Model Validation Platform Market Report Scope & Overview:

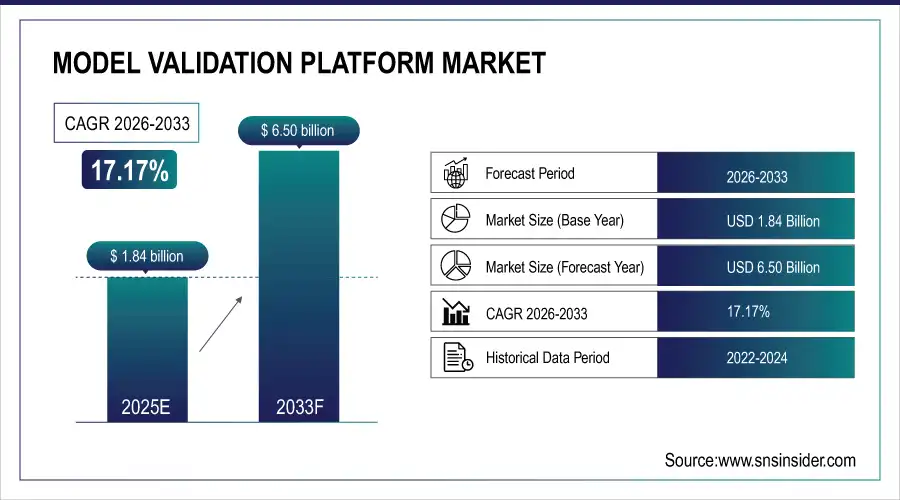

Model Validation Platform Market was valued at USD 1.84 billion in 2025E and is expected to reach USD 6.50 billion by 2033, growing at a CAGR of 17.17% from 2026-2033.

The Model Validation Platform Market is expanding rapidly due to the surge in AI and machine-learning adoption across regulated industries such as BFSI, healthcare, and telecom. Rising regulatory pressure for transparency, fairness, and risk mitigation is pushing enterprises to adopt automated validation tools. Growing model complexity, increased use of real-time decision systems, and the need for continuous monitoring drive demand for scalable platforms. Additionally, cloud-based validation solutions and integrated governance frameworks are accelerating widespread enterprise deployment.

In 2024, 78% of regulated firms adopted AI validation tools; by 2025, over 90% plan to implement automated, cloud-based platforms with real-time monitoring and governance frameworks to meet compliance demands.

Model Validation Platform Market Size and Forecast

-

Market Size in 2025E: USD 1.84 Billion

-

Market Size by 2033: USD 6.50 Billion

-

CAGR: 17.17% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Model Validation Platform Market - Request Free Sample Report

Model Validation Platform Market Trends

-

Rising focus on centralized validation frameworks to standardize model approvals across enterprises

-

Increasing reliance on continuous monitoring tools as models operate in dynamic, data-rich environment

-

Growing use of validation platforms in BFSI to strengthen risk modeling and regulatory reporting

-

Adoption of low-code validation interfaces enabling broader teams to participate in model oversight

-

Integration with MLOps pipelines to ensure seamless validation from development through deployment cycles

-

Emphasis on cross-functional collaboration between data science, compliance, and IT teams for validation

U.S. Model Validation Platform Market was valued at USD 0.61 billion in 2025E and is expected to reach USD 2.13 billion by 2033, growing at a CAGR of 16.19% from 2026-2033.

The U.S. model validation platform market is growing due to stricter regulatory expectations, rapid expansion of AI and ML adoption across financial services and healthcare, and rising enterprise focus on transparency, compliance, and risk mitigation. Increasing model complexity and demand for automated validation workflows are also fueling strong market expansion.

Model Validation Platform Market Growth Drivers:

-

Increasing regulatory scrutiny and compliance requirements are pushing organizations to adopt advanced model validation platforms to ensure transparency and reliability.

Growing regulatory pressure across sectors such as banking, insurance, healthcare, and government is significantly increasing the need for robust model validation platforms. Agencies are enforcing stricter guidelines around model governance, transparency, and risk management to ensure fairness, accuracy, and accountability in automated decision-making systems. As organizations rely heavily on analytical and AI-driven models, they must demonstrate compliance through standardized validation processes, audit trails, and performance monitoring. This regulatory environment is pushing enterprises to adopt advanced validation platforms that streamline compliance, reduce operational risks, and enhance overall model reliability.

Adoption of AI for decision-making in model validation is forecasted to climb from 9% of service firms and 5% of manufacturing firms in 2023 to an estimated 22% in 2024, driving demand for reliable validation solutions.

-

Rapid expansion of AI and machine learning models drives demand for automated validation tools to enhance accuracy, governance, and monitoring capabilities.

The accelerated adoption of AI and machine learning across industries is creating a strong need for automated model validation platforms that ensure accuracy, consistency, and dependable performance. As models become more complex, data-intensive, and frequently updated, manual validation methods are no longer efficient or scalable. Organizations require automated tools that continuously monitor model behavior, detect drift, assess bias, and maintain governance throughout the lifecycle. This rapid proliferation of AI applications is driving demand for platforms that enhance reliability, streamline validation workflows, and support responsible, high-performing AI systems.

According to McKinsey, 44% of organizations reported negative outcomes due to AI inaccuracies, underscoring the criticality of model validation to mitigate risks such as data drift and hallucinations in large language models (LLMs).

Model Validation Platform Market Restraints:

-

High Implementation Costs and Limited Budgets Restrict Adoption of Advanced Model Validation Platforms Across Small Enterprises and Cost-Constrained Organizations.

High implementation costs remain one of the biggest barriers to adopting advanced model validation platforms, especially for small and mid-sized enterprises. These platforms often require significant investment in software, infrastructure, integration, and ongoing maintenance. Organizations with limited budgets struggle to justify such expenditures, particularly when competing priorities exist across IT and operational departments. Additionally, hidden costs—such as training, customization, and compliance updates—further increase financial pressure. As a result, many smaller companies delay or avoid adopting sophisticated validation solutions, slowing overall market growth.

in 2024, 68% of small enterprises cited cost as the top barrier to advanced model validation tools; 2025 projections show 72% unable to adopt due to budget constraints, per Gartner and McKinsey reports.

-

Shortage of Skilled Data Scientists and Validation Experts Slows Effective Deployment and Optimization of Model Validation Technologies in Many Industries.

The effective deployment of model validation platforms requires trained data scientists, analytics professionals, and validation specialists—skills that are currently in short supply across many industries. This talent gap makes it difficult for organizations to fully utilize advanced validation tools, leading to slower implementation timelines and suboptimal use of platform capabilities. Without the necessary expertise, companies may struggle to manage complex models, ensure regulatory compliance, or interpret validation outputs. This shortage not only raises operational costs but also limits the scalability and efficiency of model validation technologies, hindering broader market adoption.

In 2024, 67% of firms cited data science talent shortages delaying AI deployment (McKinsey); by 2025, global demand for data scientists will exceed supply by 250,000 (World Economic Forum).

Model Validation Platform Market Opportunities:

-

Rising Adoption of AI and ML Models Creating Need for Scalable, Automated, and Transparent Validation Solutions Across Highly Regulated Industries Worldwide

The accelerating adoption of AI and machine learning across industries such as BFSI, healthcare, retail, and manufacturing are driving strong demand for scalable and automated model validation platforms. As organizations deploy increasingly complex models, there is a growing need for tools that ensure transparency, fairness, regulatory compliance, and performance reliability. Highly regulated sectors require centralized validation frameworks that can continuously monitor model behavior, detect risks, and document validation outcomes. This shift is creating significant opportunities for platforms offering automated validation, explainability features, governance tools, and end-to-end lifecycle management.

In 2024, 73% of regulated firms adopted AI/ML; by 2025, 85% will require automated validation. Global spend on AI governance tools surges to USD12B, driven by compliance demands and scalability needs.

-

Expansion of Cloud-Based Model Validation Platforms Driving Faster Deployment, Improved Collaboration, and Cost-Efficient Validation Workflows for Global Enterprises

The rapid transition toward cloud computing is creating major opportunities for cloud-based model validation platforms that offer faster deployment, enhanced scalability, and reduced IT overhead. Enterprises increasingly prefer cloud-native solutions for their ability to support collaborative workflows, integrate with multi-cloud environments, and deliver real-time monitoring and validation capabilities. Cloud platforms enable seamless model governance, centralized documentation, and automated compliance reporting. Additionally, their pay-as-you-go architecture makes advanced validation tools more accessible to organizations of all sizes. This shift toward cloud adoption is accelerating global demand for flexible, cost-efficient model validation solutions.

In 2024, 68% of enterprises adopted cloud-based model validation; by 2025, this rises to 82%, cutting deployment time by 40% and reducing IT costs by 35%, per Gartner and McKinsey reports.

Model Validation Platform Market Segment Highlights

-

By Component In 2025, Software led the market with 70% share while Services is the fastest-growing segment (2026–2033)

-

By Deployment Mode In 2025, Cloud led the market with 65% share and is also the fastest-growing segment (2026–2033)

-

By Enterprise Size In 2025, Large Enterprises led the market with 63% share while Small and Medium Enterprises is the fastest-growing segment (2026–2033)

-

By End-User In 2025, Banking and Financial Services led the market with 35% share while Healthcare is the fastest-growing segment (2026–2033)

-

By Application In 2025, Model Governance & Compliance led the market with 23% share while Fairness and Bias Auditing is the fastest-growing segment (2026–2033)

Model Validation Platform Market Segment Analysis

By Component, Software segment led in 2025; Services segment expected fastest growth 2026–2033

The Software segment dominated the Model Validation Platform Market in 2025 because organizations increasingly relied on automated tools for accuracy assessment, performance monitoring, and risk evaluation of AI models. Scalable validation workflows, real-time analytics, and integration with existing ML pipelines strengthened software adoption across regulated and data-intensive industries.

Services are expected to grow fastest from 2026–2033 due to rising demand for expert-led model audits, compliance reviews, and customized validation frameworks. As regulations tighten and AI adoption expands, enterprises increasingly seek specialized support to ensure transparency, reliability, and governance throughout the model lifecycle.

By Deployment Mode, Cloud segment led in 2025; Cloud segment expected fastest growth 2026–2033

The Cloud segment dominated the Model Validation Platform Market in 2025 and is expected to grow fastest from 2026–2033 because cloud platforms offer flexible compute capacity, rapid deployment, and seamless integration with distributed ML environments. Organizations benefit from scalable validation workflows, lower infrastructure costs, and secure, centralized model governance. The shift toward cloud-native AI, remote collaboration, and continuous monitoring further accelerates cloud-based adoption for enterprise-grade model validation.

By Enterprise Size, Large Enterprises segment led in 2025; Small & Medium Enterprises segment expected fastest growth 2026–2033

Large Enterprises dominated the Model Validation Platform Market in 2025 because they deploy complex AI models that require rigorous validation to meet regulatory, security, and risk-management requirements. Their extensive IT resources and investments in enterprise-grade AI infrastructure support higher adoption of advanced validation platforms.

Small and Medium Enterprises are expected to grow fastest from 2026–2033 as cloud-based and automated validation tools reduce implementation costs and technical barriers. SMEs increasingly adopt AI for operations and analytics, driving the need for accessible, scalable validation solutions to ensure model reliability without heavy infrastructure investments.

By End-User, Banking & Financial Services segment led in 2025; Healthcare segment expected fastest growth 2026–2033

Banking and Financial Services dominated the Model Validation Platform Market in 2025 due to strict regulatory requirements for credit risk models, fraud detection systems, and algorithmic decision-making. The need for transparency, governance, and bias-free outcomes makes comprehensive validation essential across financial institutions.

Healthcare is expected to grow fastest from 2026–2033 because AI adoption is accelerating in diagnostics, patient monitoring, and clinical decision support. Ensuring model safety, accuracy, and compliance with health regulations drives demand for robust validation tools that can evaluate high-risk AI applications.

By Application, Model Governance & Compliance segment led in 2025; Fairness & Bias Auditing segment expected fastest growth 2026–2033

Model Governance & Compliance dominated the Model Validation Platform Market in 2025 because enterprises prioritize regulatory adherence, audit readiness, and transparent model documentation. Growing scrutiny from regulators and the need to manage model risks across industries strengthen demand for governance-focused validation capabilities.

Fairness and Bias Auditing is expected to grow fastest from 2026–2033 due to increasing emphasis on ethical AI, responsible automation, and compliance with emerging fairness regulations. Organizations across finance, healthcare, and public services require tools to detect bias and ensure equitable, trustworthy AI outcomes

Model Validation Platform Market Regional Analysis

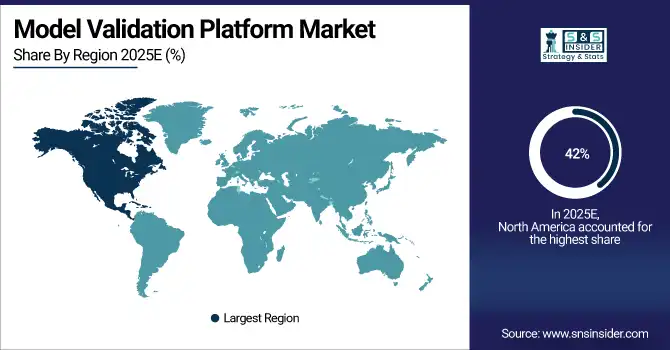

North America Model Validation Platform Market Insights

North America dominated the Model Validation Platform Market with a 42% share in 2025 due to its strong concentration of financial institutions, advanced regulatory requirements for risk management, and widespread adoption of AI and machine learning models. The presence of leading technology providers and a mature digital ecosystem further enhanced the region’s reliance on robust model validation tools.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Model Validation Platform Market Insights

Asia Pacific is expected to grow at the fastest CAGR of about 19.11% from 2026–2033, driven by rapid digital transformation, increasing fintech adoption, and rising regulatory emphasis on model risk governance. Expanding banking, insurance, and credit markets, alongside growing investments in AI-driven analytics, are accelerating demand for scalable and automated model validation platforms across the region.

Europe Model Validation Platform Market Insights

Europe held a strong position in the Model Validation Platform Market in 2025, supported by stringent regulatory frameworks such as the ECB’s TRIM and EBA guidelines that mandate rigorous model risk management. The region’s mature banking sector, growing use of advanced analytics, and increasing reliance on AI-driven financial models further strengthened demand for robust validation platforms.

Middle East & Africa and Latin America Model Validation Platform Market Insights

The Middle East & Africa and Latin America together exhibited moderate growth in the Model Validation Platform Market in 2025, driven by expanding banking and fintech ecosystems, rising adoption of digital lending, and increasing awareness of model risk governance. Growing regulatory modernization efforts, investment in AI-based financial solutions, and the gradual shift toward automated model monitoring contributed to the regions’ improving market participation.

Model Validation Platform Market Competitive Landscape:

EY (Ernst & Young)

EY is a global professional services leader providing consulting, assurance, tax, and advisory solutions. In model validation and risk analytics, EY supports enterprises with model governance, regulatory compliance, independent validation, and AI/ML risk assessments. The firm helps financial institutions strengthen model lifecycle management through advanced quantitative methods, stress testing, and audit-ready documentation. EY also offers digital transformation and data modernization services, enabling organizations to adopt scalable cloud platforms, automate workflows, and enhance the transparency and robustness of analytical models.

-

FICO, 2025: FICO announced the FICO Focused Foundation Model for financial services, which includes “Trust Scores” to manage and validate generative AI model risk.

KPMG

KPMG is a multinational professional services network offering audit, tax, advisory, and risk consulting services. In model validation, KPMG specializes in reviewing financial, credit, market, and AI/ML models for regulatory compliance, performance accuracy, and governance quality. The firm works with banks, insurers, and enterprises to assess model assumptions, conduct benchmarking, evaluate data integrity, and implement model risk management frameworks. KPMG also supports digital transformation through advanced analytics, cloud integration, and automation to enhance operational efficiency and decision-making reliability.

-

In 2025, KPMG updated its model risk management guidance to explicitly cover AI/ML-based models, recommending validation protocols for performance, sensitivity, and explainability, as well as ongoing monitoring.

Accenture

Accenture is a global consulting and technology services company known for its expertise in digital transformation, cloud modernization, artificial intelligence, and enterprise analytics. In model validation, Accenture helps organizations evaluate AI/ML, financial-risk, and forecasting models for accuracy, fairness, explainability, and compliance. Its teams support end-to-end model lifecycle management, including governance design, automated monitoring, and validation testing. Accenture also assists enterprises in adopting scalable cloud platforms, integrating data ecosystems, and deploying responsible AI frameworks to enhance decision-making and minimize risk.

-

FICO, 2024: FICO added 20+ enhancements to its FICO Platform, including improved simulation and validation capabilities to assess decision-strategy impacts safely before going live.

Deloitte

Deloitte is one of the world’s largest professional services firms, offering consulting, risk advisory, audit, tax, and analytics solutions. In model validation, Deloitte provides independent evaluation of financial, credit, operational, and AI-driven models, ensuring regulatory compliance and performance reliability. The firm assists clients with model governance, stress testing, documentation, and continuous monitoring. Deloitte also supports digital modernization by leveraging advanced analytics, cloud platforms, and automation tools to strengthen model transparency, improve data quality, and enhance risk-management capabilities across enterprises.

-

IBM Corporation, 2024: IBM’s Watson Studio includes a model risk management module for validating models across clouds and managing AI model risk.

Model Validation Platform Market Key Players

Some of the Model Validation Platform Market Companies are:

-

SAS Institute Inc.

-

IBM Corporation

-

FICO

-

Moody’s Analytics

-

Oracle Corporation

-

AxiomSL (now part of Adenza)

-

RiskSpan

-

Wolters Kluwer

-

Numerix LLC

-

QRM (Quantitative Risk Management, Inc.)

-

ModelOp

-

Zest AI

-

DataRobot

-

Alteryx

-

MathWorks

-

Deloitte

-

PwC (PricewaterhouseCoopers)

-

EY (Ernst & Young)

-

KPMG

-

Accenture

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 1.84 Billion |

| Market Size by 2033 | USD 6.50 Billion |

| CAGR | CAGR of 17.17% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software, Services) • By Deployment Mode (On-Premises, Cloud) • By Enterprise Size (Small and Medium Enterprises, Large Enterprises) • By Application (Model Governance & Compliance, Model Performance Monitoring, Pre-Deployment Validation / Staging, Drift Detection & Retraining Triggers, Fairness & Bias Auditing, Model Explainability Reporting) • By End-User (BFSI, Healthcare, Retail, Manufacturing, IT & Telecommunications, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | SAS Institute Inc., IBM Corporation, FICO, Moody’s Analytics, Oracle Corporation, AxiomSL (Adenza), RiskSpan, Wolters Kluwer, Numerix LLC, QRM (Quantitative Risk Management, Inc.), ModelOp, Zest AI, DataRobot, Alteryx, MathWorks, Deloitte, PwC (PricewaterhouseCoopers), EY (Ernst & Young), KPMG, Accenture |