Neurovascular Devices Market Report Scope & Overview:

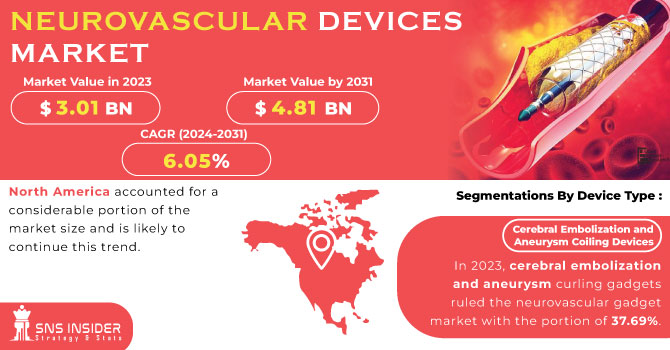

The Neurovascular Devices Market Size was valued at USD 3.35 Billion in 2023 and is expected to reach USD 6.60 Billion by 2032 and grow at a CAGR of 7.85% over the forecast period 2024-2032. This report analyzes the increased incidence and prevalence of neurovascular conditions, increasing demand for enhanced treatment options. The research provides insight into adoption and usage of neurovascular devices by various geographic regions, due to changing healthcare infrastructure and the introduction of emerging technologies. The design of neurovascular devices is changing with advancements in innovation through AI integration, robotics, and digital health integrations, all changing treatment techniques and enhancing outcomes. Further, the report examines healthcare expenditure on neurovascular interventions, comparing government, commercial, private, and out-of-pocket contributions. The clinical trials environment and regulatory approvals are similarly examined, with light shed on the developing pipeline of neurovascular devices. The study also compares treatment success rates, highlighting the increasing importance of minimally invasive techniques in optimizing patient recovery and long-term outcomes.

Get more information on Neurovascular Devices Market - Request Sample Report

Market Dynamics

Drivers

-

The neurovascular devices market is primarily driven by the rising prevalence of stroke and other neurovascular disorders.

The World Stroke Organization reported that more than 12 million individuals experience a stroke each year, and it is a top contributor to death and disability globally. The increasing number of older people also propels demand since elderly people are more susceptible to neurovascular disorders. Advances in technology, including AI-based imaging, robotic surgery, and next-generation flow diverters, are enhancing patient care and fueling the market. Moreover, growth in the number of minimally invasive procedures that decrease hospital stay and complications is driving demand for neurovascular products such as stent retrievers and embolization coils. Government policies and increased healthcare investment are also fuelling market expansion, especially within developing economies as stroke treatment infrastructure is growing there. In addition, increasing knowledge regarding early diagnosis and timely intervention, along with the increase in specialized stroke centers, is driving the adoption of neurovascular treatment solutions. Firms are also emphasizing product innovation and clinical trials, resulting in new approvals and new indications for current devices. For instance, Medtronic's Pipeline Flex Embolization Device has been increasingly adopted due to its efficacy in treating wide-neck and large aneurysms.

Restraints

-

The neurovascular devices market faces several restraints, including high costs associated with neurovascular interventions.

Advanced tools like flow diverters, thrombectomy devices, and embolization coils are costly and hence restricted by their availability, especially in economically weaker areas. Additionally, the need for expert professionals to undertake neurovascular treatments hinders market growth, given that most health centers do not have skilled neurosurgeons and interventional neuroradiologists. Robust regulatory approval is also challenging, with regulatory bodies like the FDA and CE marking authorities mandating large volumes of clinical information prior to approving devices. This leads to longer development times and higher compliance expenses for manufacturers. Furthermore, complications like hemorrhage, vessel perforation, and device migration risk can discourage adoption, especially in risk-averse care environments. Reimbursement strategies also differ geographically, with minimal insurance coverage for neurovascular procedures in some countries, further limiting market access. The absence of uniform treatment protocols and different regulatory environments in various markets pose additional challenges to companies seeking global expansion. For instance, whereas North America and Europe possess a clearly defined approval process, emerging markets experience inconsistent regulatory policies, causing product launches to be delayed. These issues combined affect the speed at which neurovascular innovations become available to patients.

Opportunities

-

The neurovascular devices market presents significant opportunities, particularly in emerging economies where healthcare infrastructure is improving.

Nations such as China, India, and Brazil are seeing more investments in stroke care centers and neurovascular treatment facilities, generating a need for sophisticated devices. The advent of artificial intelligence (AI) in neurovascular imaging is also a significant opportunity, with AI-based platforms facilitating quicker and more precise stroke diagnosis, resulting in improved patient outcomes. Viz.ai is already incorporating AI in stroke triage, reducing diagnosis-to-treatment times dramatically. In addition, the introduction of bioresorbable stents and flow diverters offers an exciting future expansion opportunity as such technologies lower late-term complications involved with permanent implantation. Robotics-assisted neurovascular intervention gains popularity with groups like Corindus (which is a company of Siemens Healthineers) and is shaping the industry even further by way of higher levels of precision while lowering the chances of procedure failures. Furthermore, government and personal investment in the research of neurovascular conditions allows for increased innovations. Increased awareness programs regarding stroke prevention and care are enhancing the rate of early diagnosis, further propelling demand for neurovascular devices. Growth in home healthcare with portable monitoring systems is another area of growth potential, as stroke survivors need long-term care and rehabilitation solutions.

Challenges

-

One of the biggest challenges in the neurovascular devices market is the complexity of neurovascular procedures, which require high precision and specialized training.

Differing from other intervention therapies, neurovascular interventions deal with sensitive structures, and thus the risk of procedural complications like vessel injury, thrombosis, and restenosis is higher. The second major challenge is limited access in rural and underdeveloped areas where healthcare facilities are not well developed and specialized stroke centers are not available. Advanced facilities and experts to undertake neurovascular procedures are not available in many developing nations, and therefore, treatment is delayed or not provided at all. Supply chain interruptions and excessive reliance on raw materials in device production are also issues, especially in the context of worldwide crises such as the COVID-19 pandemic that exposed weaknesses in the medical device supply chain. In addition, slow technology take-up as a result of resistance from physicians and insufficient training retards the market. With all the technology developed, there are still hospitals that depend on conventional treatment alternatives, keeping from widespread use newer, better neurovascular devices. Cybersecurity threats in AI-based neurovascular imaging and robotic systems are another challenge, with possible data leakage or system crashes potentially affecting patient outcomes. Overcoming these challenges involves investment in training programs, better global healthcare infrastructure, and regulatory simplification to facilitate wider use of neurovascular solutions.

Segmentation Analysis

By Device

In 2023, Cerebral Embolization and Aneurysm Coiling Devices accounted for the largest market share of 29.02% in the neurovascular devices market. High demand for the devices is majorly attributed to their high efficacy in treating aneurysms and averting hemorrhagic strokes. Their minimal invasiveness, along with innovation in bioactive and hydrogel-coated coils, has resulted in the high demand across developed and developing economies.

The Neurothrombectomy Devices segment will be the highest-growing, driven by the increasing incidence of ischemic strokes and the trend towards mechanical thrombectomy procedures. Growing awareness among medical professionals and positive clinical results have contributed considerably to the adoption of neurothrombectomy devices, particularly in aging populations and countries with high rates of stroke.

By Therapeutic Application

Stroke became the most therapeutic application segment in 2023 with a 51.6% market share. The immense burden of stroke due to age-old factors of growing populations, lifestyles, and rising rates of hypertension has driven the demand for neurovascular interventions. The expanding usage of endovascular thrombectomy techniques and enhanced emergency stroke care infrastructure further bolstered the segment's stronghold.

The Cerebral Aneurysm segment is expected to grow at the highest rate because of the rising number of diagnosed cases, improvement in imaging technologies, and greater adoption of minimally invasive coiling and flow diversion procedures. The increased emphasis on the early detection and treatment of unruptured aneurysms is also driving the demand for neurovascular devices in this segment.

By Size (in Inches)

The products with a size of 0.021" dominated the market in 2023, taking up 24.08% of the entire market share. Their popularity stems from their ideal balance of flexibility and support, which makes them universally applicable across different neurovascular procedures, especially in embolization and thrombectomy. The devices are favored because they are compatible with a wide spectrum of microcatheters and stents.

The Others segment, encompassing novel sizes for highly specialized procedures, will expand at the fastest rate. Ongoing innovation in microcatheter and guidewire technology, combined with greater customization due to complex neurovascular anatomies, are fueling the growth of this segment.

By End-use

Hospitals were the largest end-use category in 2023, holding 67.3% market share. Hospital-based neurovascular care is preferred due to the presence of high-end imaging infrastructure, trained neurosurgeons, and a greater number of neurointerventional procedures carried out within hospitals. Furthermore, having hybrid operating rooms and stroke centers incorporated within hospitals has made hospitals even more robust in the market.

The Others category, which consists of ambulatory surgery centers and specialty neurovascular treatment centers, is projected to grow most rapidly. The growth of outpatient neurovascular procedures, along with cost containment and reduced lengths of stay, is increasingly rendering these off-site healthcare settings more appealing for providers and patients alike.

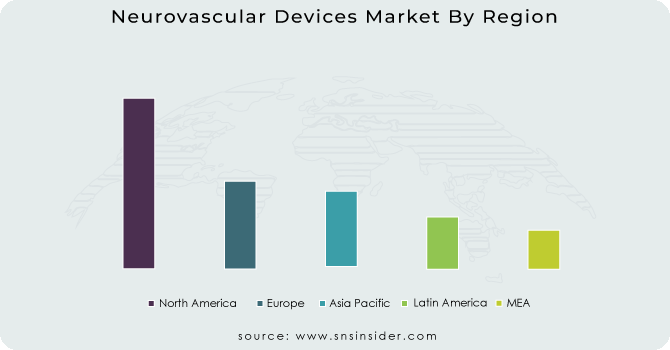

Regional Analysis

North America led the neurovascular devices market in 2023 with a market share of 24.3%. The dominance of the region is due to a well-developed healthcare infrastructure, high incidence of neurovascular diseases like stroke and aneurysms, and high adoption of advanced medical technology. The availability of major market players, regular product launches, and rising government initiatives for stroke management have also consolidated the region's leadership. Also, the increasing geriatric population, coupled with supportive reimbursement policies, has resulted in greater adoption of neurovascular devices in the United States and Canada. Growing research and development investments, as well as a robust network of specialized neurosurgical centers, are constantly fueling the growth of the market in the region.

Asia-Pacific is expected to grow at the highest rate, spurred by enhancing healthcare infrastructure, rising awareness of neurovascular disorders, and a rapidly aging population. China, India, and Japan are seeing an explosion in the number of strokes caused by lifestyle modifications and greater occurrences of hypertension and diabetes. Moreover, efforts by the government to improve stroke care centers and the increasing presence of neurovascular devices in the emerging markets are driving market growth. The number of specialized neurosurgical centers and medical tourism in the region are also fueling its high growth rate.

Need any customization research on Neurovascular Devices Market - Enquiry Now

Key Players and Their Neurovascular Device Offerings

-

Medtronic – Pipeline Flex Embolization Device, Solitaire X Revascularization Device, React Catheters

-

Stryker Corporation – Trevo XP ProVue Retriever, Neuroform Atlas Stent System, Surpass Flow Diverter

-

Terumo Corporation – SOFIA Aspiration Catheter, WEB Aneurysm Embolization System, CoilAssist Detachment System

-

Penumbra, Inc. – Penumbra JET 7 Reperfusion Catheter, ACE Aspiration Catheter, Penumbra Coil 400

-

Johnson & Johnson Services, Inc. (Cerenovus) – EMBOTRAP III Revascularization Device, CODMAN Enterprise Stent, CERENOVUS Large Bore Catheters

-

Integra LifeSciences Corporation – Codman Neuro MicroCoils, Camino Intracranial Pressure Monitoring System

-

Acandis GmbH – Acandis NeuroSlider Microcatheter, Acandis Aperio Hybrid Stent

-

Spiegelberg GmbH & Co. KG – Spiegelberg ICP Monitoring Probes, Spiegelberg External Ventricular Drainage Systems

-

MicroPort Scientific Corporation – APOLLO Intracranial Stent, Tubridge Flow Diverter, Aspiration Catheter System

-

ZYLOX-TONBRIDGE MEDICAL TECHNOLOGY CO., LTD. – Neurohawk Thrombectomy Device, Fastunnel Microcatheter

Recent Developments

In Feb 2025, France-based healthcare investment firm Lauxera Capital Partners made a strategic investment in Acandis, a German neurovascular medical device company specializing in stroke prevention and treatment. This investment aims to support Acandis’ growth and innovation in the neurovascular sector.

In July 2024, Rapid Medical successfully completed its first neurovascular procedures in the USA after receiving FDA clearance for its Active Access Solution, DRIVEWIRE 24. The device features a deflectable tip, enhancing catheter and device navigation in neurovascular and peripheral vascular procedures.

| Report Attributes | Details |

| Market Size in 2023 | USD 3.35 billion |

| Market Size by 2032 | USD 6.60 billion |

| CAGR | CAGR of 7.85% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Device [Cerebral Embolization and aneurysm Coiling devices (Embolic Coils, Flow Diversion Coils, Liquid Embolic Agents), Cerebral Angioplasty and Stenting Systems (Carotid Artery Stents, Embolic Protection Systems), Neurothrombectomy Devices (Clot Retrieval Devices, Suction Devices, Vascular Snares), Support Devices (Micro catheters, Micro guidewires)] • By Therapeutic Application [Stroke, Cerebral Artery Stenosis, Cerebral Aneurysm (Aneurysmal Subarachnoid Hemorrhage, Others), Others] • By Size (in Inches) [0.027", 0.021", 0.071", 0.017", 0.019", 0.013", 0.058", 0.068", Others] • By End-use [Hospitals, Specialty Clinics, Others] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Medtronic, Stryker Corporation, Terumo Corporation, Penumbra, Inc., Johnson & Johnson Services, Inc. (Cerenovus), Integra LifeSciences Corporation, Acandis GmbH, Spiegelberg GmbH & Co. KG, MicroPort Scientific Corporation, ZYLOX-TONBRIDGE MEDICAL TECHNOLOGY CO., LTD. |