Modular Container Market Report Scope:

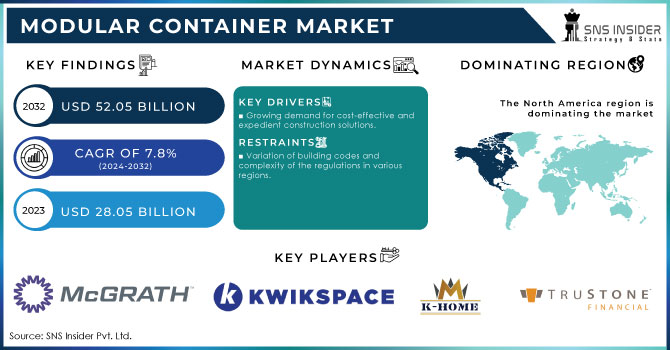

The Modular Container Market Size is projected to reach at USD 52.05 billion by 2032 and was valued at USD 28.05 billion in 2023. The market will be growing at a CAGR of 7.8% over 2024-2032.

Get More Information on Modular Container Market - Request Sample Report

The leading factors for the demand for the modular container market include rapid urbanization, increased construction activities, and the trend of more prefabricated structures. Modular containers are highly beneficial to use, as they offer the flexibility of a building process which is cheaper and quicker than the traditional ones in most places. In residential, commercial, and educational sectors, one of the significant demand-driving factors is the adoption of modular containers; it is responsible for about 25% of the market growth. Increased usage in emergency housing projects and healthcare facilities makes up about 18% of the demand. Major drivers of sustainability with an emphasis towards zero construction waste form the base of over 30% usage of modular construction to save the environment from a higher % age of construction debris. The adoption of temporary modular office spaces by small and medium-sized enterprises has resulted in a positive market demand increase of 20%. Incentives towards green building solutions by the government added a positive impact of approximately 12 % to market growth. Together, these imply that the modular container market is being directed not just by its inherent flexibility and cost-effectiveness but also by compatibility with the trends toward sustainability and efficient solutions of fast construction.

Modular containers have witnessed frequent use in construction with higher cost-effectiveness and the faster deployment offered by them. Around 35% of the customers of the construction industries prefer more modular solutions than their traditional counterpart as it can hasten completion of the project. The second most important trend is sustainability, and around 40% of the end-users prefer the modular container because of its reusable features and Eco friendliness that is in line with international sustainability goals. The market is also seeing a rise in demand for health care infrastructure, and about 25% of healthcare providers use modular containers for temporary clinics and testing facilities, citing their utility during emergencies, such as the COVID-19 pandemic. In terms of technology integration, smart container solutions are now one of the notable trends, and 20% of producers are using IoT-based features to enhance tracking and management of the usage of the container. The growth in deployments to remote and under-served areas has also been rapidly increasing, to the tune of 18% of all the deployments, as modular solutions offer a viable infrastructure option where traditional construction proves a challenge.

Modular Container Market Dynamics:

Drivers:

-

Growing demand for cost-effective and expedient construction solutions.

Modular containers cost a lot to erect, but could be built far more quickly than traditional types of construction, thereby being better suited to industries such as housing, health, and commercial space. The production of units off-site reduces labor costs and time by as much as 50% and is extremely useful in any time-sensitive projects, like disaster relief, emergency healthcare facilities, or infrastructural developments which are located remotely. This also indicates that much less material waste is incurred by as much as 30% compared to traditional building constructions, thus saving more in cost and presenting a greener approach to the construction process. It is for these reasons that this sustainable solution with the qualities of flexibility and scalability associated with modular containers explains their acceptance in most sectors as they seek fast, reliable, and efficient ways of construction. These benefits are particularly essential in urban areas where the constraints on space and the increasing costs make traditional building less viable, making the modular container an even more attractive alternative for infrastructure development in a quicker time frame.

Restrain:

-

Variation of building codes and complexity of the regulations in various regions.

Unlike traditional construction with clear-cut standards, modular container construction often falls in a grey area, due to its different process of building and off-site fabrication. Quite a number of regions have their different codes and regulations concerning the use of modular structures; therefore, it causes complications in the approval processes and sometimes delays the timeliness of constructions. Also, because zoning regulations, fire code requirements, and some structural integrity standards vary from place to place, it is quite challenging to have a standard product for mass distribution by manufacturers and builders.

Similarly, a report of Modular Container Accounting indicated that about 40% of projects experience delays or cost overruns due to regulatory compliance issues, which creates uncertainty for stakeholders. It takes some time to convince local authorities that modular containers are safe and sustainable for general use; it goes a long way in reducing adoption in areas that have serious building standards. This regulatory fragmentation increases the cost of compliance and efficiency of operations, which adversely impacts the growth of the modular container market. In addition, better communication, newer guidelines, and advocacy by the industry may help overcome these regulatory challenges that in turn can lead to broader acceptance and implementation of modular construction technologies.

Modular Container Market Segmentation Overview

By Type:

Mobile modular containers make up around 45% of the entire market share in 2023, mainly because of the flexibility and potential for temporary uses such as disaster recovery support, construction site offices, or portable housing. Fixed modular containers account for almost 55% of the market share since they are fit for permanent installations in healthcare, educational institutions, commercial development sectors, and any other sector demanding permanent structures. Increased attention given to sustainable building practices and the necessity of effective infrastructure solutions have increased the use of fixed modular containers. This is a critical part of the challenges with the current state of urbanization. Overall, two segments form a balanced landscape in the market, addressing diverse needs across industries and focusing on the value proposition of modular construction.

By Revenue Source:

Revenue source analysis of the Modular Container Market Research and Analysis by New product sales and rental services with other major contributions, and the Modular Container Market Service highlights different sectors of diverse customers' need up to 2023. New product sales account for about 57% of overall revenue within the revenue source of analysis of the Modular Container Market. There are significant demands for new, innovative, and sustainable modular solutions that provide functionality as well as adaptability. This segment has gained a lot of popularity in recent times, mainly because companies are always manufacturing environmentally friendly products suitable for long-term usage, such as construction industries, health, and education. The rental market, on the other hand, accounted for about 43% of market revenues, attracting companies that need the flexibility and cost-effectiveness for temporary uses, such as site offices, event halls, and emergency accommodation. Modular rentals are very common these days as a way of providing quality solution portfolios without front-end investment in gigantic amounts, thus perfect for projects that have needs over periods.

By Container Size:

Containers that are less than 10 feet generate about 20% of the total revenue per annum by 2023. This section of containers is majorly utilized in portable solutions in urban regions, event areas, and transitory housing where compactness and ease of transportation play a pivotal role. The largest size is 10-20 feet, comprising approximately 35% of the total revenue. It is in big demand because it is suitable for almost all types of site offices and retail spaces. The 21-40 feet segment captures approximately 30% market share. This is largely used by construction and logistics alike to find a balance between the size and usability. Lastly, the containers of size more than 40 feet account for around 15% of all income.

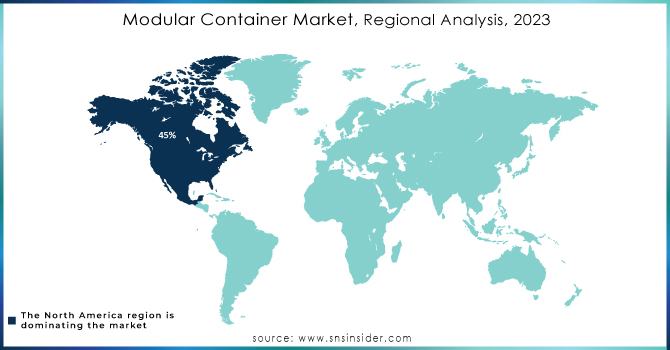

Modular Container Market Regional Analysis:

Currently, the market in North America is growing heavily. It is mainly motivated by a strong demand for affordable housing solutions coupled with an emphasis on fast construction. Around 45% of new modular container projects in the region are residentially intended and used in addressing shortages of housing, especially in urban regions. In contrast, Europe is on the motive wheel of sustainability goals, using about half of modular containers for eco-friendly projects in the education and healthcare industries. Germany and Netherlands remain in the forefront, making an effort to reduce carbon footprints by successfully using modular containers in green construction activities.

Demand for modular containers in Asia-Pacific is largely influenced by the rapid pace of urbanization and industrial development. Now, the region has begun to produce nearly 60% of the total modular containers worldwide. Countries like China and India are the key markets where modular containers are used for fast infrastructure development in commercial and residential segments. Meanwhile, modular container applications have risen in the Middle East and Africa, which is setting up temporary structures such as the construction workers camps for the major construction projects, accounting for about 25% of the market share within the regions, filling infrastructure gaps appropriately.

Need any customization research on Modular Container Market - Enquiry Now

Recent Developments:

Some of the leading companies, for instance, Modulaire Group, have been keenly focusing on the growth of rental services for modular buildings. They are rapidly changing the landscape of infrastructure projects in Europe. In 2023, they launched a new series of eco-friendly modular units for the construction and education sectors, with energy-saving technologies that improve sustainability.

Guerdon Modular Buildings-a dominant force in North America-just announced a partnership that would be involved in the development of high-volume modular housing projects to solve the housing crisis in strategic urban areas. The partnership would bring modular homes with greater design flexibility and up to a 30% faster turnaround on projects.

Wernick Group in the UK expanded its operations by investing into a manufacturing facility to increase more production capacity, especially on healthcare and educational modular units.

Key Players in Modular Container Market:

Some of the major modular container market key players are:

-

MODULE-T PREFABRIK SYSTEMS DIS TIC LTD STI - Prefabricated modular units

-

Prefabex - Modular office containers

-

McGrath RentCorp - Modular buildings

-

MODSTEEL - Steel modular buildings

-

HENAN K-HOME STEEL STRUCTURE CO., LTD. - Container houses

-

Kwikspace - Portable classrooms

-

Falcon Structures - Custom container solutions

-

Truston - Modular office units

-

WillScot Mobile Mini Holdings Corp. - Mobile offices

-

PODS Enterprises LLC - Portable storage containers

-

Container Technologies, Inc. - Custom shipping container modifications

-

Modular Space Corporation (ModSpace) - Temporary modular buildings

-

International Container Company (ICC) - Container homes

-

Boxman Studios - Custom container architecture

-

Blue Ocean Containers - Shipping container homes

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 28.05 Billion |

| Market Size by 2032 | USD 52.05 Billion |

| CAGR | CAGR of 7.8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type: (Mobile Modular Containers, Fixed Modular Containers) • By Revenue Source: (New Product Sales, Rental) • By Usage: (Office Container, Sanitary Container, Locker Container, Showroom Containers, Accommodation Containers, Storage Containers, Others) • By Container Size: (Below 10 Feet, 10-20 Feet, 21-40 Feet, Above 40 Feet) • By Application: (Construction, Industrial, Education, Healthcare, Automotive, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Amara Raja Batteries Ltd, Aulton New Energy, ECHARGEUP, Esmito Solutions, Gogoro, KYMCO, Lithion Power, NIO, Numocity, Oyika Ltd |

| Key Drivers | • Growing demand for cost-effective and expedient construction solutions. |

| RESTRAINTS | • Variation of building codes and complexity of the regulations in various regions. |