Insulation Monitoring Systems Market Size & Growth Trends:

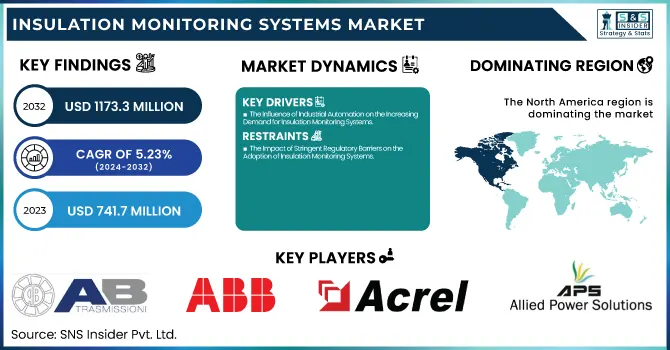

The Insulation Monitoring Systems Market was valued at USD 741.7 Million in 2023 and is projected to reach USD 1173.3 Million by 2032, growing at a CAGR of 5.23% from 2024 to 2032. The growing demand for preventive maintenance and safety practices in critical infrastructure remains a key driver for the market across sector such as power utilities, manufacturing, and transportation. Adoption rates are anticipated to soar over the next few years, particularly in regions with high industrial activity and an emphasis on energy efficiency.

To Get more information on Insulation Monitoring Systems Market - Request Free Sample Report

The US market alone was valued at USD 204.56 million in 2023 and is anticipated to reach USD 290.0 million by 2032, growing at a CAGR of 3.95% during the forecast period. Key drivers for this growth include advancements in system integration and automation, alongside the growing demand for cost-effective installation and maintenance solutions, as well as enhanced lifecycle and durability performance data.

Insulation Monitoring Devices Market Dynamics:

Drivers:

-

The Influence of Industrial Automation on the Increasing Demand for Insulation Monitoring Systems

The rise of industrial automation has significantly influenced the demand for insulation monitoring systems, as industries increasingly rely on automated processes for enhanced productivity and safety. Electrical systems play a critical role in the functioning of machines, power systems, and data centers in automated settings. Such systems are complex and require constant real-time monitoring to maintain their integrity and prevent possible hazards. An insulation monitoring system helps to detect insulation faults both to prevent costly downtimes and also to reduce the risk of electrical failures, which is a major advance in safety techniques. As automation increasingly assumes both repetitive and hazardous tasks, the importance of these systems in security is paramount. Technology systems also reduce the chances of human error through automation and reduce operating cost by shortening inspection process.

Restraints:

-

The Impact of Stringent Regulatory Barriers on the Adoption of Insulation Monitoring Systems

Stringent regulations and certification requirements can hinder the widespread adoption of insulation monitoring systems. Many industries, particularly in sectors such as energy, manufacturing, and healthcare, are subject to rigorous standards regarding electrical safety and equipment compliance. These regulations often necessitate that insulation monitoring systems undergo specific certifications, testing, and approval processes before they can be implemented in operations. This can lead to delays in installation and significant additional costs for businesses. Furthermore, the complexity of navigating these regulatory frameworks can be a barrier, especially for companies in emerging markets or smaller enterprises that lack the resources to ensure compliance with local laws. As standards evolve or vary by region, companies may face difficulties in keeping up with the latest requirements, which could affect the pace of adoption and investment in advanced insulation monitoring systems. Consequently, regulatory challenges can restrict market growth and limit the availability of these systems in some areas.

Opportunities:

-

Enhancing Smart Grid Efficiency and Safety through Insulation Monitoring System Integration.

The use of insulation monitoring system by the smart grids offers a great potential for optimizing the grid performance by enabling real-time data about the condition of electrical insulation. Insulation monitoring systems can be implemented in smart grids with high speed communication and monitoring technology, improving the early detection of faults to prevent electrical failures from happening in the first place, to reduce maintenance costs. Grid operators use these systems to monitor insulation integrity continuously, allowing them to identify issues before they become problems, resulting in improved grid reliability, efficiency, and safety. This proactive approach minimizes downtime, enhances preventive maintenance strategies, and supports the growing demand for reliable, sustainable energy distribution, making insulation monitoring systems an essential component of modern smart grid infrastructure.

Challenges:

-

Addressing Maintenance and Calibration Challenges for Reliable Insulation Monitoring Systems

Regular maintenance and calibration are crucial for the optimal functioning of insulation monitoring systems, ensuring they provide accurate and reliable data. Sensors and monitoring equipment may become worn with time and drift from their original settings, causing inaccurate readings and possible system failures over time. Routine maintenance is necessary to identify this and address the issues before it leads to downtime or operational disruption. Calibration ensures the system remains accurate, especially when inspecting insulation resistance in electrical systems where even small variations could lead to great hazards. Nevertheless, these upkeep tasks incur costs, which encompass the necessity of adept engineers, replacement components, and operational inactivity. This becomes a challenge however, as the items need to be ordered ahead of time to avoid delays, and most industries tend to have tight production schedules. So, maintenance and calibration for insulation monitoring system is time consuming, but then proper maintenance and calibration is important to maximize the performance of insulation monitoring system.

Insulation Monitoring Systems Market Segment Analysis:

By Type

The 1-Phase Insulation Monitoring Device segment dominated the largest share in the insulation monitoring systems market, accounting for around 51% in 2023. This segment's prominence is primarily driven by the widespread use of 1-phase electrical systems in various applications, including residential, small industrial setups, and light commercial infrastructure. These devices are designed to monitor the integrity of insulation in electrical circuits, ensuring the safety of electrical systems by detecting any degradation or faults in the insulation material. As electrical systems become more complex and critical for operational safety, the need for reliable monitoring tools has grown, particularly in 1-phase systems that are more commonly deployed in less complex environments. Moreover, 1-phase insulation monitoring devices offer a cost-effective solution compared to their 3-phase counterparts, making them an attractive choice for applications with limited budgets or less stringent requirements. Their simple installation, ease of use, and cost-efficiency contribute to the dominant market share, particularly in regions where residential and smaller commercial installations are prevalent.

The 3-Phase Insulation Monitoring Device segment is expected to be the fastest-growing in the insulation monitoring systems market during the forecast period from 2024 to 2032. The 3-phase electrical market is anticipated to gain traction over the upcoming period owing to increasing demand for 3-phase electrical in industries, commercial and large-scale infrastructure applications which require more power and reliable system. With the increasing automation and complexity, there is a growing demand for continuous monitoring of 3-phase electrical systems to identify failures and maintain operational safety. Moreover, the increasing number of manufacturing, energy, and commercial facilities that use 3-phase systems is driving demand for sophisticated insulation monitoring tools.

By Industry

The Power Utilities segment dominated the largest share of revenue in the insulation monitoring system market, accounting for around 39% in 2023. This dominance is driven by the critical need for reliable monitoring systems to ensure the integrity and safety of power distribution networks. As the global demand for electricity increases, power utilities must maintain and monitor extensive electrical infrastructure, including substations, power lines, and transformers. Insulation monitoring systems play a crucial role in detecting insulation faults, preventing electrical failures, and ensuring uninterrupted power supply.

The Manufacturing and Production segment is the fastest-growing segment in the insulation monitoring systems market during the forecast period from 2024 to 2032. This growth can be attributed to the rising demand for electrical system monitoring in manufacturing facilities to maintain operational efficiency, avoid equipment failure, and minimize downtime. With the advent of automation and advanced manufacturing processes across industries, the need for resilient insulation monitoring solutions for electrical infrastructure protection and production reliability improvements is growing exponentially.

Insulation Monitoring Systems Market Regional Overview:

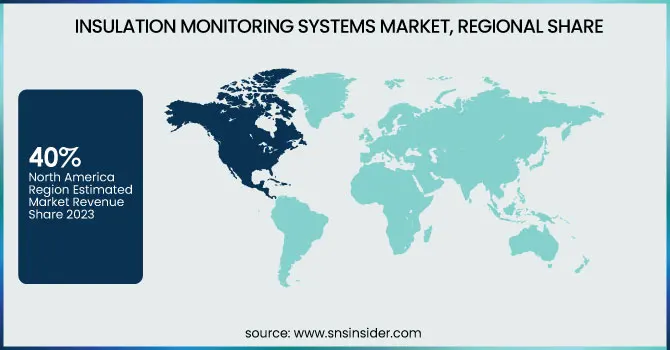

In 2023, North America held the largest share of revenue in the insulation monitoring system market, accounting for around 40%. This dominance is primarily driven by the region's advanced industrial infrastructure, high levels of automation adoption, and rigorous safety and regulatory standards. North America's industries, particularly in sectors like power utilities, manufacturing, and data centers, increasingly rely on insulation monitoring systems to ensure the safety and reliability of their electrical systems. Additionally, the region's focus on improving energy efficiency and reducing downtime further boosts the demand for these systems. As the need for robust, real-time monitoring of electrical systems continues to grow, North America remains a key market for insulation monitoring system providers.

Asia Pacific is expected to be the fastest-growing region in the insulation monitoring system market during the forecast period from 2024 to 2032. Rapid industrialization, growth of manufacturing sectors, and adoption of automation technologies in countries such as China, India, and Japan are some of the factors contributing towards this growth. This demand is also driven due to the growing emphasis on energy efficiency, safety standards, and infrastructure development in the region. The increasing adoption of smart Grids and renewable energy sources across the Asia Pacific thereby leads to the requirement of advanced monitoring solutions to ensure the safety and reliability of electrical systems. Asia Pacific is expected to witness high growth in insulation monitoring system market over the years due to huge investment in power utilities, manufacturing, and transportation.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

Some of the major key players in Insulation Monitoring Systems Market along with their product:

-

AB Trasmissioni Srl (Italy) - Electrical transmission equipment, power monitoring devices, industrial automation components.

-

ABB (Switzerland/Sweden) - Robotics, automation systems, insulation monitoring devices, energy-efficient solutions.

-

Acrel Co., Ltd. (China) - Electrical monitoring systems, insulation monitoring devices, smart grid equipment.

-

ALLIED POWER SOLUTIONS (USA) - Power quality management, insulation monitoring, surge protection devices.

-

Bender GmbH & Co. KG (Germany) - Insulation monitoring devices, electrical safety solutions, power quality equipment.

-

Blue Jay Technology Co. Ltd. (China) - Insulation monitoring devices, electrical testing equipment, power quality analyzers.

-

E. Dold & Söhne GmbH & Co. KG (Germany) - Safety relays, insulation monitoring devices, electrical monitoring systems.

-

HAKEL spol. s r.o. (Czech Republic) - Insulation monitoring devices, electrical protection devices, surge protectors.

-

HELLA GmbH & Co. KGaA (Germany) - Automotive electronics, lighting technology, power electronics.

-

Legrand (France) - Electrical distribution products, smart grid systems, insulation monitoring devices.

-

Omron Corporation (Japan) - Industrial automation equipment, sensors, insulation monitoring devices.

-

Schneider Electric (France) - Power management, insulation monitoring devices, industrial automation.

-

Sensata Technologies, Inc. (USA) - Sensors, power monitoring devices, insulation monitoring systems.

-

Socomec (France) - Power monitoring solutions, UPS systems, insulation monitoring devices.

-

Texas Instruments Incorporated (USA) - Semiconductors, insulation monitoring systems, power management solutions.

List of companies that provide raw materials and components for the Insulation Monitoring Systems Market:

-

Texas Instruments Incorporated

-

Analog Devices

-

STMicroelectronics

-

NXP Semiconductors

-

Infineon Technologies

-

Toshiba Corporation

-

Rohm Semiconductor

-

Microchip Technology

-

Panasonic Corporation

-

Mouser Electronics

Recent Development:

-

3 Sept 2024: ABB has announced that Kami Shoji, Ltd. (Japan) has adopted its L&W Fiber Tester Plus to enhance cellulose nanofiber (CNF) paper production, enabling fast, precise defibration testing and advanced fiber morphology analysis, improving production efficiency for insulation and soundproofing materials.

-

February 01, 2023: OMRON will globally launch its K7DD-PQ Series of advanced motor condition monitoring devices, starting March 1, 2023 in Japan and then globally April 3, 2023, to track trends in deterioration and wear of servomotors and machine tools, preventing unexpected equipment failure and reducing inspection efforts.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 741.7 million |

| Market Size by 2032 | USD 1173.3 Million |

| CAGR | CAGR of 5.23% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (1 Phase Insulation Monitoring Device, 3 Phase Insulation Monitoring Device, DC Insulation Monitoring Device) • By Industry (Power Utilities, Manufacturing and Production, Transportation, Healthcare, Mining, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AB Trasmissioni Srl (Italy), ABB (Switzerland/Sweden), Acrel Co., Ltd. (China), ALLIED POWER SOLUTIONS (USA), Bender GmbH & Co. KG (Germany), Blue Jay Technology Co. Ltd. (China), E. Dold & Söhne GmbH & Co. KG (Germany), HAKEL spol. s r.o. (Czech Republic), HELLA GmbH & Co. KGaA (Germany), Legrand (France), Omron Corporation (Japan), Schneider Electric (France), Sensata Technologies, Inc. (USA), Socomec (France), Texas Instruments Incorporated (USA). |