Motor Testing Equipment Market Report Scope & Overview:

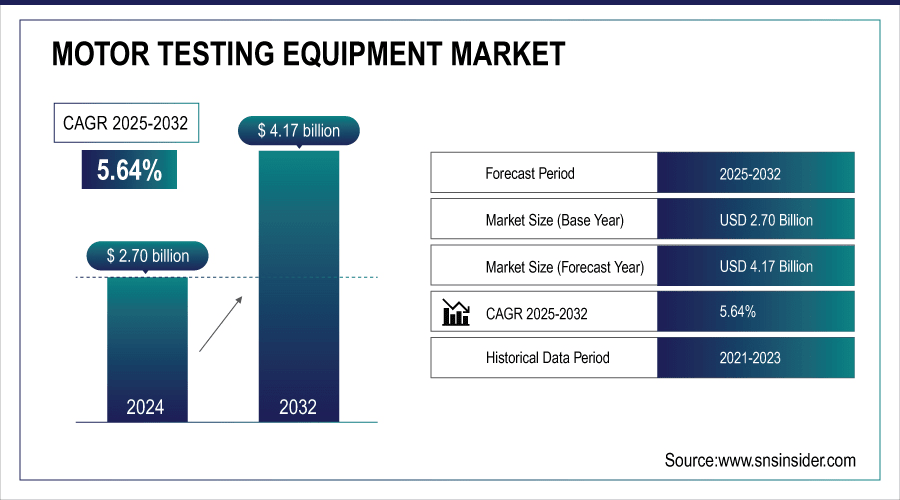

The Motor Testing Equipment Market size was valued at USD 2.70 Billion in 2024 and is projected to reach USD 4.17 Billion by 2032, growing at a CAGR of 5.64% during 2025-2032.

The Motor Testing Equipment Market is expanding due to rising adoption of electric and hybrid vehicles, industrial automation, demand for high-efficiency motors and the requirement for predictive maintenance and operational efficiency in various industries such as manufacturing, energy, transportation etc. Also, hot-in testing systems for IoT applications, AI-based analytics and cloud-enabled monitoring solutions are strengthening and expanding the market by adding accuracy, reliability, and efficiency in the way motors are performance-tested.

Over 70% of manufacturing facilities are investing in motor-driven systems, necessitating regular testing and maintenance.

To Get More Information On Motor Testing Equipment Market - Request Free Sample Report

Motor Testing Equipment Market Trends

-

Demand for high resolution motor testing solutions is also getting propelled on the back of growing acceptance of the electric and hybrid vehicles.

-

AI and IoT powered motor testing tools facilitate predictive maintenance, live monitoring and less downtime.

-

Increasing implementations of smart manufacturing initiatives and industrial automation is driving market growth for motor testing.

-

The increasing R&D and demand for rigorous testing in electric motors and industrial equipment are augmenting the requirement for high-precision test equipment.

-

Emerging markets penetration provides opportunities for product innovation, tailor made solution and expanding market.

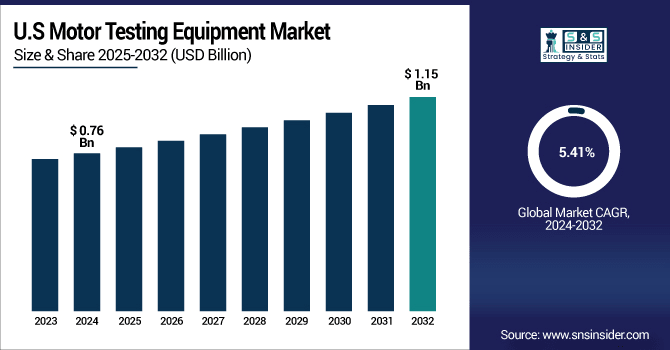

The U.S. Motor Testing Equipment Market size was valued at USD 0.76 Billion in 2024 and is projected to reach USD 1.15 Billion by 2032, growing at a CAGR of 5.41% during 2025-2032. Motor Testing Equipment Market growth is driven by rising industrial automation and smart manufacturing projects are elevating the need for accurate and live motor testing technology. The growth of renewable energy jobs is also driving demand for high-performance motors and the testing equipment that accompanies them. Device makers are making significant investment in IoT-connected and AI-powered testing systems to enhance motor performance and minimize downtime.

Predictive maintenance techniques are becoming more and more widespread, to reduce operational breakdowns and prolong motor lifetime. Further growth for testing equipment is being generated by growth in automotive and industrial sectors.

Motor Testing Equipment Market Segment Analysis

-

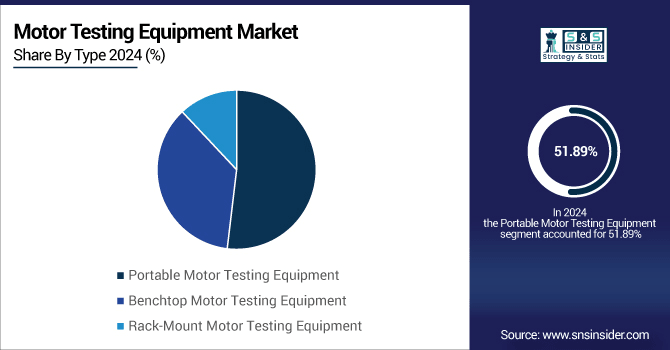

By type, Portable Motor Testing Equipment led the market with approximately 51.89% share in 2024, while Benchtop Motor Testing Equipment is the fastest-growing segment, projected to grow at a CAGR of 6.04%.

-

By service, Calibration Services dominated the market with around 58.33% share in 2024, whereas Repair Services are the fastest-growing, expected to grow at a CAGR of 6.04%.

-

By application, Maintenance led the market with approximately 53.42% share in 2024, while Design Verification is the fastest-growing segment, with a projected CAGR of 5.93%.

-

By test type, Performance Testing held the largest share at about 54.67% in 2024, whereas End-of-Line Testing is the fastest-growing segment, projected to grow at a CAGR of 5.96%.

By Type, Portable Motor Testing Equipment Leads Market While Benchtop Motor Testing Equipment Registers Fastest Growth

In 2024, based on type, Portable Motor Testing Equipment dominates the market due to its flexibility and ease of use and is also preferred for on-site testing. It permits technicians to make speedy diagnostics, without complicated data setups. On the other hand, the Benchtop Motor Testing Equipment market is expected to clock the highest growth rate on the back of growing demand for testing which has high accuracy in the controlled laboratory atmosphere.

By Service, Calibration Services Dominate While Repair Services Shows Rapid Growth

By service Calibration Services are leading the market as it maintains the accuracy, reliability, and compliance of motor testing equipment in various industries. In the meantime, the Services category is growing quickly, as more plants embrace preventive and predictive maintenance programs. Increasing requirement to reduce downtimes and increase the life of motors will support repair market.

By Application, Maintenance Lead While Design Verification Registers Fastest Growth

On the basis of application, Maintenance dominates the market in terms of market size as it is critical to maintain the reliability, efficiency, and longevity of a motor in industries. Regular maintenance is more cost effective than sudden failure and down time. Design Verification, on the other hand, is clocking the highest CAGR, on account of burgeoning need to confirm motor performance in product design and prototyping phases.

By Test Type, Performance Testing Lead While End-of-Line Testing Grow Fastest

In 2024, On the basis of testing type, Performance Testing dominates the market since it is essential to verify motor efficiency, output and operational reliability in different applications. It results in motors that are compliant with the industry and function optimally under any number of conditions. In the meantime, End-of-Line Testing represents the fastest growing segment7, as demand for quality assurance in final production grows.

Motor Testing Equipment Market Growth Drivers:

-

Growing Adoption of Electric Motors, Industrial Automation, and AI-Enabled Testing Systems Worldwide.

Growing penetration of electric and hybrid vehicles which requires accurate motor testing is the key factor fueling the market growth. Demand for precise, real-time testing solutions is increasing with growth in industrial automation and smart manufacturing projects. Testing systems with AI and IoT that are essential for the optimization of motor-system environment, contribute to the reduction of downtime and predictive maintenance. Growing usage in application industries such as renewable energy and industrial machinery is also driving the market growth.

Over 55% of new motor testing systems installed in 2023 were IoT-connected, enabling remote monitoring and cloud-based diagnostics.

Motor Testing Equipment Market Restraints:

-

High Initial Investment Costs and Complex Maintenance Requirements Limit Market Expansion

The high price of sophisticated motors testing instruments and equipment along with the installation is a major factor acting as a barrier to the market. Efficient operation requires complex calibration and maintenance and skilled personnel, which adds to operating costs. High-end solutions can be limited by budget for SMEs. Also, complexity in combining IoT- based or AI-powered systems could also limit the pace of IoT penetration.

Motor Testing Equipment Market Opportunities:

-

Rising Demand for Compact, Portable, and IoT-Enabled Motor Testing Equipment

The Motor Testing Equipment Market is growing number of IoT-based operating systems, the real time monitoring and predictive analysis is possible. Increasing R&D activities in electric motors, automotive, and industrial machinery is fueling the demand for advanced testing solutions. Penetrating the emerging markets offers prospects for product innovation and tailored solutions.

Benchtop motor testers account for ~35% of total testing equipment sales in R&D labs and small-to-medium manufacturers due to their precision and compact design.

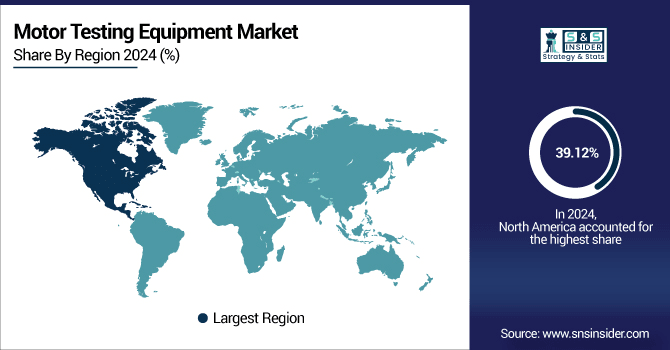

North America Motor Testing Equipment Market Insights

In 2024 North America dominated the Motor Testing Equipment Market and accounted for 39.12% of revenue share, this leadership is due to increasing motor efficiency, reduction in downtimes through predictive and preventive maintenance programs, and growing demand for the accuracy of testing equipment. The dominance of the region is further attributed to the presence of prominent market players, developed manufacturing facilities, and stringent quality and safety standards.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Asia-pacific Motor Testing Equipment Market Insights

Asia-pacific is expected to witness the fastest growth in the Motor Testing Equipment Market over 2025-2032, with a projected CAGR of 6.18% due to rapid industrialization, increasing automotive production, and the rising consumption of electric and hybrid vehicles. Growing manufacturing sector in countries such as India, China, and Japan is anticipated to augment the growth of motor testing market. Moreover, increasing investments in smart factories, automation, and renewable energy projects have been increasing the demand for high-end testing equipment.

Europe Motor Testing Equipment Market Insights

In 2024, Europe emerged as a promising region in the Motor Testing Equipment Market, due to presence of developed automotive and industrial sectors, stringent government regulations, and high adoption of hybrid and electric vehicles. Huge investment on industrial automation, smart factory, and renewable energy projects are expected to generate need for advance motor testing systems. Moreover, robust R&D capabilities, and government initiatives to stimulate energy efficiency and sustainability drive the market growth.

Latin America (LATAM) and Middle East & Africa (MEA) Motor Testing Equipment Market Insights

The Motor Testing Equipment Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions, due to slow pace of industrialization, growing popularity of electric and hybrid vehicles, and a rise in the investments in the energy and manufacturing sectors. Increasing awareness regarding predictive maintenance and operational efficiency is expected to drive the demand for motor testing. Moreover, the efforts taken by various governments in modernizing infrastructure, and surge in adoption of industrial automation have expanded the market growth.

Motor Testing Equipment Market Competitive Landscape:

AVL List GmbH, the leading company in the Motor Testing Equipment Market operates across the world with its solutions for engine and motor testing such as dynamometers, test benches, and emission measurement systems. The company provides high-accuracy performance testing, durability testing and calibration for the automotive, industrial, and renewable energy industries. AVL's technologies combine IoT, real-time data analytics and automation to enhance motor performance and minimize operational downtime.

-

In March 2025, AVL List GmbH launched a high-performance test bench system for electric vehicle powertrains, incorporating real-time simulation, regenerative load management, and multi-voltage support to address the evolving requirements of next-generation EVs.

Horiba Ltd. is a leader in the motors test instrumentation market, providing a complete offering for electric and IC engines. The TITAN eDrive platform is developed for maximized high-speed durability and functionality testing of e-motors. The TITAN eDrive test systems have battery simulation with a complete modular test bed concept simplified by a wide range customization.

-

In March 2025, Horiba launched the C05-LT 100W PEM benchtop fuel cell test station, delivering best-in-class performance for research and innovation in fuel cell technology. These advancements underscore Horiba's commitment to providing innovative and reliable motor testing equipment worldwide.

Bosch Automotive Service Solutions is a major supplier of motor testing equipment, with a full line of products including diagnostic and testing tools for the automotive shop. They offer also the high-end test stands DCI 200 and EPS 708 for all applications requiring accurate testing of Common Rail injectors and pumps for diesel applications. These test benches have user-oriented set-ups, user-friendly operation, online-updates for keeping up with the current test standards.

-

In April 2025, Bosch Automotive Service Solutions launched an advanced ADAS calibration and diagnostic platform, equipped with AI-driven fault detection and cloud connectivity. This next-generation system aims to streamline workshop operations, improve diagnostic accuracy, and minimize vehicle service downtime, enhancing overall efficiency in automotive maintenance.

Siemens AG is a dominant Motor Testing Equipment Market player, delivering cutting-edge solutions for performance and quality assessment of motors in varied industries. They feature solutions such as Simcenter Anovis for end-of-line testing, eMpulse test systems for high-accuracy electro-servo testing, and SINAMICS S120 drives for precise motor performance evaluation. Siemens' offerings deliver performance monitoring, automation and motor-control technology to improve operating efficiency and safety.

-

In April 2025, Siemens AG completed the acquisition of ebm-papst's industrial drive technology business, which will now operate under the name "Mechatronic Systems" within Siemens. This strategic move enhances Siemens' portfolio with intelligent, integrated mechatronic systems, including innovative drive solutions for applications such as free-moving, driverless transport systems. The acquisition adds approximately 650 employees to Siemens, expanding its capabilities in the industrial automation sector.

Motor Testing Equipment Market Key Players

Some of the Motor Testing Equipment Market Companies are:

-

AVL List GmbH

-

Horiba Ltd.

-

Bosch Automotive Service Solutions

-

General Electric

-

ABB Ltd.

-

Siemens AG

-

Emerson Electric Co.

-

Honeywell International Inc.

-

Schneider Electric

-

Rockwell Automation

-

Chauvin Arnoux

-

HIOKI E.E. Corporation

-

Doble Engineering Company

-

OMICRON electronics GmbH

-

Schenck Process Holding GmbH

-

SKF Group

-

Magtrol Inc.

-

Extech Instruments

-

Ametek Inc.

-

Yokogawa Electric Corporation

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 2.70 Billion |

| Market Size by 2032 | USD 4.17 Billion |

| CAGR | CAGR of 5.64% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Portable Motor Testing Equipment, Benchtop Motor Testing Equipment, and Rack-Mount Motor Testing Equipment), • By Service (Calibration Services, Repair Services, Others) • By Application (Design Verification, Maintenance, and Others) • By Test Type (Performance Testing, End-of-Line Testing, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | General Electric, ABB Ltd., Siemens AG, Emerson Electric Co., Honeywell International Inc., Schneider Electric, Rockwell Automation, AVL List GmbH, Horiba Ltd., Bosch Automotive Service Solutions, Chauvin Arnoux, HIOKI E.E. Corporation, Doble Engineering Company, OMICRON electronics GmbH, Schenck Process Holding GmbH, SKF Group, Magtrol Inc., Extech Instruments, Ametek Inc., Yokogawa Electric Corporation |