Wireless Modules Market Size & Trends:

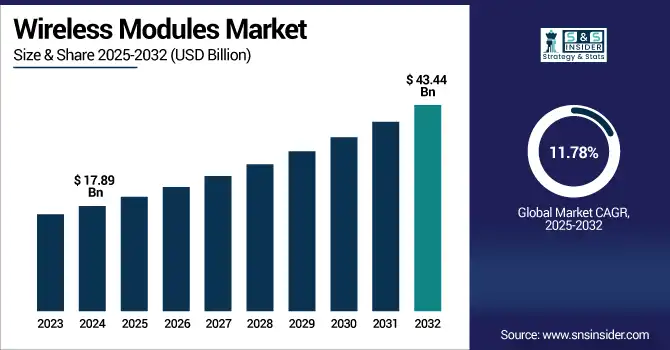

The Wireless Modules Market size was valued at USD 17.89 billion in 2024 and is expected to reach USD 43.44 billion by 2032 and grow at a CAGR of 11.78% over the forecast period 2025-2032.

The global market is analyzed in terms of its market split by type, application, technology, form factor and region. Key market drivers, restraints, opportunities and challenges language that affect growth are analyzed in the report. The demand for wireless modules is rising due to the expanding use of IoT, smart devices, and digital infrastructure in various industries. Wireless technologies that enable automation, facilitate real-time data transmission, and allow remote operation between machines are being adopted across emerging and developed economies alike, driving significant and varied applications across verticals and rapid technological advancements that are accelerating market growth.

To Get more information on Wireless Modules Market - Request Free Sample Report

For instance, nearly 85% of consumer electronics launched in 2024 included built-in wireless communication modules.

The U.S. Wireless Modules Market size was USD 3.88 billion in 2024 and is expected to reach USD 9.20 billion by 2032, growing at a CAGR of 11.46% over the forecast period of 2025–2032.

The U.S. market is projected to remain strong supported by the increasing adoption of IoT solutions for smart homes, healthcare systems, and industrial automation. Deployment of 5G infrastructure early across continents improves connectivity potentials, enabling next-generation wireless applications. Market demand is also gaining momentum due to the government initiatives encouraging connected infrastructure and digital transformation in various sectors. All of these aspects together contribute to the U.S. Wireless modules market growth making in one of the important elements in the technology application at regional and global level.

For instance, 5G networks now cover over 75% of the U.S. population, significantly improving wireless module performance in real-time applications.

Wireless Modules Market Dynamics:

Key Drivers:

-

IoT Expansion Across Industries Fuels Demand for Advanced, Integrated Wireless Communication Solutions Globally

Growing number of IoT-connected devices for various verticals such as healthcare, domestic, industrial automation and automotive are fostering the demand for wireless modules. These modules serve as centralized components having both near-real-time communication and data exchange. More enterprises are setting up to utilize modules to bring remote monitoring and smart systems and process automation wireless within their organizations. With a growing focus on connected ecosystems and smart infrastructure, they are also witnessing the traction for more low-power and high-efficiency wireless communication components. The sheer popularity of this adoption becomes one of the most potent powers driving growth in the market for consumer and industrial cases.

For instance, over 70% of large enterprises have integrated wireless modules into at least one major workflow as of 2024.

Restraints:

-

High Costs and Integration Challenges Restrict Wireless Module Deployment in Legacy Industrial Systems

The initial costs for the enterprise to put wireless modules into its existing infrastructure can be significant, especially for legacy industries and systems. Costs associated with module integration, customization of the software, and compatibility testing are included in these costs Merging wireless and cellular components in the robust, vintage equipment becomes a financial and operational nightmare. Budget constraints would discourage small- and medium-sized enterprises in the developing regions from adopting. In markets where purchase decisions are influenced more by price competitiveness and ROI, this sensitivity to cost is a major restraining factor.

Opportunities:

-

Government Investments in Smart Infrastructure Drive Large-Scale Deployment of Wireless Module Networks

Globally, governments are pouring billions of dollars into smart city projects, digital infrastructure, and industrial automation. This involves the deployment of large-scale wireless communication networks driven by modules. These all rely on strong wireless connectivity for smart transportation, energy grids, waste, and surveillance systems. However, collaboration between public-private entities and public policy yardsticks favoring digital transformation—most of which are gaining foothold in the Asia-Pacific, North American, and European regions—are making the wireless modules deployment widespread. The regulatory and financial support strengthens the market scalability and the adoption rate at well in both developed and developing economies.

For instance, over 65% of smart city projects globally integrate wireless modules for real-time data, automation, and connectivity.

Challenges:

-

Supply Chain Instability and Component Shortages Disrupt Production and Delivery of Wireless Modules

The global supply chain volatility resulted from geopolitical conflicts, natural disasters, and semiconductor shortages has greatly disrupted the production cycles of wireless modules. The unplanned and long time in making sure the availability of such critical components such as chipsets, PCBs, increase the lead time, which makes the manufacturers unable to fulfil the growing demand. Rely upon a small group of suppliers for some key performance parts thus increasing risk profile. It's not as easy as it sounds, and disruptions affect pricing, product availability, and customer relations, making it a tremendous challenge for manufacturers that want to scale.

Wireless Modules Market Segmentation Analysis:

By Type

Embedded Wireless Modules was the market leader with a 62.80% for Wireless Modules market share in 2024, due to their compact design and widespread deployment in connected devices such as smartphones, wearables and smart appliances. A top supplier, Murata Manufacturing Co, Ltd. offers a full portfolio of embedded wireless modules, suitable for high-performance and low-power use cases in the consumer, industrial and automotive spaces. Rapid growth within this segment is also expected, with the highest CAGR of 12.21% during 2024 to 2032, due to high IoT adoption and increasing demand for integrated smart sensors. A key enabler, u-blox AG is moving low-power, shrink embedded modules toward the state needed for real-time connectivity in AIoT and critical applications.

By Application

Consumer Electronics held the Wireless Modules Market with 33.50% share in 2024 and is poised to gain by the growth in demand for smart TVs, smartphones, and automation devices in household. Two important reasons: speed of digitization and user acquisition of managed ecosystem services. As a large part of Qualcomm Technologies, Inc., who sweep the world with leading edge wireless modules within chipsets amounting to billions of consumer devices globally. The scalable solutions that enhance device performance give consumer electronics the leading position based on volume and value.

The healthcare segment is being anticipated to witness most significant CAGR of 14.47% over the period of 2024 to 2032 owing to early adoption of wireless modules in remote patient monitoring and diagnostics. Demand is driven continuously by the emergence of wearable health tech and digital clinics. The strong lineup of Nordic Semiconductor in BLE modules is propelling them in the wireless health devices segment. In home and in clinical scenarios, its solutions are creating reliable, real time, high precision transmission of patient information on a continuous basis owing to their very low power consumption.

By Technology

In 2024, Wi-Fi technology represented 29.40% of the market as it is ubiquitous and supports all types of enterprises and home networks. Its pace of development, availability, and the maturity of its ecosystem of infrastructure enables them to stay ahead. Espressif System, maker of the ESP32 modules, is popular in both consumer and some industrial wi-fi enabled devices. With thousands of their highly-integrated and low-cost modules powering applications in all walks of the market, Wi-Fi continues to be the most ubiquitous wireless technology globally.

Cellular (4G, 5G) modules are projected to be the most lucrative with a 12.84% CAGR, in response to expanding deployment in smart mobility and industrial automation. There is a growing need for reliable, low-latency wireless transmission. Telit Cinterion is one of the most relevant innovator providing wide range of automotive, healthcare, and IoT dedicated 4G and 5G modules. These continued investments in R&D make cellular modules stronger positioned in key new growth & mission-critical applications.

By Form Factor

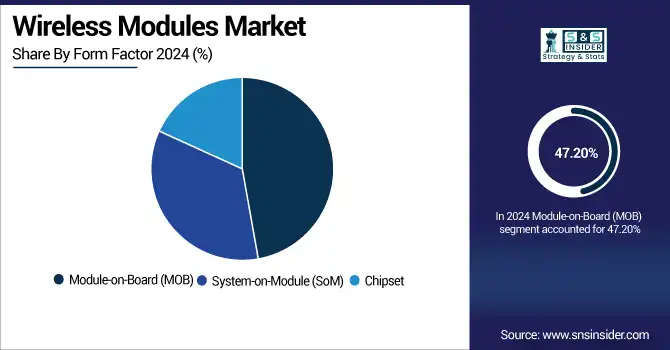

In 2024, the Module-on-Board (MOB) segment held a dominant share of 47.20%, as it is easy to integrate to its host product and it has a relatively lower cost. MOBs are perfect for mobile consumer and industrial designs that need basic wireless function. An example is large provider such as Laird Connectivity, which offers reliable extended temperature range MOB modules for challenging environments. From this ongoing evolution, Qorvo is able to offer standardized but flexible modules for manufacturers that need rapid time to market and are supported by the company's competitive edge across literally any high-volume wireless implementation that the MOB is involved in.

System-on-Module (SoM) will have a highest growth rate by 12.50% CAGR as it is flexible in terms of processing and connectivity. SoMs play a key role in sophisticated embedded applications such as AI, advanced machine vision, and automation. Toradex is a provider of high-performance System on Module (SoM) based embedded computing SoM (System on Module) with integrated wireless enablement solution for Edge and Industrial AI. Globally, an increase in demand for customized platforms for a wide range of elaborate wireless processing modules is able to serve burgeoning and fast-evolving usages of smart sectors, sectors.

Wireless Modules Market Regional Outlook:

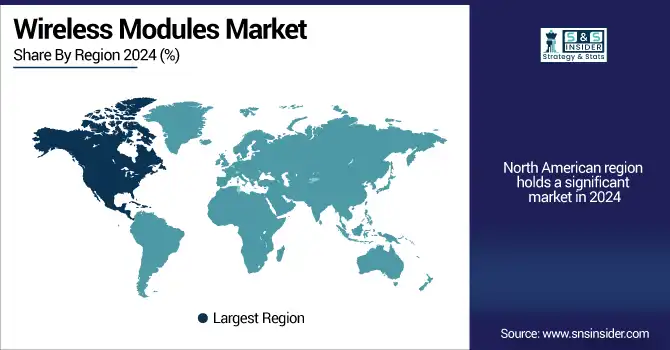

North America is driven by the early rollout of 5G technologies, high adoption of IoT devices, and a robust telecom infrastructure. North America, dominated by the U.S., continues to increase in revenue due to its momentum in smart home applications, industrial automation and connected healthcare systems. The market in North America is driven by the presence of key players, the digitalization support of governments, and seamless wireless communication demand, which will support the growth of the market across the U.S., Canada, and Mexico.

-

The U.S. dominates North America's wireless modules market due to early 5G deployment, robust IoT infrastructure, and high demand from smart homes, healthcare, and industrial automation. Strong tech ecosystem and key market players further support its leadership.

In 2024, Asia Pacific led the Wireless Modules Market, accounting for the largest share by revenue of around 34.70% owing to the presence of large scale consumer electronics manufacturing base, rapid urbanization, and strong demand across consumer, automobile, and industry sectors. The region is also projected to witness the highest CAGRs of nearly 8.17% during the period 2024-2032 owing to the high governmental support in smart city initiatives and the growing rollout of 5G across countries, including China, India, Japan, and South Korea, along with the increasing adoption of IoT devices across these countries.

-

China leads Asia Pacific’s wireless modules market driven by large-scale IoT adoption, rapid industrial digitalization, and government-backed smart city initiatives. Its strong manufacturing base and investment in 5G infrastructure position it as a regional powerhouse for wireless connectivity solutions.

Europe is attributed to robust demand across industrial automation, automotive, and healthcare application. Rising demand owing to growing adoption of smart manufacturing solutions and connectivity of vehicles Germany, France, and the UK are nations that lead in adopting IoT. While the rapid growth of wireless connectivity continues across the region, this is aided by supportive EU regulations and increasing investment in digital infrastructure.

-

Germany dominates Europe’s wireless modules market due to strong Industry 4.0 adoption, advanced automotive applications, and widespread IoT integration in manufacturing. Its robust R\&D ecosystem and presence of leading industrial technology firms further strengthen its leadership across the region.

Saudi Arabia is the largest market in the Middle East & Africa wireless modules market on the back of smart city initiatives such as NEOM and the digital investments following Vision 2030. Brazil is the largest market in Latin America as a result of the rapid growth of industrial automation demand, growing telecom infrastructure to cater to the IoT needs of industrial automation and the increased adoption of IoT in leading economic sectors.

Get Customized Report as per Your Business Requirement - Enquiry Now

Wireless Modules Companies are:

Major Key Players in Wireless Modules are Qualcomm Technologies, Inc., Intel Corporation, Sierra Wireless, Telit Cinterion, u-blox AG, Quectel Wireless Solutions, Murata Manufacturing Co., Ltd., MediaTek Inc., Broadcom Inc., Nordic Semiconductor ASA, Semtech Corporation, Texas Instruments Incorporated, Huawei Technologies Co., Ltd., Laird Connectivity, Fibocom Wireless Inc., Thales Group, Skyworks Solutions, Inc., STMicroelectronics, Gemalto and Panasonic Industry Co., Ltd and others.

Recent Developments:

-

In November 2024, Murata Manufacturing introduced two ultra‑low‑power Wi‑Fi HaLow modules (LBWA0ZZ2HK, LBWA0ZZ2HL) built on NEWRACOM’s chipset; ideal for smart automation and long‑range IoT devices.

-

In June 2024, u‑blox AG launched the LEXI‑R10 LTE Cat 1bis module, the smallest of its kind at release, designed for compact IoT devices.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 17.89 Billion |

| Market Size by 2032 | USD 43.44 Billion |

| CAGR | CAGR of 11.78% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Embedded Wireless Modules and Exteal Wireless Modules) • By Application (Consumer Electronics, Automotive, Healthcare, Industrial Automation and Aerospace & Defense) • By Technology (Wi-Fi, Bluetooth, Cellular (4G, 5G), Zigbee and LoRa) • By Form Factor (Module-on-Board (MOB), System-on-Module (SoM) and Chipset) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia,Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Qualcomm Technologies, Inc., Intel Corporation, Sierra Wireless, Telit Cinterion, u-blox AG, Quectel Wireless Solutions, Murata Manufacturing Co., Ltd., MediaTek Inc., Broadcom Inc., Nordic Semiconductor ASA, Semtech Corporation, Texas Instruments Incorporated, Huawei Technologies Co., Ltd., Laird Connectivity, Fibocom Wireless Inc., Thales Group, Skyworks Solutions, Inc., STMicroelectronics, Gemalto and Panasonic Industry Co., Ltd. |