Network Encryption Market Report Scope & Overview:

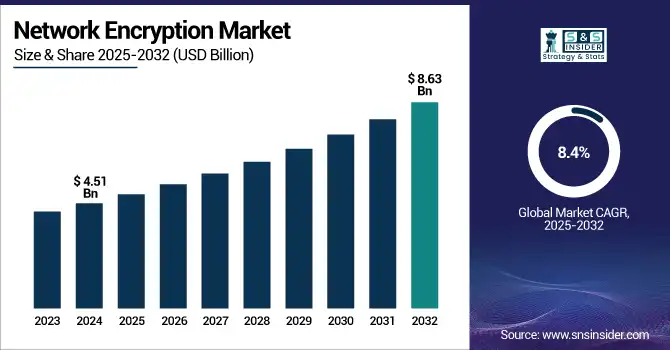

The Network Encryption Market was valued at USD 4.51 billion in 2024 and is projected to reach USD 8.63 billion by 2032, growing at a CAGR of 8.4% from 2025 to 2032.

To Get more information on Network Encryption Market - Request Free Sample Report

Growth in the market is attributed to the growing shift towards cloud-based solutions, increasing cyber threats, and need for secure transmission of data across various industries. Moreover, growing encryption technologies and the establishment of compliance regulations are expected to further boost the growth of the network encryption market in order to secure sensitive data.

For instance, the growing number of cyberattacks and data breaches globally is driving demand for encryption solutions. In 2023, over 60% of companies reported data breaches related to unsecured networks.

The U.S Network Encryption Market reached USD 1.09billion in 2024 and is expected to reach USD 1.81 billion by the end of 2032 at a CAGR of 10.76% from 2025 to 2032.

This massive growth is driven by the rising demand for secure data transfer due to increasing cyber threats, as well as for the adoption of cloud services in industries like finance, healthcare and government. Moreover, stringent regulations about data protection are pushing the need for network encryption solutions in the US.

Network Encryption Market Dyanmics

Drivers

-

Growing Demand for Eco-Friendly Products in Various Industries Boosts Growth.

Increasing requirement for safe and sustainable solutions among end-users is the key factor fuelling growth of the market. With businesses emphasizing the protection of sensitive data and stringent environmental regulations, the demand for encryption solutions has increased. Companies are implementing more secure and energy-efficient encryption technologies, as these technologies allow reasonable answers for collaboration within sustainability efforts with recent trends. The shift by companies towards implementing green technologies to support initiatives to reduce carbon footprints will continue to impact the uptake of advanced encryption methods.

In 2024, 87% of companies plan to increase their investment in encryption technologies, highlighting the growing emphasis on data security and compliance.

Restraints

-

Increasing Adoption of Cloud-Based Solutions Drives Growth

The cloud-based solution itself is one of the major contributor for the incresing growth of the market. Cloud computing changed the way businesses do business, which also led to the need for massive secure systems. Growing cloud storage (public & private), SaaS & enterprise applications has increased the need for network encryption to keep data save in storage as well as during transit. Including the rapid adoption of hybrid cloud encryption solutions from a plethora of enterprise giants like IBM illustrates the transition to cloud-based security models.

Challenges

-

Rising Data Breaches and Cyber Threats Restrain Growth

Complexity of data breaches and cyberattacks is key restraint. Even with increased use of encryption, next-gen cyber threats are moving quicker than security solutions. In addition, even if businesses implement advanced encryption systems currently, they require considerable time and money to manage them. However, continuous developments in encryption advancements seek to address these uncertainties and improve security.

Opportunities

-

Emerging Opportunities in Government and Compliance Regulations Drive Growth

With governments across the globe enforcing stricter compliance regulations related to data privacy and security, there are substantial opportunities for growth. As regulatory bodies like GDPR, CCPA, and HIPAA mandate stronger data protection protocols, businesses are increasingly required to implement encryption solutions to avoid penalties. Recent developments include the expansion of encrypted communication standards for government and healthcare sectors, as well as the increasing demand for encryption in IoT devices. This trend presents a significant opportunity for growth, as both public and private sectors prioritize secure data management and regulatory compliance.

Network Encryption Market Segment Analysis

By Component

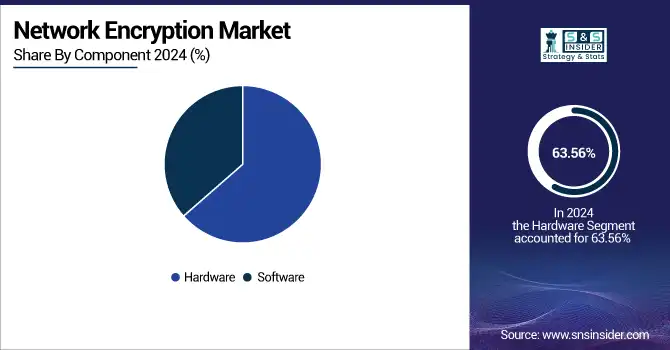

The hardware segment holds the largest share of 63.56% of the network encryption market due to the increasing demand for physical devices, such as encryption modules, that ensure high-security standards. Hardware encryption systems are also becoming more sophisticated with companies such as Cisco and Thales developing advanced systems for securing data, which is already abundant in number and is expected to keep increasing. These devices assist enterprises with securing data as it travels over various networks.

The solutions and services segment is growing at the fastest rate at 8.94% CAGR, which is propelled by an increase in the demand for encryption software and consulting services Solutions and Services IBM, Microsoft and others all have intelligent encryption solutions–cloud or on-premises encryption solutions. Encryption-as-a-service is growing in popularity as cloud adoption rapidly increases. This emerging trend has led to the broader software-based solutions adoption, which offer scalability, quicker deployment and ease of integration with legacy IT environments.

By Deployment Mode

Cloud-based segment dominates with market Share of 62.12% with an increasing number of organizations migrating their data management to the cloud environment. Growing reliance on cloud infrastructure for data security and compliance drives cloud-based encryption adoption. Cloud computing giants, such as Amazon Web Services (AWS) and Microsoft Azure, provide encryption-based cloud storage and secure data processing services. Easy data protection to meet stringent compliance standards and ensure security will boost network encryption market revenue from cloud services.

On-premises segment growing fastest with 9.8% CAGR , that need high levels of encryption solutions are booming as these owners are targeting on-premises encryption technologies. On-premise encryption hardware appears to be innovating as well, with companies such as Symantec and McAfee developing products targeted at industries that demand greater use and flow control of data. High-security requirements and control over data protection are fueling the growth of on-premises solutions.

By Organization Size

Large Enterprises segment is dominat with 60% of market Share due its larger contribution in IT services budgets and more complex data security needs. Such companies are also increasingly adopting end-to-end encryption across their networks. Big players like Cisco and Fortinet are going for big organisations with tall orders for high-throughput, scalable encryption systems that can handle global operations; Large enterprises also has a strong demand for encryption due to growing volume of data and regulatory compliance, which in turn accounts for a significant share of network encryption market.

The SME vertical is anticipated to witness the fastest growth with 8.83% CAGR, owing to the rising awareness regarding data safety and the growing availability of low-cost encryption solutions. Cloud-based encryption services from firms such as Thales and Symantec have also increased the accessibility of this technology for smaller businesses who do not have extensive infrastructure in place to deploy full encryption solutions. Increased digitalization and affordable cloud encryption solutions are driving growth in the SME segment.

By End User Industry

The BFSI segment holds the largest share with 32.31% Share due to the need to secure sensitive financial data. Banks use encryption in order for customer information to be safe, and it is used for regulatory compliance such as GDPR and PCI-DSS. To cater to the complex requirements of BFSI sector, IBM and Check Point Software are providing customized encryption solutions to the clients and leveraging network encryption market share.

Media and Entertainment Fastest Growing at 10.44% CAGR. Media and entertainment is the most developed segment, as encryption technologies are utilized to secure digital contents. As the popularity of streaming services and digital content distribution continues to grow, Microsoft and Verimatrix (now under MobiTV) are innovating protection systems that restrict piracy and unauthorized access. The growing digital content distribution and piracy concerns drive encryption adoption in media and entertainment

Regional Analysis

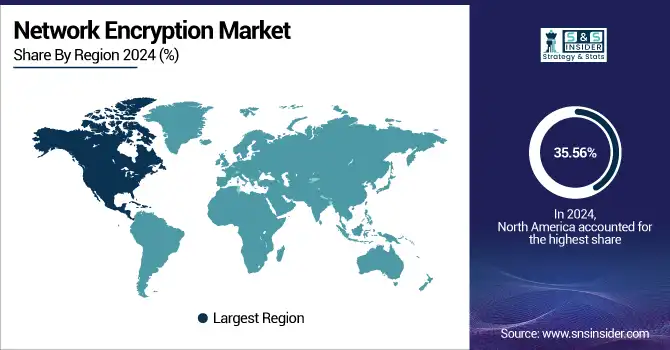

North America dominated the Network Encryption Market in 2024, with a share of around 35.56% of the total revenue worldwide. North America is a key region owing to the technological advancement, implementation of stringent regulations such as CCPA and HIPAA in the U.S and high demand for secure data management for enterprise solutions in the region. The growth of the regional market is mainly driven by the cybersecurity worries in dominated sectors such as finance and healthcare.

The United States has the largest market for network encryption owing to the excellent technology infrastructure, strict cybersecurity regulations, and high demand for encryption solutions in key industries such as finance, government, and healthcare.

Asia Pacific is expected to expand at the fastest CAGR of 9.45% from 2024 to 2032 has rapidly increased its digital transformation which creates new opportunities but also higher cyber threats, enabling network encryption growth for the coming years. Encryption adoption is being pushed by fast-growing sectors such as finance and e-commerce and their need for safe data management.

China is the leading country in Asia Pacific region, benefitting from rapid technological development, ever-increasing cyber and data protection regulation, and large-scale investments into data protection, particularly in the financial services and e-commerce sectors.

The network encryption market is well-being controlled by Europe owing to problems protection regulations (GDPR). There is a high demand for encryption solutions across various industries, including finance, healthcare, and government, due to the need for data security and compliance requirements.

Germany leads the European market. Demand for encryption solutions is driven by a widespread need for secure data management across sectors such as financial, healthcare, and manufacturing.

In the Middle East & Africa region, demand forthe network encryption market is expected to grow because ofcertain technological initiatives in the U.A.E. and the need fordata protection in banking, government, and healthcare sectors. The Latin American market is also growing due to digitisation and rising cybersecurity concerns particularly in the fintech and healthcare sectors leading to greater demand for encryption.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

The major key players for Network Encryption Market are, Rohde & Schwarz Cybersecurity GmbH Cisco Systems, Inc., IBM Corporation, Juniper Networks, Inc., Thales Group, Broadcom Inc. (Symantec), McAfee, LLC, Fortinet, Inc., Raytheon Technologies Corporation, Atos SE, Rohde & Schwarz Cybersecurity GmbH and others.

Recent Developments

-

In August 2024, Juniper Networks invested in Quantum Bridge Technologies to integrate quantum-safe networking solutions, enhancing its AI-Native Networking platform with DSKE technology for future-proofed security.

-

In October 2024, Juniper Networks launched its Secure AI-Native Edge solution, integrating network and security operations for simplified management and enhanced secure user experiences across environments.

-

In November 2024, Cisco and LTIMindtree expanded their partnership to deliver next-generation SASE solutions, enhancing security and IT management for 80,000 hybrid workers.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 4.51 Billion |

| Market Size by 2032 | USD 8.63 Billion |

| CAGR | CAGR of 8.4% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Component (Hardware, Solutions and Services) •By Deployment Mode (Cloud-based, On-premises) •By Organization Size (Small and Medium-sized Enterprises (SMEs), Large Enterprises) •By End Use Industry (Telecom and IT, BFSI, Government, Media and Entertainment, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Rohde & Schwarz Cybersecurity GmbH Cisco Systems, Inc., IBM Corporation, Juniper Networks, Inc., Thales Group, Broadcom Inc. (Symantec), McAfee, LLC, Fortinet, Inc., Raytheon Technologies Corporation, Atos SE, Rohde & Schwarz Cybersecurity GmbH and others. |