Nano Positioning Systems Market Report Scope & Overview:

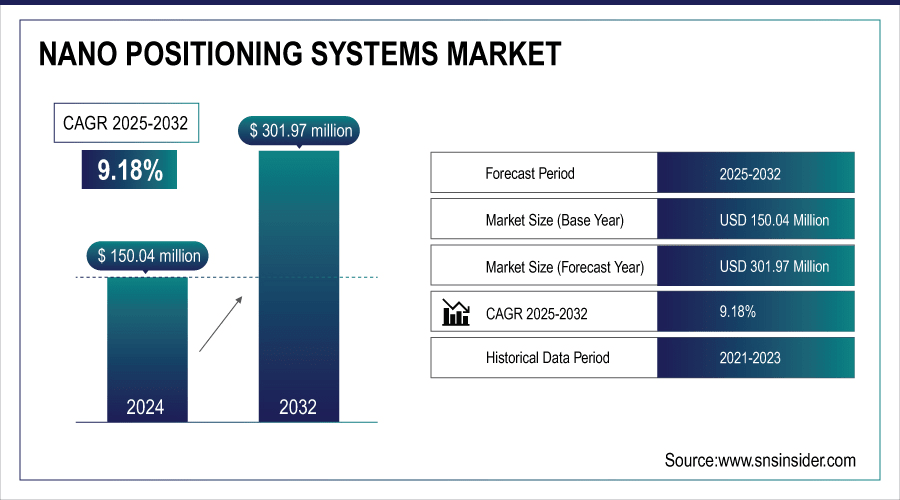

The Nano Positioning Systems market size was valued at USD 150.04 Million in 2024 and is projected to reach USD 301.97 Million by 2032, growing at a CAGR of 9.18% during 2025-2032.

The Nano Positioning Systems market is growing due to increasing demand for ultra-precise motion control in semiconductor manufacturing, optics, photonics, microscopy, and biomedical research. Advancements in piezoelectric, capacitive, and electromechanical technologies, coupled with rising adoption in aerospace, automotive, and defense sectors, are driving market expansion. Growing investments in R&D and emerging nanotechnology applications further fuel growth globally. Approximately 41% of research institutes exploring nano-scale drug delivery systems report using nanopositioning stages for precise alignment.

To Get More Information On Nano Positioning Systems market - Request Free Sample Report

Key Nano Positioning Systems Market Trends

-

Increasing demand for ultra-precise motion control in semiconductor manufacturing, optics, photonics, and microscopy

-

Growing applications in biomedical research, aerospace, and automotive sectors

-

Technological advancements in piezoelectric, capacitive, and electromechanical nano positioning systems

-

Emerging opportunities in AI-integrated positioning systems and advanced nanotechnology applications

-

Investments in R&D and development of miniaturized, high-resolution systems for enhanced performance and accuracy

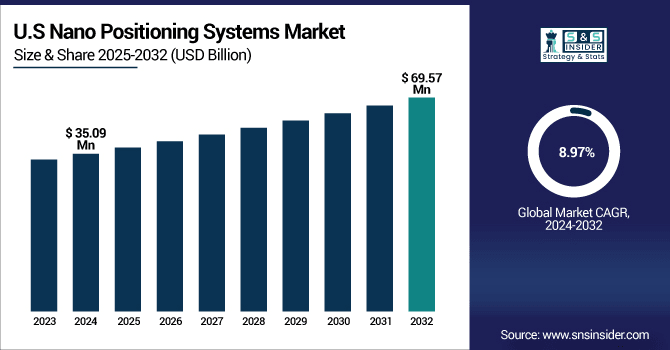

The U.S. Nano Positioning Systems market size was valued at USD 35.09 Million in 2024 and is projected to reach USD 69.57 Million by 2032, growing at a CAGR of 8.97% during 2025-2032. The U.S. Nano Positioning Systems market is expanding due to increased demand for precision in semiconductor manufacturing, advancements in microscopy techniques, and growing applications in life sciences and aerospace sectors.

Nano Positioning Systems market trends include rising adoption of piezoelectric and capacitive technologies, integration with AI-driven automation, expansion in biomedical and semiconductor applications, and increasing demand for ultra-precise nanoscale positioning globally.

Nano Positioning Systems market Growth Drivers:

-

Ultra Precise Motion Control and Technological Advancements Drive Growth in Nano Positioning Systems Market

The Nano Positioning Systems market is primarily driven by the increasing need for ultra-precise motion control in semiconductor manufacturing, optics, photonics, and microscopy. Growing applications in biomedical research, aerospace, and automotive sectors further propel demand. Technological advancements in piezoelectric, capacitive, and electromechanical systems enhance performance, accuracy, and reliability, making them indispensable for high-precision tasks.

In 2024, China accounted for 40% of global wafer fabrication equipment sales, amounting to USD 41 billion.

Nano Positioning Systems market Restraints:

-

Data Privacy Skilled Workforce Energy Compliance and Integration Challenges Hinder AI High Performance Computing Deployment

Data privacy and security concerns, shortage of skilled professionals, and challenges in integration of AI with legacy HPC systems. Additionally, energy consumption, compliance with regulatory requirements, and interoperability between different platforms are also significant barriers to the deployment and scalable use of AI-based high-performance computing solutions.

Nano Positioning Systems market Opportunities:

-

Emerging Nanotechnology and AI Integrated Positioning Systems Unlock Growth Opportunities Across Life Sciences Defense Advanced Manufacturing

Significant opportunities exist in emerging nanotechnology applications, AI-integrated positioning systems, and expanding adoption across life sciences, defense, and advanced manufacturing. Investments in R&D and miniaturized, high-resolution systems offer avenues for innovation and market growth.

35% of companies have fully deployed AI in at least one function, with 42% actively experimenting or piloting AI tools.

Nano Positioning Systems Market Segment Highlights

-

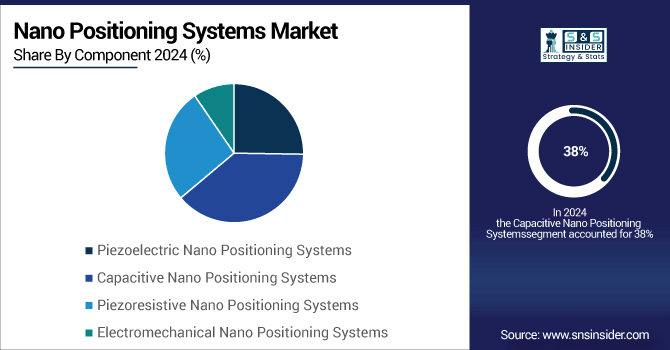

By Component, Capacitive Nano Positioning Systems led with ~ 38% share in 2024 and Piezoelectric Nano Positioning Systems is fastest segment (CAGR 9.81%).

-

By Resolution, Full HD dominated ~32% in 2024 and Ultra HD (4K and above) is fastest growing (CAGR 9.63%).

-

By Application, Semiconductor Manufacturing led ~29% in 2024; and is fastest growing (CAGR 9.53%).

-

By End User, Automotive Manufacturers held ~31% in 2024; and Defense & Security Agencies is fastest growing (CAGR 9.59%).

Nano Positioning Systems Market Segment Analysis

-

By Component, Capacitive Nano Positioning Systems Lead Market While Piezoelectric Technologies Drive Rapid Future Growth

In 2024, Capacitive Nano Positioning Systems dominated the market due to their high precision, stability, and extensive applications in optics, photonics, and semiconductor manufacturing. Their proven reliability in industrial and research environments supported widespread adoption. Meanwhile, Piezoelectric Nano Positioning Systems are expected to register the fastest CAGR from 2025 to 2032, driven by continuous technological advancements, increasing demand for ultra-precise motion control, and growing applications in biomedical research, aerospace, and advanced manufacturing sectors globally.

-

By Resolution, Full HD Leads Nano Positioning Market While Ultra HD 4K Technologies Drive Fastest Future Growth

In the Nano Positioning Systems market, Full HD technology dominated in 2024 due to its widespread adoption across industrial, medical, and research applications, offering reliable precision and cost-effectiveness. Meanwhile, Ultra HD (4K and above) is expected to register the fastest CAGR from 2025 to 2032, driven by increasing demand for higher-resolution imaging, advanced diagnostics, and AI-integrated positioning solutions across life sciences, defense, and high-precision manufacturing sectors.

-

By Application, Semiconductor Manufacturing Leads Market Growth Driven by Advanced Chips AI IoT 5G and EV Adoption.

The Semiconductor Manufacturing segment dominated the market in 2024, driven by strong demand for advanced chips across consumer electronics, automotive, and industrial applications. With continuous innovation in process technologies, miniaturization, and high-performance computing, this segment is expected to witness the fastest CAGR from 2025 to 2032. Growing adoption of AI, IoT, 5G, and electric vehicles further fuels the need for sophisticated semiconductor manufacturing solutions, supporting long-term market expansion.

-

By End User, Automotive Leads Nano Positioning Adoption While Defense Agencies Drive Fastest Future Market Growth

In the Nano Positioning Systems market, Automotive Manufacturers dominated in 2024, driven by increasing integration of high-precision positioning for autonomous driving, advanced navigation, and safety systems. Meanwhile, Defense & Security Agencies are expected to register the fastest CAGR from 2025 to 2032, fueled by growing investments in defense modernization, surveillance technologies, and precision targeting systems that leverage advanced nano positioning solutions for enhanced operational accuracy and strategic advantage.

Nano Positioning Systems Market Report Analysis

-

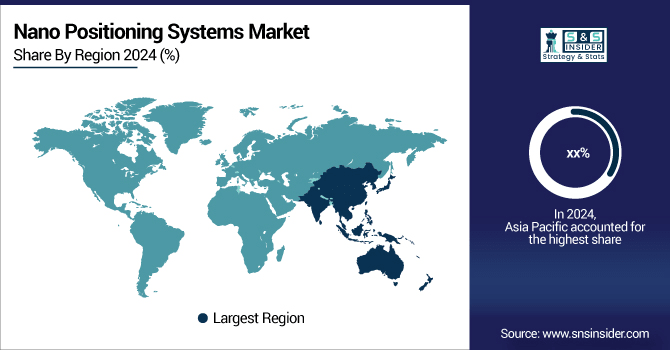

Asia Pacific Nano Positioning Systems Market Insights

Asia Pacific dominated the Nano Positioning Systems market in 2024 and is expected to register the fastest CAGR from 2025 to 2032, driven by rapid industrialization, expanding electronics manufacturing, and increasing investments in advanced research and defense applications. Rising adoption of precision automation, AI-integrated systems, and high-resolution positioning across automotive, healthcare, and industrial sectors is further fueling regional growth, making Asia Pacific a key market for future expansion.

China led the Asia Pacific market in 2024, supported by its strong semiconductor, automotive, and defense manufacturing sectors and significant government R&D investments.

Get Customized Report as Per Your Business Requirement - Enquiry Now

-

North America Nano Positioning Systems Market Insights

North America held a significant share in the Nano Positioning Systems market, driven by advanced research infrastructure, high adoption of automation and AI technologies, and strong investments in defense, healthcare, and semiconductor sectors. Continuous innovation and collaborations between industry and research institutions support market growth, positioning the region as a key hub for high-precision nano positioning solutions.

The U.S. dominated North America in 2024, fueled by leading semiconductor manufacturing, defense modernization programs, and extensive R&D initiatives in healthcare and industrial automation sectors.

-

Europe Nano Positioning Systems Market Insights

Europe maintained a strong presence in the Nano Positioning Systems market, driven by advanced manufacturing, precision engineering, and adoption in aerospace, healthcare, and industrial automation. Supportive government initiatives and R&D investments continue to bolster regional growth.

Germany led Europe in 2024, backed by its robust automotive, aerospace, and industrial automation sectors, along with significant investments in precision engineering and research infrastructure.

-

Latin America (LATAM) and Middle East & Africa (MEA) Nano Positioning Systems Market Insights

The LATAM and MEA regions held a moderate share in the Nano Positioning Systems market, driven by growing industrial automation, defense modernization, and healthcare infrastructure development. Increasing government initiatives, investments in advanced technologies, and rising adoption of high-precision positioning solutions in manufacturing, research, and surveillance applications are expected to support steady market growth in both regions.

Competitive Landscape for Nano Positioning Systems market:

Aerotech Inc. is a U.S.-based leader in precision motion control and automation, specializing in high-performance positioning systems for industries such as semiconductor, aerospace, medical devices, and photonics. With over 50 years of experience, Aerotech offers both standard and custom solutions, including nanopositioners, air-bearing stages, and integrated automation systems, supported by global engineering and manufacturing capabilities

-

In May 2025, Aerotech launched the second generation of its ANT nanopositioning stages. These stages are engineered to deliver superior performance, building on their best-in-class predecessor, and are designed for applications requiring outstanding dynamics and nanometer-level precision.

Physik Instrumente (PI) GmbH & Co. KG is a global leader in precision motion control and nanopositioning systems. Founded in 1970, PI specializes in developing and manufacturing piezoelectric actuators, flexure-based nanopositioners, and air-bearing stages with nanometer to sub-nanometer resolution. Their solutions are integral to applications in industrial automation, microscopy, life sciences, semiconductor testing, and photonics.

-

In August 2025, Physik Instrumente, the F-690.S1 offers precise six-axis motion with nanometer-level resolution. Utilizing a parallel-kinematic design with 3-phase linear motors, it achieves bidirectional repeatability down to 100 nm and supports payloads up to 2 kg.

Nano Positioning Systems Market Key Players:

Some of the Nano Positioning Systems Market Companies

-

Aerotech Inc.

-

Physik Instrumente (PI) GmbH & Co. KG

-

Cedrat Technologies SA

-

Dynamic Structures & Materials LLC

-

Mad City Labs Inc.

-

OME Technology Co., Ltd.

-

OWIS GmbH

-

SmarAct GmbH

-

Thorlabs Inc.

-

Piezosystem Jena GmbH

-

Prior Scientific Instruments Ltd.

-

3D Systems

-

Allied Motion Technologies Inc.

-

MKS Instruments Inc.

-

Novanta Inc.

-

Grayfield Optical Inc.

-

Harbin Core Tomorrow Science and Technology Co. Ltd.

-

ISP System

-

MICRONIX USA

-

WITTENSTEIN SE

| Report Attributes | Details |

| Market Size in 2024 | USD 150.04 Million |

| Market Size by 2032 | USD 302.97 Million |

| CAGR | CAGR of 9.18% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Piezoelectric Nano Positioning Systems, Capacitive Nano, Positioning Systems, Piezoresistive Nano Positioning Systems, and Electromechanical Nano Positioning Systems) • By Resolution (Standard Definition (SD), High Definition (HD), Full HD, and Ultra HD (4K and above)) • By Application (Optics & Photonics, Semiconductor Manufacturing, Microscopy, Biomedical Research, and Aerospace & Automotive) • By End User (Healthcare Institutions, Defense & Security Agencies, Automotive Manufacturers, and Individual/Consumer Users) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Aerotech, Physik Instrumente (PI), Cedrat Technologies, Dynamic Structures & Materials, Mad City Labs, OME Technology, OWIS, SmarAct, Thorlabs, Piezosystem Jena, Prior Scientific, 3D Systems, Allied Motion Technologies, MKS Instruments, Novanta, Grayfield Optical, Harbin Core Tomorrow Science & Technology, ISP System, MICRONIX USA, and WITTENSTEIN SE. |