Elastomers Market Report Scope & Overview:

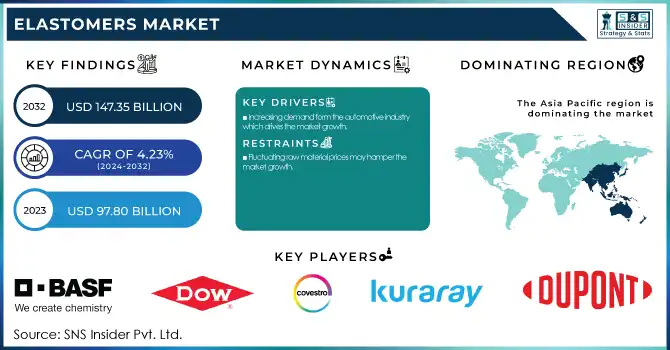

The Elastomers Market size was USD 97.80 Billion in 2023 and is expected to reach USD 147.35 Billion by 2032 and grow at a CAGR of 4.23% over the forecast period of 2024-2032. The report covers cost-efficient production and evolving pricing trends in raw materials like synthetic rubber and thermoplastic elastomers and provide the information related to the funding & investments in sustainable elastomers. It also provides the data related to the regulatory & policy impact in the elastomers market. Moreover, the report also focused on the merger and acquisition activity in the market and recent trends and upcoming trend related to the market.

To Get more information on Elastomers Market - Request Free Sample Report

Elastomers Market Dynamics

Drivers

-

Increasing demand form the automotive industry which drives the market growth.

One of the most significant factors promoting market growth is the pace of demand from the automotive industry. Automotive elastomers (more specifically, thermoplastic elastomers (TPEs), styrene-butadiene rubbers (SBR), and nitrile butadiene rubbers (NBR) have emerged in automotive manufacturing over the decades as excellent durability, flexibility, heat, abrasion, and chemical resistant materials. These are utilized in a multitude of vehicle parts like seals, gaskets, hoses, tires, tray panels, and weatherstripping. The trend of lightweight materials that contribute to fuel efficiency (especially in the case of EVs) means that elastomers will also be increasingly in demand due to advancements in vehicle technology. These elastomers reduce device weight while maintaining strength and elasticity. The shift towards more sustainable solutions in the automotive industry has also fueled the growing demand for bio-based elastomers, which allow for higher sustainability without compromising performance.

Restraint

-

Fluctuating raw material prices may hamper the market growth.

The growth of the elastomers market is likely to be hindered by fluctuating raw material prices, which are one of the major factors impacting the elastomers market. The need for oil-based raw material is high for elastomers, especially synthetic rubbers such as styrene-butadiene rubber (SBR) and nitrile butadiene rubber (NBR). These material prices are subject to rapid up and down movement depending on many reasons including wars, disasters, supply chains and the world oil price changes. Higher prices for raw materials lead to higher production costs, which are ultimately translated into higher prices of elastomer products for manufacturers. In turn, this unemployability can make them non-competitive against alternative materials, especially in market segments with less price elasticity.

Opportunity

Rising demand for sustainable and bio-based elastomers which create the opportunity in the market.

The shift in consumer preference towards sustainability, as well as the increased use of bio-based materials resulting in the creation of elastomers, which can either decrease carbon emissions, or are obtained from renewable resources provide massive opportunities within the elastomers product. With the global focus on greener environments, sectors are becoming more on the lookout for substitutes for the traditional petroleum-based elastomers that have long been linked to carbon emissions, environmental degradation as well as high energy input-intensive processes. Based on renewable resources (natural rubber, soy-based oils and other bio-derived materials), bio-based elastomers provide a sustainable resource with a lower environmental impact. These elastomers help reduce dependence on fossil fuels and help manufacturers meet stricter environmental regulations and sustainability goals as well.

Challenges

Intense Competition may create the challenge for the market.

The intense competition is amongst the prominent challenges confronted by the market participants for elastomers, as they have to innovate and keep control over them for cost management. The global market is significantly competitive, with a large number of established players globally and an increasing number of new players entering the market, and competing for their fair share of the market. Big companies, however, have a lot of ways to benefit from economies of scale as well, so competitive prices and more efficient production can be expected from larger companies with a wealth of resources. This gives larger companies a competitive edge, ensconced in the stability that prevents smaller players from expanding, particularly through their niche or vertical offerings.

Elastomers Market Segmentation

By Type

SBR (Styrene Block Copolymers) held the largest market share around 22% in 2023. SBR is one of the most cost-effective synthetic rubber grades and is suitable for many industries, including tires, automotive components, footwear, and industrial products. One of the most durable, flexible, and abrasion-resistant polymerized materials it is favored for most high demand applications. The automotive industry, where SBR finds its major applications in the production of tires, is a primary driver behind its market leadership. Moreover, the dominant share in other rubber products production such as gaskets, seals & hoses strengthens its position in the market.

By Application

Automotive segment held the largest market share around 42% in 2023. Increasing demand for durable, weather-resistant, and energy-efficient materials in construction projects. SBR, NBR, and TPU are elastomers that are important for the manufacture of high-performance parts including tires, seals, gaskets, hoses, weatherstripping, and vibration dampers. Such materials are preferred for their strength, flexibility, heat, and environmental resistance critical to automotive performance and safety. Continuous production of automotive vehicles, development of technologies in electric vehicle (EV) and changing demands of customers for comfort & safety features in vehicles are driving elastomers demand for automotive applications.

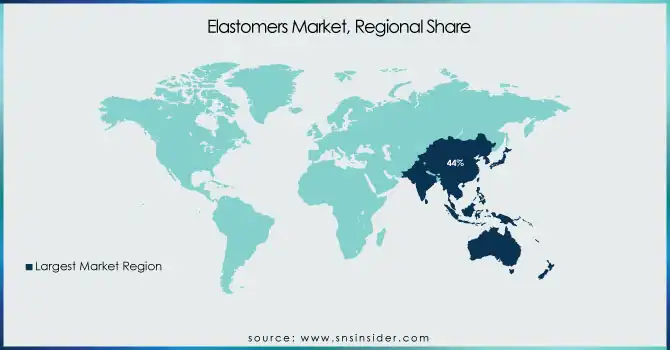

Elastomers Market Regional Analysis

Asia Pacific held the largest market share around 44% in 2023. It is owing to rapid industrialization, growth of automotive sector, and developing manufacturing capabilities in the region. China, Japan, South Korea and India are the key countries in the elastomer market China is also a leading elastomer producer and a huge consumer globally. The expanding automotive industry in the region, especially China and India, is one of the leading contributors to the demand for elastomers, as they are essential for manufacturing tires, seals, gaskets, and such other automotive components.

North America held the significant market share in the elastomers market. The North America is majorly involved in innovation and technological advancement in elastomer materials and is very high in terms of R&D investment in it. Specialty elastomers, including thermoplastic elastomers (TPEs) and fluoroelastomers, used in high-demand applications in various sectors including aerospace, electronics, and healthcare, are also witnessing an upsurge in demand in the region.

In addition, North America is gaining traction for its increased focus on sustainability and regulatory pressures for sustainable development which is driving eco-friendly, bio-based elastomers in this region. Additionally, the strong supply chain coupled with the long history of manufacturing in the region continues to support growth of elastomers in North America.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

BASF SE (Elastollan, Styrolux)

-

Dow (ENGAGE™, NORDEL™)

-

Covestro AG (Desmopan, Baypren)

-

Kuraray Co., Ltd. (SEPTON™, HYBRAR™)

-

Huntsman International LLC (IROGRAN, VITROX)

-

DuPont de Nemours, Inc. (Vamac, Kalrez)

-

INEOS (Kraton, Keltan)

-

Asahi Kasei Corporation (Tufprene, Asaprene)

-

LANXESS AG (Therban, Levapren)

-

LG Chem (LUPOY, LUCENE)

-

ExxonMobil (Vistalon, Santoprene)

-

Arkema (Pebax, Kynar)

-

JSR Corporation (SBR, EPDM)

-

Zeon Corporation (Nipol, Zetpol)

-

Wacker Chemie AG (ELASTOSIL, SILPURAN)

-

Trinseo (CALIBRE, MAGNUM)

-

Evonik Industries (VESTAMID, VESTOPLAST)

-

Mitsui Chemicals, Inc. (TAFMER, MILASTOMER)

-

Kraton Corporation (Kraton G, Cariflex)

-

Teknor Apex Company (Monprene, Sarlink)

Recent Development:

-

In 2024, BASF launched Elastollan 1190A for applications requiring higher abrasion resistance and mechanical properties, specifically for the automotive sector.

-

In 2023, Huntsman unveiled IROGRAN 1130A, a new thermoplastic polyurethane elastomer designed for use in industrial applications, offering better chemical resistance and load-bearing capacity.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 97.80 Billion |

| Market Size by 2032 | USD 147.35 Billion |

| CAGR | CAGR of 4.23% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (SBR (Styrene block copolymers), ACM (Acrylic Elastomer), EPM (Ethylene-propylene Elastomer), IIR (Butyl Elastomer), NBR (Nitrile Elastomer), TPU (Thermoplastic Polyurethanes), PEBA (Thermoplastic polyether block amides), SBC (Styrene block copolymers), TPO (Thermoplastic Polyolefin), TPV (Thermoplastic Vulcanizates) • By Application (Automotive, Consumer Goods, Medical, Industrial, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, Dow, Covestro AG, Kuraray Co., Ltd., Huntsman International LLC, DuPont de Nemours, Inc., INEOS, Asahi Kasei Corporation, LANXESS AG, LG Chem, ExxonMobil, Arkema, JSR Corporation, Zeon Corporation, Wacker Chemie AG, Trinseo, Evonik Industries, Mitsui Chemicals, Inc., Kraton Corporation, Teknor Apex Company |