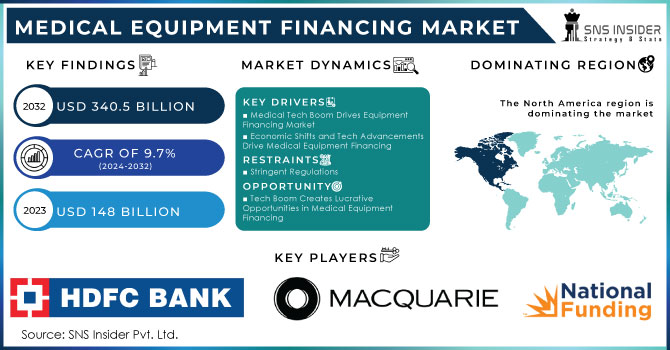

Medical Equipment Financing Market Report Scope & Overview:

The Medical Equipment Financing market size was USD 157.09 billion in 2023 and is expected to reach USD 305.98 billion by 2032 and grow at a CAGR of 7.69% over the forecast period of 2024-2032. This report provides in-depth insights into the medical equipment financing market, covering key trends such as the increasing demand for leasing solutions, the impact of fluctuating interest rates on financing decisions, and the growing role of vendor-backed financing programs. It analyzes loan approval rates, delinquency trends, and the preference for leasing versus traditional loans among healthcare providers. The report also explores government-backed funding initiatives, tax incentives, and the role of private financial institutions in expanding medical equipment accessibility. Additionally, it highlights segment-wise financing trends across hospitals, diagnostic centers, and ambulatory surgical centers. Regional financing disparities, competitive dynamics, and mergers & acquisitions in the financial services sector are examined. Overall, this study provides a data-driven outlook on how evolving financial models are shaping the medical equipment acquisition landscape.

Get More Information on Medical Equipment Financing Market - Request Sample Report

The U.S. held the largest market share of 74%, valued at USD 44.17 billion, in the medical equipment financing market due to its well-established healthcare infrastructure, high adoption of advanced medical technologies, and strong presence of financial institutions offering tailored financing solutions. Favorable government initiatives, such as Medicare and Medicaid reimbursement programs, encourage healthcare providers to opt for financing solutions to manage capital costs efficiently. Additionally, the growing demand for diagnostic imaging, surgical instruments, and patient monitoring devices has driven the need for flexible financing options. The presence of major medical equipment manufacturers and financial service providers further strengthens the market. Rising hospital consolidation and an increasing preference for leasing over direct purchases continue to boost the U.S. market dominance.

Market Dynamics

Drivers

-

Increasing healthcare infrastructure investments and rising demand for advanced medical equipment are propelling the medical equipment financing market growth.

The rapid expansion of the healthcare infrastructure, coupled with the increasing demand for technologically advanced medical equipment, is significantly driving the medical equipment financing market. Governments and private healthcare providers worldwide are heavily investing in upgrading hospitals, diagnostic centers, and ambulatory surgical facilities, necessitating financing solutions to manage high capital costs. In 2023, U.S. healthcare spending exceeded USD 4.5 trillion, emphasizing the growing need for financial assistance in acquiring cutting-edge medical devices. Additionally, the rising prevalence of chronic diseases has accelerated the adoption of imaging systems, surgical equipment, and patient monitoring devices, further driving demand for financing. Financial institutions and manufacturers are offering customized loan and leasing options, making high-cost medical equipment more accessible to healthcare providers. This trend is expected to sustain the market’s strong growth trajectory in the coming years.

Restrain

-

Stringent regulatory policies and compliance requirements limit the growth of the medical equipment financing market.

The medical equipment financing market faces significant challenges due to strict regulatory policies and compliance requirements imposed by governments and financial authorities. Regulations governing healthcare financing, such as HIPAA in the U.S. and MDR in Europe, demand stringent compliance, making loan approval processes complex and time-consuming. Additionally, financial institutions must assess risks associated with equipment obsolescence, borrower creditworthiness, and repayment capabilities, further limiting accessibility to financing solutions. Stringent capital adequacy norms for banks and non-banking financial companies (NBFCs) can restrict lending flexibility, impacting loan availability for small and mid-sized healthcare providers. Moreover, variations in regional regulatory frameworks create inconsistencies in financing approval rates, delaying equipment acquisitions. These factors collectively hinder market growth by increasing operational challenges for financial institutions and limiting seamless access to capital for healthcare providers.

Opportunity

-

Integration of ai and digital platforms in loan processing creates growth opportunities for the medical equipment financing market.

The growing integration of AI-driven financial assessment tools and digital lending platforms is revolutionizing the medical equipment financing market by streamlining loan approvals, reducing paperwork, and improving credit risk analysis. AI-powered financial models can efficiently assess borrower profiles, predict default risks, and automate approval processes, thereby reducing turnaround time. Additionally, the adoption of blockchain-based smart contracts enhances security, transparency, and fraud prevention in financial transactions. Several fintech companies and banks are leveraging AI to provide real-time loan approvals and offer customized financing solutions for medical equipment purchases. The rise of embedded finance within healthcare procurement platforms allows seamless financing integration at the point of purchase, further enhancing accessibility. These technological advancements create significant opportunities for financial institutions to expand their market presence and improve service efficiency.

Challenge

-

High risk of equipment obsolescence and depreciation poses a major challenge to the medical equipment financing market.

One of the biggest challenges in the medical equipment financing market is the rapid obsolescence and depreciation of medical devices, which significantly impact loan repayment structures and resale values. Medical technology is evolving at an unprecedented pace, with continuous innovations in imaging systems, robotic-assisted surgery, and AI-driven diagnostics. As newer models enter the market, previously financed equipment may lose its market value quickly, creating risks for lenders in terms of collateral devaluation. Financial institutions must carefully structure financing terms to mitigate losses associated with outdated equipment, often resulting in higher interest rates or stricter repayment conditions for borrowers. Additionally, healthcare providers face difficulties in upgrading to newer technologies while still repaying previous loans, leading to financial strain. Addressing these challenges requires flexible financing models, including shorter loan tenures and structured leasing options.

Segmentation Analysis

By Device Type

Diagnostic Equipment held the largest market share around 48%, in 2023. It is associated with high demand, frequent technology upgrades, and large investment. The growing burden of chronic diseases, including cancer, cardiac, and respiratory diseases, require substantial financial investment in high-end imaging systems, which include MRI, CT scans, ultrasound, and X-ray machines. Moreover, increasing implementation of AI-based diagnostic and digital imaging solutions has contributed to the rising demand for financing. Diagnostic imaging makes up a significant share of hospital capital expenditure, which has forced health care providers to depend upon leasing and loan options for the procurement of equipment, as per reports in the industry. Additionally, growth is driven by government initiatives and private-sector funding programs that support early disease detection and preventive healthcare. This continuous upgrade cycle in diagnostic technology, along with increasing demand for leasing as opposed to direct purchase, make diagnostic equipment holding sway in the market.

By End-User Industry

Hospitals & Clinics held the largest market share at around 42% in 2023. It is owing to high demand for advanced medical technologies, large-scale patient care, and substantial capital requirements. Hospitals and clinics act as the primary healthcare providers requiring a large variety of medical equipment such as diagnostic imaging systems, surgical instruments, patient monitoring devices, and life-support equipment, and these usually represent very costly investments. As chronic diseases grow and hospital admissions increase, healthcare infrastructure facilities are regularly upgrading their MedTech capabilities for the best patient care. Because cutting-edge scientific equipment is so expensive to acquire and maintain, financing is often the best alternative. Hospitals and clinics have been prompted to adopt financing solutions with additional government funding programs, private investment initiatives, and flexible leasing options. They remain dominant in the market as well on the back of sustainably high demand for medical equipment financing ever since the proliferation of multi-specialty hospitals and private healthcare networks.

Regional Analysis

North America held the largest market share at around 38% in 2023. It is due to an organized healthcare infrastructure, enormous healthcare spending, and an enormous financial service provider market. There exists a strong medical industry in the region (especially in the U.S. and Canada) wherein there is a huge demand for technologically inclined gear, including MRI machines, robotic surgical systems, and AI-based diagnostic instruments, which require a substantial financial commitment. Furthermore, positive government initiatives, such as Medicare, Medicaid, and tax incentives in healthcare investments, have driven hospitals, clinics, and diagnostic centers to go for lease and loan options. Major financial institutions providing medical equipment financing plans tailored to suit the needs of consumers, along with the rise of the private-sector healthcare expansion, will bolster the market in North America.

Asia Pacific held the significant market share. This is due to the rapidly growing healthcare investments in China, India, Japan, and South Korea for upgrading hospitals, diagnostic centers, and specialty clinics. High-cost equipment, including MRI machines, CT (computerized tomography) scanners, and robotic surgical systems, costs, and financing solutions are some of the other aspects driving the global healthcare equipment financing market due to the increasing burden of chronic diseases, rising geriatric populations, and the increasing medical tourism industry. Government-sponsored initiatives such as funding programs, public-private partnerships (PPPs), and tax incentives for medical equipment procurement have further improved affordability by making capital funds more accessible. The market is also growing in Asia Pacific due to the presence of regional and global financial institutions providing low-interest loans and leasing options, making the region a crucial market.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key Players

-

HDFC Bank (Medical Equipment Loans, Healthcare Infrastructure Financing)

-

CMS Funding (Equipment Leasing, Working Capital Loans)

-

National Funding (Medical Equipment Financing, Business Loans)

-

Macquarie Group Limited (Healthcare Asset Financing, Medical Equipment Leasing)

-

TIAA Bank (Healthcare Equipment Loans, Vendor Financing)

-

Toronto-Dominion Bank (Medical Equipment Leasing, Healthcare Business Loans)

-

Société General S.A (Medical Equipment Lease Financing, Capital Equipment Loans)

-

Bajaj Finserv (Doctor Loan, Medical Equipment Finance)

-

First American Healthcare Finance (Medical Equipment Leasing, Capital Loans)

-

Amur Equipment Finance (Equipment Leasing, Business Line of Credit)

-

GE Healthcare Financial Services (Capital Equipment Financing, Diagnostic Imaging Loans)

-

Siemens Financial Services (Medical Technology Financing, Radiology Equipment Loans)

-

Wells Fargo Healthcare Finance (Medical Equipment Leasing, Healthcare Real Estate Loans)

-

Bank of America Healthcare Finance (Medical Equipment Leasing, Healthcare Working Capital)

-

Hitachi Capital America (Imaging Equipment Financing, Surgical Equipment Leasing)

-

Stryker Flex Financial (Operating Room Equipment Financing, Surgical Equipment Leasing)

-

Canon Medical Finance (Imaging System Loans, Healthcare Equipment Leasing)

-

MED One Group (Hospital Equipment Leasing, Patient Monitoring System Financing)

-

PNC Healthcare (Healthcare Equipment Financing, Medical Practice Loans)

-

KeyBank Healthcare Finance (Medical Equipment Loans, Diagnostic Equipment Leasing)

Recent Developments:

-

In 2024, GE HealthCare formed strategic alliances with Sutter Health in the U.S. and Nuffield Health in the UK to deploy AI-powered diagnostic equipment across hospital networks.

-

In December 2024, Bajaj Finserv Asset Management Ltd. introduced the Bajaj Finserv Healthcare Fund, an equity mutual fund designed to invest in healthcare-related sectors, including hospitals, pharmaceuticals, and diagnostics.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD157.09 Billion |

| Market Size by 2032 | USD305.98 Billion |

| CAGR | CAGR of7.69 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Device Type (Therapeutic Equipment, Diagnostic Equipment, Therapeutic Equipment, Others) • By End User (Laboratories and Diagnostic Centers, Hospitals & Clinics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | HDFC Bank, CMS Funding, National Funding, Macquarie Group Limited, TIAA Bank, Toronto-Dominion Bank, Société Générale S.A., Bajaj Finserv, First American Healthcare Finance, Amur Equipment Finance, GE Healthcare Financial Services, Siemens Financial Services, Wells Fargo Healthcare Finance, Bank of America Healthcare Finance, Hitachi Capital America, Stryker Flex Financial, Canon Medical Finance, MED One Group, PNC Healthcare, KeyBank Healthcare Finance |