Feed Mycotoxin Detoxifiers Market Report Scope & Overview:

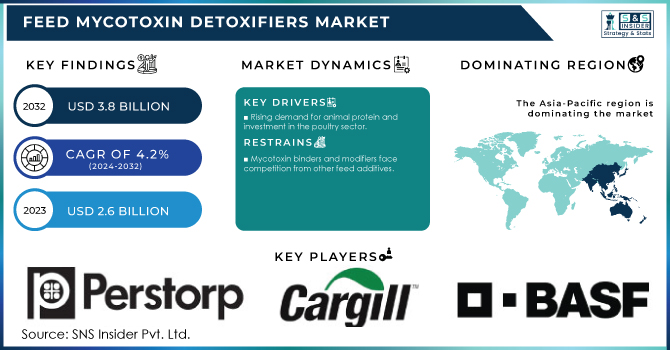

The Feed Mycotoxin Detoxifiers Market size was valued at USD 2.6 Billion in 2023. It is expected to grow to USD 3.8 Billion by 2032 and grow at a CAGR of 4.2% over the forecast period of 2024-2032.

Increasing focus on sustainable agriculture and organic farming practices is notably impacting the natural and organic mycotoxin detoxifiers market growth. With food safety and environmental sustainability becoming key drivers for consumers, the producers are forced to implement practices that improve not only animal health, but also reduce their carbon footprint. These sustainable practices in line with the organic quality of farm produce offer viable alternatives in the form of natural and organic detoxifiers, extracted from plant-based sources or produced by beneficial microbial culture that can help farmers to balance out on synthetic additives.

These toxins can not only harm livestock but also potentially enter the human food chain if contaminated feed is consumed by animals. Feed mycotoxin detoxifiers offer a reliable solution to mitigate these risks, ensuring animal well-being and consumer safety. For example, according to the World Health Organization in 2023 "One Health" focus exemplifies the rising emphasis on animal health's link to human well-being. Mycotoxin mitigation through feed detoxifiers safeguards animal health, potentially reducing the risk of zoonotic diseases.

Feed Mycotoxin Detoxifiers Market Size and Forecast:

-

Market Size in 2023: USD 2.6 Billion

-

Market Size by 2032: USD 3.8 Billion

-

CAGR: 4.2% from 2024 to 2032

-

Base Year: 2023

-

Forecast Period: 2024–2032

-

Historical Data: 2020–2022

Get More Information on Feed Mycotoxin Detoxifiers Market - Request Sample Report

Feed Mycotoxin Detoxifiers Market Trends:

-

Rising focus on sustainable agriculture and organic farming practices

-

Increasing adoption of natural and plant-based mycotoxin detoxifiers

-

Growing awareness of animal health and food safety under the “One Health” approach

-

Expansion of the global livestock and poultry industry driving feed additive demand

-

Advancements in mycotoxin binding and detoxification technologies

-

Strong growth in poultry and aquafeed sectors supporting market expansion

Furthermore, the expanding global livestock industry presents significant growth. The demand for meat, poultry, eggs, and dairy products is surging due to population growth, rising disposable income, and urbanization. This translates to a larger market for feed additives, including mycotoxin detoxifiers. Additionally, growing awareness among farmers regarding the detrimental effects of mycotoxins on animal performance and production losses is propelling the adoption of these feed additives. Advancements in detoxification technology further enhance the market's potential. The development of new and improved methods for deactivating or binding mycotoxins leads to more effective and efficient feed detoxifiers, solidifying their position as a vital tool in modern animal production. According to the U.S. Department of Agriculture (USDA), organic meat sales in the U.S. surged by over 12% in 2023, reflecting this growing consumer interest.

Feed Mycotoxin Detoxifiers Market Drivers

-

Rising demand for animal protein and investment in the poultry sector.

Consumer preferences are shifting towards poultry due to its affordability compared to other meats, and events like the African swine fever outbreak that reduced pork availability further solidified this trend. This growth is bolstered by substantial investments across the sector. Leading producers like China, with its massive layer hen populations, and companies like Almarai in Saudi Arabia investing heavily in new farms exemplify this commitment. This rise in poultry production necessitates increased feed production, which in turn is expected to drive demand for feed additives in the coming years. Overall, the future of the poultry industry appears bright, fueled by consumer preferences and significant investments.

The rising global demand for animal protein is driving significant growth in the livestock and poultry sectors. Increasing incomes, urbanization, and changing dietary patterns have led to higher consumption of meat, eggs, and dairy products. According to the Food and Agriculture Organization (FAO), global meat consumption increased by 2.3% in 2022, with poultry accounting for over 40% of total meat production. This demand surge is pushing farmers and producers to expand their poultry operations, invest in modern farming techniques, and adopt enhanced feed solutions to meet growing consumer needs. The U.S. Department of Agriculture (USDA) advanced data indicated that decades-high poultry production in the U.S. amounting to 49.2 billion pounds in 2023 resulted from expanding investments in sustainable farming solutions and modernized feed approaches. These investments are designed to enhance efficiency and to answer the growing demand for high-quality animal proteins around the globe.

Feed Mycotoxin Detoxifiers Market Restraint

-

Mycotoxin binders and modifiers face competition from other feed additives.

While mycotoxin binders and modifiers offer a targeted approach to address mycotoxin contamination, some livestock producers remain unconvinced of their necessity. They often prioritize other feed additives that deliver broader benefits. Mold inhibitors, for instance, directly target the root cause of the problem by preventing mold growth in the first place. This can significantly reduce the risk of mycotoxin production in stored feed. Additionally, acidifiers create an unfavorable environment for mold and bacteria, further enhancing feed preservation. These strategies, along with other feed preservatives, contribute to improved shelf life and overall feed quality, ultimately benefiting livestock health and profitability. it is important to acknowledge that these alternative approaches might not be a complete solution. Mold inhibitors and preservatives, while effective, may not eliminate the risk of mycotoxin contamination, especially if the contamination occurred before storage.

Feed Mycotoxin Detoxifiers Market Opportunity

-

Increasing demand for feed mycotoxin detoxifiers from the poultry and aquafeed sectors.

The rise of large-scale, intensive farming practices has created a significant growth engine for the feed mycotoxin detoxifier market, particularly within the poultry and aquaculture sectors. These sectors rely heavily on feedlots, confined environments where animals are raised at high densities. This intensive approach, while efficient, creates ideal conditions for mold growth and subsequent mycotoxin contamination in feed. This challenge presents a significant growth opportunity for the feed mycotoxin detoxifiers market. As the demand for poultry meat continues to soar globally, driven by factors like population increase and rising disposable incomes, ensuring the health and safety of these birds becomes paramount. Consumers across regions and income levels are increasingly turning to poultry as a source of protein, further fueling the growth trajectory of this sector.

Feed Mycotoxin Detoxifiers Market Segmentation Analysis

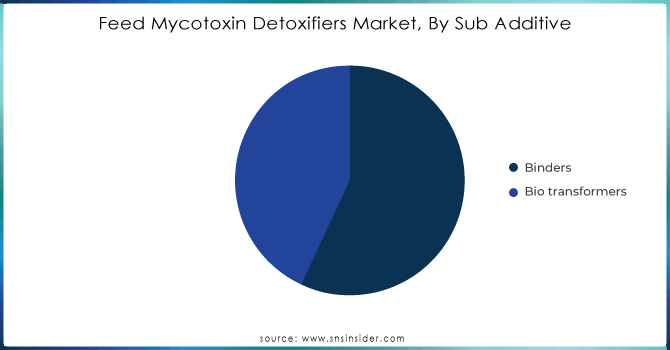

By Sub Additive

The binders held the largest market share around 68% in the market in 2023. The binders have emerged as a critical tool in modern animal feed management. Their popularity stems from a compelling combination of efficacy and affordability. These binders function as a protective shield within the animal's digestive tract, effectively preventing harmful mycotoxins from entering the bloodstream. This intervention plays a vital role in safeguarding livestock health by mitigating the risk of mycotoxin-induced neurological disorders. These disorders, if left unchecked, can manifest in a range of debilitating symptoms, including tremors, seizures, and even death in severe cases. By binding to mycotoxins within the digestive system, binders prevent their absorption, thereby safeguarding animal health and well-being.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Animal Type

The poultry segment held the largest market share around 32% in 2023. Poultry farming takes less space, time, and investment to rear than any other livestock giving a reason for farmers to choose poultry farms. Moreover, poultry meat is a rich source of protein available at lower prices which makes it attractive to health-professional consumers contributing to the growth of the market. The production of poultry reached more than 40 percent of the global meat, driven largely by increasing consumption of chicken and eggs, a recent report released by Food and Agriculture Organization (FAO) has revealed. Supportive government policies and advancements in poultry farming have reinforced this segment leading the market.

Feed Mycotoxin Detoxifiers Market Regional Analysis

Asia-Pacific region dominated the feed mycotoxin detoxifiers market in 2023, and held a 35% market share. This dominance can be attributed to two key factors, high feed production and a vast animal population within the region. These factors create a significant demand for mycotoxin mitigation strategies. Moreover, due to rapid population growth, increasing urbanization, and rising disposable incomes. These factors have led to a surge in demand for affordable protein sources like poultry meat and eggs. Countries like China, India, and Indonesia are major contributors, with large-scale investments in poultry farming and feed production to meet growing domestic consumption. According to the Food and Agriculture Organization (FAO), Asia-Pacific accounted for over 40% of global poultry production in 2022. Additionally, supportive government policies, such as subsidies and modernization programs, have accelerated the expansion of the poultry industry in the region.

Key Players

-

Cargill (Promote)

-

BASF (Mycofix)

-

ADM (Synergize Detox)

-

Bayer (MycoGuard)

-

Perstorp (ProSid MI 700)

-

Chr. Hansen (BioPlus)

-

Kemin (TOXFIN)

-

Nutreco (Selko Toxo)

-

Adisseo (Microvit)

-

Alltech (Mycosorb A+)

-

Novus International (Solis)

-

Biomin (Mycofix Plus)

-

Impextraco (Elitox)

-

Norel (Nor-Guard)

-

Global Nutritech (NutriTox)

-

Olmix (MT.X+)

-

Anpario (Neutox)

-

Evonik (GutCare)

-

Orffa (Excential Toxin Plus)

-

Neovia (Secur-Atox)

Key Users

-

JBS S.A.

-

CP Foods

-

WH Group

-

BRF S.A.

-

New Hope Group

-

Smithfield Foods

-

Vion Food Group

-

Perdue Farms

-

NongHyup Feed

Recent Development:

-

In February 2024, Cargill's analyzed over 350,000 samples from feed plants, farms, and storage locations, equips them with crucial data to make informed decisions about using additives to mitigate these risks.

-

In May 2024, Bayer has partnered with G+FLAS, a South Korean biotech company. Together, they'll use gene editing to develop vitamin D3-enriched tomatoes. This is a big deal, as vitamin D deficiency affects millions globally, especially in regions with limited winter sun.

-

In March 2024, Cargill captured over 15,000 tonnes of CO2 equivalents in 2023 through regenerative agriculture practices. This marks a significant increase from the 1,000 tonnes captured the prior year.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.6 Billion |

| Market Size by 2032 | USD 3.8 Billion |

| CAGR | CAGR of 4.2% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Sub Additive (Binders, Biotransformers) • By Animal Type (Aquaculture, Poultry, Ruminants, Swine) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Impextraco, Bayer, ADM, Cargill, BASF, Perstorp, Kemin, Biomin, Norel, Nutreco, Adisseo, Chr. Hansen, Global Nutritech, Alltech, Novus International, and Other Players. |