Omega 3 Prescription Drugs Market Report Scope & Overview:

The Omega 3 Prescription Drugs Market size was valued at USD 1.45 billion in 2024 and is expected to reach USD 2.46 billion by 2032, growing at a CAGR of 6.85% over the forecast period of 2025-2032.

To Get more information on Omega 3 Prescription Drugs Market - Request Free Sample Report

The omega 3 prescription drugs market is experiencing robust growth, driven by the global increase in cardiovascular disorders and a move toward evidence-based, prescription omega-3 fatty acids for heart health and hypertriglyceridemia treatment.

For instance, with one person dying every 36 seconds from cardiovascular-related reasons, the U.S. Centers for Disease Control and Prevention (CDC) says, that heart disease is the top cause of mortality in the country.

Expanding indications for EPA/DHA drugs, regulatory agencies such as the European Medicines Agency and the U.S. FDA help to encourage the integration of omega-3 pharmaceutical formulations into clinical practice. Prescription omega-3-derived drugs are being adopted globally in response to these changes, as well as increasing consumer awareness and government-sponsored preventative health initiatives.

The omega 3 prescription drugs market is primarily driven by the escalating prevalence of cardiovascular diseases and hypertriglyceridemia hence, prompting increased physician reliance on prescription omega-3 fatty acids including eicosapentaenoic acid (EPA) and docosahexaenoic acid (DHA).

For instance, the CDC notes that 36% of U.S. adults are obese and 69% are overweight or obese, two important risk factors for increased triglycerides and cardiovascular events.

The U.S. omega 3 prescription drugs market dominated with a value of USD 0.49 billion in 2024 and is expected to reach USD 0.82 billion with a 6.74% CAGR over the forecast period. Driven by modern healthcare infrastructure, great knowledge, and regular implementation of prescription lipid-lowering therapies, the global industry. The FDA's approval of new cardiovascular indications for Vascepa and the continuous incorporation of omega-3 treatment for high cholesterol into national guidelines highlight the momentum of the market even more. With 12.5% of U.S. adults between the ages of 40 and 59 using omega-3 supplements, the CDC notes a rising trend toward preventative healthcare and more demand for prescription omega-3-derived drugs. New indications, including cognitive decline and inflammatory diseases, which could thus widen the omega 3 prescription drugs market trends, are under investigation in continuous clinical trials for omega-3 Drugs.

Market Dynamics

Drivers

-

Increasing Prevalence of Cardiovascular Diseases and Regulatory Approvals Fuel Market Growth

One of the main drivers for the expansion of omega-3 prescription medications is the growing global burden of cardiovascular diseases (CVDs).

For instance, the World Health Organisation (WHO) estimates that CVDs account for 32% of all fatalities globally and cause around 20.5 million deaths annually.

This concerning figure emphasizes how urgently good preventive and therapeutic measures are needed. Prescription omega-3 medications such as Lovaza and Vascepa (icosapent ethyl) have shown great success in lowering the risk of major cardiovascular events and triglyceride levels. Following strong data from the REDUCE-IT study, which revealed a 25% decrease in major adverse cardiovascular events, the U.S. Food and Drug Administration (FDA) extended Vascepa's indication in 2023 to include cardiovascular risk reduction in high-risk patients.

Further driving clinical acceptance are omega-3 prescription medications recommended by the American Heart Association and other top medical organizations for people with increased triglycerides. Rising rates of diabetes-affecting 537 million persons globally, also increase cardiovascular risk, hence widening the pool of qualified patients for omega-3 treatments. Prescription omega-3 medications are predicted to become more in demand as regulatory authorities keep supporting new indications and reimbursement schemes, therefore highlighting their essential role in the management and prevention of cardiovascular diseases.

Restrain

-

Competition from Over-the-Counter Supplements and Generics Limits Market Expansion

The increase of generic prescription formulations combined with the broad availability and customer inclination for over-the-counter (OTC) omega-3 supplements creates major challenges to the expansion of the omega-3 prescription drugs market. OTC supplements differ from prescription medications in that they are not under strict regulatory control for efficacy, purity, or dosage consistency, which results in great variation in product quality. Notwithstanding these flaws, many consumers believe that OTC supplements are just as good as prescription alternatives, mostly because of aggressive marketing and cheaper prices.

The National Institutes of Health (NIH) estimates that about 19 million Americans take omega-3 supplements yearly, therefore redirecting possible patients from prescription treatments.

Moreover, generic alternatives enter the market at much lower prices as patents on branded omega-3 medications expire, therefore undermining the market share and profitability of well-known brands. For example, after the introduction of generic Lovaza, branded sales declined by over 30% within a year. Manufacturers under pressure from commoditization must lower prices and restrict their capacity to devote resources to research and development for new formulations. Tightening rules by regulatory bodies as the European Medicines Agency (EMA) have also limited several indications for omega-3 derived medications, therefore reducing the market. These elements taken together make a difficult environment for prescription omega-3 medications since competition from generic pharmaceuticals and unregulated supplements compromises both incentives for innovation and income possibilities.

Segmentation analysis

By Drug

The others segment dominated with a 47% omega 3 prescription drugs market share in 2024, The others segment includes generic and alternative omega-3 pharmaceutical formulations. The broad availability and low cost of generics drives the expansion of this category since prescription omega-3 fatty acids are more easily available in many different healthcare systems.

For instance, the March 2023 release of generic Icosapent Ethyl Capsules by Hikma Pharmaceuticals in the United States provides reasonably priced EPA/DHA treatments for hypertriglyceridemia treatment and cardiovascular risk reduction.

The Lovaza segment held a significant share due to its established efficacy in managing severe hypertriglyceridemia and its FDA approval, it faces competition from generics. With substantial expenditures in education and marketing to healthcare professionals, Woodward Pharma Services's acquisition of Lovaza in August 2021 has revitalized market presence. Particularly among patients needing high-purity omega-3 therapy for high cholesterol and heart health, Lovaza's clinical validation as a triglyceride-lowering drug justifies its ongoing usage.

By Application

The cardiovascular drugs dominated the market with comprising 87% of the omega-3 prescription drugs market share in 2024, are expected to expand at a noteworthy CAGR. The great worldwide load of cardiovascular illnesses explains this supremacy. A main risk factor for CVD is raised triglyceride levels; clinically recognized as triglyceride-lowering agents are prescription omega-3 fatty acids, especially EPA/DHA drugs such as Vascepa and Lovaza.

Vascepa prescription trends have been much improved by the U.S. FDA's enhanced approval of the medication for cardiovascular risk reduction in 2020, therefore enabling more use among high-risk groups. High-dose icosapent ethyl (EPA) lowers major cardiovascular events by 34%, according to REDUCE-IT and other clinical trials for omega-3 drugs, therefore supporting their inclusion in treatment guidelines and fuelling the omega-3 prescription drug market growth. The CDC says that 25% of American adults have excessive triglyceride levels; omega-3 prescription medications are advised for those whose levels are above 500 mg/dL.

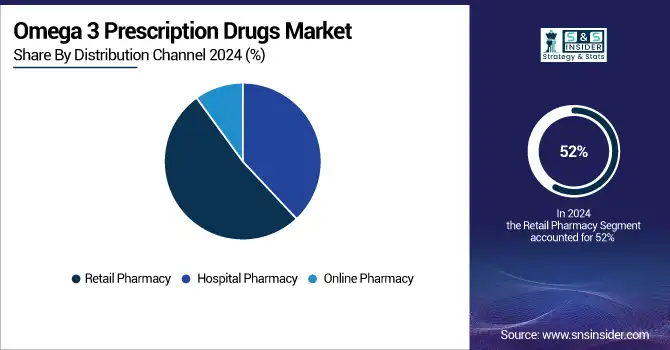

By Distribution Channel

With 52% of revenue share in 2024, retail pharmacy dominated the Omega-3 prescription drugs market. This results from retail stores' pharmacist-led patient education, convenience, and accessibility. Patients' utilization of prescription omega-3 fatty acids for hypertriglyceridemia therapy and cardiovascular risk management is much guided by pharmacists. Driven by pharmacist-led education and the ease of in-store and online services, American retail pharmacy chains held the biggest share in 2023.

For instance, the European Commission's approval of new omega-3 pharmaceutical formulations for retail distribution in 2022 strengthens retail pharmacy supremacy in the area even further.

The online pharmacy segment is expected to witness moderate omega 3 prescription drugs market growth over the forecast period, driven by digitalization of healthcare and rising customer comfort with online pharmaceutical purchases. Particularly in North America and Europe, the spread of telehealth and e-prescription services has helped access omega-3 pharmaceutical formulations for management of chronic conditions. Digital health platforms are increasing access to prescription omega-3 fatty acids for hypertriglyceridemia treatment, hence driving rising online pharmacy sales in Asia-Pacific.

Regional Analysis

North America dominated the omega-3 prescription drug market with 43% of global sales in 2024. The high frequency of cardiovascular illnesses and obesity in the area underpins the leadership of which prescription omega-3 fatty acids, such as EPA and DHA are mostly driven.

For example, the CDC reports that one person dies from cardiovascular illness every 36 seconds, so heart disease remains the leading cause of death in the U.S.

The U.S. omega-3 prescription drugs market was valued at USD 0.49 billion in 2024. A strong presence of prominent omega-3 prescription pharmaceuticals businesses, excellent healthcare infrastructure, great uptake of prescription lipid-lowering therapies, and strong insurance coverage all help to explain this region's dominance. Further driving market expansion are growing knowledge of the advantages of omega-3 for heart health and hypertriglyceridemia therapy, as well as physician recommendations and continuous clinical trials on omega-3 medications. Canada and Mexico also contribute to the region’s expansion, supported by similar health trends and growing healthcare investments.

Europe held the second-largest share in the global omega-3 prescription drugs market in 2024. Strong healthcare systems, especially in Germany, France, the UK, and Italy, where demand for evidence-based omega-3 fatty acid prescriptions and efficient cardiovascular treatments is growing, fuel the region's development. For instance, in European omega-3 prescription drugs market analysis, Germany distinguishes itself with its sophisticated healthcare system and legislative backing of omega-3 pharmaceutical formulations, which enable more patient access and acceptance. Regulatory developments such as the approval of new omega-3 pharmaceutical formulations and plant-based substitutes, as well as an increasing focus on controlling high triglyceride levels to lower cardiovascular risk, help to further support the European market.

With a predicted CAGR of 7.41% from 2025 to 2032, Asia-Pacific is the fastest-growing region of the global omega-3 prescription drugs market. Rising healthcare costs, an older population, and more consumer knowledge of cardiovascular health help to explain this quick growth. Rising incidence of chronic diseases such as cardiovascular diseases, diabetes, and hypertension has driven demand for prescription omega-3 fatty acids and EPA/DHA drugs for hypertriglyceridemia treatment and cardiovascular risk lowering. Key markets include China, India, and Japan, where government programs to increase pharmaceutical distribution networks, improve access to healthcare, and change treatment approaches are accelerating market penetration.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

The key omega 3 prescription drugs Companies are Sun Pharmaceutical Industries Ltd., Amarin Pharmaceuticals Ireland Limited, PuraCap Pharmaceutical LLC, Wilshire Pharmaceuticals, INC., Woodward Pharma Services LLC, CSPC Pharmaceutical Group Limited, Sofgen, GLW Pharma GMBH, ChartwellPharma, Amneal Pharmaceuticals LLC, Mankind Pharma, and others.

Recent Developments

-

Launching generic Icosapent Ethyl Capsules in the U.S. in March 2023, Hikma Pharmaceuticals increases access to EPA-based prescription omega-3 fatty acids for hypertriglyceridemia treatment and cardiovascular risk reduction.

-

A major turning point for EPA/DHA medications in the Asia-Pacific area, China's NMPA authorized Vascepa (Icosapent Ethyl) in February 2023, therefore boosting Omega 3 Prescription Drug Trends.

-

Aiming at people with excessive triglycerides at cardiovascular risk, Portugal approved national reimbursement for Amarin's VAZKEPA in July 2024. Supporting Amarin's aim to increase access and fight cardiovascular disease, which causes 29% of annual deaths in Portugal, this represents its eighth reimbursement in Europe.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.45 Billion |

| Market Size by 2032 | USD 2.45 Billion |

| CAGR | CAGR of 6.85% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Drug (Vascepa, Lovaza, and Others) • By Distribution Channel (Hospital Pharmacy, Online Pharmacy, and Retail Pharmacy) • By Application Cardiovascular, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Sun Pharmaceutical Industries Ltd., Amarin Pharmaceuticals Ireland Limited, PuraCap Pharmaceutical LLC, Wilshire Pharmaceuticals, INC., Woodward Pharma Services LLC, CSPC Pharmaceutical Group Limited, Sofgen, GLW Pharma GMBH, ChartwellPharma, Amneal Pharmaceuticals LLC, Mankind Pharma, and others |