Stone Crushing Equipment Market Key Insights:

To Get More Information on Stone Crushing Equipment Market - Request Sample Report

The Stone Crushing Equipment Market size was valued at USD 6.20 Billion in 2023 and is now anticipated to grow to USD 12.40 Billion by 2032, displaying a compound annual growth rate (CAGR) of 8.01% during the forecast Period 2024 - 2032.

The stone crushing equipment market is witnessing a significant growth driven by increasing infrastructure development and urbanization. This equipment plays a vital role in processing materials like granite, limestone, and basalt into smaller sizes suitable for construction, road building, and mining operations. The demand for high-quality aggregates in construction projects, particularly in emerging economies, is propelling market expansion. Moreover, the rising construction of roads, bridges, and buildings to support global urbanization is contributing to the increased use of stone crushers. Technological advancements in stone crushing equipment, such as the integration of automated systems and advanced control systems, have led to improved efficiency, reduced downtime, and enhanced productivity. Manufacturers are focusing on developing more energy-efficient and cost-effective solutions to meet the growing demand for sustainable mining practices. Additionally, the adoption of mobile crushing units, which offer increased flexibility and ease of transport, is becoming more popular in the market.

The market is also benefiting from the rising emphasis on recycling and environmental sustainability. Stone-crushing equipment is increasingly being utilized in the recycling of construction and demolition waste, contributing to the reduction of waste going to landfills and promoting the reuse of materials. This trend aligns with global efforts to promote sustainable practices across industries. The demand for better productivity and lower operational costs has also driven the development of crushers with enhanced automation and precision. As a result, the stone crushing equipment market is expected to continue its upward trajectory, fueled by innovations, infrastructure development, and sustainability trends.

MARKET DYNAMICS

DRIVERS

- Rising construction and infrastructure activities drive the stone crushing equipment market.

With rapid urbanization, population growth, and increasing demand for residential and commercial spaces, there is a significant rise in the construction of roads, bridges, highways, and other infrastructure projects. These developments require large quantities of aggregates such as sand, gravel, and crushed stone, which in turn boosts the demand for stone crushing equipment. As countries across the globe invest in infrastructure to support economic growth and urban development, the stone crushing industry experiences growth as it plays a critical role in supplying essential materials for construction.

The trend of large-scale construction projects, especially in emerging economies, is driving the demand for advanced stone crushing machinery. Equipment manufacturers are innovating with technologies like mobile crushers and automated systems to meet the need for higher efficiency and productivity. Additionally, the rising emphasis on sustainable construction practices has led to innovations in crushing technology that reduce energy consumption and environmental impact. The increasing demand for crushed aggregates, combined with advancements in equipment design, indicates a strong growth trajectory for the stone crushing equipment market, particularly in regions focused on infrastructure development.

RESTRAIN

- The stone crushing industry faces significant challenges due to environmental concerns and regulations

The process of crushing stones generates large amounts of dust, noise, and particulate matter, contributing to air and noise pollution, which can adversely affect surrounding communities and ecosystems. This has led to stricter environmental regulations aimed at minimizing these impacts. Governments and regulatory bodies around the world have implemented guidelines and standards to limit emissions, dust levels, and noise pollution from crushing equipment, driving manufacturers to develop more eco-friendly solutions. For instance, modern stone crushers are being designed with advanced dust suppression systems, noise-reduction technologies, and improved energy efficiency to comply with environmental standards.

As these regulations tighten, operational costs for stone-crushing operators increase. They must invest in costly pollution control measures, such as dust filters and noise barriers, and adhere to frequent monitoring and compliance checks. However, these challenges have also spurred growth in the market for environmentally friendly and energy-efficient equipment, with rising demand for green technology. The adoption of mobile crushers, which can be deployed closer to construction sites, is also gaining traction as a sustainable alternative, reducing the need for transportation and its associated environmental impact.

KEY SEGMENTATION

By Type

The Jaw Crusher segment dominated with the market share of over 38% in 2023, due to its widespread application across various industries, particularly mining, construction, and quarrying. Jaw crushers are designed to handle large rocks and materials, making them ideal for primary crushing tasks where high efficiency and reliability are crucial. Their robust construction allows them to endure heavy-duty operations, offering long-term durability even under harsh working conditions. Additionally, jaw crushers are cost-effective, which makes them a preferred choice for many industries seeking both performance and value.

By Application

The Mining segment dominated with a market share of over 42% in 2023, primarily driven by the extensive demand for crushed stones and aggregates in mineral extraction processes. Stone crushing equipment is vital in breaking down large rocks and ores into smaller, usable sizes, enabling the extraction of valuable minerals like gold, coal, and iron. This equipment is used in both surface and underground mining operations to efficiently process materials for further refinement. As global industrialization continues and the need for raw materials increases, the mining industry remains a key driver of market growth. Additionally, the rising demand for construction aggregates, such as sand and gravel, further strengthens the position of the mining segment.

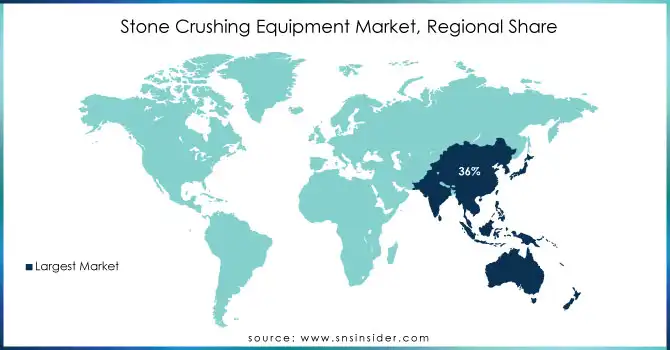

KEY REGIONAL ANALYSIS

The Asia-Pacific region dominated with the market share over 36% in 2023, primarily driven by rapid industrialization and urbanization in countries such as China and India. As these nations experience significant growth in their construction and infrastructure sectors, the demand for construction materials like crushed stones has surged. China and India, in particular, are undertaking large-scale infrastructure projects, including roads, bridges, and residential developments, fueling the need for stone crushing equipment. Additionally, the region benefits from an abundant supply of raw materials and low-cost labor, making it an attractive destination for manufacturers and investors.

The Middle East and Africa is the fastest-growing regions in the Stone Crushing Equipment Market, fueled by substantial investments in construction and mining activities. Countries like Saudi Arabia, the UAE, and South Africa are witnessing a boom in infrastructure projects, such as roads, railways, and residential developments. This growth is driving the demand for stone crushing equipment to meet the rising need for construction materials. As these nations continue to invest in large-scale projects, the demand for efficient and high-capacity stone crushers is expected to grow, making MEA a key market for stone crushing equipment.

Do You Need any Customization Research on Stone Crushing Equipment Market - Inquire Now

Some of the major key players of Stone Crushing Equipment Market

-

BUCY International (Stone Crushers, Grinders, Screening Equipment)

-

Sandvik AB (Jaw Crushers, Cone Crushers, Impact Crushers, Mobile Crushers)

-

Metso Oyj (HP Series Cone Crushers, Nordberg Jaw Crushers, Mobile Crushers)

-

Terex Corporation (Cone Crushers, Jaw Crushers, Impact Crushers, Mobile Crushers)

-

CNH Global N.V. (Tractors, Backhoe Loaders, Stone Crushers for Agricultural Use)

-

Komatsu Ltd. (Mobile Crushers, Jaw Crushers, Impact Crushers, Hydraulic Excavators)

-

Caterpillar Inc. (Track-Type Tractors, Crushers, Excavators)

-

Joy Global Inc. (Crushing Equipment, Crushers, Conveyors)

-

Kleemann GmbH (Mobile Crushers, Jaw Crushers, Impact Crushers, Screening Plants)

-

Hitachi Construction Machinery Co., Ltd. (Excavators, Crushers, Screeners)

-

McCloskey International (Mobile Crushers, Screening Equipment, Conveyors)

-

Atlas Copco (Jaw Crushers, Cone Crushers, Mobile Crushers)

-

Eagle Crusher Company, Inc. (Jaw Crushers, Impact Crushers, Cone Crushers)

-

Terex Finlay (Mobile Crushers, Screening Equipment, Vibrating Feeders)

-

Powerscreen (Mobile Crushers, Screening Equipment, Impact Crushers)

-

Shanghai Shibang Machinery Co., Ltd. (Jaw Crushers, Cone Crushers, Grinding Mills)

-

L&T Construction & Mining Machinery (Crushing Equipment, Mobile Crushers)

-

Astec Industries, Inc. (Jaw Crushers, Cone Crushers, Impact Crushers)

-

SANY Group (Excavators, Stone Crushers, Mobile Crushers)

-

Zhengzhou Yifan Machinery Co., Ltd. (Stone Crushers, Sand Making Machines, Mobile Crushers)

Suppliers are recognized for their (aggregate production, mining, recycling, and construction) Stone Crushing Equipment Market

-

Metso Outotec

-

Sandvik

-

Terex Corporation

-

Eagle Crusher Company

-

Astec Industries

-

McCloskey International

-

Terex Finlay

-

Kleemann

-

Volvo Construction Equipment

-

Powerscreen

Recent Development

-

In December 2024: Powerscreen Crushing & Screening, a provider of equipment for the aggregate and recycling industries, officially expanded its service area to Michigan, extending its reach beyond Indiana, Kentucky, Tennessee, Alabama, Mississippi, Kansas, and Missouri.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 6.20 Billion |

| Market Size by 2032 | USD 12.40 Billion |

| CAGR | CAGR of 8.01% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Jaw Crusher, Cone Crusher, Impact Crusher, Others) • By End Users (Mining, Quarrying, Recycling, Construction & Infrastructure, Others [Railways, Agricultural]) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BUCY International, Sandvik AB, Metso Oyj, Terex Corporation, CNH Global N.V., Komatsu Ltd., Caterpillar Inc., Joy Global Inc., Kleemann GmbH, Hitachi Construction Machinery Co., Ltd., McCloskey International, Atlas Copco, Eagle Crusher Company, Inc., Terex Finlay, Powerscreen, Shanghai Shibang Machinery Co., Ltd., L&T Construction & Mining Machinery, Astec Industries, Inc., SANY Group, Zhengzhou Yifan Machinery Co., Ltd. |

| Key Drivers | • Rising construction and infrastructure activities drive the stone crushing equipment market as increased demand for aggregates for roads, buildings, and urbanization fuels the need for efficient crushing solutions. |

| RESTRAINTS | • Environmental concerns in the stone crushing industry, including dust, noise, and pollution, have led to stricter regulations, increasing operational costs for manufacturers and operators. |