Lateral Flow Assays Market Overview:

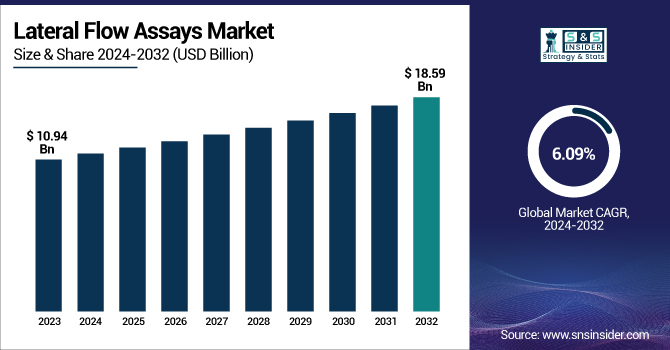

The Lateral Flow Assays Market Size was valued at USD 10.94 billion in 2023 and is expected to reach USD 18.59 billion by 2032 and grow at a CAGR of 6.09% over the forecast period 2024-2032.

To Get more information on Lateral Flow Assays Market - Request Free Sample Report

This report discusses the prevalence and incidence of target diseases, which is focused on the increasing demand for rapid diagnosis solutions in many healthcare settings. The research also delves into product and application trends by geographic region, displaying how markets within regions are taking up lateral flow technologies for the detection of infectious disease, pregnancy, and drug detection. It further analyzes regulatory approval and adoption patterns, revealing the impact of compliance frameworks on expansion in the market. The report also explores healthcare and diagnostic spending trends by region, in addition to trends in technological developments and innovation, including the integration of AI and smartphone-based readers, which are improving lateral flow assay accuracy and efficiency.

Lateral Flow Assays Market Dynamics

Drivers

-

The Lateral Flow assay market is driven by the increasing demand for rapid, point-of-care diagnostics, particularly in infectious disease detection.

The growing prevalence of COVID-19, flu, malaria, HIV, and tuberculosis has profoundly increased the utilization of lateral flow assays. As an example, more than 3 billion rapid antigen COVID-19 tests were released internationally between the period of 2020-2023. Technological progress involving smartphone-connected lateral flow readers as well as multiplex assays further improved diagnosis specificity and accessibility. The increasing demand for home testing, such as pregnancy, ovulation, and glucose testing, also accelerates market growth. In addition, government policies and healthcare expenditures have boosted the application of rapid diagnostics in disease surveillance and outbreak control. For instance, the WHO and CDC have encouraged the application of lateral flow assays in the early detection of infectious diseases in remote areas. The increasing cost of chronic diseases like cardiovascular conditions has also spurred the demand for quick biomarker detection. Additionally, cost savings and user-friendliness relative to conventional laboratory tests have established lateral flow assays as a first choice for diagnostic purposes. The increasing need for veterinary, food safety, and environmental analysis also further reinforces market demand with rising regulatory approvals and product developments backing universal adoption.

Restraints

-

The Lateral Flow Assays Market faces restraints due to limited sensitivity and specificity compared to laboratory-based diagnostic methods.

False negative and false positive results are problematic, particularly among low viral loads, resulting in greater dependence on confirmatory PCR testing. There is also an obstacle to entry through strict regulation requirements, such as the necessity for lateral flow assays to get approval from regulating bodies like the FDA, CE Mark, and WHO before commercialization. High-quality standards for control complicate product rollouts, inhibiting access to innovative diagnostic technology. Furthermore, the rising competition from newer molecular diagnostic technologies like PCR and next-generation sequencing (NGS) restricts the market share of lateral flow assays because these newer technologies provide greater accuracy and reliability. Another limitation is the limited shelf life and storage constraints of lateral flow assay kits, which need to be stored in controlled environments to keep the tests accurate. In the developing world, the inability to spread awareness and the suboptimal health infrastructure keep these diagnostics from being adopted at large levels. Furthermore, cost sensitivity in low-income economies prevents governments and healthcare providers from making a large-scale purchase, which impacts overall market penetration and availability.

Opportunities

-

The Lateral Flow Assays Market presents significant opportunities driven by technological advancements and expanding applications in diverse industries.

The emergence of smartphone- and AI-enabled lateral flow readers has enhanced the accuracy of the test, data integration, and remote monitoring of patients. Firms like Roche and Abbott are investing in digital health products that can drive diagnostic power. Multiplex detection assays, which can detect more than one biomarker through a single test, are also gaining popularity in detecting diseases and individualized medicine. The second major opportunity is the rising use of home-based self-testing kits, with increasing demand for pregnancy, infectious disease, and chronic disease monitoring kits. The rise in the use of lateral flow assays in veterinary diagnostics, food safety testing, and environmental monitoring further gives rise to new growth opportunities. Finally, government support for infectious disease surveillance and outbreak preparedness, including the Global Fund's expenditure on malaria rapid tests, offers significant market growth opportunities. Increased demand for decentralized healthcare solutions in rural and underserved regions increases demand for portable, user-friendly diagnostic kits. Furthermore, partnerships between diagnostic firms and pharmaceutical companies for companion diagnostics during drug development present new revenue opportunities, making lateral flow assays an essential element in precision medicine and clinical trials.

Challenges

-

The Lateral Flow Assays Market faces challenges related to product standardization, quality control, and global supply chain disruptions.

Manufacturing process variability impacts test reliability and accuracy, raising issues of false results and regulatory recalls. In 2022, several COVID-19 antigen tests were recalled for inconsistent performance and low sensitivity rates. Counterfeit and substandard diagnostic kits are another significant challenge, especially in emerging markets where regulatory enforcement is less stringent. The growing incidence of new and emerging infectious diseases also presents a challenge, as lateral flow assays need to be continuously updated to identify new strains and emerging pathogens. In addition, the integration of lateral flow technology with digital healthcare systems is also a challenge owing to data privacy, interoperability, and infrastructure constraints. The scarcity of trained personnel to interpret results in low-resource settings also affects market adoption. In addition, strong competition from laboratory diagnostics and molecular testing techniques, with greater sensitivity, limits market growth. Concerns about single-use plastic parts of lateral flow test kits also emerge, as the trend toward sustainable diagnostic products increases. Meeting these challenges necessitates ongoing innovation, harmonization of regulation, and collaboration between industry and regulators to ensure market momentum is sustained.

Lateral Flow Assays Market Segmentation Analysis

By Product

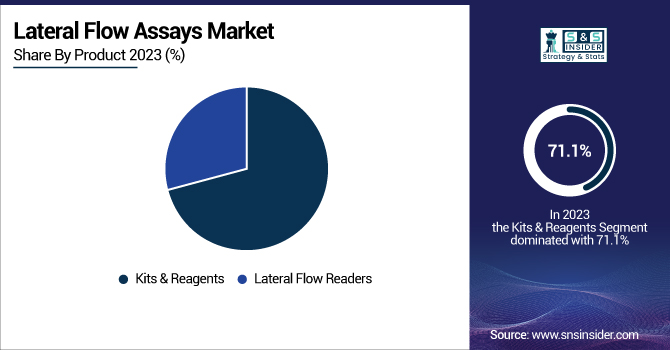

The Kits & Reagents segment led the market with a revenue share of 71.1% in 2023, fueled by their extensive use in point-of-care testing, home diagnostics, and lab applications. Their growing demand for quick and trustworthy test kits for infectious diseases, chronic conditions, and pregnancy diagnoses fueled this leadership.

The Lateral Flow Readers segment is anticipated to grow strongly in the future. Growing use of digital and smartphone-based readers, improving result accuracy, and allowing integration of data into healthcare systems is fueling the growth. Growing demand for automated and connected diagnostic solutions is likely to drive the growth of this segment further.

By Application

The Clinical Testing segment held the highest market share of 79.2% in 2023, thanks to the prevalent infectious and chronic diseases that necessitate quick diagnostic solutions. The extensive application of lateral flow assays in hospitals, emergency departments, and home testing for diseases like COVID-19, influenza, and cardiac markers supported the segment's leadership.

The Drug Development & Quality Testing segment is expected to witness the highest growth rate in the coming years. The surge in the use of lateral flow assays in pharmaceutical and biotechnology industries for quality assurance, biomarker detection, and research purposes is fueling its high growth. The growing requirement for rapid and accurate testing methodologies in drug development and manufacturing procedures also augurs well for the segment's growth.

By Technique

Sandwich Assays held the highest share of revenue with 42.3% in 2023 due to high sensitivity and specificity for the detection of large molecules like proteins and antigens. Its wide application in clinical diagnosis, especially for infectious disease diagnosis and pregnancy diagnosis, made it a market leader.

The Multiplex Detection Assays segment will be growing the fastest. The mounting demand for the detection of multiple biomarkers in one test, increasing efficiency and precision in diagnostics, is fueling this trend. The growth in the segment is driven by improved lateral flow technology, which lowers the cost and makes multiplex assays more convenient for different uses, such as disease screening and personalized medicine.

By Therapy

The Lateral Flow Immunoassay segment was the market leader with a 69.3% revenue share in 2023 due to its extensive application in point-of-care diagnostics, detection of infectious diseases, and home testing. Immunoassays are the go-to choice in clinical and veterinary diagnostics due to their ease of use, quick results, and cost-effectiveness.

The Nucleic Acid Lateral Flow Assay segment is expected to expand at a notable rate during the coming years. The increasing demand for molecular diagnostics, especially for the detection of genetic material of pathogens, is contributing to the growth. Rising emphasis on high-sensitivity tests for infectious diseases and the fusion of nucleic acid-based techniques with lateral flow technology are some of the main drivers for the growth of the segment.

By End-Use

The Hospitals & Clinics segment dominated the market with a share of 39.5% in 2023, since the healthcare centers are the major consumers of lateral flow assays for the diagnosis of diseases, emergency tests, and general health checks. The increasing incidence of infectious diseases and the requirement for rapid diagnostic solutions in hospitals further supported the dominance of the segment.

The Pharmaceutical & Biotechnology Companies segment is also expected to witness the highest growth in the forecast period. Growing application of lateral flow assays in drug testing, research and development, and biomarker analysis is one of the main drivers. The need for effective quality control techniques in pharma manufacturing and the expanding contribution of lateral flow technology to companion diagnostics and personalized medicine are driving this segment's growth.

Lateral Flow Assays Market Regional Insights

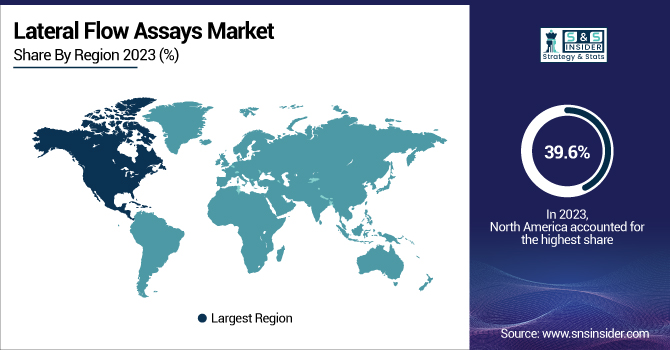

North America led the Lateral Flow Assays Market with the highest revenue share of 39.6% in 2023. The dominance of the region is due to a strong established healthcare infrastructure, high usage of point-of-care testing, and growing demand for rapid diagnostic tools. The strong presence of leading players and frequent approvals of new-generation lateral flow assays by regulators are additional factors propelling the market growth. The extensive application of lateral flow assays across clinical testing, home testing, and infectious disease screening especially in the United States and Canada has been a major contributor to the region's leadership. Moreover, increased government support for infectious disease surveillance and early disease detection initiatives has also driven demand. The growing incidence of chronic diseases like cardiovascular diseases and diabetes further fuels the demand for rapid and accurate diagnostic solutions in the region.

The Asia-Pacific region is projected to experience the highest growth over the coming years. These include a high population, a rising prevalence of infectious diseases, and an elevated awareness of point-of-care testing, which are fueling growth. Moreover, advancements in healthcare infrastructure, government efforts for disease management on the rise, and the growing footprint of diagnostic manufacturers in nations such as China, India, and Japan are speeding up the region's market expansion. The ease of affordability and access to lateral flow assays in urban and rural regions also add to its increasing uptake.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players and Their Lateral Flow Assay Products

-

Abbott Laboratories – BinaxNOW, Panbio, ID NOW

-

Thermo Fisher Scientific, Inc. – SureTect, Accula SARS-CoV-2 Test

-

F. Hoffmann-La Roche AG – SARS-CoV-2 Rapid Antigen Test, Cobas Liat System

-

Bio-Rad Laboratories, Inc. – Reliance SARS-CoV-2/Flu A&B RT-PCR Assay, Bio-Rad Lateral Flow Immunoassays

-

bioMérieux SA – VIKIA Rapid Tests, BIOFIRE Respiratory Panels

-

Quidel Corporation – QuickVue, Sofia SARS Antigen FIA

-

Hologic, Inc. – Panther Fusion, Aptima SARS-CoV-2 Assay

-

PerkinElmer, Inc. – COVID-19 Antigen Test, lateral flow-based diagnostics

-

Merck KGaA – Miriad Lateral Flow Assays, Singlepath Lateral Flow Tests

-

BD (Becton, Dickinson and Company) – Veritor System, BD SARS-CoV-2 Antigen Test

-

Siemens Healthineers – CLINITEST Rapid COVID-19 Antigen Test, Atellica IM SARS-CoV-2 Assay

-

Danaher Corporation – Cepheid Xpert, Beckman Coulter Lateral Flow Assays

-

QIAGEN N.V. – QIAreach, QIAstat-Dx Respiratory Panel

Recent Developments in Lateral Flow Technologies

-

In November 2024, Roche launched the Elecsys HCV Duo test, which aims to improve the diagnosis of hepatitis C by identifying both antibodies and the virus at the same time, allowing for earlier detection and treatment.

-

Abbott expanded its BinaxNOW COVID-19 test in October 2024, adding a digital health platform that enables customers to view their test results through a mobile app, improving convenience and accessibility.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 10.94 billion |

| Market Size by 2032 | USD 18.59 billion |

| CAGR | CAGR of 6.09% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product [Kits & Reagents, Lateral Flow Readers (Benchtop Readers, Digital Readers)] • By Application [Clinical Testing (Infectious Disease Testing, Cardiac Marker Testing, Pregnancy & Fertility Testing, Cholesterol Testing/Lipid Profile, Drugs of Abuse Testing, Other Clinical Tests), Veterinary Diagnostics, Food Safety & Environment Testing, Drug Development & Quality Testing] • By Technique [Sandwich Assays, Competitive Assays, Multiplex Detection Assays] • By Therapy [Lateral Flow Immunoassay, Nucleic Acid Lateral Flow Assay] • By End-Use [Hospitals & Clinics, Diagnostic Laboratories, Home Care, Pharmaceutical & Biotechnology Companies, Others] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Abbott Laboratories, Thermo Fisher Scientific, Inc., F. Hoffmann-La Roche AG, Bio-Rad Laboratories, Inc., bioMérieux SA, Quidel Corporation, Hologic, Inc., PerkinElmer, Inc., Merck KGaA, BD (Becton, Dickinson and Company), Siemens Healthineers, Danaher Corporation, QIAGEN N.V. |