Motor Insurance Market Report Scope & Overview:

To get more information on Motor Insurance Market - Request Free Sample Report

The Motor Insurance Market was valued at USD 858.26 billion in 2023 and is expected to reach USD 1470.72 billion by 2032, growing at a CAGR of 6.23% from 2024-2032.

The motor insurance market has seen substantial growth, fueled by factors like the increasing number of vehicles on the road, government regulations, and a greater awareness of the importance of financial protection. In the United States, for instance, at the end of 2022, more than 285 million vehicles were registered, symbolizing a greater insurance demand because of increased reliance on cars as daily vehicles. These gains in vehicle numbers have been further enhanced by technological advancements like telematics, enabling insurers to offer personalized, usage-based policies. Increased competition on price and customer service through online platforms for comparing and purchasing insurance has also boosted market participation. In fact, in 2022, the average American paid $1,759 for insurance, reflecting a 15% rise from the previous year, reflecting the growing costs tied to vehicle ownership and coverage.

The demand for motor insurance is because of the increasing need for comprehensive coverage with rising cases of road accidents, traffic cases, and increased cases of vehicle thefts. In 2022, there were 42,514 fatal car accidents on U.S. roadway surfaces, thus calling for more comprehensive coverage. As of 2023, the District of Columbia is declared to have had the largest rate of motor vehicle theft in the United States, with as many as 1,070.9 cases per 100,000 inhabitants, making theft protection even more necessary. As the number of cars also increases, the consumer's demand grows for more customized policies, like third-party liability, theft, and comprehensive coverage. With more and more cars on the road, insurance providers are now offering customized policies that mitigate certain specific risks drivers may encounter so they are better guarded against both accidents and thefts.

In terms of future opportunities, the motor insurance market is poised for further growth with the rise of autonomous vehicles and connected car technology. This particularly opens up opportunities for the innovation of various products by insurers, such as usage-based insurance and automated claims processing. Increasing consumer demand for flexible, on-demand insurance will also spur the industry into offering more customized coverage plans with dynamic pricing models. But all growth comes with challenges, including regulatory issues and the need for insurers to adjust to new technologies while maintaining customer trust and satisfaction.

MARKET DYNAMICS

DRIVERS

-

The Impact of Telematics and Usage-Based Insurance (UBI) on the Motor Insurance Market

Telematics and Usage-Based Insurance (UBI) is revolutionizing the motor insurance landscape, enabling insurers to offer far more personalized and dynamic pricing models. As this development in telematics technology has enabled the real-time tracking of driver behavior, insurers can further initiate premiums based on actual usage, leading to greater customer satisfaction and trust. These customized policies, where customers can receive value-driven, flexible solutions, also fall in alignment with growing consumer demand. Telematics-driven UBI also supports the effort to mitigate risks, hence reducing claims costs for insurers. As a result, this innovation not only boosts market competitiveness but also creates significant growth opportunities, especially in attracting tech-savvy and price-conscious customers.

-

The Role of Regulatory Requirements in Shaping the Motor Insurance Market

Regulatory requirements can effectively influence motor insurance demand because most areas of the world require coverage for car owners. Regulatory needs ensure that accident circumstances protect drivers in the financial aspects, leading to stability and predictability of the insurance market. As governments continue to enforce the needs, stricter standards are introduced, and the market enjoys constant demand with limited choice from the buyers' end. This mandatory nature of coverage also provides a solid ground for insurers, given that it guarantees some level of revenue. As a result, the regulatory environment not only facilitates market growth but also creates space for insurers to innovate with policies that converge with the changing legal framework.

RESTRAINTS

-

Impact of Rising Fraud and Increasing Claims Costs on the Motor Insurance Market

The increasing fraudulent claims problem and increasing cost of automobile accidents, repair, and medical treatment represent some of the main restrictions of the motor insurance market. Insurers have a major problem detecting fraud as these people have also improved their fraudulent methods. Inflation in claims has thus resulted. At the same time, repair and medical costs keep rising with inflation and new technologies in vehicles. These push insurers to raise their premiums; however, regulatory restrictions restrict their ability to do so. The two factors mentioned above will likely slow down the growth of the market, increase operational costs, and limit profitability for insurers.

SEGMENT ANALYSIS

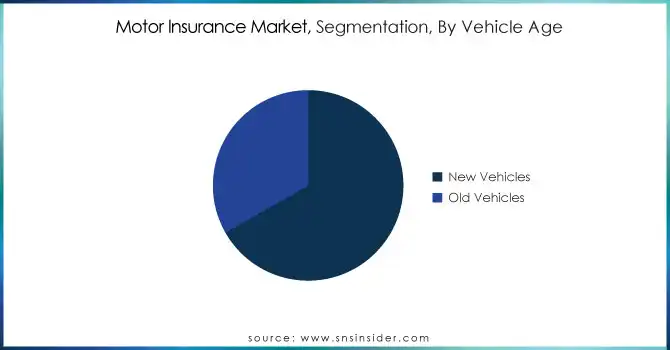

BY VEHICLE AGE

New Vehicles segment dominated the Motor Insurance Market with the highest revenue share of about 67% in 2023. This is because most consumers are highly demanding about the latest models, which are usually replete with advanced safety and technology features. These types of vehicles usually require high coverage options, thus more premium payouts and a high revenue yield for the insurance companies.

The old Vehicles segment is expected to grow at the fastest CAGR of about 7.36% from 2024-2032, mainly due to the growth in the number of aging cars on the road; consumers are holding onto them for longer periods because it makes economic sense. Because of this, insurers provide specific coverage for older vehicles, which increases the attraction and market size of that segment.

BY APPLICATION

The Personal Vehicle segment dominated the Motor Insurance Market with the highest revenue share of about 71% in 2023. This dominance is largely driven by the high volume of individual car ownership globally, with consumers seeking comprehensive coverage for personal use. Additionally, the increasing number of new drivers and vehicles entering the market contributes to sustained demand for personal vehicle insurance.

Commercial Vehicle segment is expected to grow at the highest CAGR of about 7.15% from 2024-2032. This growth is fueled by the expanding global logistics and e-commerce sectors, which rely heavily on commercial vehicles for transportation. As businesses continue to invest in fleets and delivery vehicles, the need for specialized commercial vehicle insurance coverage is expected to rise, driving the segment's rapid expansion.

BY COVERAGE

Liability Coverage segment dominated the Motor Insurance Market with the highest revenue share of about 43% in 2023. This dominance stems from its mandatory nature in most regions, ensuring that drivers meet legal requirements to cover damages or injuries caused by third parties. Its widespread adoption makes it an essential policy, consistently driving significant revenue for insurers.

The Comprehensive Insurance segment is expected to grow at the fastest CAGR of about 8.14% from 2024-2032. This growth is fueled by rising consumer demand for broader coverage, protecting against theft, natural disasters, and other non-collision incidents. As vehicle values increase, consumers prioritize comprehensive protection, driving its rapid adoption.

BY DISTRIBUTION CHANNEL

The Insurance Agents/Brokers segment dominated the Motor Insurance Market with the highest revenue share of about 46% in 2023. The long-established trust consumers drive this dominant place in agents and brokers for personalized service, expert advice, and tailored policy recommendations. Their ability to navigate complex insurance options and provide face-to-face interactions continues to be a key factor in retaining a significant market share.

The Direct Response segment is expected to grow at the highest CAGR of about 8.30% from 2024-2032. This growth is largely attributed to the increasing consumer preference for online and self-service insurance solutions, which offer convenience and competitive pricing. The rise of digital platforms and the ability to instantly compare and purchase policies without intermediaries is expected to drive this segment’s expansion, appealing to tech-savvy consumers seeking efficiency.

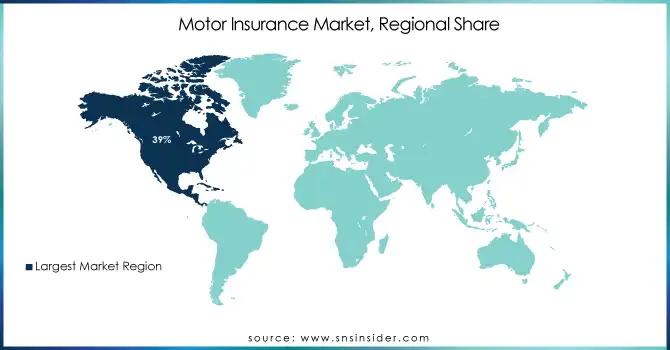

REGIONAL ANALYSIS

North America dominated the motor insurance market in 2023, holding a 39% revenue share. This dominance is attributed to the high vehicle ownership rate, robust regulatory environment, and a well-established insurance infrastructure. Additionally, the demand for comprehensive coverage and the region's relatively high premium rates contribute significantly to North America's leading position in the global market.

The Asia Pacific region is expected to grow at the fastest CAGR of 8.10% from 2024 to 2032. This growth is driven by rapid urbanization, increasing disposable income, and rising vehicle ownership in countries like China and India. As more consumers in this region seek insurance solutions, coupled with improvements in digital insurance platforms, Asia Pacific is poised to become a major driver of global motor insurance market expansion.

RECENT NEWS-

- In 2024, rising car insurance premiums have led to a drop in shares for Admiral and Direct Line, with the UK Labour Party launching a task force to address the issue.

- In Q1 2024, GEICO, a subsidiary of Berkshire Hathaway, experienced a 7.3% growth in written premiums, largely driven by rate hikes and increased average premiums in the motor insurance market.

KEY PLAYERS

-

Berkshire Hathaway, Inc. (Auto Insurance, Liability Coverage)

-

Tokio Marine Holdings, Inc. (Personal Auto Insurance, Commercial Vehicle Insurance)

-

People’s Insurance Company of China (Vehicle Insurance, Third-Party Liability Insurance)

-

State Farm Mutual Automobile Insurance (Auto Insurance, Comprehensive Coverage)

-

Ping An Insurance (Group) Company of China, Ltd. (Car Insurance, Personal Liability Insurance)

-

Allstate Insurance Company (Auto Insurance, Collision Coverage)

-

Admiral (Car Insurance, Multicar Insurance)

-

China Pacific Insurance Co. (Motor Vehicle Insurance, Third-Party Liability)

-

GEICO (Auto Insurance, Liability Insurance)

-

Allianz (Car Insurance, Commercial Vehicle Insurance)

-

American International Group Inc. (Auto Insurance, Personal Liability Coverage)

-

Assicurazioni Generali S.p.A. (Car Insurance, Comprehensive Coverage)

-

AXA Cooperative Insurance Company (Gulf Insurance Company K.S.C.) (Auto Insurance, Liability Insurance)

-

Bajaj Allianz General Insurance Company Limited (Car Insurance, Personal Coverage)

-

Reliance General Insurance Company Limited (Reliance Capital Limited) (Car Insurance, Liability Coverage)

-

The Hanover Insurance Group Inc. (Opus Investment Management) (Auto Insurance, Commercial Vehicle Coverage)

-

The Progressive Corporation (Auto Insurance, Liability Insurance)

-

Universal Sompo General Insurance Company Limited (Car Insurance, Third-Party Liability)

-

Zurich Insurance Group Ltd. (Motor Insurance, Collision Coverage)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 858.26 Billion |

| Market Size by 2032 | USD 1470.72 Billion |

| CAGR | CAGR of 6.23% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Coverage (Liability Coverage, Collision Coverage, Comprehensive Insurance, Others) • By Distribution Channel (Insurance Agents/Brokers, Direct Response, Banks, Others) • By Vehicle Age (New Vehicles, Old Vehicles) • By Application (Commercial Vehicle, Personal Vehicle) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Berkshire Hathaway, Inc., Tokio Marine Holdings, Inc., People’s Insurance Company of China, State Farm Mutual Automobile Insurance, Ping An Insurance (Group) Company of China, Ltd., Allstate Insurance Company, Admiral, China Pacific Insurance Co., GEICO, Allianz, American International Group Inc., Assicurazioni Generali S.p.A., AXA Cooperative Insurance Company (Gulf Insurance Company K.S.C.), Bajaj Allianz General Insurance Company Limited, Reliance General Insurance Company Limited (Reliance Capital Limited), The Hanover Insurance Group Inc. (Opus Investment Management), The Progressive Corporation, Universal Sompo General Insurance Company Limited, Zurich Insurance Group Ltd. |

| Key Drivers | • The Impact of Telematics and Usage-Based Insurance (UBI) on the Motor Insurance Market • The Role of Regulatory Requirements in Shaping the Motor Insurance Market |

| RESTRAINTS | • Impact of Rising Fraud and Increasing Claims Costs on the Motor Insurance Market |