Gas Insulated Switchgear Market Size Analysis:

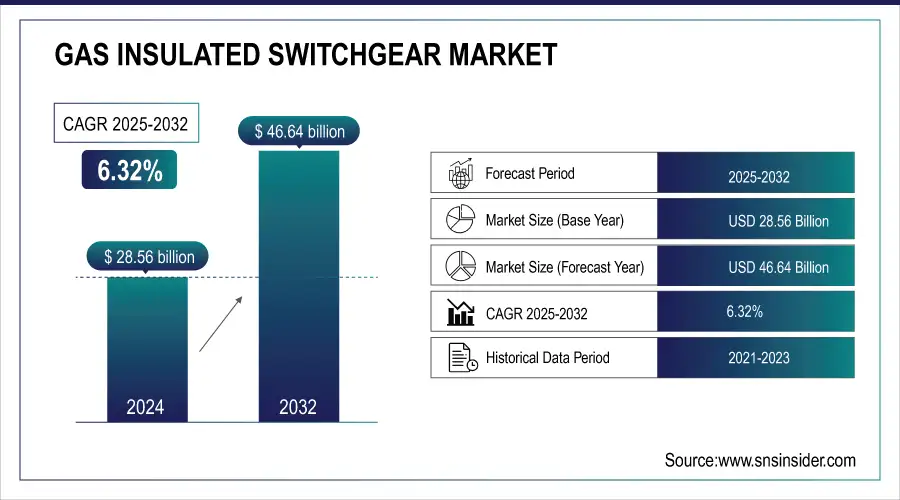

The Gas Insulated Switchgear Market size was valued at USD 28.56 billion in 2024 and is expected to reach USD 46.64 billion by 2032. It will grow at a CAGR of 6.32% over the forecast period 2024-2032.

Gas-insulated switchgear (GIS) is gaining popularity due to its numerous advantages over traditional switchgear systems, particularly in terms of space efficiency, reliability, and safety. This growth is driven by the increasing demand for electrification in urban and industrial settings, where space is limited. GIS is compact and ideal for installation in densely populated cities or underground infrastructure projects.

To Get More Information on Gas-Insulated Switchgear Market - Request Sample Report

Gas Insulated Switchgear Market Size and Forecast:

-

Market Size in 2024: USD 28.56 Billion

-

Market Size by 2032: USD 46.64 Billion

-

CAGR: 6.32% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Gas Insulated Switchgear (GIS) Market Highlights:

-

GIS supports reliable transmission and distribution for solar, wind, and other renewable sources, handling high voltages and fluctuating loads effectively

-

GIS enables modernization of aging power grids, improving efficiency, resilience, and safety in urban and industrial areas

-

GIS systems require less space and maintenance, making them suitable for dense urban locations and limited infrastructure areas

-

GIS is capable of operating under extreme temperatures, high moisture, and other challenging environmental conditions

-

The cost of GIS installation is significant, which can deter adoption, particularly among smaller utilities or industries

-

Dependence on SF6 gas, a potent greenhouse gas, increases compliance costs and drives research for sustainable insulating alternatives

GIS is highly suited for high-voltage requirements in renewable energy projects. In 2024, renewables accounted for 12.7% of global energy demand, with solar and wind contributing over 80% of new capacity. Investments in clean energy technologies exceeded USD 1.5 trillion, with nearly half going to developing economies. Despite this, fossil fuels still dominate with 78% of energy consumption. Renewable energy jobs reached 13 million globally, with the solar sector contributing significantly. Furthermore, stringent safety and environmental regulations drive industries to adopt GIS, minimizing accidents and ensuring operational security. This market is propelled by urbanization, the need for reliable energy transmission, and the integration of renewable energy sources.

Gas Insulated Switchgear Market Drivers:

-

Driving Renewable Energy Growth with GIS Technology for Reliable Power Transmission and Distribution Solutions

The primary growth driver for GIS is renewable energy integration. With the rising trend toward cleaner energy sources, the demand for robust transmission and distribution systems has increased appreciably. GIS technology comes in handy for managing diverse fluctuating energy inputs from renewable sources of energy, including solar and wind. These systems have the capability of handling high voltage and load variations in renewable energy farms for connection to national grids. The reliability of GIS under harsh environmental conditions makes it a crucial aspect in support of the shift to renewable energy globally.

-

Enhancing Power Grids Efficiency and Resilience with GIS Solutions for Urbanization and Industrial Growth

Growth in the GIS market is also driven by the need to upgrade the strength and efficiency of power grids. Increasing industrial growth and urbanization increase pressure on such grids, and consequently, modernizing the existing infrastructure to meet increasing power requirements becomes a precondition. GIS provides a compact, low-maintenance solution that is especially suited for aging grids that require upgrades but have limited physical space. Other pluses of GIS involve high safety levels, making sure that reliable and uninterrupted transmission and distribution of power occur in difficult environmental conditions, such as high moisture levels or extreme temperatures. This fact is making GIS increasingly acceptable in many fields.

Gas Insulated Switchgear Market Restraints:

-

Addressing Investment Challenges and Environmental Concerns in GIS Adoption for Sustainable Infrastructure Development

A key challenge for GIS is the high initial investment in installation, which acts as a major deterrent factor when considering them for installations such as those of smaller utilities or industries that have very thin margins for investment. Environmental issues related to complicated manufacturing processes and dependency on SF6 gas, which is a potent greenhouse gas, hold a big risk. Higher regulatory pressure on reducing SF6 emissions will compel higher compliance costs or may demand the research of alternative insulating material. Moreover, the long replacement cycle of GIS systems means that while demand is growing, the market growth might be temperate given the slow rate at which the infrastructure upgrades are being done.

Gas Insulated Switchgear Market Segmentation Analysis

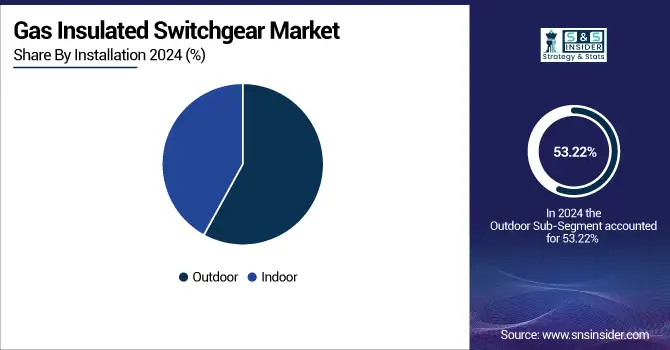

By Installation

The Outdoor segment dominated the total market share of 53.22% in 2023. This is because the product is highly suitable for high voltage and high rigidity against rugged environmental elements. Installations are much preferred outdoors in areas where space constraints do not prevail, as larger equipment and systems with high capacities, like substations and transmission lines, can be easily integrated. Such high resilience to weather conditions makes the use of outdoor GIS more popular for utility and large industrial applications.

The indoor segment grows at the highest CAGR of 6.73% over the forecast period. Indoor space-efficient solutions in confined urban spaces become increasingly necessary. For example, commercial building spaces and underground structures require higher degrees of safety and less footprint. Improved aesthetics means their high aesthetic appeal for indoor usage. Cities are growing briskly, and a greater number of people are shifting to cities at a faster rate. As cities grow, compact and reliable indoor switchgear solutions make space in the shortest span.

By Voltage

The 170 kV-550 kV voltage segment dominates the GIS market, with a 42.34% market share in 2023, mainly because of its prevalent usage in high transmission and distribution systems. With an optimal balance between efficiency and capacity, this is preferred by utilities and industries for both urban and rural electrification projects. This range is always in high demand as countries upgrade their power infrastructures and increase their grid capacities.

The above 550 kV segment is the fastest-growing market at a CAGR of 7.09% over the forecast period, primarily due to the growing need for ultra-high-voltage transmission systems to support long-distance electricity transport and renewable energy integration. Over the last few years, connecting remote renewable energy resources, including offshore wind farms and solar parks, to centralized grids, has been in rising demand for GIS solutions at high voltage levels. Also, technological advancements and infrastructure projects to upgrade the network in terms of reliability and efficiency are further driving growth in this segment.

By End-use

In 2023, the Utilities segment held the largest market share of around 51.45% of the total market size. Utilities are very crucial for electric power generation, transmission, and distribution. The Governments as well as electricity companies are spending significant time as well as amount on improving old infrastructure, and so a definite demand for an efficient GIS solution is there. Utility requires GIS for high-voltage applications mainly in urban areas where space is a challenge, and traditional switchgear is no longer feasible. However, increased integration needs of renewable energy are driving this further growth as utilities adapt to new sources of energy and build a more resilient grid.

The industrial sector, with a CAGR of 6.65%, is expected to be the fastest-growing sector during the forecast period. This has been driven by the energy requirements of the manufacturing and processing industries, which will need a reliable supply of power to work at an efficient level. The more complex the technologies are in the industries and the more automated they become, the more critical it is to have power transmitted to each component of the operation efficiently. On top of this, an interest in sustainability and efforts toward achieving energy efficiency also at industrial levels are resulting in enhanced investment in modern GIS solutions. Rapid growth has also been featured in this segment.

Gas Insulated Switchgear Market Regional Outlook:

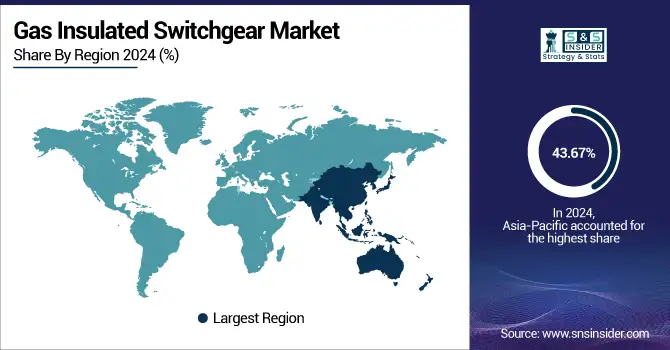

Asia-Pacific Gas Insulated Switchgear Market Trends

In 2023, the Asia-Pacific region dominated the total market share, accounting for 43.67% of the total market share. This was mainly driven by increased rates of urbanization, high demand for electricity, and high investments in infrastructure development sectors across countries like China, India, and Japan. Growth in the industrial sector in this region, coupled with an increasing renewable energy sector, is demanding more efficient and reliable power transmission systems. The other significant reason is that governments treat grid modernization as one of the ways to ensure a stable and secure energy supply, thereby fueling the GIS development process.

Do You Need any Customization Research on Gas-Insulated Switchgear Market - Inquire Now

Asia-Pacific is expected to have the highest growth rate of CAGR of 6.58% in the forecast period. Growth will be due to continuous urbanization and industrialization activities in that region, which are going to increase the need for higher energy consumption along with more infrastructure build-up. The adoption of renewable sources of energy and smart grid initiatives further challenges the demand in ascending order for GIS solutions in the regions. Regional Countries are focusing on energy usage by controlling the emission factor and, therefore, looking towards advancement in GIS technology to ensure efficient power delivery for reliability across their geospatial landscape.

North America Gas Insulated Switchgear Market Trends

In 2024, North America held a significant market share due to investments in grid modernization, renewable energy integration, and demand for reliable power transmission systems. The United States and Canada are driving growth with infrastructure upgrades and smart grid initiatives. The region is projected to grow steadily, supported by regulatory focus on energy efficiency and sustainable power solutions.

Europe Gas Insulated Switchgear Market Trends

Europe maintains a strong presence in the GIS market, led by countries like Germany, France, and the UK. Growth is driven by renewable energy adoption, urbanization, and stringent emission regulations. Investments in smart grids and industrial expansion further boost demand for advanced GIS technology. The region is expected to witness consistent growth, supported by government policies emphasizing energy efficiency and system reliability.

Latin America Gas Insulated Switchgear Market Trends

Latin America’s GIS market growth is propelled by industrial expansion, urban development, and modernization of power infrastructure in countries such as Brazil, Mexico, and Argentina. Investments in renewable energy and efforts to enhance grid reliability are driving demand. The region is expected to grow at a moderate pace, supported by infrastructure investments and government initiatives to ensure stable and efficient electricity distribution.

Middle East & Africa Gas Insulated Switchgear Market Trends

The Middle East & Africa region is expanding its GIS market due to rising urbanization, industrialization, and large-scale infrastructure projects. Countries like UAE, Saudi Arabia, and South Africa are investing heavily in power transmission networks. Increasing renewable energy projects and the need for reliable electricity supply are key growth drivers, with the market projected to grow steadily over the forecast period.

Gas Insulated Switchgear Companies are:

-

Siemens AG (GIS 8DQ1, 8DAB 12)

-

Schneider Electric (GHA, GCB)

-

General Electric (GE) (GIS 38kV, 72.5kV GIS)

-

ABB Ltd. (ELK-04, ELK-03)

-

Hitachi Energy (Z-3 Series, Z-5 Series)

-

Mitsubishi Electric (GIS 170 kV, GIS 72.5 kV)

-

Toshiba Corporation (GIGATAP, GIGATAP-M)

-

Eaton Corporation (XGIS, R3 Series)

-

Nissin Electric Co., Ltd. (GIS-CC, GIS-CF)

-

LS Electric (E-GIS, GSC Series)

-

Hyundai Electric (GIS 550 kV, GIS 170 kV)

-

China XD Group (GCGIS, XGIGIS)

-

S&C Electric Company (Vista Underground, PureWave)

-

Pars Mavad (PM GIS, PM XGIS)

-

Crompton Greaves Consumer Electricals Ltd. (GIS 36 kV, GIS 72 kV)

-

Keco Co., Ltd. (K-GIS, K-EGIS)

-

General Electric (GE) (B105, B165)

-

Asea Brown Boveri (ABB) (Type A, Type B)

-

Bharat Heavy Electricals Limited (BHEL) (BHEL GIS 400kV, BHEL GIS 220kV)

-

Siemens Energy (SIVACON S8, SIVACON 8PS)

Gas Insulated Switchgear Market Competitive Landscape:

Siemens India, a subsidiary of Siemens AG, has been a pioneer in the Indian electrical infrastructure sector. In 2009, it inaugurated its first gas-insulated switchgear (GIS) manufacturing facility in Aurangabad, marking its entry into India's high-voltage GIS market Further strengthening its presence, Siemens expanded its operations in Goa in 2012 to produce medium-voltage GIS . The company continues to innovate with environmentally friendly solutions, such as the Blue GIS, which eliminates the use of SF₆ gas.

-

In May 2024, Siemens India announced its plan to invest Rs 519 crore to enhance its gas-insulated switchgear factory in Goa and expand its metro train manufacturing facility in Aurangabad. This investment aims to bolster the company's production capabilities and support future growth.

Godrej Electricals & Electronics is a division of Godrej & Boyce, established in 1897 in Mumbai, India. This unit specializes in manufacturing high-voltage Gas Insulated Switchgear (GIS) and Air Insulated Switchgear (AIS) systems. In FY 2023–24, it secured orders exceeding ₹1,000 crore, including a landmark 765kV GIS project in Khavda, Gujarat. The company continues to contribute significantly to India's energy infrastructure development.

-

In April 2024, Godrej Electricals & Electronics, part of Godrej & Boyce, announced securing over Rs 1,000 crore in orders for its Power Infrastructure sector in fiscal year 2024. The orders mainly focus on Air Insulated Switchgear (AIS) and Gas Insulated Switchgear (GIS) substations across India, with project capacities reaching up to 765kV.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 28.56 Billion |

| Market Size by 2032 | USD 46.64 Billion |

| CAGR | CAGR of 6.32% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Installation (Indoor, Outdoor) • By Voltage (Up to 66 kV, 66 kV-170 kV, 170 kV-550 kV, above 550 kV) • By End-Use (Utilities, Industrial, Commercial, Residential, Other) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Siemens AG, Schneider Electric, General Electric, ABB Ltd., Hitachi Energy, Mitsubishi Electric, Toshiba Corporation, Eaton Corporation, Nissin Electric Co., Ltd., LS Electric, Hyundai Electric, China XD Group, S&C Electric Company, Pars Mavad, Crompton Greaves Consumer Electricals Ltd., Keco Co., Ltd., Bharat Heavy Electricals Limited (BHEL), and Siemens Energy are the key players in the Gas Insulated Switchgear (GIS) market. |