Veterinary Therapeutics Market Size and Overview:

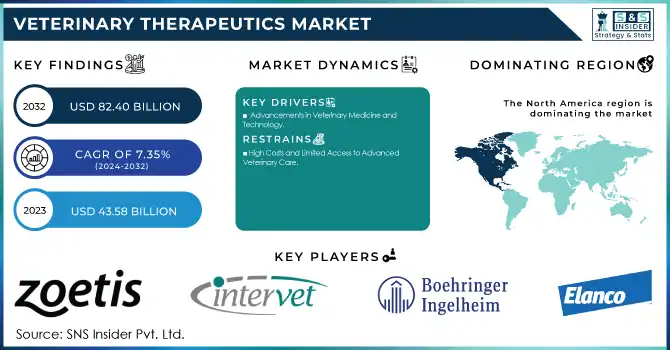

The Veterinary Therapeutics Market size was valued at USD 43.58 Billion in 2023 and is projected to reach USD 82.40 Billion By 2032, Growing at a CAGR of 7.35% from 2024 to 2032.

Get More Information on Veterinary Therapeutics Market - Request Sample Report

The veterinary therapeutics market is experiencing significant growth, driven by rising awareness of animal health, advancements in veterinary medicine, and the growing prevalence of animal diseases. The increasing trend of pet humanization has been a major catalyst, with pet owners prioritizing the health and well-being of their animals. According to the American Pet Products Association, nearly 67% of U.S. households own a pet, reflecting a growing investment in veterinary care. Pet owners are increasingly seeking advanced treatments, such as therapies for arthritis, diabetes, and cancer, demonstrating the rising demand for effective veterinary solutions.

The need for efficient disease management has gained prominence in the livestock sector due to its direct impact on productivity and food security. Diseases such as bovine mastitis in dairy cattle and avian influenza in poultry have emphasized the importance of vaccines and anti-infective treatments. The Food and Agriculture Organization estimates that livestock diseases cost the global agricultural industry billions annually, underscoring the critical role of veterinary therapeutics in mitigating losses.

Advancements in veterinary medicine have further propelled the market. Innovations such as monoclonal antibody therapies, now used to treat conditions like canine atopic dermatitis, highlight the progress in targeted treatments. Additionally, biologics like Zoetis' Cytopoint have gained traction for their efficacy in managing chronic conditions in pets. Controlled-release drug delivery systems, such as long-acting injectables, are improving treatment compliance and outcomes in companion animals and livestock.

The rise in zoonotic diseases has also driven awareness and demand for preventive veterinary care. According to the World Health Organization, over 60% of human infectious diseases are zoonotic, highlighting the interconnectedness of animal and human health. Vaccination programs, deworming initiatives, and regular veterinary check-ups are becoming standard practices for pet owners and livestock farmers alike, reflecting a proactive approach to animal health.

Veterinary Therapeutics Market Dynamics

Drivers

-

Advancements in Veterinary Medicine and Technology

The continuous innovation in veterinary medicine has led to the development of sophisticated treatments and diagnostic tools, transforming animal healthcare. Technologies such as CRISPR-based gene editing, monoclonal antibody therapies, and regenerative medicine are redefining the management of chronic and genetic conditions in animals. Diagnostic advancements, like rapid point-of-care testing and imaging solutions, enable early detection of diseases, improving treatment outcomes. Wearable devices, monitoring vital signs and activity levels in real-time, are gaining traction as they allow veterinarians to deliver precise and proactive care. These advancements not only enhance treatment efficacy but also boost the adoption of veterinary therapeutics globally.

-

Rising Prevalence of Chronic and Zoonotic Diseases

The increasing incidence of chronic conditions such as arthritis, obesity, and cardiovascular diseases in companion animals has intensified the demand for long-term therapeutic solutions. Simultaneously, the growing threat of zoonotic diseases like rabies, leptospirosis, and avian influenza underscores the importance of preventive care and vaccination programs. Governments and global health organizations actively support initiatives to curb these diseases through advanced veterinary treatments, contributing to market growth. The interdependence of human and animal health, driven by One Health initiatives, is further emphasizing the need for effective veterinary therapeutics to manage disease outbreaks.

-

Evolving Consumer Awareness and Behavioral Trends

Pet owners are increasingly treating their animals as family members, driving demand for high-quality, preventive, and therapeutic veterinary care. The shift toward premiumization in pet healthcare, including nutraceuticals, therapeutic diets, and wellness products, has opened new avenues in the market. Additionally, the rise of telemedicine and e-commerce platforms has made veterinary care more accessible, encouraging pet owners to invest in innovative treatments. Educational campaigns by organizations and veterinary service providers are also fostering awareness about routine health management and advanced therapies, further accelerating market growth.

Restraints

-

High Costs and Limited Access to Advanced Veterinary Care

The high cost of advanced veterinary treatments and therapeutics poses a significant restraint on market growth, particularly in developing and underprivileged regions. Sophisticated procedures like regenerative medicine, monoclonal antibody therapies, and advanced diagnostics often come with steep price tags, making them inaccessible to a large portion of pet owners and livestock farmers. Additionally, the lack of sufficient veterinary infrastructure, such as specialized clinics and trained professionals, further limits the availability of these advanced solutions. This challenge is particularly acute in rural areas where animal health services are sparse, leading to delays in treatment and disease management. Regulatory hurdles, such as lengthy approval processes for new veterinary drugs and biologics, also slow market progress. Addressing these barriers through cost-effective innovations and improved access to veterinary care will be critical for unlocking the market's full potential.

Veterinary Therapeutics Market Segmentation Analysis

By Product Type

Drugs held the largest share in 2023, accounting for 65.2% of the market. This dominance is attributed to the widespread use of pharmaceuticals for treating infectious diseases, chronic conditions, and pain management in animals. The increasing prevalence of conditions such as arthritis and obesity in companion animals and mastitis and respiratory infections in livestock has driven the demand for therapeutic drugs. Additionally, advancements in drug formulations, such as extended-release and combination therapies, have enhanced treatment efficacy and adoption rates.

Vaccines are expected to be the fastest-growing segment due to the rising emphasis on preventive healthcare for animals. The growing threat of zoonotic diseases, including rabies and avian influenza, has prompted increased vaccination rates among both livestock and companion animals. The global adoption of vaccination programs supported by government initiatives has further accelerated this segment's growth trajectory.

By Animal Type

Livestock animals accounted for the largest share of the market in 2023, with around 60% dominance. The primary driver is the high economic importance of livestock in agriculture-based economies. The need to ensure food security, maintain animal productivity, and prevent disease outbreaks in cattle, poultry, and swine has led to a substantial investment in veterinary therapeutics for livestock. Medicated feed additives, antibiotics, and vaccines are commonly used to address health challenges and ensure herd safety.

Companion animals are projected to grow at the fastest pace due to the pet humanization trend. The increasing willingness of pet owners to invest in premium veterinary treatments, coupled with the rising prevalence of chronic conditions like diabetes and cardiovascular diseases in pets, is driving this growth. The expansion of pet insurance coverage and the availability of innovative treatments further support the rapid growth of this segment.

Need any customization research on Veterinary Therapeutics Market - Enquiry Now

Regional Insights

North America emerged as the leading region in the veterinary therapeutics market in 2023, driven by advanced veterinary infrastructure, a high rate of pet ownership, and significant spending on animal healthcare. The United States, in particular, accounted for a substantial share, owing to strong government support for animal disease prevention, well-established livestock farming, and the rising popularity of premium pet care products. Additionally, the widespread adoption of pet insurance in the region has facilitated access to advanced veterinary treatments.

Europe held the second-largest market share, with countries like Germany, France, and the United Kingdom contributing significantly. Factors such as the increasing focus on preventive animal health and the region’s robust livestock industry have propelled demand for veterinary therapeutics. The European Union's stringent regulations for livestock health and food safety have further driven the adoption of vaccines and medicated feed additives.

Asia-Pacific is expected to be the fastest-growing region due to the rising livestock population, increasing disposable incomes, and growing awareness of animal health. Countries like China, India, and Japan are witnessing surges in both pet ownership and livestock farming, boosting demand for veterinary products. Government initiatives to improve animal healthcare infrastructure and combat zoonotic diseases are also key growth drivers in the region.

List of Key Players and Their Products in the Veterinary Therapeutics Market

-

Zoetis, Inc. - Apoquel (allergy treatment), Simparica Trio (flea, tick, and heartworm protection), Rimadyl (pain relief), Convenia (antibiotics), Vanguard vaccines.

-

Intervet Inc. (Merck Animal Health) - Nobivac vaccines (for dogs and cats), Banamine (pain relief), Safe-Guard (antiparasitic), Zuprevo (respiratory disease treatment), Revalor (growth implants).

-

Elanco Animal Health - Trifexis (flea, heartworm, intestinal parasite control), Galliprant (pain and inflammation relief), Cydectin (antiparasitic), Inteprity (poultry gut health management).

-

Merial (Acquired by Boehringer Ingelheim) - Frontline (flea and tick prevention), Heartgard (heartworm disease prevention), Purevax vaccines (cats).

-

Bayer AG (Now part of Elanco Animal Health) - Advantix (flea and tick treatment), Baytril (antibiotics), Profender (dewormer).

-

Boehringer Ingelheim International GmbH - NexGard (flea and tick control), Ingelvac (swine vaccines), Duramune (canine vaccines), Metacam (pain relief).

-

Ceva Santé Animale - Vectra (flea and tick treatment), Cevac vaccines (for poultry), Adaptil (stress management in dogs), Feliway (cat pheromone product).

-

Vetoquinol S.A. - Marbocyl (antibiotics), Clavaseptin (antimicrobial), Vetprofen (pain management), Zylkene (behavior support).

-

IDEXX Laboratories, Inc. - SNAP diagnostics (rapid tests for diseases like parvovirus and heartworm), Cornerstone software (veterinary practice management).

-

Virbac - Effipro (flea and tick protection), CaniLeish (leishmaniasis vaccine), Milpro (broad-spectrum dewormer).

-

Biogénesis Bagó SA - BioBos vaccines (for livestock), Suigen vaccines (swine health), MasterVet antibiotics.

-

Biovac Ltd. - Vaccines for poultry and livestock diseases like Newcastle disease and foot-and-mouth disease.

Recent Developments

In Jan 2025, Ceva, the fifth-largest animal health company globally, acquired biotech firm Scout Bio, a University of Pennsylvania spin-out specializing in monoclonal antibodies. This acquisition strengthens Ceva's capabilities in pet therapeutics.

In Sept 2024, CureLab Veterinary Inc. launched a Regulation D offering to raise USD 15 million to advance its innovative treatments for cancer and inflammatory diseases in pets. The fundraising initiative, open exclusively to accredited investors, aims to support the company's veterinary therapeutics development.

In July 2024, InVetx announced its upcoming acquisition by Dechra Pharmaceuticals, a global leader in animal health. This strategic move will enhance Dechra's portfolio with high-value monoclonal antibody therapeutics specifically for companion animals.

In May 2023, Scottish biotech company ILC Therapeutics entered into an R&D partnership with Dechra Pharmaceuticals PLC to advance the development of ILC’s Caniferon product for treating atopic dermatitis in dogs. Atopic dermatitis, the most common form of eczema in humans and canines, represents a significant segment of the global canine dermatology market, valued at over USD 1 billion.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 43.58 Billion |

| Market Size by 2032 | USD 82.40 Billion |

| CAGR | CAGR of 7.35% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

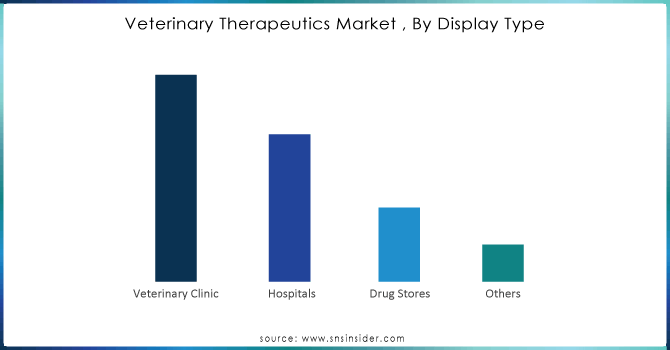

| Key Segments | • By Product Type [Vaccines Type, Drugs Type, Medicated Feed Additives] • By Animal Type [Livestock Animals, Companion Animal] • By Route Of Administration [Parenteral, Oral, Topical] • By End-User [Drug Stores, Veterinary Clinics, Veterinary Hospitals, Pharmacies] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Zoetis, Inc., Intervet Inc., Elanco Animal Health, Merial, Bayer AG, Boehringer Ingelheim International GmbH, Ceva Santé Animale, Vetoquinol S.A., IDEXX Laboratories, Inc., Virbac, Biogénesis Bagó SA, Biovac Ltd |

| Key Drivers | • Advancements in Veterinary Medicine and Technology • Rising Prevalence of Chronic and Zoonotic Diseases • Evolving Consumer Awareness and Behavioral Trends |

| Restraints | • High Costs and Limited Access to Advanced Veterinary Care |