Network Security Firewall Market Report Scope & Overview:

The Network Security Firewall Market was valued at USD 6.47 billion in 2023 and is expected to reach USD 33.46 billion by 2032, growing at a CAGR of 20.09% from 2024-2032.

Get more information on Network Security Firewall Market - Request Free Sample Report

The network security firewall market has seen rapid growth because businesses are being increasingly faced with sophisticated cyberattacks, making them focus on strong cybersecurity solutions. In 2024, cybercrime is estimated to cost the world USD 9.5 trillion USD, which is a dire need for proper security measures. This is closely linked to the increased reliance on digital infrastructure across various industries, amplifying the need for effective firewalls to protect sensitive data. For example, hackers exploited a critical vulnerability in Fortinet's FortiGate firewalls, tracked as CVE-2024-55591, in January 2025, breaching corporate networks, underlining the need for advanced firewall solutions. With cloud-based services from companies and adoption of more remote work models, the attack surface continues to grow, with advanced firewalls required for network security. Additionally, the Internet of Things integrated into business also increases vulnerability, making strong firewall defenses even more important in protecting the growing digital ecosystem.

As an organization continues to face security challenges and manage different patterns of traffic across its hybrid IT environment, it would require more firewalls in the coming years. In fact, in October 2024, Tata Communications collaborated with Palo Alto Networks to fortify the enterprise's cyber defenses through enhanced networking and cloud security as a direct result of growing exigencies for strong defenses. This shift to cloud infrastructure and proliferation of mobile devices in the workplace is further pushing the demand for firewalls that can protect both traditional and mobile networks. With cyber threats getting more sophisticated, businesses are embracing next-generation firewalls that do more than just provide perimeter protection, incorporating features such as intrusion prevention and application control. It's a move towards more complex firewall systems to remain ahead of more evasive attacks and maintain continued protection on all platforms.

The network security firewall market is highly destined to expand, especially in regions experiencing rapid digital transformation. With the introduction of 5G technology, new network vulnerabilities will emerge to put a challenge and create an opportunity for advance firewall solutions for next-generation connectivity. Increasing use of AI and machine learning in firewall solutions, vendors with scalable and adaptive systems are likely to have a higher market share. In addition, growing regulatory requirements in the global sphere will make companies implement sophisticated firewalls, accelerating the market and creating further scopes for innovation.

Market Dynamics

Drivers

-

Escalating Cybersecurity Threats Fuel the Growing Demand for Network Security Firewalls

As cyberattacks continue to intensify, businesses are increasingly vulnerable to sophisticated threats such as ransomware, malware, and DDoS attacks. These rising security risks have made it imperative for organizations to strengthen their defense mechanisms, driving significant demand for advanced network security firewalls. Firewalls play a critical role in preventing unauthorized access, blocking malicious traffic, and ensuring network integrity. With cybercriminals continuously evolving their tactics, businesses are turning to more robust and sophisticated firewall solutions to safeguard sensitive data and critical infrastructure. The urgency to protect against these evolving threats is pushing the adoption of next-generation firewalls equipped with AI-driven threat detection, intrusion prevention, and real-time monitoring capabilities. As a result, the demand for comprehensive firewall solutions is expected to grow significantly, supporting the expansion of the network security firewall market.

-

The Rise of Advanced Threat Protection Capabilities Boosts Demand for Next-Generation Firewalls

As cyber threats become increasingly sophisticated, the demand for firewalls equipped with advanced threat protection features has surged. Firewalls that incorporate intrusion detection/prevention systems, deep packet inspection, and AI-powered threat intelligence are offering businesses a more comprehensive defense against malicious attacks. These advanced firewalls are capable of detecting and mitigating complex threats in real-time, identifying potential vulnerabilities, and proactively blocking suspicious activities. With the growing complexity of cyberattacks, traditional firewalls are no longer sufficient, and organizations are turning to next-generation solutions that offer enhanced visibility and control over network traffic. The integration of AI and machine learning algorithms helps firewalls evolve and adapt to emerging threats, further solidifying their role as a critical component in enterprise network security. This shift towards advanced threat protection is a key driver of growth in the network security firewall market.

Restraints

-

High Costs of Advanced Firewall Solutions Limit Adoption Among SMBs, Hindering Market Growth

The high cost of next-generation firewall solutions, equipped with advanced features such as AI-powered threat detection, deep packet inspection, and intrusion prevention, presents a significant restraint for the network security firewall market. These sophisticated solutions, while offering robust protection, come with a steep price tag that may be out of reach for small and medium-sized businesses. As many SMBs operate with limited budgets, the financial burden of purchasing and maintaining these advanced firewalls can hinder their adoption. Additionally, the cost of ongoing updates, system management, and specialized personnel for maintenance further escalates the total cost of ownership. As a result, the market growth is constrained, as these businesses may opt for more affordable, traditional firewalls that lack the advanced security features, potentially leaving them more vulnerable to emerging threats.

-

Complex Implementation and Management of Advanced Firewalls Deter Broader Market Adoption

Advanced firewall solutions often require specialized expertise for configuration, maintenance, and monitoring, creating a significant barrier to adoption. The intricate setup process, coupled with the need for continuous updates and real-time threat management, can overwhelm IT teams, particularly in organizations with limited cybersecurity resources. Smaller businesses, in particular, struggle to allocate the skilled personnel required to manage these systems effectively. The global shortage of cybersecurity professionals further exacerbates this issue, making it difficult for organizations to maintain optimal firewall performance. Additionally, the operational complexity of these systems can lead to inefficiencies, increased costs, and delayed deployment. As a result, many businesses opt for simpler, less sophisticated security solutions, limiting the adoption of advanced firewalls and constraining market growth.

Segment Analysis

By Solution

In 2023, the SMS Firewall segment held the largest revenue share of approximately 56% in the Network Security Firewall Market due to the surge in global mobile messaging traffic and the rising threats of SMS-based fraud, such as phishing and smishing. Organizations prioritized the implementation of SMS firewalls to safeguard users against these risks while ensuring compliance with data protection regulations. Additionally, the widespread adoption of A2P messaging across industries like banking, e-commerce, and healthcare further cemented the dominance of SMS firewalls, as businesses relied on secure and reliable communication channels.

The Signaling Firewall segment is projected to grow at the fastest CAGR of approximately 21.60% from 2024 to 2032, driven by the increasing sophistication of signaling attacks targeting telecom networks. With the advent of 5G and IoT technologies, the volume and complexity of signaling traffic have surged, creating an urgent need for advanced security solutions to mitigate vulnerabilities. Furthermore, regulatory bodies and industry standards are mandating stricter signaling security protocols, compelling network operators to invest in signaling firewalls to protect their infrastructure and maintain trust in their services.

By Services

In 2023, the Managed Services segment accounted for the largest revenue share of approximately 55% in the Network Security Firewall Market, driven by the increasing reliance on outsourced expertise for comprehensive network protection. Businesses prioritized managed services to address the growing complexity of cybersecurity threats while minimizing the burden on internal IT teams. The scalability, cost-effectiveness, and continuous monitoring provided by managed service providers made them an essential choice for organizations across industries seeking robust and efficient security solutions.

The Professional Services segment is expected to grow the fastest CAGR of 21.36% from 2024 to 2032, fueled by the rising demand for tailored cybersecurity strategies. With the rapid adoption of advanced technologies such as 5G, IoT, and cloud computing, businesses require specialized consulting, implementation, and training services to address evolving security challenges. Additionally, heightened regulatory compliance requirements and the need for in-depth threat assessments are prompting organizations to engage professional services to fortify their security frameworks.

By Type

In 2023, the Next-Generation Firewall segment led the Network Security Firewall Market with a revenue share of approximately 44%, owing to its advanced capabilities in addressing modern security challenges. NGFWs integrate traditional firewall functionalities with features like application awareness, intrusion prevention, and real-time threat intelligence, making them indispensable for enterprises combating sophisticated cyberattacks. Their widespread adoption across industries stemmed from the need for comprehensive, multi-layered defense systems capable of protecting increasingly complex IT infrastructures.

The Unified Threat Management segment is expected to grow at the fastest CAGR of approximately 21.38% from 2024 to 2032, as businesses seek cost-effective, all-in-one security solutions. The UTM approach combines multiple security functions, including firewalls, intrusion detection, and anti-malware, into a single platform, appealing to small and medium-sized enterprise with limited budgets and IT resources. Additionally, the rising adoption of remote work and hybrid models has amplified the demand for simplified yet robust network protection.

By Deployment Type

In 2023, the Cloud segment led the Network Security Firewall Market with a dominant revenue share of approximately 55%, driven by the widespread adoption of cloud-based solutions across industries. Businesses increasingly relied on cloud-native firewalls to secure dynamic and scalable cloud environments against evolving cyber threats. The cost efficiency, flexibility, and seamless integration of these solutions with modern IT infrastructures further propelled their popularity, particularly among enterprises embracing digital transformation.

The Network Function Virtualization segment is expected to grow at the fastest CAGR of approximately 22.24% from 2024 to 2032, fueled by the rising demand for agile and cost-effective network solutions. NFV enables the virtualization of network services, reducing the need for costly hardware while offering scalability and ease of deployment. As 5G networks and IoT ecosystems expand, organizations are increasingly adopting NFV-based firewalls to address complex security needs in highly dynamic and distributed environments.

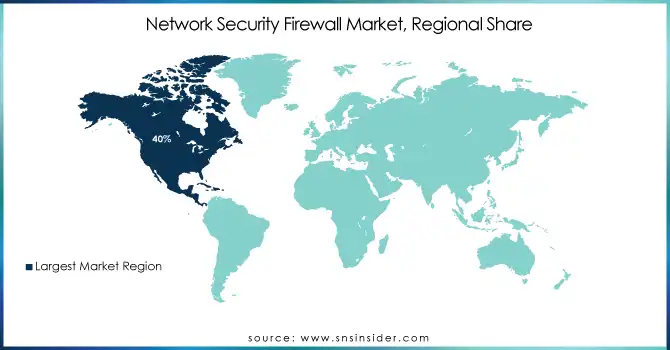

Regional Analysis

In 2023, North America led the Network Security Firewall Market with a revenue share of approximately 40%, driven by the region’s advanced technological infrastructure and early adoption of cutting-edge cybersecurity solutions. The presence of major industry players, coupled with increasing investments in network security to counter growing cyber threats, solidified its market dominance. Additionally, stringent regulatory frameworks and high awareness of data protection among businesses further boosted demand for network security firewalls in the region.

The Asia Pacific region is expected to grow at the fastest CAGR of approximately 22.43% from 2024 to 2032, fueled by rapid digitalization and the expansion of IT and telecom sectors. The proliferation of mobile devices, increasing internet penetration, and the rising adoption of cloud-based services have heightened the need for robust network security solutions. Furthermore, government initiatives to strengthen cybersecurity frameworks and the growing focus on securing critical infrastructure are key factors driving the region’s impressive growth trajectory.

Need any customization research on Network Security Firewall Market - Enquiry Now

Key Players

-

Orange (Orange Cyberdefense, Orange Business Services)

-

Amd Telecom S.A. (Amd Firewall, Secure Sms Gateway)

-

Adaptivemobile Security (Adaptive Mobile Firewall, Secure Firewall Solutions)

-

Sinch (Sinch Security Platform, Messaging Security)

-

Anam Technologies (Anam Firewall Solution, Global Sms Firewall)

-

Cellusys (Sms Firewall, Cellusys Security Gateway)

-

Netnumber Inc (Numi Firewall, Netnumber Global Security)

-

Openmind Networks (Openmind Firewall, Security Intelligence Platform)

-

Mobileum (Mobileum Firewall, Security Analytics)

-

Sap SE (Sap Network Security, Sap Cloud Security)

-

Hewlett Packard Enterprise (Hpe Network Security, Aruba Clearpass)

-

Symsoft (Symsoft Firewall, Symsoft Security Solutions)

-

Tata Communications (Tata Security Solutions, Firewall As A Service)

-

Infobi (Infosec Firewall, Mobile Security Suite)

-

Cisco Systems Inc. (Cisco Asa Firewall, Cisco Firepower)

-

Barracuda Networks, Inc. (Barracuda Web Application Firewall, Barracuda Nextgen Firewall)

-

Check Point Solution Technologies Ltd. (Check Point Ngfw, Check Point Cloudguard)

-

Juniper Networks, Inc. (Juniper Srx Firewall, Juniper Firefly Perimeter)

-

Cato Networks Ltd. (Cato Cloud Firewall, Cato Sd-Wan)

-

Palo Alto Networks (Palo Alto Ngfw, Palo Alto Prisma Cloud)

-

Fortinet, Inc. (Fortigate Firewall, Fortiweb Waf)

-

Force Point Llc (Forcepoint Next-Gen Firewall, Forcepoint Data Security)

-

Sophos Ltd. (Sophos Xg Firewall, Sophos Utm)

-

Zscaler, Inc. (Zscaler Internet Access, Zscaler Private Access)

-

Watchguard Technologies, Inc. (Watchguard Firebox, Watchguard Cloud Security)

-

Sonicwall (Sonicwall Tz Firewall, Sonicwall Nsa Firewall)

Recent Developments:

-

In October 2024, Cisco released an urgent fix for a vulnerability in its ASA and FTD software, actively exploited in cyberattacks, potentially causing denial-of-service (DoS) conditions on VPN services. The flaw impacts Cisco's Remote Access VPN service, exposing networks to risk.

-

In November 2024, Palo Alto Networks disputed findings by Shadowserver, which reported that 2,000 of its firewalls were compromised due to a zero-day vulnerability. While Palo Alto acknowledged the issue and issued a patch, they downplayed the scope, stating that fewer firewalls were affected.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 6.47 Billion |

| Market Size by 2032 | USD 33.46 Billion |

| CAGR | CAGR of 20.09% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Stateful Packet Inspection, Next Generation Firewall, Packet Filtering, Unified Threat Management) • By Solution (Signaling Firewall, SMS Firewall) • By Services (Professional Services, Managed Services) • By Deployment Type (On-Premises, Cloud, Network Function Virtualization) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ORANGE, AMD TELECOM S.A., ADAPTIVEMOBILE SECURITY, SINCH, ANAM TECHNOLOGIES, CELLUSYS, NETNUMBER INC, OPENMIND NETWORKS, MOBILEUM, SAP SE, HEWLETT PACKARD ENTERPRISE, SYMSoft, TATA COMMUNICATIONS, INFObi, CISCO SYSTEMS INC., BARRACUDA NETWORKS, INC., CHECK POINT SOLUTION TECHNOLOGIES LTD., JUNIPER NETWORKS, INC., CATO NETWORKS LTD., PALO ALTO NETWORKS, FORTINET, INC., FORCE POINT LLC, SOPHOS LTD., ZSCALER, INC., WATCHGUARD TECHNOLOGIES, INC., SONICWALL. |

| Key Drivers | • Escalating Cybersecurity Threats Fuel the Growing Demand for Network Security Firewalls • The Rise of Advanced Threat Protection Capabilities Boosts Demand for Next-Generation Firewalls |

| RESTRAINTS | • High Costs of Advanced Firewall Solutions Limit Adoption Among SMBs, Hindering Market Growth • Complex Implementation and Management of Advanced Firewalls Deter Broader Market Adoption |