QUANTUM CASCADE LASER MARKET REPORT SCOPE & OVERVIEW:

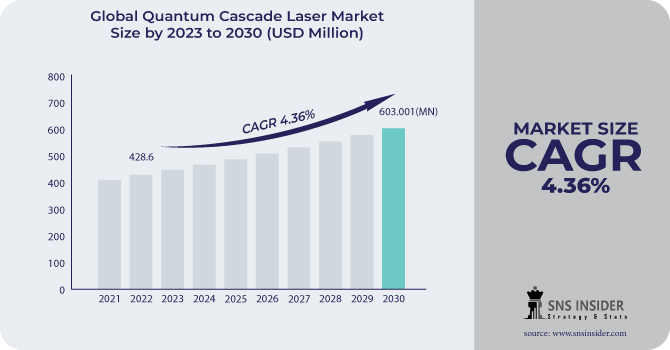

The Quantum Cascade Laser Market was valued at USD 416.85 million in 2023 and is expected to reach USD 617.93 million by 2032, growing at a CAGR of 4.50% over the forecast period 2024-2032.

Rising demand for versatile laser systems and advanced development technology has made the Quantum Cascade Laser (QCL) market grow. Due to their high efficiency, low volume, and ability to emit in the mid-IR and THz bands, QCLs are used for gas sensing, spectroscopy, and environmental monitoring. This is essential in industrial applications to sense dangerous gases and in healthcare for non-invasive diagnostics. The increasing focus on sustainability and environmental safety is also a key factor driving the demand for QCLs by enabling emission monitoring and pollution control. Using QCL-based sensors, breath analysis for diseases such as COPD and asthma reaches >90% specificity. Gas such as CO₂ in pipeline gas or for environmental monitoring achieves 99.9% at as little as 500 ppm. QCLs at wavelengths implicitly tuned from 3-12 microns offer 10-100x more power than conventional diode lasers in the mid-infrared region. With their high sensitivity and real-time capabilities, QCLs now are seeing demand of more than 20% growth per annum for industrial and environmental monitoring applications.

In addition, huge contributions of defense and telecommunications help to contribute to the growth of the market. In defense, we use QCLs for chemical detection and infrared countermeasures making them reliable and resilient. QCLs are used in the telecommunications industry for high-speed optical communication and tunable devices. The growing investments in research and development are expected to further support market growth along with new applications in biomedical imaging and homeland security. The fastest growth in the Asia-Pacific region is due to the recent industrialization of China and India, while the dominance of North America is supported by a healthy technology base and adoption rates. QCLs in defense have driven the development of IRCM systems that emit powers of up to 1 W and have been shown to provide trace-level chemical detection (10 ppb) in less than 1 second with service lifetimes of greater than 10,000 hours. From telecoms, where QCLs enable >10 Gbps data rates and wavelength stability of ±0.01 nm, in compact footprints of 10 mm by 10 mm. With USD 500 M China funding propelling 15-20% annual growth in QCL adoption in the Asia-Pacific region and over 50,000 deployed QCL systems, North America provides 70% of mid-infrared technology R&D funding.

MARKET DYNAMICS

KEY DRIVERS:

-

Driving Growth of Quantum Cascade Lasers with Miniaturization High Efficiency and Portable Field Applications

The important factors that are fueling the growth of the Quantum Cascade Laser (QCL) market are the miniaturization of semiconductor lasers and the growing usage of miniaturized QCLs in portable devices. The requirement of building compact and high-performance systems stimulates the advancements in quantum cascade laser (QCL) fabrication toward miniaturization, high efficiency, and ease of integration into portable sensors and handheld devices. This is especially important for applications that involve on-site monitoring, as portability is often a must. Compact QCL systems have shown great potential in on-site applications such as gas leak detection, air quality monitoring, and industrial safety where real-time and accurate data is crucial. These improvements yield a more flexible design, allow for a greater array of possibilities, and encourage a more widespread integration and adoption of QCLs. Power efficiencies of miniaturized QCLs exceed 20%, compared to 5%–10% for bulk lasers. Additionally, Compact QCL modules can be implemented as compact handheld sensors (< 1 kg) suitable for field deployments. Moreover, QCLs are portable and enable greater than 99% real-time measurement accuracy for gas analysis in safety-critical environments like chemical plants.

-

Revolutionizing Agriculture Food Safety and Semiconductor Inspection with High-Accuracy Cost-Effective Quantum Cascade Lasers

An increasing need for hyperspectral imaging in applications such as agriculture, food safety, and semiconductor inspection. Hyperspectral imaging is based on the unique property of QCLs to emit certain wavelengths for the detection of specific materials and identification through spectral fingerprints. This ability has broadened the scope of diverse applications ranging from food contaminants detection to crop health monitoring and semiconductor manufacturing quality control. The demand for QCLs is also expected to grow due to the rise of industries that are reliant on precision-based atmospheric imaging & as global food safety & security increases. With the reduction in cost and improvement in technology, the QCLs are anticipated to be adapted in larger numbers in hyperspectral imagers and to enhance their market utilities. Hyperspectral imaging systems based on quantum cascade lasers (QCL) have been developed for the early detection of diseases with > 95% detection accuracy by identifying chlorophyll fluorescence in crops and over a 4–12 micron spectral ⁄ range for identification of the composition of materials in the surrounding environment. QCLs have become increasingly commercially viable in the past decade as costs have fallen by more than 30 percent in the past decade. For food safety, QCLs have been used to perform more than 10,000 samples per hour with high rejection rates, while more than 90% prediction accuracy in fruit quality and crop yield of >90% cases has supported the optimization of input resources and ensured food safety.

RESTRAIN:

-

Challenges in Quantum Cascade Lasers Fabrication High Costs Thermal Management and Limited Scalability Hinder Adoption

The complexity of manufacturing & fabrication is one of the major challenges in the Quantum Cascade Laser (QCL) market. Due to their specific purposed material growth and processing techniques like molecular beam epitaxy (MBE), QCLs can have a high cost of production (high purity growth) with scalability challenges. This is a source of technical complication that also affects the large-scale fabrication of QCLs, limiting their ability to penetrate the market and/or to be adopted at higher rates by users with either novel applicative needs or products where simpler technologies are more likely to be attractive. QCLs have their problems too of which one major one is defined as thermal management issues. However, as these lasers operate, they can produce a lot of heat, which can impair the performance and shorten the life of the lasers. In particular, in high-power applications, proper cooling systems are essential to prevent sensitive elements from malfunctioning or being damaged. Furthermore, QCL systems have the additional challenge of requiring advanced thermal management solutions that make their integration into smaller and less expensive solutions difficult.

KEY MARKET SEGMENTS

BY PACKAGING TYPE

In 2023, the Quantum Cascade Laser (QCL) market was dominated by the C-Mount packaging type, which accounted for a share of 43.7% due to its versatility and wide range of applications. For such wide-ranging markets as industrial sensing, gas detection, and spectroscopy, where robustness and reliability are critical, C-Mount packages lend themselves to these very requirements. In addition, the packaging has become the packaging of choice for many users since it can handle high-power QCLs well with good thermal management. Specsol's ability to integrate well with existing systems and proven ease of implementation into spectroscopic instruments further cement its lead in the market.

HHL & VHL packages are projected to register the highest CAGR from 2024 to 2032. The former is propelled by their reduced footprint and better thermal management features, rendering them suitable for military, defense, and portable sensing applications where the weight and space considerations are critical. These packages are more appropriate for applications needing higher power output in smaller, more power-efficient packaging. The rapid adoption of new technologies with increasing need for compact, high-power-output QCLs, fieldable chemical sensing wearable sensors, etc. This high market growth rate can continue to be attributed to growing industrial demands for a more efficient and portable solution, which both HHL & VHL packages can deliver.

BY OPERATION MODE

The Continuous Wave (CW) mode segment held the biggest quantum cascade laser (QCL) market share of 63.4% in 2023, owing to the rising need for devices for gas sensing, environmental monitoring, and spectroscopy. The advantage of CW lasers is that these provide an uninterrupted continuous emission, which is important for real-time monitoring purposes and applications where continuous emission over a long period is required; for instance, industrial and medical applications. Part of the reason CW lasers have such a large market share is the consistent reliability and performance of CW lasers in harsh environments.

The Pulsed QCLs are anticipated to show the highest CAGR during the period from 2024 to 2032, as they can produce short pulses of high power that render them attractive for precision demanding applications such as material processing, LIDAR & high-speed spectroscopy. Pulsed QCLs have gained broad utilization in biomedical imaging and telecommunications, where the high-intensity pulses of light generated for particular applications are essential [2]. Continuing developments in pulsed QCL technology, especially in their miniaturization and efficient operation, will spur rapid growth in many applications that require short, high-energy pulses.

BY FABRICATION TECHNOLOGY

The Quantum Cascade Laser (QCL) market was led by the Distributed Feedback (DFB) laser segment, which made up 59.4% of the market in 2023. DFB lasers are popular because they generate stable, narrow linewidth emissions which are particularly important for applications that require precision, such as gas sensing, spectroscopy, and telecommunications. The lasers exhibit great wavelength stability and high efficiency, these properties are the basis for environmental monitoring or industrial process control. They are widely used because they can operate continuously and execute high performance in harsh environments. Further, DFB lasers are used in field-carriage applications as a result of their extended operation life with minimum failure rate, making them an important segment in vital applications such as chemical detection and research laboratories.

The Tunable External Cavities is anticipated to observe the highest Compound Annual Growth Rate (CAGR) between 2024 and 2032. Such lasers are mostly appreciated for their tunability nature of emitted wavelength at wide ranges of wavelength due to their high applicability in spectroscopy, chemical sensors, and biomedical imaging. The tunability Saves feature enables users to select precise wavelengths, which is important for, but not limited to, pharmaceutical testing and environmental monitoring SHS where different wavelengths are required to detect different compounds. By allowing tunable laser outputs for tailored high-precision tasks, tunable external cavity QCLs are becoming an ever more critical component in industries and research fields that require such flexibility in laser characteristics. Its capability to provide wavelength-specific solutions is helping it to grow in advanced research applications and expand into sensitive detection systems.

BY END USE

The industrial sector led the Quantum Cascade Laser (QCL) market with 37.3% in 2023 and this can be attributed to the large number of QCL applications in gas sensing, chemical detection, and environmental monitoring. Applications of such sensors are significant in oil and gas, automotive, and manufacturing sectors where high accuracy in the detection of gases including methane, carbon dioxide, and other volatile compounds is extremely critical for health, efficiency, and regulatory compliance. One essential application for QCLs is in industrial process control, where their sensitivity, low noise, and stability in unpleasant conditions offer great benefits. The industrial segment has emerged as the major application segment owing to its rising use for pollutant detection and environmental compliance.

Healthcare is expected to be at the highest CAGR during the period 2024-2032. This boom is primarily attributed to the increasing adoption of QCL in biomedical imaging, non-invasive diagnostics, and medical spectroscopy. This allows QCL for disease diagnostics, cancer detection, and biomarker identification by highly sensitive detection at very precise wavelengths. Given the increasing need for high-throughput, accurate, and non-invasive diagnostic techniques, QCLs are expected to have a major impact on medical research and personalized medicine. The increasing consideration of laser-based systems for improving health through disease prevention and detection in healthcare is based on their capability to detect molecular signatures at specific wavelengths.

REGIONAL ANALYSIS

North America led the Quantum Cascade Laser (QCL) market in 2023 with a 38.6% share, owing to the presence of modern technological infrastructure as well as investment in research and development activities. Take the case of the USA and its major players in QCL manufacturing, including Daylight Solutions and Thorlabs, who have pioneered applications that span from gas sensing to spectroscopic imaging. Moreover, similar to the midinfrared CO2 laser, the U.S. defense sector is likely to broadly use quantum cascade lasers for chemical detection, homeland security, and military applications, and thus these lasers will also have a stable need for high-performance lasers. North America continues to dominate the QCL market, primarily due to its emphasis on advanced manufacturing, and precision sensors demand for automotive and telecommunication industries.

Asia-Pacific is anticipated to register the fastest growth rate in the QCL market between 2024 and 2032. China, India, and Japan are the major contributors to this growth due to their rapid industrialization with meat detection, environmental monitoring, and biomedical applications, which are also growing economic growth demand QCLs. The use of QCLs in China's industrial sector is, for instance, one such application that allows for real-time detection of gas emissions and pollutants as the country continues to tighten its environmental legislation. In like manner, Japan's telecoms and defense industries are also putting R&D dough into QCL tech for next-gen sensing and imaging systems. The growth rate is also anticipated to be high in the Asia-Pacific region due to the increasing need for high-precision sensors across various applications, especially for innovations in smart cities and healthcare.

.png)

KEY PLAYERS

Some of the major players in the Quantum Cascade Laser Market are:

-

Hamamatsu Photonics KK (CASCADIA-QCL, AOPD-QCL)

-

Thorlabs Inc. (QCL-1390, QCL-1580)

-

Adtech Optics Inc. (A-MID-1550-QCL, A-MID-1050-QCL)

-

Mirsense SAS (MIR-QUANT, MIR-LITE)

-

Leonardo DRS Inc. (QCL-4000, DFB-QCL)

-

Nanoplus Nanosystems and Technologies GmbH (QCL-THz, QCL-MIR)

-

Inphenix Inc. (Evolv-QCL, InfraLase-QCL)

-

Alpes Lasers SA (THz QCL, MIR QCL)

-

Sacher Lasertechnik GmbH (TUNABLE-QCL, CW-QCL)

-

Block Engineering Inc. (QCL-AR, MIR-Sense)

-

Lumenis Ltd. (Cascadia-QCL, OptoTherm-QCL)

-

Toptica Photonics AG (FEMTO-3, Quantum-Cascade-THz)

-

Laser Components GmbH (QC-DFB, Tunable-QCL)

-

University of California Santa Barbara (QCL Chip, Mid-IR QCL)

-

Optical Insights Inc. (QCL Spectrometer, THz QCL)

-

Laser Light Technologies Inc. (Mid-IR QCL, Broad Band QCL)

-

Photonics Systems GmbH (CW-QCL, MOCVD QCL)

-

Princeton Instruments (OPERA-QCL, EXO-QCL)

-

Quantum Devices, Inc. (QCL-MID, QCL-THZ)

-

Lidar Technologies Inc. (QCL Lidar, High Power QCL)

Some of the Raw Material Suppliers for Quantum Cascade Laser Companies:

-

IQE PLC

-

Aixtron SE

-

SUMITOMO ELECTRIC INDUSTRIES LTD.

-

Velo Photonics

-

II-VI Incorporated

-

Advanced Photonix, Inc.

-

Elbit Systems Ltd.

-

MOCVD Technology Ltd.

-

WaferTech

-

Global Switch

Hamamatsu Photonics K.K. (Japan)-Company Financial Analysis

RECENT TRENDS

-

In January 2024, Thorlabs partnered with Sensirion’s IRsweep to commercialize QCL-based dual-frequency comb spectroscopy for industrial and environmental sensing.

-

In June 2024, Leonardo DRS secured a full-rate production contract with Northrop Grumman to supply Quantum Cascade Laser (QCL) technology for Common Infrared Countermeasure (CIRCM) systems, enhancing U.S. military aircraft protection.

-

In October 2023, Block Engineering launched its next-generation mid-infrared Quantum Cascade Lasers (QCLs). The new lasers offer increased power, stability, and miniaturized electronics for enhanced performance in fields like life sciences and industrial safety.

Quantum Cascade Laser Market Report Scope:

Report Attributes Details Market Size in 2023 USD 416.85 Million Market Size by 2032 USD 617.93 Million CAGR CAGR of 4.50% From 2024 to 2032 Base Year 2023 Forecast Period 2024-2032 Historical Data 2020-2022 Report Scope & Coverage Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook Key Segments • By Packaging Type (C-Mount, HHL & VHL Package, TO3 Package)

• By Operation Mode (Continuous Wave, Pulsed)

• By Fabrication Technology (Distributed Feedback, Tunable External Cavities, Fabry-Perot)

• By End Use (Industrial, Healthcare, Telecommunications, Military & Defense, Other End Uses)Regional Analysis/Coverage North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) Company Profiles Hamamatsu Photonics KK, Thorlabs Inc., Adtech Optics Inc., Mirsense SAS, Leonardo DRS Inc., Nanoplus Nanosystems and Technologies GmbH, Inphenix Inc., Alpes Lasers SA, Sacher Lasertechnik GmbH, Block Engineering Inc., Lumenis Ltd., Toptica Photonics AG, Laser Components GmbH, University of California Santa Barbara, Optical Insights Inc., Laser Light Technologies Inc., Photonics Systems GmbH, Princeton Instruments, Quantum Devices, Inc., Lidar Technologies Inc. Key Drivers • Driving Growth of Quantum Cascade Lasers with Miniaturization High Efficiency and Portable Field Applications

• Revolutionizing Agriculture Food Safety and Semiconductor Inspection with High-Accuracy Cost-Effective Quantum Cascade LasersRESTRAINTS • Challenges in Quantum Cascade Lasers Fabrication High Costs Thermal Management and Limited Scalability Hinder Adoption