Monkeypox Testing Market Report Scope & Overview:

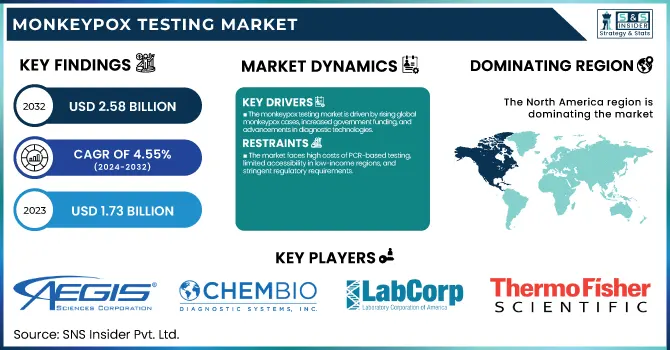

The Monkeypox Testing Market Size was valued at USD 1.73 billion in 2023 and is expected to reach USD 2.58 billion by 2032 and grow at a CAGR of 4.55% over the forecast period 2024-2032. This report presents the uptake rate of monkeypox testing by region, dictated by public health activity and government response measures. Reimbursement policy and insurance cover are considered in the research, which is the main determinants of accessibility of the market, as well as the changing regulatory environment and approval patterns impacting test availability. Moreover, it delves into the latest breakthroughs in monkeypox diagnosis, such as rapid and molecular testing advancements, and the increasing trend towards point-of-care (PoC) testing compared to conventional laboratory techniques. The report also evaluates government, commercial, private, and out-of-pocket healthcare expenditures on monkeypox testing, reflecting regional variations in market trends and investment.

To Get more information on Monkeypox Testing Market - Request Free Sample Report

The U.S. Monkeypox Testing Market Size was valued at USD 0.54 billion in 2023 and is expected to reach USD 0.73 billion by 2032 and grow at a CAGR of 5.75% over the forecast period 2024-2032. In the United States, expanded federal funding and CDC-driven efforts have fueled test availability, as commercial labs and public health networks boosted diagnostic capacity to meet growing demand.

Monkeypox Testing Market Dynamics

Drivers

-

The monkeypox testing market is driven by rising global monkeypox cases, increased government funding, and advancements in diagnostic technologies.

The 2022 worldwide monkeypox pandemic prompted increased attention and monitoring, pushing the pace of demand for speedy and precise testing. There were more than 85,000 confirmed instances reported by the WHO in 110 nations, reinforcing the requirement for extensive diagnostics with speed. Governments around the world invested enormous sums; e.g., the United States Department of Health and Human Services (HHS) put USD 140 million towards strengthening testing facilities. Technological advancements in PCR and LFA have accelerated detection speed and precision, enhancing accessibility for testing. The increasing focus on PoCT has further increased market growth, with organizations creating portable and affordable rapid tests. Regulatory approvals for monkeypox diagnostic kits have also increased—the FDA approved more than 20 emergency-use diagnostic kits in 2023 alone. Growth through more public-private collaborations and partnerships between healthcare organizations and diagnostic firms is also driving market growth. Increased awareness initiatives and compulsory testing protocols in risk areas have urged people to increase tests. The surge in demand from hospitals, diagnostics laboratories, and public health centers has positioned the monkeypox testing market to witness constant growth, coupled with continuous research efforts in CRISPR-based and AI-assisted diagnostic platforms.

Restraints

-

The market faces high costs of PCR-based testing, limited accessibility in low-income regions, and stringent regulatory requirements.

The most precise diagnostic tests, PCR tests, are costly, priced between USD 100 and USD 300 per test, rendering them inaccessible in most areas. The use of cold-chain logistics and advanced laboratory facilities further restrains the reach of rural and less developed regions. Regulatory obstacles also slow down market growth. Diagnostic firms need to comply with stringent FDA, EMA, and WHO approval procedures, holding back the launch of new testing kits. Numerous rapid antigen-based tests, for instance, were held up over fears of decreased sensitivity relative to PCR. Compliance adds to costs for manufacturers, slowing down innovation. Furthermore, low awareness and stigma surrounding monkeypox have led to underreporting and reduced testing levels, especially in developing countries. Social discrimination is a major reason why many individuals shun testing, especially where monkeypox is erroneously linked to certain groups. The reliance on central laboratory testing further inhibits market penetration. Access to high-level diagnostic infrastructure exists in only 30% of global healthcare facilities, constraining rapid detection and response activities. In the absence of significant government interventions and policy reforms, accessibility of testing will continue to pose a hindrance to market growth.

Opportunities

-

The rising demand for point-of-care testing, AI-driven diagnostics, and strategic partnerships presents lucrative growth opportunities in the monkeypox testing market.

Point-of-care (PoC) testing is on the rise because it can offer decentralized and rapid testing, taking the load off conventional laboratories. Portable PCR and lateral flow assays provide room for real-time diagnostics at clinics, airports, and rural health centers, making it more accessible. Integration of AI and machine learning in diagnostics is another area with great potential. Cepheid and Abbott are among the companies investing in AI-based test platforms that can automate result interpretation, eliminate human error, and enhance efficiency. AI-based diagnostics can read thousands of test results in seconds, enhancing outbreak surveillance. Strategic collaborations among government agencies, biotech companies, and healthcare organizations are speeding up innovation. For instance, the Bill & Melinda Gates Foundation collaborated with several diagnostic companies to create affordable monkeypox testing solutions for underserved areas. Increasing public-private partnerships will propel cost-effective solutions and regulatory clearances. Additionally, the growing emphasis on home use and self-testing kits provides an unexploited market sector. Businesses are developing at-home monkeypox testing kits, comparable to rapid COVID-19 tests, with convenience and discretion. Rolling out these innovations worldwide could revolutionize accessibility to testing, particularly among areas with poor healthcare infrastructure.

Challenges

-

The monkeypox testing market faces supply chain disruptions, the risk of false negatives, and global healthcare inequalities, limiting its rapid expansion.

The lack of essential diagnostic materials, such as PCR reagents and test kits, has resulted in bottlenecks in the availability of tests. Disruptions in global supply chains due to geopolitical tensions and raw material shortages have raised production costs by 20-30%, which has made affordable diagnostics more difficult to attain. Another issue is false negatives, most notably for lateral flow assays (LFA). As LFA offers rapid results, its sensitivity is lower than PCR, and thus it misses cases and delays treatment. LFA tests, under real-world conditions, have reported false-negative rates of 15-20%, which makes the reliability of LFA questionable. This then restricts reliance on rapid diagnostic tools, hindering their extensive use. Moreover, global health disparities continue to pose a major hindrance. Low-income nations, especially those in Africa and some regions of Asia, have few facilities for testing, trained personnel, and government support. As high-income countries scale up testing, disadvantaged communities lack resources to make mass diagnostics a reality, and this results in late outbreak responses.

Monkeypox Testing Market Segmentation Analysis

By Technology

Polymerase Chain Reaction (PCR) led the monkeypox testing market in 2023 with a 68.5% share of the overall market. PCR was the gold standard because it is highly accurate, specific, and can detect diseases early. The demand increased as governments and healthcare institutions gave high priority to molecular diagnostics for exact identification, particularly during outbreaks. The extensive presence of PCR facilities in hospitals and laboratories further reinforced its dominant position.

Lateral Flow Assay (LFA) is the most rapidly expanding technology segment due to its low cost, simplicity, and short turnaround time. With the growing demand for point-of-care testing and decentralized diagnosis, LFA has been popular in resource-poor environments and emergency testing applications. Public health efforts to increase monkeypox surveillance in underserved areas are also boosting its growth.

By End-use

Diagnostic laboratories dominated the market in 2023, with 52.3% of the overall market share. This leadership was fueled by the dependence on centralized laboratory testing, especially PCR-based diagnostics, which needs sophisticated infrastructure and skilled personnel. Governments and healthcare organizations favored laboratory-based testing for precision and epidemiological monitoring, cementing its dominance.

Hospitals & Clinics represent the most rapidly growing end-use segment, driven by the rapid adoption of rapid diagnostics at the point of care. The need to deliver on-the-spot testing and treatment information has prompted hospital-based monkeypox testing, particularly in infectious disease and emergency units. Enhanced access to rapid molecular testing as well as increasing numbers of suspected cases have fueled this segment's growth even more.

Monkeypox Testing Market Regional Insights

North America held the largest share in the monkeypox testing market in 2023 at 41.2% of the total global market share. The region's high rate of testing established healthcare systems, and robust government programs to stem the epidemic were responsible for its dominance. The United States accounted for the lion's share within the region, with the CDC and FDA being actively involved in the expansion of monkeypox testing, such as PCR and point-of-care tests. Major diagnostic companies' presence and extensive public awareness accelerated market growth.

Europe was close to following, as it had substantial government-sponsored programs of testing and high rates of uptake of the latest diagnostic tools. The UK, Germany, and France registered high volumes of testing, particularly in hospitals and public health labs.

The Asia-Pacific region is the fastest-growing market, expected to grow at a significant rate with growing investments in healthcare infrastructure, growing cases, and better access to diagnostic equipment. The lead is taken by China, India, and Japan, whose governments are strengthening laboratory capacity and point-of-care testing accessibility. Africa is also another critical focus area because of endemic outbreaks and global organizations are expanding funding for low-cost rapid testing solutions to enhance disease surveillance and control.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

BD (Becton, Dickinson, and Company)

-

Chembio Diagnostics Inc.

-

Laboratory Corporation of America Holdings (LabCorp)

-

Mayo Clinic Laboratories

-

QIAGEN

-

Quest Diagnostics Inc.

-

Sonia Healthcare Ltd

-

Sonora Quest Laboratories

-

Thermo Fisher Scientific

Recent Developments

-

In Aug 2024, Siemens developed an indigenous Monkeypox RT-PCR testing kit for India, which has received approval from the Central Drugs Standard Control Organisation (CDSCO). This marks a significant step in strengthening India's diagnostic capabilities against Monkeypox.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.73 billion |

| Market Size by 2032 | USD 2.58 billion |

| CAGR | CAGR of 4.55% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology [Polymerase chain reaction (PCR), Lateral Flow Assay (LFA), Others] • By End-use [Hospitals & Clinics, Diagnostics Laboratories, Others] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Aegis Sciences Corporation, BD (Becton, Dickinson and Company), Chembio Diagnostics Inc., Laboratory Corporation of America Holdings (LabCorp), Mayo Clinic Laboratories, QIAGEN, Quest Diagnostics Inc., Sonia Healthcare Ltd, Sonora Quest Laboratories, Thermo Fisher Scientific. |