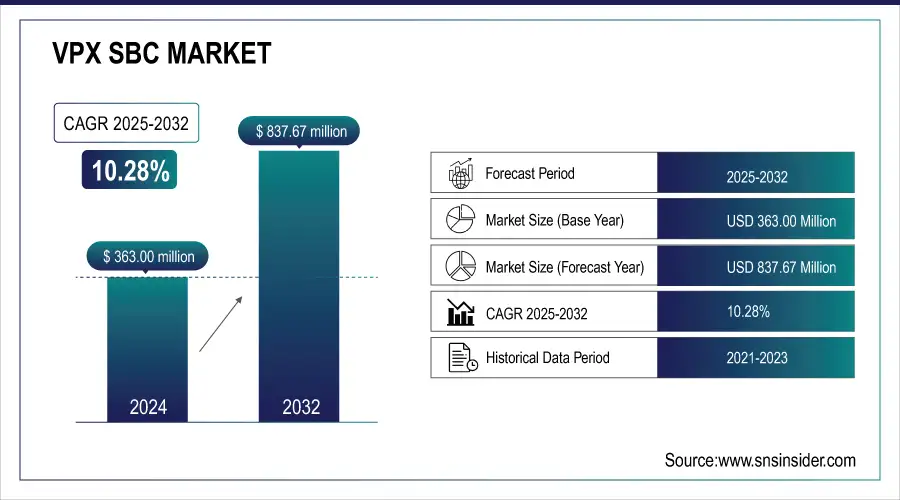

VPX SBC Market Size & Growth Analysis:

The VPX SBC Market size was valued at USD 363.00 Million in 2024 and expected to reach 837.67 Million by 2032 and grow at a CAGR of 10.28% over the forecast period of 2025-2032.

The VPX Single Board Computer (SBC) market is expanding rapidly because there is a higher demand for smaller, lighter, and more efficient rugged computing systems. These systems are crucial in fields like defense, aerospace, and industrial automation, where compact, lightweight, and strong solutions are required to function reliably in challenging environments. Miniaturization in VPX SBCs involves making parts like processors, memory, and connectors smaller without losing performance.

The aerospace and defense sector is the largest and most influential end-user segment of the VPX Single Board Computer (SBC) market, driven by the need for rugged, high-speed, and real-time computing systems. VPX SBCs power mission-critical applications such as electronic warfare, radar, C4ISR, and avionics, in line with the U.S. DoD’s MOSA initiative promoting OpenVPX interoperability. Recent developments include Abaco Systems’ USD 4 million radar upgrade order for U.S. Air Force jets, Mercury Systems’ aircraft-ready OpenVPX modules, HENSOLDT’s avionics mission computer in Europe, and DRDO’s VPX SBC procurement in India—highlighting rapid global adoption across defense and aerospace modernization programs.

VPX SBC Market Size and Forecast:

-

Market Size in 2024: USD 363.00 Million

-

Market Size by 2032: USD 837.67 Million

-

CAGR (2025–2032): 10.28%

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Get more information on VPX SBC Market - Request Sample Report

VPX SBC Market Trends Highlights:

-

Defense modernization and rising global military spending (USD 2.71 trillion in 2024) are driving strong demand for rugged VPX SBCs used in radar, EW, and unmanned systems.

-

Companies such as Curtiss-Wright and Mercury Systems are launching AI-ready VPX computing solutions for multi-domain, autonomous, and sensor-fusion applications.

-

High design, certification, and ruggedization costs—ranging from USD 300 to USD 2,500 per unit—remain a key restraint for smaller OEMs and cost-sensitive industries.

-

Integration complexity with legacy VME and CompactPCI systems continues to increase development time and non-recurring engineering expenses.

-

The U.S. Department of Defense’s MOSA initiative and the 2024 SOSA 1.1 release are boosting interoperability, modularity, and AI acceleration across VPX systems.

-

Collaborations such as Elma Electronic and Kontron AG’s MOSA-compliant VPX platforms are promoting faster prototyping, cost efficiency, and wider market adoption.

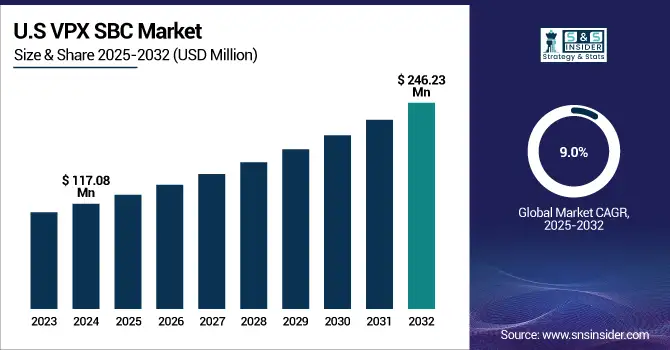

The United States dominates the North American VPX Single Board Computer (SBC) Market, valued at USD 117.08 million in 2024 and projected to reach USD 246.23 million by 2032 at a 9.0% CAGR. Growth is driven by defense modernization, aerospace innovation, and AI-enabled mission systems. Key players like Abaco Systems, Mercury Systems, and Northrop Grumman integrate rugged VPX modules in radar, avionics, UAVs, and secure computing platforms for next-generation military and aerospace programs.

VPX SBC Market Drivers:

-

Defense Modernization Fueling Demand for Rugged VPX Embedded Systems

Global defense modernization initiatives and rising investments in advanced military electronics are driving strong growth in the VPX Single Board Computer (SBC) Market. Modern defense platforms—such as radar, EW, and unmanned systems—demand compact, high-speed, and rugged computing for real-time mission performance. VPX SBCs, built on OpenVPX and SOSA standards, meet these needs through modularity and durability. With global military expenditure reaching USD 2.71 trillion in 2024, manufacturers like Curtiss-Wright and Mercury Systems are introducing AI-ready VPX SBCs to support next-generation, multi-domain defense missions.

Regional Insights and Market Impact

|

Region |

Key Insights |

Impact on VPX SBC Market |

|

North America |

Strong defense R&D budgets, major aerospace OEM presence (Lockheed Martin, Boeing, Northrop Grumman), and rapid adoption of OpenVPX/SOSA standards. |

Drives large-scale integration of VPX SBCs in avionics, C4ISR, and unmanned defense systems across the U.S. and Canada. |

|

Europe |

Increasing investments in defense digitalization under NATO and EU frameworks, with key programs like FCAS and Tempest. |

Encourages adoption of rugged VPX architectures for radar, mission computing, and secure communication applications in defense modernization. |

|

Asia-Pacific |

Expanding defense budgets and indigenous aerospace initiatives in China, India, Japan, and South Korea. |

Creates emerging opportunities for local VPX SBC manufacturing and integration in radar, UAVs, and electronic warfare platforms. |

|

Latin America |

Growing focus on border security, surveillance, and aerospace modernization, particularly in Brazil and Mexico. |

Stimulates gradual adoption of cost-effective and modular VPX SBCs for tactical defense and homeland security applications. |

VPX SBC Market Restraints:

-

High Development and Integration Costs

The VPX Single Board Computer market faces significant challenges due to the high cost of product design, customization, and integration. For aerospace PCBs (a component of rugged computing platforms), typical added cost due to certification, compliance, and test-processes ranges from USD 300 to over USD 2,500 per unit, indicating how board-level certification and ruggedization sharply raise cost. VPX SBCs are designed to perform in extreme environments such as aerospace, defense, and industrial automation requiring compliance with stringent military and environmental standards like MIL-STD-810, DO-254, and DO 178C. The development process involves ruggedization, signal integrity testing, thermal analysis, and long validation cycles, which increase both time-to-market and total development costs. Moreover, VPX systems often require custom backplanes, power supplies, and chassis, which raise non-recurring engineering (NRE) expenses. Many defense contractors and OEMs, especially small and mid-sized firms, struggle to justify the return on investment due to limited production volumes and government budget constraints. Integration complexity also adds to the cost since VPX systems must interoperate with legacy VME or CompactPCI architectures, demanding additional interface development and validation. These factors collectively limit large-scale adoption of VPX SBCs in cost-sensitive applications outside defense and aerospace.

VPX SBC Market Opportunities:

-

Rising Demand for Modular Open Systems Architecture (MOSA) and Interoperability Standards

The rising adoption of Modular Open Systems Architecture (MOSA) is transforming the VPX Single Board Computer (SBC) market. Mandated by the U.S. Department of Defense, MOSA encourages the use of OpenVPX and SOSA standards to enhance interoperability, scalability, and cost efficiency across defense platforms. The 2024 release of SOSA Technical Standard 1.1 introduced AI acceleration and improved thermal designs, advancing VPX capabilities. Collaborations such as Elma Electronic and Kontron AG’s MOSA-compliant VPX platform exemplify faster prototyping and reduced integration costs, positioning modular, standards-based VPX systems as the cornerstone of future defense modernization initiatives.

Recent Developments (Standardization & Interoperability):

|

Organization |

Initiative |

Year |

Insight |

|

The Open Group SOSA Consortium |

Released latest SOSA Technical Standard 1.1 incorporating AI acceleration and enhanced thermal design provisions. |

2024 |

Promotes faster innovation and interoperability in VPX SBCs. |

|

Elma Electronic & Kontron AG |

Collaborated to develop a MOSA-compliant VPX development platform for defense integrators. |

2025 |

Reduces design complexity and integration costs across multi-vendor systems. |

VPX SBC Market Segment Analysis:

By Processor Architecture

The VPX Single Board Computer (SBC) market is led by NXP Power Architecture, projected to grow from USD 109.30 million in 2024 to USD 243.11 million by 2032 at a CAGR of 9.78%, driven by its proven reliability, security, and rugged performance in aerospace and defense systems. Simultaneously, Intel Architecture is poised for rapid expansion due to advancements in AI, edge computing, and energy-efficient processors like Xeon-D and Core Ultra. Intel’s ecosystem strength, backward compatibility, and focus on AI-driven military and industrial automation solutions position it as the fastest-growing segment in next-generation VPX SBC platforms.

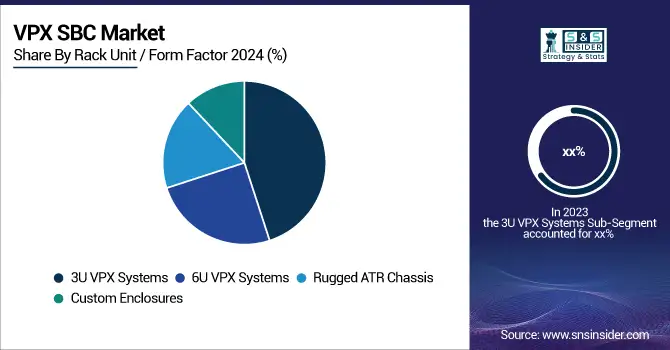

By Rack Unit/Form Factor

The VPX Single Board Computer (SBC) market is led by 3U VPX systems, valued at USD 152.10 million in 2024 and projected to reach USD 345.25 million by 2032 at a CAGR of 10.06%, driven by compact, rugged, and power-efficient designs ideal for defense, avionics, and unmanned platforms. In contrast, 6U VPX systems are set to register the fastest CAGR of 10.87%, rising from USD 113.37 million in 2024 to USD 273.21 million by 2032, fueled by high-performance computing demands in radar, AI-enabled missions, naval systems, and industrial automation where scalability, bandwidth, and parallel processing are critical.

By Application

The Electronic Warfare (EW) segment led the global VPX SBC market in 2024, valued at USD 81.25 million, projected to reach USD 185.65 million by 2032 with a CAGR of 10.15%, driven by AI-enabled threat detection, SIGINT, and real-time mission computing in advanced defense platforms like the F-35 and EA-18G. Meanwhile, the Radar Systems segment is the fastest-growing, expanding from USD 64.64 million in 2024 to USD 156.86 million by 2032 at a CAGR of 10.97%, fueled by next-gen AESA, AEW&C, and maritime radar upgrades demanding high-speed data fusion and A I-assisted situational awareness.

By End-User

The Defense segment dominated the global VPX Single Board Computer (SBC) market in 2024, valued at USD 147.78 million, and is projected to reach USD 344.24 million by 2032 with a CAGR of 10.41%, driven by rising demand for rugged, high-performance computing in mission-critical applications such as EW, radar, C4ISR, and unmanned platforms. Meanwhile, the Aerospace segment is the fastest-growing, expanding from USD 99.75 million in 2024 to USD 232.82 million by 2032 at a CAGR of 10.43%, supported by advancements in avionics, satellite systems, and AI-enabled flight computing. Together, these sectors underpin VPX SBC adoption in next-generation defense and aerospace modernization programs worldwide.

By Platform

The Airborne Systems segment led the VPX SBC market in 2024 at USD 134.84 million, projected to reach USD 314.02 million by 2032 (CAGR 10.41%), driven by adoption in combat aircraft, UAVs, and commercial aviation for real-time mission computing and avionics upgrades. Meanwhile, the Ground-Based Systems segment will grow fastest from USD 118.09 million to USD 277.39 million (CAGR 10.52%), supported by defense modernization, radar, and C5ISR integration. Programs like the F-35, MQ-9 Reaper, AN/TPY-2 Radar, and CV90 vehicle highlight VPX SBCs’ critical role in powering next-gen, rugged, and interoperable defense computing platforms.

North America VPX SBC Market Insights:

North America led the global VPX Single Board Computer (SBC) market in 2024, valued at USD 140.30 million, projected to reach USD 303.24 million by 2032, at a CAGR of 9.38%. The region’s dominance is fueled by extensive defense modernization, aerospace innovation, and AI-driven industrial adoption. Programs like MOSA, NGAD, and F-35 avionics upgrades drive demand for high-performance VPX systems in radar, EW, and command-control. Additionally, collaborations under the SOSA Consortium enhance interoperability, while strong investments in space exploration, autonomous vehicles, and edge AI solidify North America’s leadership in rugged embedded computing.

Need any customization research on VPX SBC Market - Enquiry Now

United States and Canada VPX SBC Market Trends:

The United States leads the North American VPX Single Board Computer (SBC) Market, valued at USD 117.08 million in 2024, projected to reach USD 246.23 million by 2032 at a CAGR of 9.00%. Its dominance is driven by defense modernization, aerospace innovation, and AI-enabled mission systems. In contrast, Canada is the fastest-growing market, increasing from USD 23.22 million in 2024 to USD 57.01 million by 2032 at a CAGR of 11.12%, propelled by NORAD renewal, aerospace digitalization, and AI-integrated R&D collaborations, positioning it as a rising force in rugged embedded computing innovation.

Europe VPX Single Board Computer (SBC) Market Insights:

Europe accounted for a significant share of the global VPX SBC market in 2024, valued at USD 95.83 million, and is expected to reach USD 209.00 million by 2032, growing at a CAGR of 9.50%. Growth is driven by defense modernization, aerospace expansion, and industrial automation. Programs such as FCAS (France, Germany, Spain) and the UK’s Tempest use VPX-based systems for AI-driven avionics and radar processing. Companies like Airbus, Leonardo, and Thales are integrating rugged VPX modules in aircraft and satellites. Supported by the European Defense Fund (EDF) and VITA-Europe, Europe emphasizes open standards, interoperability, and technological independence.

Germany and Spain VPX SBC Market Trends:

Germany led the European VPX SBC market in 2024 at USD 26.68 million, projected to reach USD 54.55 million by 2032 with a CAGR of 8.62%. Growth is driven by Bundeswehr modernization, aerospace advancements by Airbus and Diehl Aerospace, and Industry 4.0 automation via Siemens and Bosch Rexroth. Collaborative R&D by DLR and Fraunhofer enhances FPGA and GPU-based VPX systems.Spain is the fastest-growing market, rising from USD 9.02 million (2024) to USD 21.15 million (2032) at a CAGR of 10.49%, fueled by defense upgrades, FCAS participation, aerospace expansion via Airbus España and SENER, and national digitalization initiatives.

Asia-Pacific VPX SBC Market Insights:

Asia-Pacific is the fastest-growing region in the global VPX Single Board Computer (SBC) market, valued at USD 80.40 million in 2024 and projected to reach USD 224.91 million by 2032, at a CAGR of 12.93%. Growth is fueled by defense modernization, aerospace expansion, and industrial digitalization in China, India, Japan, and South Korea. Defense forces are integrating VPX SBCs into C4ISR, radar, and EW systems, while agencies like ISRO, CNSA, and JAXA employ them in space missions. Additionally, industrial automation, 5G deployment, and local manufacturing initiatives like “Made in China 2025” and PLI bolster regional innovation and self-reliance.

China and India VPX SBC Market Trends:

China and India are propelling the Asia-Pacific VPX Single Board Computer (SBC) market’s rapid expansion. China, valued at USD 23.86 million in 2024 and projected to reach USD 69.68 million by 2032 (CAGR 13.54%), leads through defense modernization, aerospace advancements, and semiconductor self-sufficiency under the Made in China 2025 initiative. India, growing at the fastest rate (CAGR 13.98%), is accelerating VPX adoption through Make in India and Atmanirbhar Bharat initiatives, supported by DRDO, BEL, ISRO, and HAL. Together, both nations are driving technological innovation and transforming APAC into a leading hub for rugged embedded computing solutions.

Latin America VPX SBC Market Insights:

Latin America’s VPX Single Board Computer (SBC) Market was valued at USD 23.78 million in 2024 and is projected to reach USD 55.70 million by 2032, growing at a CAGR of 10.49%. The region’s market growth is primarily driven by rising investments in defense modernization, aerospace collaboration, and the increasing adoption of rugged computing systems in industrial automation and research institutions. Brazil and Mexico are the key contributors, with their governments focusing on strengthening military and aerospace capabilities while supporting indigenous technology development.

Brazil and Colombia Maket VPX SBC Market Trends:

Brazil and Colombia are the key growth engines of the Latin American VPX Single Board Computer (SBC) Market. Brazil, valued at USD 8.66 million in 2024, dominates the region, driven by defense modernization, aerospace innovation, and industrial automation through programs like SISFRON and collaborations with Embraer and Petrobras. Colombia, growing at the fastest CAGR of 11.28%, leverages VPX SBCs in defense, telecommunications, and energy sectors. Supported by initiatives like Plan Colombia and partnerships with CODALTEC and Ecopetrol, it is rapidly advancing its embedded computing ecosystem for surveillance, automation, and national security modernization.

Middle East & Africa (MEA) VPX SBC Market Insights:

The Middle East & Africa VPX SBC market, valued at USD 22.69 million in 2024 and projected to reach USD 44.82 million by 2032 (CAGR 8.14%), is driven by defense modernization, aerospace development, and industrial automation.The Middle East & Africa VPX Single Board Computer (SBC) market is witnessing robust growth driven by national defense modernization, aerospace expansion, and industrial digitalization. Saudi Arabia, under Vision 2030, integrates VPX SBCs into radar, C4ISR, and EW systems via SAMI.

Saudi Arabia, UAE, Israel, and South Africa VPX SBC Market Trends:

The MEA VPX SBC market is expanding with defense modernization, aerospace missions, and industrial automation. Saudi Arabia and the UAE drive adoption in radar, C4ISR, and satellite systems, while Israel and South Africa integrate rugged VPX SBCs in defense, avionics, and energy applications through local innovation and partnerships.

Key VPX SBC Companies are:

-

Extreme Engineering Solutions

-

Connect Tech

-

Kontron AG

-

Aitech

-

Mercury Systems

-

Acromag

-

Advantech Co., Ltd.

-

Concurrent Technologies Inc.

-

GE Aviation Systems

-

Ecrin Systems

-

ADLINK Technology Inc.

-

Mistral Solutions Pvt. Ltd.

-

Cornet Technology, Inc.

-

Elma Electronic Inc.

-

General Micro Systems (GMS)

-

Pixus Technologies Inc.

-

General Dynamics Mission Systems, Inc.

-

Wolf Advanced Technology

List of companies that supply raw materials and components critical to the VPX SBC market. These suppliers provide essential components such as semiconductors, PCBs, interconnect solutions, and rugged enclosures:

-

Intel Corporation

-

NVIDIA Corporation

-

AMD

-

Xilinx

-

Broadcom Inc.

-

TE Connectivity

-

Samtec

-

Rogers Corporation

-

Honeywell International Inc.

-

Schroff

VPX SBC Market Competitive Landscape:

Abaco Systems (Established in 2015)

Abaco Systems is a leading U.S.-based provider of rugged, open-architecture embedded computing solutions for defense, aerospace, and industrial applications. The company specializes in VPX, VME, and SOSA-aligned systems, delivering high-performance computing, networking, and sensor processing solutions for mission-critical environments.

-

June 2024 – Abaco Systems introduced the SBC3901, a 3U VPX single-board computer featuring Nvidia’s Jetson AGX Orin GPU. Designed for autonomous and embedded edge computing, it delivers 248 TOPS of AI performance, integrates advanced AI processing accelerators, and meets MIL-STD-810 standards for rugged environments, making it ideal for defense, aerospace, and industrial applications.

Connect Tech Inc. (Established in 1985)

Connect Tech Inc. is a Canada-based company specializing in embedded computing and hardware design solutions. It offers a wide range of VPX, COM Express, and NVIDIA Jetson-based embedded systems used in defense, aerospace, and industrial automation. The company is known for rugged, high-performance, and customizable computing platforms.

-

September 2024, – Connect Tech has joined the Gigabit Multimedia Serial Link (GMSL) Ecosystem by Analog Devices as a Design Partner. This collaboration strengthens their edge AI and robotics solutions, with products like the Anvil Embedded System and Sentry-X2 MIL-Rugged supporting advanced vision and AI computing.

Elma Electronic Inc. (Established in 1960)

Elma Electronic Inc. is a leading Swiss-based provider of high-performance embedded computing, enclosure, and backplane solutions. The company designs and manufactures VPX systems, ATR chassis, and modular enclosures for defense, aerospace, and industrial applications. Elma is recognized for its expertise in rugged system design, open architecture platforms, and VITA-compliant solutions.

-

October 2024, – Elma Electronic has launched the portable FlexVNX+ development chassis, designed to accelerate testing and development of VNX+ PICs. This compact, rugged system offers high-speed communications and flexible interfaces, ideal for defense applications such as mission control, surveillance, and threat detection.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 363.00 Million |

| Market Size by 2032 | USD 837.67 Million |

| CAGR | CAGR of 10.28% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Processor Architecture (NXP Power Architecture, Intel Architecture, ARM Architecture, FPGA-Based Computing Modules, GPU-Accelerated Platforms, Others) • By Rack Unit / Form Factor (3U VPX Systems, 6U VPX Systems, Rugged ATR Chassis, Custom Enclosures) • By Application (Electronic Warfare (EW), Radar Systems, Mission Computers, Intelligence, Surveillance & Reconnaissance (ISR), Command, Control, Communications, Computers & Intelligence (C4I), Avionics Systems, Space Systems, Others) • By End User (Defense, Aerospace, Naval, Space Agencies, Commercial Industrial) • By Platform (Airborne Systems, Ground-Based Systems, Naval Systems, Space Systems) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Abaco Systems, Extreme Engineering Solutions, Connect Tech, Kontron AG, Aitech, Curtiss-Wright, Mercury Systems, Acromag, Advantech Co., Ltd., Concurrent Technologies Inc., GE Aviation Systems, Ecrin Systems, ADLINK Technology Inc., Mistral Solutions Pvt. Ltd., Cornet Technology, Inc., Elma Electronic Inc., General Micro Systems (GMS), Pixus Technologies Inc., General Dynamics Mission Systems, Inc., Wolf Advanced Technology. |