAX Technology Limited

-

Zebra Technologies Corporation

-

Toast, Inc.

-

Lightspeed Commerce Inc.

-

NCR Corporation

-

Oracle Corporation

-

Microsoft Corporation

-

Samsung Electronics Co., Ltd.

-

Honeywell International Inc.

-

HP Inc.

-

Chipper Cash

-

SumUp Ltd.

-

Revel Systems

-

Ingenico Group

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 27.51 Billion |

| Market Size by 2033 | USD 57.13 Billion |

| CAGR | CAGR of 9.58% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Component (Hardware, Software, Services) •By Type (Mobile POS, Traditional POS) •By Deployment Mode (Cloud-Based, On-Premise) •By End-User (Retail & E-commerce, Hospitality, Healthcare, Transportation & Logistics, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Square, Inc., PayPal Holdings, Inc., Shopify Inc., Verifone Systems, Inc., Clover Network, LLC, Worldline, PAX Technology Limited, Zebra Technologies Corporation, Toast, Inc., Lightspeed Commerce Inc., NCR Corporation, Oracle Corporation, Microsoft Corporation, Samsung Electronics Co., Ltd., Honeywell International Inc., HP Inc., Chipper Cash, SumUp Ltd., Revel Systems, and Ingenico Group. |