Calcium Carbonate Market Report Scope & Overview:

Get E-PDF Sample Report on Calcium Carbonate Market - Request Sample Report

The Calcium Carbonate Market size was USD 45.6 billion in 2023 and is expected to reach USD 79.8 billion by 2032 and grow at a CAGR of 6.4% over the forecast period of 2024-2032.

The increasing demand for calcium carbonate in the paper and pulp industry is mainly due to the cost-effective nature of calcium carbonate as a high-performance filler material. Calcium carbonate improves paper brightness, opacity, and surface smoothness, and is therefore often used in manufacturing high-quality printing and writing papers. In addition, its use also brings a significant volume reduction in the expensive wood pulp used in the paper manufacturing process, making it more sustainable. The growing adoption of calcium carbonate, especially in lightweight and recyclable paper products for packaging and printing applications, is positively impacting the market demand. This trend is particularly further validated by innovations in coating technologies facilitating the production of high-end paper with superior printability and appearance. With manufacturers of paper consistently looking to improve the overall operational efficiency and adherence to environmental standards, calcium carbonate is an ever-more prominent force within the industry.

The U.S. Department of Commerce reported consistent growth in the paper and pulp industry, significantly driving demand for calcium carbonate, a key filler material. Calcium carbonate is estimated to account for 40% of the filler used in paper production, especially for coated paper varieties.

High demand in the construction industry owing to the fictional performance improvement of cement and concrete, as calcium carbonate serves to great extent strongly impacts the growth of calcium carbonate market. In the process of making Portland cement, calcium carbonate also serves as an essential compound that provides the strength and durability of this material. In concrete, it acts as a filler to increase the compressive strength and to decrease the permeability so that the applied concrete has a better durability against the hostile environment conditions such as moisture and temperature changes. As a key component of infrastructure from roads to bridges to homes, the affordability and abundance of this material only add to its necessity.

As the global scope of construction activity grows, particularly in developing countries such as India and China, where urban development and infrastructure works are advancing, the market for calcium carbonate can be expected to increase at a steady rate. Worldwide calcium carbonate usage in the construction industry has continued to rise, as noted by the U.S. Geological Survey, as this mineral has become an integral part of modern building practice.

Calcium Carbonate Market Dynamics

Drivers

The increasing usage of calcium carbonate in agriculture is projected to drive the market's growth.

This rising adoption of calcium carbonate in agriculture is a notable factor expected to propel the market growth as calcium carbonate is critical for enhancing soil health and increasing crop yield. From agricultural lime, calcium carbonate neutralizes the acid soils and raises the pH of soils, providing a friendly ecosystem for the plants to draw nutrients. This is especially important in parts of Asia and South America where agriculture is a mainstay of the economy but the soils are either very depleted or close to naturally acidic. Calcium carbonate also provides necessary calcium and magnesium to the soil and it can help the soil structure and retain water. Among other factors, increasing focus on sustainable farming practices and rising agricultural productivity to sustain increasing global food demand is accelerating its adoption. Also, a reflection of a global trend, is that the usage of lime rose in the U.S. for use in soil management (USDA). Such advancements further establish calcium carbonate as a savior for modern agriculture, upon which the international food supply chain relies.

The USDA highlights that calcium carbonate, commonly used as agricultural lime, plays a significant role in neutralizing acidic soils. It improves pH balance, which is essential for optimal plant growth and nutrient uptake. Approximately 50% of agricultural lime usage in the U.S. is attributed to calcium carbonate applications, improving the productivity of millions of acres of farmland annually.

Restraint

-

The high cost of transportation duties and stringent rules are anticipated to hinder market growth.

The largest impediments to the growth of the calcium carbonate market are the expensive transporting duties and constraints of the regulatory requisites. Calcium carbonate is one of the heaviest chemical compounds; therefore, transportation costs related to this product, especially for bulk shipments, are significantly high. The logistics of transporting calcium carbonate that has poor weight to value ratio can be expensive. For international trade, however, this is even more troublesome, as duties and tariffs merely add more costs onto the fees. Moreover, the market is subject to stringent environmental regulations regarding mining and processing, since the production process of calcium carbonate consumes a considerable amount of energy and emits pollutants. And to comply with these regulations requires immense expenditure on sustainable technologies and processes, which drives up our production costs. As an illustration, the layers of complexity and cost introduced by government mandates governing carbon footprint reduction and emission controls in Europe and North America, deters smaller manufacturers from entering the market. All these factors collectively restrain the potential market growth with increased operational cost and restricting profitability.

Calcium Carbonate Market Segmentation

By Type

Ground Calcium Carbonate held the largest market share around 69% in 2023. The largest impediments to the growth of the calcium carbonate market are the expensive transporting duties and constraints of the regulatory requisites. Calcium carbonate is one of the heaviest chemical compounds; therefore, transportation costs related to this product, especially for bulk shipments, are significantly high. The logistics of transporting calcium carbonate that has a poor weight-to-value ratio can be expensive. For international trade, however, this is even more troublesome, as duties and tariffs merely add more costs to the fees. Moreover, the market is subject to stringent environmental regulations regarding mining and processing, since the production process of calcium carbonate consumes a considerable amount of energy and emits pollutants. And to comply with these regulations requires immense expenditure on sustainable technologies and processes, which drives up our production costs.

By Application

The paper segment held the largest market share around 42% in 2023. because of its wide applications as filler and coating in paper and pulp industry. Calcium Carbonate aids in the brightness, opacity and surface smoothening of paper, making it highly preferable for high-quality printing and writing applications. Also, due to its lower cost than kaolin, makes it increasingly used. As governments worldwide take steps to adopt sustainable practices and reduce dependency on non-biodegradable materials, it has bolstered the demand for papers filled with calcium carbonate as they are more easily recyclable. For example, stringent regulations regarding sustainable packaging in Europe and North America have increased the need for such practices. All the above-mentioned factors collectively propel the paper segment to dominate the calcium carbonate market.

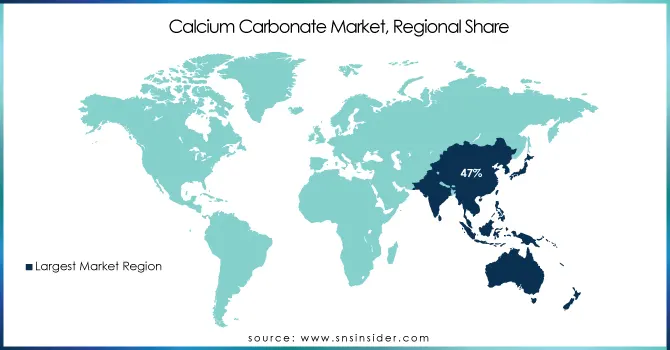

Calcium Carbonate Market Regional Analysis

Asia Pacific held the largest market share around 47% in 2023. is driven by a rapidly growing industrial and manufacturing sector, particularly in the paper, plastics, and construction industries. Growing regional populations and rapid urbanization are driving demand for quality paper products, structural materials and plastics all major consumers of calcium carbonate.

Calcium carbonate is primarily used in the paper and cement industries in countries like China and India as these countries are some of the largest paper producers and consumers in the world. Government reports show that China currently produces around 40% of the total paper in the world, and this paper production directly drives the high demand for calcium carbonate. Moreover, presence of vast construction activities across Asia Pacific region on residential, commercial, and industrial buildings expands demand for calcium carbonate used in cement and concrete to enhance durability.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Key Players

-

Gulshan Polyols Ltd. (Gulshan Precipitated Calcium Carbonate, Gulshan Ground Calcium Carbonate)

-

Wolkem (Wolkem GCC, Wolkem PCC)

-

Sibelco (Calcium Carbonate, LithoCal)

-

Imerys (Imerys GCC, Imerys PCC)

-

Huber Engineered Materials (HuberCal, Hubercarb)

-

Minerals Technologies Inc. (Calcium Carbonate, Hydrate Products)

-

ASCOM (ASCOM PCC, ASCOM GCC)

-

CITIC Calcium Industry Co. Ltd. (CITIC GCC, CITIC PCC)

-

Jay Minerals (Jay Ground Calcium Carbonate, Jay Precipitated Calcium Carbonate)

-

GP Group (GP GCC, GP PCC)

-

Longcliffe (Longcliffe GCC, Longcliffe PCC)

-

Fitz Chem LLC (FitzCal GCC, FitzCal PCC)

-

Nitto Funka Kogyo (Calcium Carbonate, Nitto-Funka)

-

AGSCO Corp (AGSCO GCC, AGSCO PCC)

-

Carmeuse (Carmeuse Calcium Carbonate, Carmeuse Lime)

-

Blue Mountain Minerals (Blue Mountain GCC, Blue Mountain Lime)

-

GCCP Resources Limited (GCCP Ground Calcium Carbonate, GCCP Precipitated Calcium Carbonate)

-

Midwest Calcium Carbonates (Midwest GCC, Midwest PCC)

-

Mississippi Lime (Mississippi Lime Calcium Carbonate, Mississippi Lime Hydrated Lime)

-

Omya (Omya GCC, Omya PCC)

Recent Development:

-

Minerals Technologies Inc- In 2023 Three long-term precipitated calcium carbonate (PCC) supply agreements that Minerals Technologies engaging will help the company's Specialty Additives product line in China and India grow even further. The agreements are with three major paper companies in 2 companies in china and India.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 45.6 Billion |

| Market Size by 2032 | US$ 79.8 Billion |

| CAGR | CAGR of 6.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Ground Calcium Carbonate (GCC), Precipitated Calcium Carbonate (PCC)) •By Application (Automotive, Pharmaceutical, Agriculture, Building, Paper & pulp, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Gulshan Polyols Ltd., Wolkem,Sibelco, Imerys, Huber Engineered Materials, Minerals Technologies Inc., ASCOM, CITIC Calcium Industry Co. Ltd., Jay Minerals, GP Group, Longcliffe, Fitz Chem LLC, Nitto Funka Kogyo, AGSCO Corp, Carmeuse, Blue Mountain Minerals, GCCP Resources Limited, Midwest Calcium Carbonates, Mississippi Lime, Omya and Others |

| Key Drivers | • The increasing usage of calcium carbonate in agriculture is projected to drive the market's growth. |

| RESTRAINTS | • The high cost of transportation duties and stringent rules are anticipated to hinder market growth. |