Multiprotocol Storage Market Report Scope & Overview:

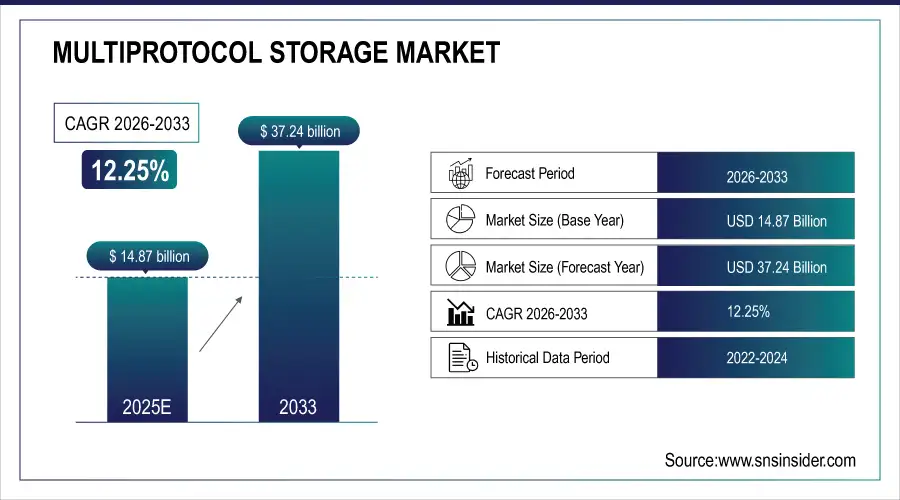

The Multiprotocol Storage Market was valued at USD 14.87 billion in 2025E and is expected to reach USD 37.24 billion by 2033, growing at a CAGR of 12.25% from 2026-2033.

The Multiprotocol Storage Market is experiencing strong growth driven by the rising need for flexible, scalable, and interoperable storage solutions that can seamlessly handle diverse data types and protocols. Increasing data volumes from cloud computing, AI, IoT, and big data analytics where 2.5 quintillion bytes of data are created daily, and 90% of the world's data has been generated in the last two years alone, according to the Telecommunications Industry Association are pushing enterprises to adopt multiprotocol systems for improved performance and compatibility.

Multiprotocol Storage Market Size and Forecast:

-

Market Size in 2025E: USD 14.87 Billion

-

Market Size by 2033: USD 37.24 Billion

-

CAGR: 12.25% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Multiprotocol Storage Market - Request Free Sample Report

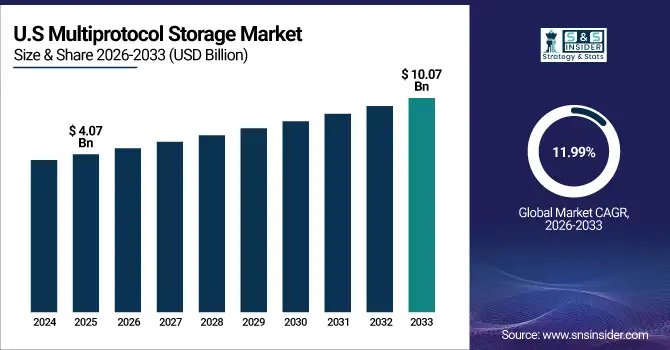

U.S. Multiprotocol Storage Market was valued at USD 4.07 billion in 2025 and is expected to reach USD 10.07 billion by 2033, growing at a CAGR of 11.99% from 2026-2033.

The U.S. Multiprotocol Storage Market growth is driven by increasing enterprise data, adoption of hybrid cloud solutions, demand for high-performance and scalable storage, and integration with AI, IoT, and big data applications to ensure efficient, secure, and flexible data management.

Multiprotocol Storage Market Drivers:

-

Accelerating adoption of hybrid cloud environments driving demand for unified multiprotocol storage platforms enabling seamless cross-platform data operations and performance

As organizations increasingly adopt hybrid cloud strategies, the ability to manage and move data efficiently across environments is critical. Multiprotocol storage systems provide unified access to data regardless of the protocol, enabling smoother integration between on-premises and cloud infrastructures. This reduces bottlenecks, improves interoperability, and ensures faster workload migration. By supporting various storage formats under one system, enterprises gain agility to adapt to changing IT demands. The shift toward workload distribution across multiple environments makes multiprotocol storage essential, as it streamlines operations, lowers latency, and enhances performance while keeping data governance and compliance intact.

-

The U.S. Department of Defense's Cloud Migration Primer emphasizes the importance of using multiple cloud providers and a hybrid approach to maintain flexibility and prevent vendor dependency.

-

Additionally, a report predicts that 90% of organizations will adopt a hybrid cloud approach by 2027, highlighting the increasing reliance on flexible cloud strategies

Multiprotocol Storage Market Restraints

-

Complexity of managing multiprotocol storage systems leading to increased operational challenges and potential for configuration errors impacting performance

Multiprotocol storage solutions, while versatile, introduce significant operational complexity due to the need to support multiple storage protocols concurrently. IT teams must manage diverse configurations, ensure compatibility, and maintain optimal performance across varying workloads. This complexity increases the likelihood of misconfigurations, security vulnerabilities, and performance degradation. Organizations without specialized expertise risk operational inefficiencies and higher maintenance costs. Moreover, troubleshooting issues in multiprotocol environments can be time-consuming, as root causes may span multiple systems. The added complexity may discourage some enterprises from adopting such solutions, particularly those lacking dedicated storage management teams or advanced automation tools.

Multiprotocol Storage Market Opportunities

-

Growing demand for AI, analytics, and big data applications requiring versatile multiprotocol storage architectures to handle diverse and complex data workloads

The rise of AI, big data analytics, and machine learning applications has created unprecedented demand for storage systems that can handle varied data formats. Multiprotocol storage enables seamless access to structured, semi-structured, and unstructured data, supporting different protocols without siloed infrastructure. This flexibility is crucial for organizations running analytics across multiple platforms and data sources. By eliminating protocol barriers, enterprises can accelerate insights, improve decision-making, and support real-time data processing. This opens new opportunities for solution providers to cater to emerging workloads, positioning multiprotocol storage as a key enabler of next-generation data-driven applications.

-

IBM's watsonx.data, combined with IBM Storage Scale, offers a scalable and cost-effective data and AI platform. This solution facilitates seamless data access and sharing, enabling enterprises to connect to data wherever it resides and extract actionable insights efficiently.

Multiprotocol Storage Market Challenges

-

Data security and compliance concerns in multiprotocol storage environments increasing risk management challenges for enterprises operating in regulated sectors

Multiprotocol storage environments, by supporting multiple protocols and access points, can expand the attack surface for cyber threats. Managing consistent security policies across protocols is challenging, especially for enterprises in highly regulated industries like finance, healthcare, or government. Variations in encryption standards, authentication mechanisms, and data handling practices can create compliance gaps. If not properly managed, these gaps increase the risk of data breaches, regulatory penalties, and reputational damage. Enterprises must invest in advanced security frameworks and continuous monitoring, but the additional cost and complexity can deter adoption, especially in organizations with limited cybersecurity expertise.

Multiprotocol Storage Market Segmentation Analysis:

By Enterprise Size, Large Enterprises Dominate, While SMEs Emerge as the Fastest-Growing Segment

Large enterprises accounted for the largest share due to their extensive storage requirements, complex data environments, and need for high-performance, scalable, and secure multiprotocol solutions. These organizations often operate across multiple regions, requiring seamless integration of diverse data formats and protocols. Their strong IT budgets enable investment in advanced infrastructure, driving adoption for hybrid and multi-cloud deployments, big data analytics, and mission-critical workloads that demand consistent availability and robust storage management capabilities.

Small and medium enterprises are expected to grow fastest as they increasingly adopt digital transformation strategies, cloud-based applications, and data-driven operations. The availability of cost-effective, flexible multiprotocol storage solutions is enabling SMEs to handle diverse workloads without heavy infrastructure investments. Enhanced scalability, ease of deployment, and improved accessibility through managed services are removing adoption barriers. Growing e-commerce, remote work models, and industry-specific applications are accelerating demand for such solutions among SMEs, fostering rapid market growth in this segment.

By Application, BFSI Leads the Market; Healthcare Set for Rapid Expansion

BFSI dominated due to its massive data volumes, stringent compliance requirements, and demand for secure, high-performance multiprotocol storage to support real-time transactions and analytics. Financial institutions rely on robust, scalable infrastructure to manage structured and unstructured data seamlessly, ensuring operational efficiency, fraud detection, and customer service optimization. The need to integrate legacy systems with modern platforms further drives BFSI’s investment in advanced storage architectures, making it the largest revenue contributor in the market.

Healthcare is projected to grow fastest as digital health records, medical imaging, and telehealth services expand rapidly, generating large and diverse datasets. Multiprotocol storage enables healthcare providers to store, access, and share data across various platforms while ensuring compliance with strict privacy regulations. The rising adoption of AI for diagnostics, predictive analytics, and patient care optimization further boosts demand for scalable, interoperable storage systems, positioning healthcare as a high-growth segment through 2032.

By Type, NAS Holds the Largest Share, While Computed Storage Registers Fastest Growth

Network attached storage dominated due to its cost-effectiveness, simplicity, and ability to support multiple protocols for diverse workloads. Its centralized management and easy scalability make it ideal for enterprises managing growing datasets across departments. NAS enables seamless file sharing, backup, and disaster recovery while integrating well with hybrid and cloud environments. Its reliability, lower complexity compared to SANs, and strong SMB adoption have cemented its leadership in multiprotocol storage deployments.

Computed storage is expected to grow fastest, driven by increasing demand for storage architectures that integrate compute capabilities for data-intensive applications like AI, analytics, and IoT. This convergence reduces latency, optimizes performance, and enables real-time data processing closer to the source. Businesses seeking higher efficiency, scalability, and automation are rapidly adopting computed storage for workloads requiring both high-speed access and advanced processing capabilities, fueling its strong CAGR over the forecast period.

By Deployment, Public Cloud Leads Deployment; Hybrid Cloud Poised for Strongest Growth

Public cloud leads due to its scalability, cost-effectiveness, and ability to support diverse protocols without heavy infrastructure investments. It allows businesses to quickly provision storage, integrate multiple workloads, and benefit from global accessibility. Enterprises leverage public cloud multiprotocol solutions for backup, disaster recovery, and big data analytics, supported by continuous innovations from hyperscalers. Its pay-as-you-go model and flexible service offerings have driven its dominance in the market.

Hybrid cloud is set to grow fastest as organizations seek to balance on-premises control with cloud scalability and cost efficiency. Multiprotocol storage in hybrid environments enables seamless data movement across platforms while maintaining compliance and security. It supports workload optimization by placing sensitive data on-premises and leveraging cloud for scalability. Increasing adoption of hybrid IT strategies and the need for flexible, interoperable storage solutions are accelerating growth in this segment.

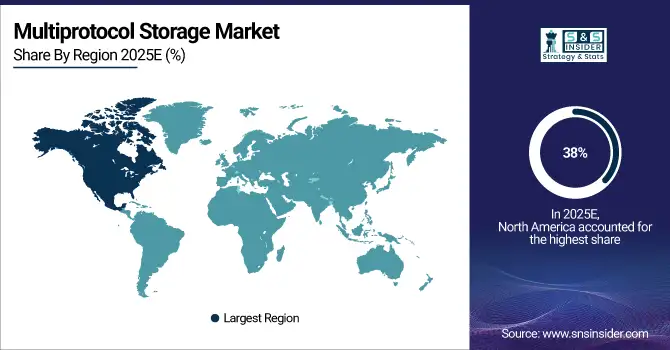

Multiprotocol Storage Market Regional Insights

North America Dominates the Multiprotocol Storage Market in 2025E

In 2025E, North America is estimated to command around 38% of the Multiprotocol Storage Market, driven by its advanced cloud ecosystem, dense concentration of hyperscale data centers, and strong enterprise demand for scalable, secure, and interoperable storage solutions. Continuous investment in hybrid and multi-cloud environments, combined with rapid AI and analytics adoption, fuels large-scale deployment of multiprotocol storage architectures across industries. This technological maturity solidifies North America as the leading region in market share and innovation.

Get Customized Report as per Your Business Requirement - Enquiry Now

United States: The Leading Country in North America

The United States dominates the region, supported by the world’s largest data-center footprint, high cloud adoption, and the presence of leading technology vendors specializing in unified and multiprotocol storage. U.S. enterprises invest heavily in digital modernization, AI workloads, and multi-cloud strategies, driving sustained demand. Regulatory compliance needs, strong cybersecurity focus, and rapid expansion of AI-enabled storage infrastructure further reinforce the country’s leadership in the North American multiprotocol storage landscape.

Asia Pacific Is the Fastest-Growing Region in the Multiprotocol Storage Market in 2025E

Asia Pacific is projected to grow at an estimated CAGR of 11.1% in 2025E, driven by rapid digital transformation, massive cloud adoption, and accelerated data-center expansion across emerging and developed economies. Growing investments in AI, 5G, IoT, and enterprise modernization significantly raise the need for flexible, scalable multiprotocol storage, making Asia Pacific the highest-growth region.

China: The Dominating Country in Asia Pacific

China leads the Asia Pacific market, supported by large-scale cloud infrastructure development, strong government digitalization initiatives, and rapid enterprise adoption of AI and big data analytics. The presence of major domestic cloud providers, strong manufacturing modernization, and expanding telecom networks further amplify demand for multiprotocol storage. China’s aggressive rollout of hyperscale data centers and increasing enterprise workloads firmly position it as the region’s primary growth engine.

Europe Multiprotocol Storage Market Insights, 2025

Europe held a meaningful share of the Multiprotocol Storage Market in 2025, supported by strong regulatory requirements, enterprise focus on data protection, and increased adoption of hybrid cloud architectures. Demand for secure, compliant, and interoperable storage solutions rose across industries such as manufacturing, BFSI, and healthcare. Strict data protection regulations increased enterprise compliance needs, which in turn accelerated Europe’s adoption of secure multiprotocol storage systems.

Germany: The Dominating Country in Europe

Germany leads Europe’s Multiprotocol Storage Market due to its advanced industrial base, rapid digital transformation initiatives, and heightened adoption of scalable storage for automation, IoT, and smart manufacturing. Its strong regulatory alignment, emphasis on data security, and investments in modernizing enterprise infrastructure further strengthen its leadership in the region.

Middle East & Africa and Latin America Multiprotocol Storage Market Insights, 2025

In 2025, the Middle East & Africa region experienced steady expansion in the multiprotocol storage market, driven by digital infrastructure upgrades, accelerating cloud adoption, and increased investment in smart city and telecom modernization projects. South Africa, the UAE, and Saudi Arabia led demand as enterprises embraced hybrid storage to support government digitization initiatives. Latin America also recorded notable growth, particularly in Brazil and Mexico, where expanding data centers, SME digitalization, and government-backed technology programs stimulated adoption of scalable, cost-efficient multiprotocol storage solutions across diverse industries.

Multiprotocol Storage Market Key Players:

-

IBM Corporation

-

Cisco Systems

-

NetApp

-

NTT Communications Corporation

-

Dell EMC (Dell)

-

Avere

-

Hewlett-Packard (HP)

-

Zadara Storage

-

EMC Corporation

-

Huawei Technologies

-

Hitachi Vantara

-

Pure Storage

-

Fujitsu Limited

-

Western Digital Corporation

-

Oracle Corporation

-

Infinidat

-

Quantum Corporation

-

DataDirect Networks (DDN)

-

Nutanix

-

Tintri

Competitive Landscape of the Multiprotocol Storage Market:

IBM Corporation

IBM Corporation is a U.S.-based global technology leader offering advanced hybrid-cloud, AI-driven, and enterprise infrastructure solutions, including multiprotocol storage systems designed for mission-critical workloads. The company specializes in software-defined storage, unified data management, and secure, scalable architectures that support block, file, and object protocols. IBM plays a vital role in the multiprotocol storage market by delivering high-performance, interoperable platforms that enhance data availability, streamline hybrid-cloud integration, and support enterprise digital transformation across regulated and data-intensive industries.

-

In 2025, IBM enhanced its multiprotocol storage portfolio with improved AI-driven data management and hybrid-cloud optimization features to support complex enterprise workloads.

Cisco Systems

Cisco Systems is a U.S.-based leader in networking, cloud infrastructure, and converged data-center solutions that integrate seamlessly with multiprotocol storage environments. The company focuses on delivering high-throughput, low-latency architectures through its servers, storage networking technologies, and hyperconverged infrastructure offerings. Cisco’s role in the multiprotocol storage market is significant, enabling enterprises to deploy unified, scalable, and secure infrastructures that support diverse workloads across on-premises and cloud ecosystems.

-

In 2025, Cisco introduced strengthened interoperability offerings for hybrid and multi-cloud storage environments, enhancing performance and simplifying storage-network operations.

NetApp

NetApp is a U.S.-based data management and storage solutions provider renowned for its ONTAP platform, which delivers robust multiprotocol support across file, block, and object storage. The company focuses on hybrid and multi-cloud optimization, enabling seamless data mobility, enhanced security, and unified management across distributed environments. NetApp’s role in the multiprotocol storage market is central, offering efficient, cloud-ready storage architectures that help enterprises modernize IT operations and support analytics, AI, and large-scale workloads.

-

In 2025, NetApp expanded its ONTAP and cloud data services with improved automation and advanced multiprotocol management capabilities for hybrid environments.

NTT Communications Corporation

NTT Communications Corporation is a Japan-based global infrastructure and managed-services provider offering integrated cloud, network, and multiprotocol storage solutions tailored to enterprise needs. Leveraging its extensive global data-center footprint, NTT delivers scalable, secure, and fully managed storage environments that support diverse access protocols for multinational operations. Its role in the multiprotocol storage market is crucial, helping enterprises simplify infrastructure management, meet compliance standards, and ensure high availability across distributed cloud and on-premises deployments.

-

In 2025, NTT expanded its managed multiprotocol storage services within its global data-center network to enhance enterprise cloud migration and data-governance initiatives.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 14.87 Billion |

| Market Size by 2033 | USD 37.24 Billion |

| CAGR | CAGR of 12.25% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Network Attached Storage, Storage Area Network, Computed Storage) • By Deployment (Public Cloud, Hybrid Cloud, Private Cloud) • By Enterprise Size (Small and Medium Enterprises, Large Enterprises) • By Application (BFSI, Healthcare, Logistics, Retail & E-Commerce, Media & Entertainment, Manufacturing, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | IBM Corporation, Cisco Systems, NetApp, NTT Communications Corporation, Dell EMC (Dell), Avere, Hewlett-Packard (HP), Zadara Storage, EMC Corporation, Huawei Technologies, Hitachi Vantara, Pure Storage, Fujitsu Limited, Western Digital Corporation, Oracle Corporation, Infinidat, Quantum Corporation, DataDirect Networks (DDN), Nutanix, Tintri, Qumulo, Panasas, Synology, Lenovo Group Limited |