Vacuum Skin Packaging Market Key Insights:

Get More Information on Vacuum Skin Packaging Market - Request Sample Report

The Vacuum Skin Packaging Market size was valued at USD 7.97 Billion in 2023 and it is expected to reach USD 11.04 Billion by 2032 with a growing CAGR of 3.69 % over the forecast period 2024-2032.

Recent innovations in VSP technologies have significantly reduced plastic usage while maintaining the integrity and freshness of packaged products. Advanced top webs used in VSP systems are offering cost savings of 15-53% when compared to traditional Modified Atmosphere Packaging (MAP). Additionally, material downgrades, reducing film thickness to as low as 80 microns, are leading to a reduction in carbon footprints by 21-37% and plastic use by up to 51%.

The increased operational efficiency, with packaging cycles improving from 6 to 8.5 cycles per minute, further drives the adoption of VSP solutions. These innovations align with growing environmental concerns, as they contribute to reduced food waste and offer significant material savings. As consumer and retailer demand for eco-friendly packaging continues to rise, particularly in the food sector, the VSP market is poised for substantial growth in the coming years. The focus on sustainability, combined with the enhanced preservation of product freshness, positions VSP as a preferred packaging solution for food processors and manufacturers globally.

In recent developments, companies like Coveris are expanding their production capabilities to meet the growing demand for vacuum skin packaging. For example, Coveris recently opened a state-of-the-art vacuum skin packaging facility in Winsford, UK, to cater to this rising consumer need. The facility, which is the largest blown-extrusion site for polyethylene (PE) films in the UK, further solidifies Coveris' position as a key player in the VSP market. The expansion underscores the market's potential for growth, driven by innovations and investments that aim to boost efficiency and production capacity.

Furthermore, technological advancements in the packaging industry are contributing significantly to the growth of the VSP market. New materials and sealing technologies have improved the performance of vacuum skin packaging, including enhanced barrier properties, which help prolong shelf life and improve the visual appeal of food products. These innovations meet the increasing consumer demand for clean-label products that emphasize natural ingredients without artificial preservatives. As more consumers prioritize transparency and health, vacuum skin packaging has become a preferred solution for maintaining product integrity.

Market Dynamics

Drivers

-

The Pivotal Role of Innovative Packaging Solutions in Sustainability

A key driver of the vacuum skin packaging (VSP) market is the pressing need to combat food waste and its environmental consequences. In 2021, a staggering 38% of the U.S. food supply went unsold or uneaten, resulting in a loss of USD 444 billion and significantly contributing to resource depletion and greenhouse gas emissions. In this regard, vacuum skin packaging emerges as an essential solution, as it extends the shelf life of perishable goods and provides superior protection during storage and transportation. By creating an effective barrier against oxygen and moisture, VSP not only maintains food freshness but also reduces spoilage, ultimately lessening the total amount of food waste. The adoption of innovative packaging designs, such as vacuum skin technology, could significantly divert millions of tons of food waste each year while also decreasing greenhouse gas emissions. This relationship highlights the increasing significance of VSP in fostering sustainability and resilience in the food supply chain, meeting consumer demands for fresh, high-quality products while alleviating environmental impacts. For example, optimizing packaging design could prevent 1.1 million tons of food waste annually and cut greenhouse gas emissions by 6 million metric tons, illustrating the potential of innovative packaging solutions to enhance sustainability across the food supply chain.

Restraints

-

Material Constraints in Vacuum Skin Packaging as Barriers to Sustainability and Market Growth

Vacuum skin packaging (VSP) relies on specialized plastic films, including nylon, polyester, and polyethylene, designed to create a secure seal around food products. However, these materials present several challenges that can hinder market growth. Availability of these specialized films may be limited, leading manufacturers to rely on niche suppliers and resulting in potential production delays. Cost is another concern, as high-quality films for VSP can be expensive due to raw material prices and advanced manufacturing processes, discouraging adoption among companies with tight margins. Additionally, recyclability poses a significant issue; many plastics used in VSP are not easily recyclable because of their multilayer structures, creating challenges in environmentally regulated markets. As consumers increasingly demand sustainable packaging options, the inability of VSP to meet these expectations may negatively affect its market acceptance. Moreover, regulatory compliance varies by region, with differing packaging regulations related to food safety and environmental impact adding complexity and increasing costs. Addressing these material limitations is essential for broader VSP adoption, with innovations in material science, such as recyclable films or alternative packaging solutions, potentially alleviating these concerns and enhancing the sustainability of vacuum skin packaging in the food industry.

Market Segmentation Analysis

By Material

In 2023, the dominance of polyethylene (PE) in the vacuum skin packaging (VSP) market, capturing approximately 38% of total revenue, was further reinforced by notable product launches and strategic developments by leading companies in the segment. For instance, Sealed Air Corporation unveiled a new range of vacuum skin packaging solutions that utilize advanced PE materials to enhance food preservation while reducing environmental impact. Their innovative packaging design not only improves the shelf life of perishable products but also incorporates recyclable PE, responding to the growing consumer demand for sustainable packaging options. Amcor launched its latest line of VSP solutions made from high-performance PE films, focusing on the meat and dairy sectors. These products are designed to provide superior barrier properties against oxygen and moisture, ensuring freshness and safety while appealing to environmentally conscious consumers. Amcor's commitment to sustainability is reflected in its goal to make all its packaging recyclable or reusable by 2025, further solidifying its market position. Berry Global has invested in developing PE-based vacuum skin packaging that enhances product visibility while maintaining an eco-friendly profile. Their recent developments emphasize reducing plastic waste through innovative recycling processes and the use of post-consumer recycled materials. These strategic initiatives not only highlight the growing trend towards sustainable packaging but also demonstrate how advancements in polyethylene materials are driving innovation within the vacuum skin packaging market . As companies continue to launch new products and improve their existing offerings, the importance of PE in the VSP market is expected to strengthen, enabling it to maintain its significant revenue share in the coming years.

By Technology

In 2023, thermoforming technology dominated the vacuum skin packaging (VSP) market, capturing approximately 44% of the total revenue. This substantial market share can be attributed to several key factors and notable company developments in the segment.

One major driver of thermoforming’s success is its ability to create customized packaging solutions tailored to various food products. For instance, companies like Sealed Air have introduced innovative thermoformed packaging that enhances product presentation and minimizes waste by ensuring precise fits for perishable goods. Their recent launch of the BUBBLE WRAP brand foam packaging, which utilizes thermoforming technology, showcases how brands are leveraging this approach to extend shelf life while appealing to environmentally conscious consumers. Cost-effectiveness and scalability also play a crucial role in the widespread adoption of thermoforming. Berry Global, a leading packaging solutions provider, announced new investments in their thermoforming production capabilities in early 2023. This expansion enables them to efficiently meet growing demand while offering high-quality packaging solutions at competitive prices. Advancements in material efficiency are another significant aspect. For example, Pactiv Evergreen has developed lightweight thermoformed trays that reduce material usage without sacrificing strength or barrier properties. This innovation aligns with sustainability goals and responds to consumer preferences for eco-friendly packaging options. Companies are increasingly integrating smart packaging features into their thermoformed products. Amcor, a global leader in packaging, unveiled a new range of thermoformed packaging solutions that incorporate active and intelligent packaging technologies, allowing for real-time monitoring of product freshness. This advancement not only enhances food safety but also boosts consumer engagement by providing vital information about shelf life.

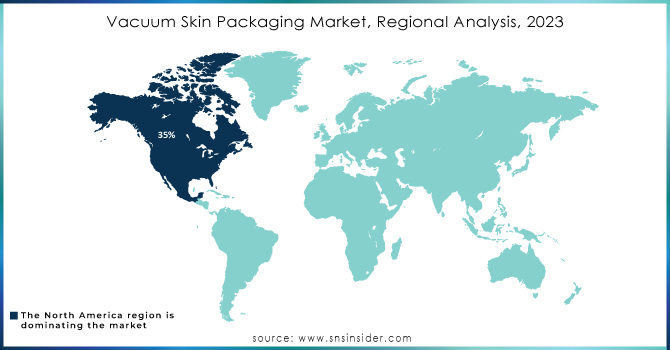

Regional Analysis

North America accounted for approximately 35% of the market, driven by a robust food industry and rising consumer demand for convenience and sustainability. Major players like Tyson Foods and Kraft Heinz have adopted VSP to enhance product freshness and reduce food waste, aligning with consumer preferences for fresh, minimally processed foods.

Meanwhile, the Asia-Pacific region emerged as the fastest-growing market, fueled by rapid industrialization and urbanization. Countries like China, India, and Japan are leading the charge, with rising disposable incomes prompting consumers to seek convenient, high-quality food options. In China, VSP adoption is surging among food companies, supported by government initiatives for modernization in packaging. Both regions emphasize sustainability, with manufacturers developing eco-friendly materials and adhering to stringent food safety regulations, ensuring product integrity and consumer satisfaction.

Need Any Customization Research On Vacuum Skin Packaging market - Inquiry Now

Key Players

Some of the major players in Vacuum Skin Packaging market who provide product and solution:

-

Adapa (Custom vacuum skin packaging films, pre-formed trays)

-

Amcor (Flexible packaging, rigid containers, vacuum skin packaging solutions)

-

Atlantis-Pak (Vacuum skin packaging systems, materials for meat and seafood)

-

Coveris Holdings (Flexible and rigid packaging solutions, vacuum skin packaging for food and non-food applications)

-

Flexopack (Vacuum skin packaging films, trays for meat and dairy products)

-

G. Mondini (Vacuum skin packaging machines, systems for various food applications)

-

Klckner Pentaplast (Rigid and flexible films for vacuum skin packaging, food and pharmaceutical applications)

-

KM Packaging Services (Custom packaging solutions, vacuum skin packaging for the food industry)

-

MULTIVAC Group (Complete packaging solutions, vacuum skin packaging machines and materials)

-

Pakmar (Vacuum skin packaging films, materials for fresh produce and meat)

-

Plastopil (Specialty films for vacuum skin packaging, food applications)

-

Hazorea Prepac Packaging Solutions (Custom vacuum skin packaging solutions for fresh and processed foods)

-

Sealed Air Corporation (Vacuum packaging solutions, Cryovac® brand vacuum skin packaging films and equipment)

-

SEALPAC International (Vacuum packaging machines, trays for various food products)

-

Sirane (Innovative vacuum skin packaging solutions for meat, poultry, and seafood)

-

Stora Enso (Sustainable packaging solutions, vacuum skin packaging materials)

-

Toray Plastics (America) (Advanced films for vacuum skin packaging, food and other industries)

-

Triton International (Vacuum packaging solutions tailored for food products)

-

Winpak (Vacuum skin packaging films, trays primarily for food packaging)

List of suppliers:

-

Amcor

-

Sealed Air Corporation

-

MULTIVAC Group

-

Coveris Holdings

-

Toray Plastics (America)

-

Klckner Pentaplast

-

Flexopack

-

Pakmar

-

Atlantis-Pak

-

Winpak

Recent Developments:

-

In August 16, 2024, ExxonMobil partnered with Brazilian packaging converter Videplast to create a cost-effective vacuum skin packaging solution that eliminates the use of ionomers. This innovative packaging addresses the demand for reduced film thickness while ensuring high performance, making it suitable for a range of food packaging applications.

-

On September 19, 2024, Coveris inaugurated a new vacuum skin packaging manufacturing facility in Winsford, Cheshire, making it the UK's sole producer of VSP. This investment includes a dedicated conversion hall and advanced manufacturing equipment, enhancing the site’s capabilities in polyethylene film production.

-

On June 13, 2024, SEE launched three innovative skin packaging top webs designed to enhance efficiency and performance in the food packaging industry. Compatible with CRYOVAC Darfresh technologies, these solutions feature superior oxygen barriers and exceptional formability, all while maintaining the integrity of the packaged products.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 7.97 Billion |

| Market Size by 2032 | USD 11.04 Billion |

| CAGR | CAGR of 3.69 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Polyethylene (PE), Polypropylene (PP), Polyvinyl Chloride (PVC), and Others) • By Technology(Thermoforming Technology, Film-based Technology, Tray-based Technology) • By Application (Meat, Poultry & Seafood, Fruits & Vegetables, Dairy, Ready-to-eat Meals, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Adapa, Amcor, Atlantis-Pak, Coveris Holdings, Flexopack, G. Mondini, Klckner Pentaplast, KM Packaging Services, MULTIVAC Group, Pakmar, Plastopil, Hazorea Prepac Packaging Solutions, Sealed Air Corporation, SEALPAC International, Sirane, Stora Enso, Toray Plastics (America), Triton International, and Winpak. |

| Key Drivers | • The Pivotal Role of Innovative Packaging Solutions in Sustainability |

| Restraints | • Material Constraints in Vacuum Skin Packaging as Barriers to Sustainability and Market Growth |