Mosquito Repellent Market Report Scope & Overview:

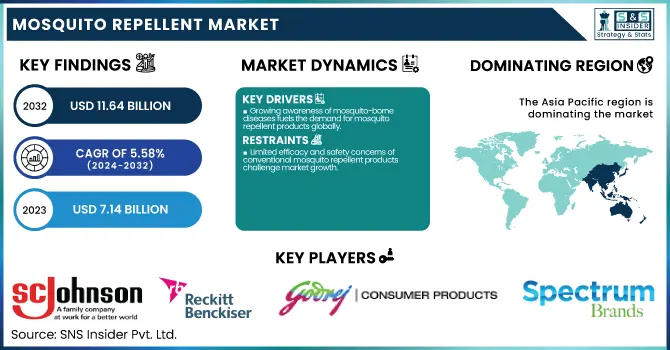

The Mosquito Repellent Market size was USD 7.14 billion in 2023 and is expected to reach USD 11.64 billion by 2032 and grow at a CAGR of 5.58% over the forecast period of 2024-2032.

To Get more information on Mosquito Repellent Market - Request Free Sample Report

The report offers detailed insights into various key trends and statistical factors shaping the industry. We provide a comprehensive analysis of production capacity and utilization, by region and repellent type, highlighting trends and shifts. Additionally, the report includes data on feedstock prices for different repellent products across major markets, alongside the regulatory landscape and its impact on product formulations. The report also examines environmental metrics, such as emissions data and sustainability efforts, across different regions. Furthermore, we explore ongoing innovations and R&D efforts that are driving advancements in repellent technologies. With insights into regional adoption rates and key features of popular mosquito repellent products, the report provides a holistic view of the current market dynamics and future growth potential.

The Mosquito Repellent market in the United States was Market size was USD 1.08 billion in 2023 and is expected to reach USD 1.87 billion by 2032 and grow at a CAGR of 6.22% over the forecast period of 2024-2032. This is due to several factors, including the country’s high consumer awareness, robust healthcare infrastructure, and advanced retail channels. The growing concern over mosquito-borne diseases like Zika virus, malaria, and West Nile virus has led to a strong demand for effective mosquito repellent products. Additionally, the U.S. market is characterized by a significant number of key players offering a wide range of mosquito repellents, which cater to varying consumer preferences, from sprays to coils and mats. The availability of these products in supermarkets, e-commerce platforms, and pharmacies further drives market growth. Strong regulations regarding product safety and efficacy also contribute to consumer confidence, ensuring that repellents are safe and effective. Moreover, the increasing awareness of personal health and hygiene further accelerates the demand for mosquito repellents across urban and rural areas alike.

Mosquito Repellent Market Dynamics

Drivers

-

Growing awareness of mosquito-borne diseases fuels the demand for mosquito repellent products globally.

The increasing prevalence of mosquito-borne diseases like malaria, Zika virus, and dengue is a primary driver for the growth of the mosquito repellent market. Governments and health organizations worldwide are raising awareness about the risks associated with these diseases, leading to an increased demand for effective repellents. Consumers are becoming more proactive in using repellents to protect themselves, especially in high-risk areas. Additionally, the growing need for protection in both tropical and urban areas, where mosquitoes thrive, is pushing the demand for a wide range of products like sprays, coils, and vaporizers. This growing awareness and demand for protection are significantly contributing to market growth, as consumers prioritize personal health and safety.

Restrain

-

Limited efficacy and safety concerns of conventional mosquito repellent products challenge market growth.

One of the major restraints in the mosquito repellent market is the limited efficacy and safety concerns associated with some conventional products. Many chemical-based repellents, such as DEET (N,N-Diethyl-m-toluamide), have raised concerns regarding their potential side effects, including skin irritation and toxicity if used improperly. This has caused hesitation among consumers, especially those seeking safer, natural alternatives. As the awareness about the possible harmful effects of chemical ingredients grows, consumers are turning to more eco-friendly and organic repellent solutions. Despite their effectiveness, these products face challenges in terms of limited duration of action and increased cost, further impacting their widespread adoption.

Opportunity

-

. Rising demand for natural and eco-friendly mosquito repellents creates opportunities for market expansion.

The rising demand for natural and eco-friendly products presents a significant opportunity in the mosquito repellent market. As consumers become more environmentally conscious and health-aware, there is a growing preference for products that use natural ingredients like citronella, eucalyptus, and lavender. These repellents are seen as safer for both humans and the environment, driving their adoption in households, public spaces, and outdoor settings. Manufacturers are increasingly investing in research and development to create innovative, plant-based repellents that can offer long-lasting protection without harmful chemicals. This shift towards organic and sustainable options is likely to provide strong growth potential in the market, particularly in regions where consumers prioritize eco-conscious choices.

Challenge

-

Effectiveness of mosquito repellents in different environmental conditions remains a major challenge for manufacturers.

A key challenge faced by manufacturers in the mosquito repellent market is ensuring the effectiveness of repellents under various environmental conditions. Products that work well in indoor, controlled environments may not provide adequate protection in outdoor or humid areas, where mosquitoes are more prevalent. For instance, repellents may lose effectiveness during rain or high temperatures, limiting their use during specific seasons. Consumers expect long-lasting protection, especially in areas with high mosquito activity, but not all products can meet these expectations. Manufacturers are continuously working to improve the formulation of repellents to enhance their durability and performance across different weather conditions, but this remains a significant challenge for the market.

Mosquito Repellent Market Segmentation Analysis

By Repellent Type

Coil held the largest market share around 32% in 2023. It is due to their widespread use and long-lasting effectiveness, especially in outdoor and large area applications. Mosquito coils are highly popular because they are easy to use, affordable, and can provide protection over an extended period, often lasting several hours. Their effectiveness in repelling mosquitoes, particularly in areas with high mosquito populations such as gardens, patios, and open spaces, makes them a preferred choice for many consumers. Additionally, coils are generally perceived as a cost-effective solution, providing good value for money compared to other repellent products like sprays or vaporizers. Their established presence in various markets, especially in Asia-Pacific and Africa, where mosquito-borne diseases are more prevalent, further reinforces their dominance in the market.

By Bite Type

Lotion held the largest market share at around 38% in 2023. It is owing to its convenience, ease of applicability, and its wide consumer acceptance. Mosquito Repellent Lotions Mosquito repellent lotions are high for a cause; as they are non-greasy, easy-to-spread across the skin, and long-lasting, they can serve a plethora of people. They are often used by people looking for a feeling comfortable and skin-friendly option, that can be applied over larger areas of the body. Moreover, in the warmer temperate regions, lotions are preferred because they are light, absorb fast, and leave little behind. The wide range of easily available formulations that include natural or skin-friendly components only enhances the popularity and demand of these masks in the market. So, lotions are one of the most preferred and widely used products in my personal care products to repel them.

By Distribution Channel

Hypermarket & Supermarket held the largest market share, around 45%, in 2023. This is due to their extensive reach, product variety, and consumer trust. These retail formats serve as one-stop destinations for daily essentials, including health and personal care products like mosquito repellents. Consumers prefer shopping from these outlets because they can physically examine product packaging, compare brands side-by-side, and benefit from promotional discounts or combo offers often run by manufacturers and retailers. Moreover, the presence of major brands on dedicated shelves in supermarkets enhances visibility and impulse purchasing. Hypermarkets and supermarkets also have better product stock rotation, ensuring the availability of fresh and latest formulations. In both urban and semi-urban areas, these channels offer higher accessibility and convenience, making them a dominant distribution mode for mosquito repellents across sprays, vaporizers, coils, lotions, and more.

Mosquito Repellent Market Regional Outlook

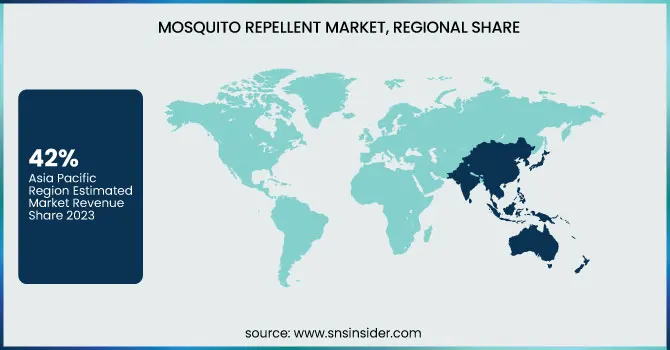

Asia Pacific held the largest market share, around 42%, in 2023. This is due to its high population density, tropical climate, and increasing mosquito-borne diseases like dengue, malaria, and chikungunya. Countries such as India, China, Indonesia, and the Philippines face a year-round mosquito menace, driving strong demand for various repellent products. Government initiatives in the region to control vector-borne diseases, along with rising awareness about personal hygiene and health protection, have further fueled market growth. Additionally, the presence of leading domestic and international brands, coupled with expanding retail networks and growing disposable incomes, has made mosquito repellents more accessible to both urban and rural populations. The region's large base of middle-income consumers favors cost-effective formats like coils and vaporizers, while rising urbanization and lifestyle shifts are boosting demand for sprays, roll-ons, and creams.

North America held a significant market share. It is due to its strong consumer awareness regarding health and wellness, coupled with increasing concern over vector-borne diseases such as West Nile Virus and Zika. The U.S. and Canada have witnessed periodic mosquito outbreaks, prompting both government and private sector initiatives to promote the use of repellents. The region also benefits from advanced R&D capabilities and the presence of well-established players offering a wide range of innovative and eco-friendly repellent products, including DEET-free and natural formulations. Moreover, high disposable income, a well-developed retail infrastructure, and a growing preference for outdoor recreational activities contribute to sustained demand. The expansion of e-commerce platforms has further supported easy access to mosquito repellent products, making North America a key contributor to the global market despite having fewer mosquito-prone months compared to tropical regions.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

SC Johnson (OFF! Deep Woods, OFF! Family Care)

-

Reckitt Benckiser (Raid, Mortein)

-

Godrej Consumer Products Limited (Goodknight, Hit)

-

Spectrum Brands (Cutter, Repel)

-

Dabur India Limited (Odomos, Herbal Mosquito Repellent)

-

Perrigo Company (Repel, off! Family Care)

-

BASF (Thermacell, Mosquito Repellent Coils)

-

Coleman Company (Repel, off! Clip-On)

-

Quantum Health (Buzz Away, Herbal Armor)

-

3M (UltraShield, Mosquito Repellent Patches)

-

Buggins (Buggins Insect Repellent, Buggins Natural)

-

Airo Outdoor (Airo Mosquito Repellent, Airo Guard)

-

Ecolab (ECOSAFE Mosquito Repellent, EcoMIST)

-

Avon (Skin So Soft Bug Guard, Skin So Soft)

-

Enesis Group (Autan, Rid)

-

Mosquito Guard (Mosquito Guard Spray, Mosquito Guard Lotion)

-

Insect Shield (Insect Repellent, Insect Shield Clothing)

-

Kincho (Kincho Mosquito Repellent, Kincho Coil)

-

Thermacell Repellents (Thermacell Radius, Mosquito Repellent Lantern)

-

ExOfficio (BugsAway, BugsAway Jacket)

Recent Development:

-

In 2024, Godrej Consumer Products Ltd launched the Goodknight Flash Liquid Vapouriser, featuring Renofluthrin, India's first indigenously developed mosquito repellent molecule. This innovative formulation is twice as effective as current products, providing extended protection.

-

In 2024, Dabur India Ltd launched the Odomos Universal Mosquito Liquid Vapouriser, marking its debut in the liquid vapouriser segment. This strategic move aims to capture a market 12 times larger than existing categories, capitalizing on the brand's established heritage and consumer trust.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 7.14 Billion |

| Market Size by 2032 | USD 11.64 Billion |

| CAGR | CAGR of 5.58% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Repellent Type (Spray, Vaporizer, Cream & Oil, Coil, Mat) •By Bite Type (Lotion, Balm, Gel, Roll-on) •By Distribution Channel (Hypermarket & Supermarket, Independent Stores, E-commerce) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | SC Johnson, Reckitt Benckiser, Godrej Consumer Products Limited, Spectrum Brands, Dabur India Limited, Perrigo Company, BASF, Coleman Company, Quantum Health, 3M, Buggins, Airo Outdoor, Ecolab, Avon, Enesis Group, Mosquito Guard, Insect Shield, Kincho, Thermacell Repellents, ExOfficio |