Mobile Crane Market Report Scope & Overview:

Get More Information on Mobile Crane Market - Request Free Sample Report

The Mobile Crane Market Size was valued at USD 17.06 Billion in 2023 and is expected to reach USD 30.46 Billion by 2032 with a growing CAGR of 6.66% over the forecast period 2024-2032.

The mobile crane market is witnessing steady growth driven by increasing demand across industries such as construction, mining, infrastructure, and transportation. These versatile machines offer high lifting capacity and flexibility, making them integral to projects requiring heavy load lifting and material handling. The growing emphasis on infrastructure development, urbanization, and smart city projects has significantly contributed to the demand for mobile cranes globally. The rise of public-private partnerships for infrastructure investments further strengthens the market's expansion. Key trends shaping the market include the increasing adoption of technologically advanced mobile cranes equipped with telematics and automation features. These innovations enhance operational efficiency, reduce downtime, and improve safety. Hybrid and electric-powered mobile cranes are gaining traction as industries focus on sustainability and reducing carbon emissions. The integration of IoT and AI-based monitoring systems for real-time data analysis has improved predictive maintenance and fleet management, optimizing costs for end-users.

Additionally, a rise in specialized applications, such as wind turbine installation and modular construction, is boosting demand for high-capacity and all-terrain mobile cranes. The construction sector remains a major contributor, with ongoing projects such as bridges, highways, and urban infrastructure fueling steady procurement of these cranes. The mining and energy sectors are also driving adoption, particularly in regions rich in natural resources.

Mobile Crane Market Dynamics

DRIVERS

-

Rapid urbanization and large-scale infrastructure projects in emerging economies, particularly in Asia-Pacific, are driving the growing demand for mobile cranes.

The rapid pace of urbanization and ongoing infrastructure development are major drivers of growth in the mobile crane market. As cities around the world expand, particularly in emerging economies such as India and China, there is an increasing need for efficient construction equipment to support large-scale projects. Mobile cranes play a crucial role in these projects by providing the flexibility and mobility required to lift heavy materials, such as steel beams and concrete, and transport them across construction sites. In Asia-Pacific, the construction of smart roads, bridges, and residential and commercial buildings is at an all-time high, driven by population growth, urban sprawl, and economic development. These factors necessitate the use of advanced lifting equipment like mobile cranes to handle the demanding logistics of such large infrastructure projects.

The need for urban infrastructure, such as transportation networks and public utilities, is fueling demand for mobile cranes as they are essential for constructing bridges, highways, airports, and power plants. Additionally, the rise of smart cities and green buildings further boosts this demand, as construction projects increasingly require precise lifting operations in confined urban environments. As emerging economies continue to industrialize and modernize, the construction sector remains one of the largest contributors to mobile crane market growth. The ability of mobile cranes to adapt to various construction scenarios, including high-rise buildings and large infrastructure projects, positions them as an indispensable asset in the growth of these economies. Consequently, the increasing infrastructure investments and urbanization trends in these regions are expected to propel the mobile crane market forward.

RESTRAIN

-

The high initial purchase cost, along with ongoing maintenance and operational expenses, can deter small and medium-sized enterprises from adopting mobile cranes, limiting market growth.

One of the key factors impacting the growth of the Mobile Crane Market is the high initial investment cost associated with purchasing these machines. Mobile cranes, especially those with advanced features, high lifting capacities, and cutting-edge technologies, come with a hefty price tag. This upfront cost can be a significant barrier for small and medium-sized enterprises (SMEs) or companies with limited capital, which may deter them from purchasing new cranes or upgrading existing ones. As a result, many businesses, particularly those involved in small-scale or less frequent construction projects, might opt for rental services instead of ownership. This trend can slow down market adoption, especially in regions where SMEs dominate the construction and infrastructure sectors. In addition to the high purchase price, the maintenance and operational costs of mobile cranes further exacerbate the financial burden. These machines require regular servicing, spare parts, and fuel, all of which add to the total cost of ownership. Moreover, the need for skilled operators to manage mobile cranes effectively leads to additional training and labor costs. For businesses with limited financial resources, these ongoing expenses can be challenging to manage, particularly during economic downturns or slow periods in the construction industry.

Mobile Crane Market Segmentation Overview

By Product Type

In 2023, the truck-mounted crane segment dominated the market, capturing a significant revenue share of 64%. This growth is primarily driven by the increasing need for mobile machinery across industries such as power and utilities, construction, and other verticals. Truck-mounted cranes provide substantial loading capacity, making them ideal for efficiently transporting goods between locations. Their versatility and ease of mobility make them indispensable for various construction activities, including bridge building, railway infrastructure projects, and hydropower installations. As demand for flexible and efficient equipment continues to rise, the truck-mounted crane segment is poised for sustained growth.

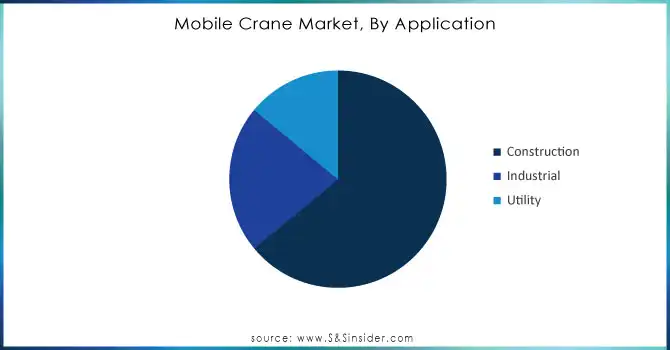

By Application

In 2023, the construction segment dominated the mobile cranes market, accounting for 53% of the total revenue. This growth is driven by ongoing residential and commercial infrastructure projects worldwide. Unlike tower cranes, which remain fixed until a project is finished, mobile cranes offer the flexibility to be relocated as needed. This adaptability makes them a preferred choice for builders managing multiple projects simultaneously. Additionally, mobile cranes minimize equipment idle time, improving operational efficiency and overall productivity. The demand for mobile cranes is expected to remain strong as infrastructure development continues to expand globally, further boosting this segment's growth.

Need any customization research on Mobile Crane Market - Enquiry Now

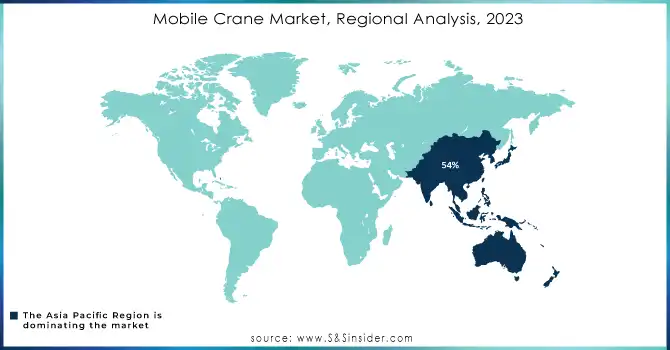

Mobile Crane Market Regional Analysis

The Asia-Pacific region dominated with the market share over 54% in 2023. This dominance is attributed to robust construction and infrastructure development across key economies such as China, India, and Southeast Asian countries. Rapid urbanization and industrial expansion have spurred demand for mobile cranes in large-scale projects, including transportation networks, commercial buildings, and energy sectors. Countries like China and India have seen a surge in government-backed initiatives, such as smart cities and infrastructure modernization, further bolstering mobile crane adoption. Additionally, the region's thriving manufacturing industry and significant investments in renewable energy projects drive the need for versatile lifting and material-handling equipment.

North America is emerging as the fastest-growing region in the mobile crane market, fueled by substantial investments in infrastructure refurbishment and modernization. The U.S. government’s strategic focus on revitalizing aging infrastructure, including bridges, highways, and urban development projects, significantly contributes to this growth. Additionally, the region is witnessing a surge in renewable energy initiatives, particularly wind power and solar power installations, which require specialized cranes for equipment assembly and maintenance. The adoption of technologically advanced mobile cranes with enhanced efficiency, safety, and automation features further accelerates market expansion. Innovations such as telematics, remote monitoring, and hybrid-powered cranes are increasingly being embraced by industries to improve operational capabilities.

Some of the major key players of Mobile Crane Market

-

BAUER AG (Rotary Drilling Rigs, BAUER Mobile Crane)

-

The Manitowoc Company, Inc. (Grove Cranes, Manitowoc Cranes)

-

Kobelco Construction Machinery Co., Ltd. (Kobe Steel, Ltd.) (Crawler Cranes, Kobelco Mobile Cranes)

-

Liebherr-International AG (Liebherr All-Terrain Cranes, Mobile Crawler Cranes)

-

Manitex International, Inc. (Boom Trucks, Truck Cranes)

-

Palfinger AG (Palfinger Cranes, Knuckle Boom Cranes)

-

Sarens N.V. /S.A. (Heavy Lifting Cranes, Transport and Installation Cranes)

-

Terex Corporation (Terex Cranes, Truck Cranes, All-Terrain Cranes)

-

Zoomlion Heavy Industry Science & Technology Co., Ltd. (Zoomlion Mobile Cranes, Crawler Cranes)

-

Xuzhou Construction Machinery Group Co., Ltd. (XCMG Mobile Cranes, Rough Terrain Cranes)

-

SANY Group (SANY Mobile Cranes, All-Terrain Cranes)

-

Furukawa Co. Ltd. (Furukawa Mobile Cranes)

-

Hitachi Sumitomo Heavy Industries Construction Crane Co., Ltd. (Truck Mounted Cranes, Crawler Cranes)

-

Manitowoc Cranes (Grove, Manitowoc, and Potain Cranes)

-

Tadano Ltd. (Tadano Cranes, All-Terrain Cranes, Truck Cranes)

-

Terex Cranes (All-Terrain Cranes, Rough Terrain Cranes)

-

Demag Cranes & Components (Demag Mobile Cranes, Crawler Cranes)

-

JCB (JCB Mobile Cranes)

-

Volvo Construction Equipment (Volvo Cranes, Telescopic Cranes)

-

Liebherr (Liebherr Mobile Cranes, All-Terrain Cranes)

Suppliers for high-quality hydraulic and crawler cranes, Liebherr is recognized for its reliability, innovative technology, and large lifting capacities, making it ideal for heavy-duty applications in various industries of Mobile Crane Market

-

Liebherr Group

-

Terex Corporation

-

Zoomlion Heavy Industry Science & Technology Co. Ltd.

-

KATO WORKS CO., LTD.

-

Manitowoc Cranes

-

SANY Group

-

XCMG Construction Machinery Co. Ltd.

-

Hitachi Sumitomo Heavy Industries Construction Cranes Co., Ltd.

-

Furukawa UNIC Corporation

-

Tadano Ltd.

RECENT DEVELOPMENT

-

In June 2024: Germany-based Liebherr introduced the LTM 1400-6.1, a six-axle mobile crane, at its Customer Days event in Berg-Ehingen, Germany. The new LTM 1400-6.1, featuring a Y-guy system, boasts a lifting capacity of 400 tons, a 70-meter boom, and an easy setup. It succeeds the LTM 1350-6.1, offering significantly improved lifting capabilities.

-

In December 2023: Liebherr expanded its mobile crane portfolio with the addition of the LG 1800-1.0. This model combines the mobility of a mobile crane with the load capacity of a crawler crane, capable of lifting up to 800 tons. The LG 1800-1.0 has a newly designed axle load of just 10 tons, making it suitable for use on public roads worldwide.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 17.06 billion |

| Market Size by 2032 | USD 30.46 billion |

| CAGR | CAGR of 6.66% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Truck Mounted Crane, Trailer Mounted Crane, and Crawler Crane) • By Application (Construction, Industrial, Utility) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BAUER AG, The Manitowoc Company, Inc., Kobelco Construction Machinery Co., Ltd. (Kobe Steel, Ltd.), Liebherr-International AG, Manitex International, Inc., Palfinger AG, Sarens N.V. /S.A., Terex Corporation, Zoomlion Heavy Industry Science & Technology Co., Ltd., Xuzhou Construction Machinery Group Co., Ltd., SANY Group, Furukawa Co. Ltd., Hitachi Sumitomo Heavy Industries Construction Crane Co., Ltd., Manitowoc Cranes, Tadano Ltd., Terex Cranes, Demag Cranes & Components, JCB, Volvo Construction Equipment, Liebherr. |

| Key Drivers | • Rapid urbanization and large-scale infrastructure projects in emerging economies, particularly in Asia-Pacific, are driving the growing demand for mobile cranes. |

| RESTRAINTS | • The high initial purchase cost, along with ongoing maintenance and operational expenses, can deter small and medium-sized enterprises from adopting mobile cranes, limiting market growth. |