Main Landing Gears Market Size & Growth Insights:

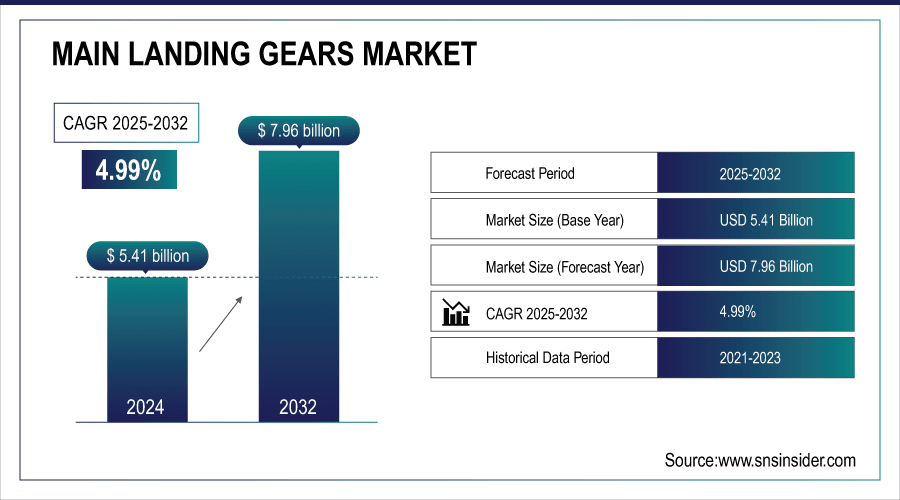

The Main Landing Gears Market size was valued at USD 5.41 Billion in 2024 and is projected to reach USD 7.96 Billion by 2032, growing at a CAGR of 4.99% during 2025-2032.

The Main Landing Gears Market is expanding due to the increasing aircraft deliveries and upgradation of aircraft programs. Air travel is on the rise, as are deliveries of aircraft, so manufacturers of the vehicles are turning more to high-performance materials and methods for building planes automatically. The growing focus on safety, dependability, and fuel efficiency is prompting airlines to modernize or replace old landing gear parts. Moreover, expansion in regional and business aviation is escalating demand for tailor-made landing gear offerings, worldwide.

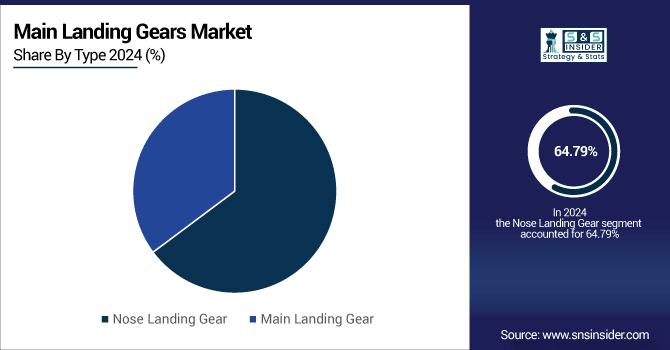

The main landing gear segment accounts for over 60% of total landing gear systems value due to complexity and weight-bearing requirements.

Main Landing Gears Market Size and Forecast:

-

Market Size in 2024: USD 5.41 Billion

-

Market Size by 2032: USD 7.96 Billion

-

CAGR: 4.99% (from 2025 to 2032)

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

To Get More Information On Main Landing Gears Market - Request Free Sample Report

Main Landing Gears Market Trends

-

Manufacturers are also taking weight out of their aircraft with composites and high-strength alloys to make them more fuel-efficient. These materials also provide greater durability and performance under extreme conditions.

-

Automation and precision machining processes are being used to increase quality, decrease costs and guarantee datable landing gear performance.

-

Predictive maintenance systems are finally being built into equipment for the first time, in the form of IoT sensors and real-time monitoring.

-

Increasing demand for short range, regional and business aircraft is one the major drivers for customised landing gear systems. Vendors are developing products optimized for smaller aircraft implementations.

-

The global aging fleet is driving demand for landing gear overhaul, repair and replacement parts, leading to ongoing revenue opportunities.

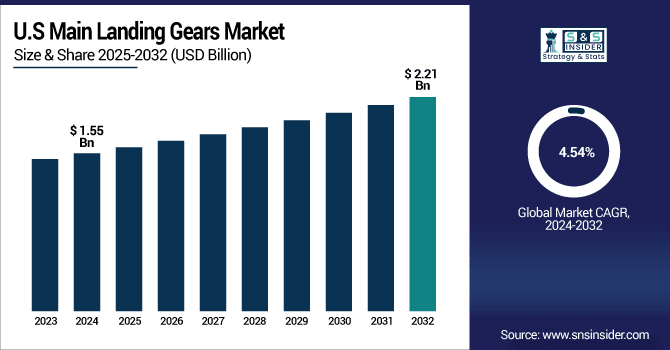

The U.S. Main Landing Gears Market size was valued at USD 1.55 Billion in 2024 and is projected to reach USD 2.21 Billion by 2032, growing at a CAGR of 4.54% during 2025-2032. Main Landing Gears Market growth is driven by new generation and fuel-efficient aircraft in commercial, military, and business aviation is one of the key factors driving the growth of the U.S. main landing gears market. Growing air traffic and increasing aircraft procurements are encouraging airlines to procure sophisticated landing gear systems. Technological innovations like alloys and composites have increased performance and lowered maintenance.

The Main Landing Gears Market trends include the growth of increasing defense budgets and restructuring of military aircraft fleets also drive market growth. Aging aircraft are being replaced and maintained as well. In general, new technology, equitable regulations, and increased air travel are stimulating the steady development of the U.S. landing gear market.

Main Landing Gears Market Segment Analysis

-

By type, nose landing gear led the market with approximately 64.79% share in 2024, while main landing gear was the fastest-growing segment with a CAGR of 5.33%.

-

By platform, fixed-wing aircraft dominated the market with around 73.11% share in 2024, whereas rotary wing aircraft showed the fastest growth with a CAGR of 5.20%.

-

By application, commercial aircraft led the market with about 48.51% share in 2024, and military aircraft emerged as the fastest-growing segment with a CAGR of 5.83%.

-

By end-user, original equipment manufacturers (OEMs) held the largest share at approximately 68.35% in 2024, while the aftermarket segment experienced the fastest growth with a CAGR of 5.32%.

By Type, Nose Landing Gear Leads Market While Main Landing Gear Registers Fastest Growth

Nose Landing Gear (NLG) segment accounts for largest share of aircraft landing gear market as it bears the main weight of the airplane during takeoff/landing and keeps aircraft stable while on ground and it absorbs the forces during landing. It is this vast use in commercial and military aircrafts that has kept it at the top. The main landing gear (MLG) segment, on the other hand, is experiencing the highest growth due to the rising deliveries of narrow- and regional-body jets. This rapid growth is supported in part by high utilization on short-haul sectors and frequent replacement requirements.

By Platform, Fixed-Wing Dominate While Rotary Wing Shows Rapid Growth

Fixed-wing aircraft have clear dominance in global aircraft platform market at present because of its efficacy in long-distance travel, high-speed missions, and ability to carry large payload. These are the reasons why fixed-wing aircraft are indispensable for commercial and military services. On the other hand, the rotary-wing aircraft category is the fastest growing, based on its multi-purpose nature, capability of a vertical take-off and landing, and operational ability in cluttered environments.

By Application Industry, Commercial Aircraft Lead While Military Aircraft Registers Fastest Growth

The commercial aircrafts segment is the largest in the world aircrafts market because of high demand from airlines, fleet expansion and extensive usage for carrying passengers. It is continuing its domination with the demand for a cost effective, long-haul, high capacity plane in domestic and international routes. However, the military aircraft segment is poised to witness the most rapid growth as a result of modernization programmes, growing defense budgets and increasing requirement for multi-role platforms.

By End-User, Original Equipment Manufacturer (OEM) Lead While Aftermarket Grow Fastest

OEM (Original Equipment Manufacturer) segment, which leads the industry today, for the steady demand for the factory intended parts and services. To achieve vehicle performance and safety, the OEMs are providing high-quality add-ons and have a greater market availability. But the after-market segment is growing at a faster pace driven by more vehicles on the road, booming e-commerce business and a burgeoning culture of people getting cars customized.

Main Landing Gears Market Growth Drivers:

-

Rising Demand for Advanced, Lightweight, and Durable Aircraft Landing Gear Systems

The growth of Main Landing Gears Market is driven by rising air travel and aircraft deliveries globally. Aircraft operators are also looking for landing gear systems that are fuel efficient, lightweight and perform well to improve safety and reliability. Advances in materials and automatic technologies are also promoting market development. The need for aging fleets to be maintained, repaired and replaced also continues to drive the market.

Modern aircraft like Boeing 787 Dreamliner and Airbus A350 use titanium and high-strength steel alloys, reducing landing gear weight by 15–20% compared to older models.

Main Landing Gears Market Restraints:

-

High Manufacturing Costs and Stringent Regulatory Compliance Challenges

The market is hindered by the expensive cost of the production of advanced landing gear systems. The stringent safety and certification requirements create the complexity in the production and the approval timelines. Scarcity of labor, skilled staff and high price of materials are some things that can prevent you from scaling. There is also the uncertainty of the economy having an effect on airline investment, which would slow the implementation of new landing gear technology.

Main Landing Gears Market Opportunities:

-

Growing Regional and Business Aviation Driving Customized Landing Gear Solutions

There are opportunities for specializing on-the market between regional and business aircraft. Manufacturers, meanwhile, can concentrate on more glamor tasks like developing a new generation of short-haul and niche aircraft. Replans and upgrades are in great demand, to thus some kind of recurring revenues. Additionally, the technological systematization such as predictive maintenance or IoT-based monitoring widens product offerings.

Over 6,000 business and regional aircraft will enter heavy maintenance or upgrade programs by 2030, driving demand for modernized landing gear.

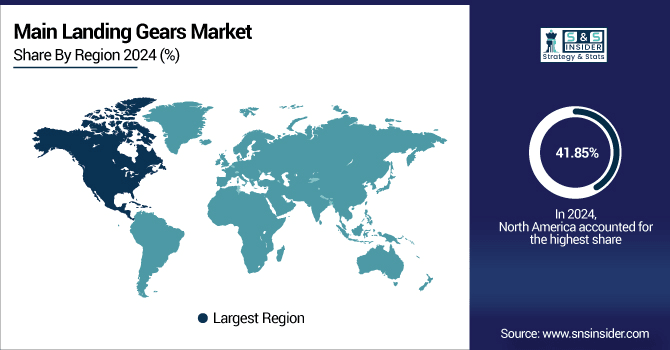

North America Main Landing Gears Market Insights

In 2024 North America dominated the Main Landing Gears Market and accounted for 41.85% of revenue share, this leadership is due to the strong presence of large aircraft manufacturers and developed aerospace infrastructure in the region. The modern landing gear system witnesses large adoption as strong demand triggered by commercial airlines and defense sectors. Progress of materials technology and automated production technologies reinforce the primacy of the region. In addition, continued fleet growth and maintenance will help to push the market forward.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Main Landing Gears Market Insights

The U.S. Main Landing Gears Market is experiencing a strong growth which is supported by increasing commercial aircraft deliveries and military modernization programs. Strengthening Material Quality and Lightweight Technologies Aerial landing system will be the Driving Market Growth Sections such as advanced properties of the materials and lightweight technology in the realm of landing gear is a clear indicator of the future of landing gear market.

Europe Main Landing Gears Market Insights

Europe is expected to witness the fastest growth in the Main Landing Gears Market over 2025-2032, with a projected CAGR of 5.65% due to rising deliveries of aircraft and advancements in the existing fleet. Increasing investments in regional as well as business aviation industries is propelling the demand for sophisticated landing gear systems. Advancements in the technology and use of lightweight, high-performance materials also serve value to the market. Defense and aerospace are also accounts for growing market trajectory in the region.

Germany Main Landing Gears Market Insights

The Germany Main Landing Gears Market is also relatively stable and will continue to grow over the next few years as a center of the European aerospace supply chain. Major suppliers, such as Liebherr-Aerospace, Airbus Germany, and Safran Germany, are leading the R&D work on innovations like lightweight materials, including special alloys and composite structures, and improved braking systems.

Asia-pacific Main Landing Gears Market Insights

In 2024, Asia-pacific emerged as a promising region in the Main Landing Gears Market, due to increasing number of low-cost airlines and improving air travel demand is accelerating the need for advanced landing gear systems. The region’s investment in aerospace manufacturing and infrastructure also benefit advanced technologies. Furthermore, fleet up-gradation programs and maintenance operations are generating ample market prospects.

China Main Landing Gears Market Insights

Demand for Advanced Landing Gear to Drive the Landing Gear Systems Market in the Coming Years The country’s several ambitious aircraft development programs and upgradation projects are driving the growth. The latest push is to develop fabrication and manufacturing prowess domestically to satisfy rising demands of work in the aerospace sector.

Latin America (LATAM) and Middle East & Africa (MEA) Main Landing Gears Market Insights

The Main Landing Gears Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions, due to the continuous rise in air passenger travel and slow expansion in fleet sizes. Spendings on infrastructural development and regional aviation are stimulating demand for advanced landing gear systems. The low capability of manufacturing and gradual adoption of state of the art technologies discipline the rate of growth.

Main Landing Gears Market Competitive Landscape:

Safran Landing Systems is a global leader in aircraft landing and braking systems and a wholly-owned subsidiary of Safran. It provides landing gear systems for commercial, regional, business and military aircraft. Its advanced research and development strength ensures the R&D of lightweight, rugged and high-performance system, improving the security and reliability of aviation. Safran also has an extensive global service network to provide full maintenance, repair and overhaul (MRO) coverage for its thrust reverser systems, a key to its market leadership.

-

In June 2025, Safran Landing Systems inaugurated a new state-of-the-art machining building and advanced surface treatment lines at its Molsheim facility in France. This expansion aims to enhance production capabilities and meet the growing demand for landing gear systems.

Collins Aerospace, an established player in the Main Landing Gears Market, is well-known for its complete landing gear systems that span commercial, military, and business aviation. The firm manufactures fully integrated landing gear solutions which also include structural assemblies, cockpit controls, brake systems, and actuation components. Their products are on the world’s foremost aircraft, like the Airbus A380, where their performance is challenging status quo.

-

In July 2025, Collins Aerospace's actuation and flight control business was acquired by Safran, a French aerospace company. This transaction, valued at $1.8 billion, is expected to generate approximately $50 million in annual cost synergies by 2028.

Liebherr-Aerospace is one of the leading suppliers of integrated systems, including design, manufacturing and in-service support. It serves civil and defense aviation markets and offers integrated systems comprising structural components, actuators, and control electronics. Present worldwide and with innovative capabilities, Liebherr-Aerospace guarantees the stability and efficiency of the landing gear throughout the aircraft lifecycle.

-

In February 2024, at the Singapore Airshow, Liebherr-Aerospace and Japan Airlines signed a long-term service contract for the overhaul of landing gear systems on J-Air’s Embraer E170/E190 fleet. This agreement extends their existing partnership and strengthens Liebherr's presence in the Asia-Pacific region.

Heroux-Devtek Inc., is an international company specializing in the design, development, manufacture and repair and overhaul of landing gear and actuation systems and components for the Aerospace market. The company is the world’s third largest landing gear manufacturer serving nearly 100% of the North American airlines, as well as a significant number of constructors for other types of commercial, regional and military aircraft, such as Bombardier and Safran.

-

In February 2025, Héroux-Devtek announced the completion of its acquisition by Platinum Equity, a global investment firm. This strategic move aims to enhance the company's growth prospects and operational capabilities in the aerospace sector.

Main Landing Gears Companies are:

-

Safran Landing Systems

-

Liebherr-Aerospace

-

Heroux-Devtek Inc.

-

Triumph Group Inc.

-

AAR Corp.

-

GKN Aerospace

-

Honeywell Aerospace

-

UTC Aerospace Systems

-

SPP Canada Aircraft Inc.

-

CIRCOR Aerospace Inc.

-

Mecaer Aviation Group

-

Aerospace Turbine Rotables Inc.

-

APPH Group

-

Whippany Actuation Systems

-

Hawker Pacific Aerospace

-

Eaton Corporation

-

Sumitomo Precision Products Co. Ltd.

-

Moog Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 5.41 Billion |

| Market Size by 2032 | USD 7.96 Billion |

| CAGR | CAGR of 4.99% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Nose Landing Gear and Main Landing Gear), • By Platform (Fixed-Wing and Rotary Wing) • By Application (Commercial Aircraft, Military Aircraft, Business Jet, Helicopters, and others) • By End-User (Original Equipment Manufacturer (OEM), Aftermarket) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Safran Landing Systems, Collins Aerospace, Héroux-Devtek Inc., Liebherr-Aerospace, Honeywell International Inc., Magellan Aerospace, AAR Corporation, CIRCOR Aerospace, Revima Group, Sumitomo Precision Products, Meggitt PLC, GKN Aerospace, SPP Canada Aircraft Inc., Triumph Group Inc., Alaris Aerospace, Hawker Pacific Aerospace, Lufthansa Technik AG, Diehl Aviation, Parker Hannifin, UTC Aerospace Systems. |