Instrument Transformer Market Size & Growth:

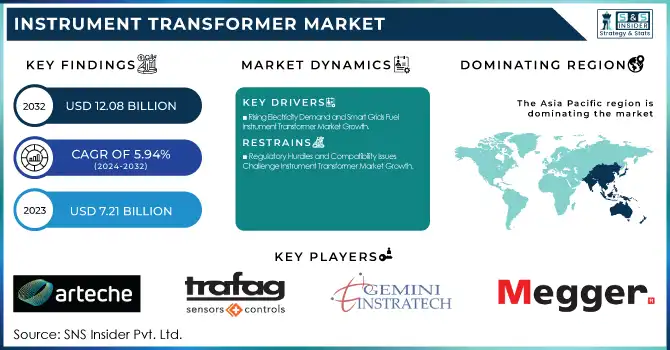

The Instrument Transformer Market Size was valued at USD 7.21 Billion in 2023 and is expected to reach USD 12.08 Billion by 2032 and grow at a CAGR of 5.94% over the forecast period 2024-2032. The demand for specific application areas of the instrument transformer market, such as switchgear assemblies, metering, and protection systems, is expected to grow since they are useful for precise monitoring and control.

To get more information on Instrument Transformer Market - Request Free Sample Report

The grid is gaining improved reliability aided by rapid technology adoption, including digital and smart transformers, which provide the foundation for better real-time data analytics. To increase operational efficiencies, manufacturers have concentrated on optimal production processes and supply chains. In addition, companies are using competitive advantage metrics the research establishes this as technological differentiation, brand loyalty, and strategic partnerships that help the companies capture a strong market position in this saturated market and cater to the market's evolving need for utilities and industrial end-users.

Instrument Transformer Market Dynamics

Key Drivers:

-

Rising Electricity Demand and Smart Grids Fuel Instrument Transformer Market Growth

With an increase in demand for electricity, there is a need for expansion of existing power grids, thus driving the growth of the instrument transformer market. Moreover, investments in renewable energy sources, such as wind and solar power need reliable transmission and distribution infrastructure, which is another factor augmenting the growth of the global instrument transformers market. Moreover, the growing demand for grid safety and stability, combined with the need for strict regulatory guidelines for electrical equipment, is accelerating the uptake of high-precision and dependable instrument transformers. The growth of smart grids and digital substations, which involve the measurement and control of electrical parameters precisely, is also expected to boost the growth of the market.

Restrain:

-

Regulatory Hurdles and Compatibility Issues Challenge Instrument Transformer Market Growth

Another factor acting as a challenge for the instrument transformer market is the long period taken for the standardization and certification process making it a long reddish process. The extensive regulatory approval process, driven by strict safety and performance standards, can delay product approvals and market entry. Moreover, the use of established digital technologies integrated with classical power systems faces compatibility issues which enforce limited proliferation of smart instrument transformers. Market growth is also hampered by limited awareness and technical expertise relating to new digital solutions, especially in developing regions. Restrictions on the usage of SF6 gas in some instrument transformers due to environmental concerns are also restraining the development of the market as they have come under regulatory focus to curb greenhouse gas emissions.

Opportunity:

-

Urbanization and Smart Grid Adoption Drive Instrument Transformer Market Growth

Urbanization and industrialization, especially in developing economies, are key growth-driving factors for the instrument transformer market. The transition to transmission systems utilizing high voltage and ultra-high voltage transmission systems to minimize transmission losses offers new opportunities for measuring ultra-high voltage instrument transformers. In addition to this, increasing focus on energy efficiency and grid automation led to the rise in demand for technologically driven and advanced transformers. With the growing trend of utilities and industries digitalization and shift towards smart metering solutions, the communication and monitoring transformers segment is anticipated to grow at a rapid pace over the forecast period. Furthermore, suitable potential market expansion in the developed regions is provided by consequently changing of aging power infrastructure.

Challenges:

-

Rapid Tech Advances and Cybersecurity Risks Challenge Instrument Transformer Market

Technological advancement and fast innovation cycles pose challenges for the market as manufacturing companies need to invest continuously in R&D to stay up to date with the latest technology in the field. Maintaining high accuracy and reliability across different environmental and operational conditions is another challenge, particularly for applications in extreme and remote environments. Furthermore, end-user demand interacting with high voltage and ultra-high voltage transformers has complex installation and maintenance requirements, which remains a challenging task as it requires specialists and resources. Digital transformation accelerates the evolution of cybersecurity threats in digital substations and smart grids that risk data integrity and system reliability, creating a need for more advanced security solutions that increase the complexity of deployment in the substation and smart grid.

Instrument Transformer Market Segmentation Overview

By Type

The Current type of Instrument transformer accounted for the largest market share of 44.3% in 2023, owing to their wide usage for power measurement, protection, and control applications in the industrial and utility sectors. The precision with which it can monitor the current flow and its reliability was the key to its dominance.

The Combined type will witness the highest growth rate for forecast periods 2024–2032 because of its dual functionality to measure both current and voltage, making it more efficient and reducing overall installation costs. Some of the salient drivers supporting the fast growth of such transformers market include the growing demand for compact, multifunctional transformers.

By Dielectric Medium

Liquid dielectric medium accounted for a significant portion of the market share of 53.8% for instrument transformers in 2023. This is attributed to their superior insulation properties as well as cooling for high-voltage applications. It had a significant advantage in this technology, mainly due to its high reliability and low cost in power transmission and distribution systems.

The Solid dielectric medium is projected to record the highest CAGR between 2024 and 2032 owing to its eco-friendly properties, less maintenance, and expanding use in small-scale and interior setups. Its rapidly growing market is driven by the consumption preferences shift panting towards eco-friendly and sustainable solutions.

By Enclosure

The Outdoor enclosure type held the largest share of the instrument transformer market in 2023, at 60.1%, due to its widespread application in transmission and distribution networks operating at your scale of high voltage. This gave it the advantage due to durability and also exposure to harsh environmental conditions.

The Indoor category is anticipated to witness a significant increase in CAGR between 2024 and 2032, driven by the need for space-saving and secure electrical systems in urban environments and industrial photovoltaics. Its rapid market growth is also bolstered by the shift towards smart grids and digital substations.

By Voltage

High Voltage Transmission segment held the largest market share of 34.7% in 2023, attributed to its crucial role in long-distance, efficient power transmission. It played a leadership role due to its extensive use in grid expansion projects and the integration of renewable energy sources.

The Ultra-High Voltage Transmission segment is projected to be the fastest-growing segment at CAGR from 2024 to 2032, owing to the growing demand for transmission loss reduction and grid stability. The market growths are also further energized by rapidly increasing cities and cross-border power transmission projects.

By Application

The transformer & circuit breaker busing segment commanded the largest share of the instrument transformer market with a share of 39.7% in 2023, due to their critical function in facilitating the safe & effective flow of power substations & switchgear systems. The confidence in this type of insulator increased its dominance due to its extensive use in transmission and distribution networks.

The Primary Metering Units segment is anticipated to witness the strongest growth rate in the period from 2024 to 2032, attributable to the rising need for precision in energy measurement and billing services. The central role that smart grid technologies and digital substations can play only accelerates its expansion in this sector.

By End Use

The instrument transformer market was led by the Power Utilities segment with a large share of 48.7% in 2023, as they require reliable monitoring and protection of transmission and distribution networks. This was a vital tool for ensuring grid stability and optimal power flow that helped it gain the leadership position.

The Power Generation segment is anticipated to record the highest CAGR through 2024–2032 amid increasing use of renewable energy sources and increasing capacity expansions of power plants. Smart grid and digital substations are witnessing large-scale investments which in turn propels the Market growth swiftly.

Instrument Transformer Market Regional Analysis

Asia Pacific, the leading region of the instrument transformer market, held 38.5% of the revenue in 2023, due to rapid urbanization and industrial developments, and increasing energy needs in China, India, and Japan. The growing need for reliable power transmission and distribution systems due to major infrastructure projects, such as the Belt and Road Initiative for China & Smart Cities Mission for India, is expected to fuel the instrument transformers market growth in the coming years. Moreover, the widespread adoption of renewables, for instance, massive solar and wind farms in China and India, further boosts the requirement for high-voltage and ultra-high voltage transformers to facilitate efficient power transfer.

North America is projected to witness the highest CAGR during 2024-2032, due to the rising investments in smart grid technologies and grid modernization projects. Similarly in the US, programs such as the Grid Modernization Initiative (GMI) provide support to improve grid resilience and reliability which in turn, is gradually fuelling demand for these advanced instrument transformers. In addition, the increasing penetration of renewable energy and distributed energy resources is also pushing the demand for precise metering and protection. Meanwhile, in Canada, developing wind and hydropower projects are also driving the market. North America is fast-moving due to the digital substations and intelligent grid solutions drive.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key players

Some of the major players in the Instrument Transformer Market are:

-

Arteche Group (Current Transformers, Voltage Transformers)

-

Trafag AG (Pressure Transmitters, Gas Density Monitors)

-

Gemini Instratech Ltd. (Resin Cast Instrument Transformers, OIP Insulated Instrument Transformers)

-

Megger Group Limited (Insulation Testers, Time-Domain Reflectometers)

-

Transformers and Electricals Kerala Limited (TELK) (Power Transformers, Current Transformers)

-

China XD Group (High Voltage Switchgear, Power Transformers)

-

Siemens Energy (Gas-Insulated Switchgear, Instrument Transformers)

-

Hitachi Energy (Gas-Insulated Switchgear, Instrument Transformers)

-

GE Vernova (Power Transformers, Instrument Transformers)

-

ABB (Current Transformers, Voltage Transformers)

-

Schneider Electric (Protection Relays, Instrument Transformers)

-

Eaton Corporation (Current Transformers, Voltage Transformers)

-

CG Power and Industrial Solutions Limited (Power Transformers, Instrument Transformers)

-

Nissin Electric Co., Ltd. (Gas-Insulated Switchgear, Instrument Transformers)

-

Končar Group (Power Transformers, Instrument Transformers)

Recent Trends

-

In February 2024, Siemens Energy is investing USD 150 million to expand its Charlotte, NC facility, addressing the U.S. power transformer shortage and creating nearly 600 jobs. Production is set to begin by early 2026.

-

In February 2024, GE Vernova secured major orders from PGCIL to supply 765 kV shunt reactors, supporting India’s renewable energy integration and grid stability.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 7.21 Billion |

| Market Size by 2032 | USD 12.08 Billion |

| CAGR | CAGR of 5.94% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Current, Potential, Combined) • By Dielectric Medium (Liquid, SF6, Solid) • By Enclosure (Indoor, Outdoor) • By Voltage (Distribution Voltage, Sub-transmission Voltage, High Voltage Transmission, Extra High Voltage Transmission, Ultra-High Voltage Transmission) • By Application (Transformer & Circuit Breaker Busing, Switchgear Assemblies, Relaying, Metering & Protection, Primary Metering Units) • By End Use (Power Utilities, Power Generation, Railway & Metros, Industries & OEM) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Arteche Group, Trafag AG, Gemini Instratech Ltd., Megger Group Limited, Transformers and Electricals Kerala Limited (TELK), China XD Group, Siemens Energy, Hitachi Energy, GE Vernova, ABB, Schneider Electric, Eaton Corporation, CG Power and Industrial Solutions Limited, Nissin Electric Co., Ltd., Končar Group. |