Mobile Robots Market Report & Overview:

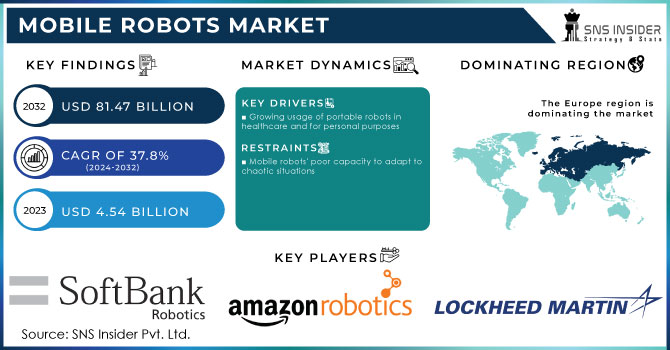

The Mobile Robots Market Size was USD 19.55 billion in 2023 and is expected to reach USD 90.92 billion by 2032, growing at a CAGR of 18.62 % over the forecast period of 2024-2032. Advancements in AI, machine learning, and sensor technology are driving this explosive growth — allowing robots to better navigate and interact with their environments. Main contributors include the increasing need for automation across multiple sectors (e.g., logistics, healthcare, and manufacturing) with the e-commerce sector being an enormous component. Other growing trends are collaborative robots (cobots), robotics-as-a-service (RaaS) models and integration of 5G to allow for real-time processing. Mobile robots are also branching out into areas like agriculture and defense.

Get More Information on Mobile Robots Market - Request Sample Report

Mobile Robots Market Dynamics

Drivers:

-

Revolutionizing Mobile Robots Operations with 5G Integration

The integration of 5G technology is transforming the mobile robots market by enabling real-time data processing, faster speeds, and enhanced connectivity. Ultra-low latency allows mobile robots to efficiently traverse dynamic landscapes by processing a high volume of data at the edge and deciding better. In fields such as defense, 5G enables coordination of up to 10,000 robots in complex terrain for autonomous reconnaissance and rescue missions, among other applications. It will enable the development of innovative autonomous delivery systems, agriculture, industrial automation, and robotics-as-a-service (RaaS).Advanced countermeasure techniques guarantee coverage for 5G in combat settings, making it possible for mobile robots to function correctly even amidst electromagnetic interference.

Restraints:

-

Mobile robots face difficulties navigating complex, unstructured environments with unpredictable obstacles and sudden changes.

Despite advancements, mobile robots still face significant challenges that limit their widespread adoption A continuing challenge is navigating complex, unstructured environments, particularly in dynamic environments where sudden disturbances or obstacles can hinder performance. Furthermore, managing fragile objects carefully and working in extreme situations such as sub-optimal light or unfavorable weather remains a challenge. Another hurdle is that mobile robots are difficult to combine with existing infrastructure. For example, 91% of shippers and 75% of logistics providers use warehouse management systems, while fewer than 8% of warehouses in the U.S. use autonomous mobile robots (AMRs).Larger companies often lead adoption, with smaller firms following later, creating a gap in technology usage between different-sized operations.

Opportunities:

-

The increasing demand in e-commerce offers a chance for mobile robots to optimize warehouse operations, improving inventory management, order fulfillment, and reducing labor costs.

The rapid growth of e-commerce has significantly increased the demand for autonomous mobile robots (AMRs) in warehouses and fulfillment centers. Robots, such as BrightPick’s Giraffe, are revolutionizing tasks like inventory management, order fulfillment, and navigating high shelves up to 20 feet tall. AMRs streamline operations, improve accuracy, and enhance efficiency, helping meet the rising demands of online shopping. The use of AMRs addresses challenges like labor shortages, scalability, and cost efficiency. As companies invest in warehouse automation, including AMRs, this trend is expected to expand further, with robots handling everything from sorting and picking to last-mile delivery, creating a major opportunity in modernizing logistics operations.

Challenges:

-

Integrating mobile robots into existing systems involves challenges in ensuring compatibility, adjusting infrastructure, and achieving seamless operational integration.

Integrating mobile robots into existing infrastructure and supply chain systems remains a significant challenge, as it requires overcoming technical complexity and substantial costs. Many organizations struggle to ensure seamless communication and compatibility between mobile robots and legacy systems. This process requires comprehensive data acquisition, adjustments in systems, and upgrades in existing workflows, that can incur a cost and operational downtime to get integrated. More importantly, as organizations increasingly turn to automation, the demand for competent workers to oversee and sustain these programs grows. If they are not properly integrated, they can be seriously limited in their potential to optimize operations, which can slow adoption and reduce return on investment.

Mobile Robots Segment Analysis

By Professional Robots

In 2023, professional robots dominated the mobile robots market, accounting for approximately 69% of the market share. These robots are prevalent in various sectors such as healthcare, logistics, and manufacturing as they are known for their high accuracy, capabilities and flexibility. Professional robots are usually built for specialized roles for specific applications like medical surgeries, automation in warehouses and inspection, thus it is very important to have robots to help improve operations efficiency and safety. They excel in performing complex and repetitive tasks, as well as hazardous activities, which is one reason why they dominate.

The Personal & Domestic Robots segment is expected to experience the fastest growth from 2024 to 2032, Increase to the rising demand for home automation and convenience. Factors spurring this segment’s growth include an increase in dual-income households, an aging population and rising consumer interest in smart home technologies. Moreover, with the entrance of AI, robotics, and IoT combination into the customer portion, development is advancing the functionality of individual and domestic robots, making them less demanding and less expensive. As these robots become more intelligent, affordable, and reliable, their adoption in everyday homes is expected to surge, further driving market expansion.

By Application

The Healthcare segment is the dominant application in the mobile robots market, holding around 25% of the market share in 2023. The increasing adoption of mobile robots in healthcare is driven by the need for improved efficiency, patient care, and operational productivity. Mobile robots are being increasingly used in hospitals and healthcare facilities for tasks such as disinfection, delivery of medical supplies, and assisting healthcare staff in non-critical tasks. This allows medical personnel to focus on patient care while enhancing the overall quality of service. The growing aging population and rising healthcare demands are fueling the need for automation in healthcare facilities, which is expected to further boost the market for mobile robots in this sector over the coming years.

The agriculture sector is expected to be the fastest-growing segment in the mobile robots market from 2024 to 2032, as labor shortages, environmental concerns, and the need for high productivity increase, mobile robots can perform a wide range of agricultural tasks more efficiently. Planting, harvesting, monitoring crops, spraying pesticides, and studying soil types are among these tasks. Mobile robots equipped with advanced sensors and AI technologies allow for precise, data-driven farming, reducing waste and increasing crop yields. The growth of precision agriculture, coupled with the push for sustainable farming practices, is significantly driving the adoption of mobile robots in agriculture.

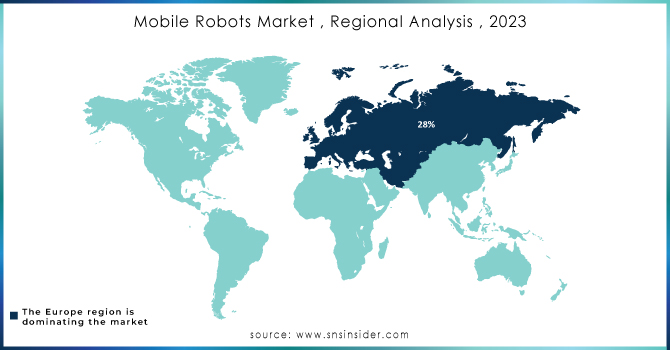

Mobile Robots Regional Analysis

Asia-Pacific is the dominant region in the mobile robots market, holding around 50% of the market share in 2023. This dominance is largely driven by the rapid technological advancements, increasing adoption of automation, and the presence of key manufacturing hubs in countries like China, Japan, and South Korea. These countries have been early adopters of robotics and automation in industries such as manufacturing, logistics, and healthcare. China's significant investments in AI and robotics technology, along with its expanding smart manufacturing industry, contribute heavily to the region’s growth. Japan, a leader in robotics innovation, continues to advance in both industrial and service robots, with applications in sectors like healthcare, retail, and agriculture. South Korea also stands out with its robust robotics infrastructure, particularly in the automotive and electronics industries. Additionally, countries in Southeast Asia, such as Singapore and India, are rapidly catching up with growing investments in robotics as they look to modernize their industries and tackle labor shortages. The region’s dominance is further bolstered by favorable government policies, the availability of skilled labor, and increasing interest in robotics in emerging industries.

North America is the fastest-growing region in the mobile robots market from 2024-2032, driven by advancements in automation, AI, and robotics. The U.S. is at the forefront of technological innovations and industries, such as logistics, healthcare and manufacturing, that are increasingly employing mobile robots to enhance efficiency, and cost go down and offset labor shortages. E-commerce and wholesale/retail automation led by Amazon and Walmart & Co. are robust growth drivers. In Canada too, we have growth, most notably in healthcare and agriculture as mobile robots are being utilized for precision farming and patient care. Favorable government policies and funding further support the region's growth, positioning North America as a leader in mobile robot deployment.

Need any customization research on Mobile Robots Market - Enquiry Now

Mobile Robots Market Key Players

Some of the major players in Mobile Robots Market along with their product:

-

KUKA (Germany) - (Industrial Robots, Automation Solutions)

-

ABB (Switzerland) - (Industrial Robots, Collaborative Robots, Automation Solutions)

-

Honda Motor (Japan) - (ASIMO Robot, Autonomous Delivery Robots)

-

Mobile Industrial Robots (Denmark) - (Autonomous Mobile Robots, AMRs)

-

Omron Automation (US) - (Autonomous Mobile Robots, Robotics Automation Solutions)

-

Honda Motor Co. Ltd (Japan) - (ASIMO Robot, Autonomous Robots for Various Applications)

-

Northrop Grumman Corporation (US) - (Autonomous Robotics, Military Robots, Drones)

-

iRobot Corporation (US) - (Home Cleaning Robots, Roomba, Robotic Vacuum Cleaners)

-

SoftBank Robotics Group (Japan) - (Pepper Robot, Social Robots, Humanoid Robots)

-

Kongsberg Maritime (Norway) - (Autonomous Underwater Vehicles, Robotics for Maritime Applications)

-

GeckoSystems Intl. Corp. (US) - (Mobile Robots, Care Robots, Autonomous Robots for Elderly Assistance)

-

ECA GROUP (France) - (Autonomous Underwater Vehicles, Drones, Robotics for Defense and Security)

-

LG Electronics (South Korea) - (Service Robots, Home Robots, Automated Cleaning Robots)

-

Lockheed Martin Corporation (US) - (Military Robots, Autonomous Systems, Robotic Technology for Aerospace and Defense)

List of Suppliers who provide raw material and component in Mobile Robots Market:

Raw Material Suppliers:

-

BASF (Germany)

-

Dow Chemical Company (US)

-

ArcelorMittal (Luxembourg)

-

Alcoa (US)

-

ThyssenKrupp (Germany)

Component Suppliers:

-

Nidec Corporation (Japan)

-

Mitsubishi Electric (Japan)

-

STMicroelectronics (Switzerland)

-

Bosch Rexroth (Germany)

-

Omron Corporation (Japan)

Recent Development

-

August 05, 2024, KUKA Robotics will present state-of-the-art solutions, including AMRs and advanced robotic palletizing systems, at PACK EXPO International 2024. Featured will be its KMP 1500P AMR, which is equipped with cutting-edge SLAM navigation, and its KR IONTEC robot designed for high-efficiency depalletizing. These innovations help KUKA address the demands for greater flexibility, speed and precision in packaging and processing applications.

-

June 6, 2024, ABB’s new T702 tug-style AMR introduces a 360-degree point cloud data through Visual SLAM for more accurate navigation in dynamic environments, 6 June 2024 When combined with AMR Studio software, it commissions faster and performs better than unstructured installations.

| Report Attributes | Details |

| Market Size in 2023 | USD 19.55 Billion |

| Market Size by 2032 | USD 90.92 Billion |

| CAGR | CAGR of 18.62% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Professional Robots, Personal & Domestic Robots) • By Application (Agricultural, Cleaning, Educational, Healthcare, Manufacturing, Warehousing & Logistics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | KUKA (Germany), ABB (Switzerland), Honda Motor (Japan), Mobile Industrial Robots (Denmark), Omron Automation (US), Northrop Grumman Corporation (US), iRobot Corporation (US), SoftBank Robotics Group .(Japan), Kongsberg Maritime (Norway), GeckoSystems Intl. Corp. (US), ECA Group (France), LG Electronics (South Korea), and Lockheed Martin Corporation (US). |