On-Device AI Market Report Scope & Overview:

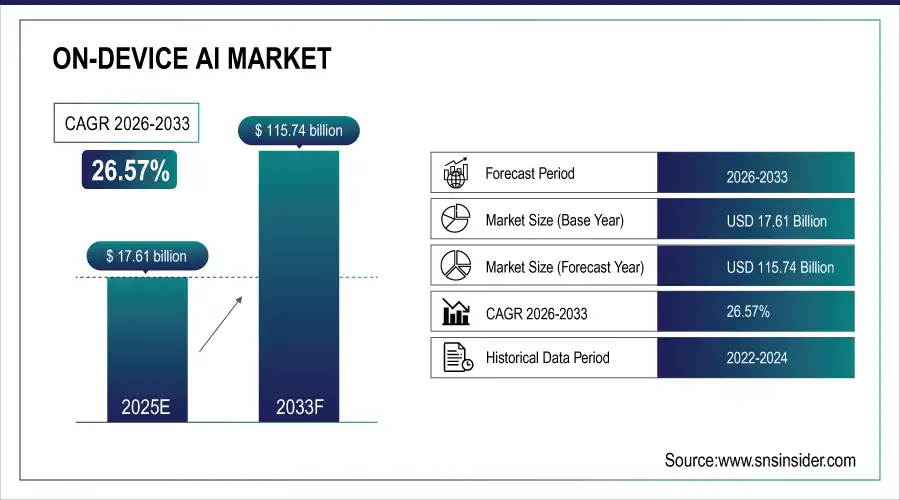

The On-Device AI Market Size was valued at USD 17.61 Billion in 2025E and is expected to reach USD 115.74 Billion by 2033 and grow at a CAGR of 26.57% over the forecast period 2026-2033.

The On-Device AI Market analysis is primarily driven by the rising demand for real-time processing and better data privacy. On-device AI, on the contrary to the cloud, allows the devices to process the data locally reducing the latency and the dependence on the internet, which is extremely vital for the applications in smartphones, wearables, and automotive systems. Another key driver for adoption is the proliferation of AI-enabled consumer electronics such as smart cameras, virtual assistants, and IoT devices. Third, AI chipsets and embedded systems have been further developed to run more complex algorithms on the edge device to increase the sophistication of the device with respect to some tasks as well as improve the user experience. According to study, Smartphones, wearables, and automotive systems are highlighted as major adopters; this can translate to an estimated 55–60% of on-device AI deployments concentrated in these segments.

Market Size and Forecast:

-

Market Size in 2025: USD 17.61 Billion

-

Market Size by 2033: USD 115.74 Billion

-

CAGR: 26.57% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On On-Device AI Market - Request Free Sample Report

On-Device AI Market Trends

-

Real-time on-device AI adoption rises in smartphones, wearables, and automotive systems.

-

Increasing demand for low-latency AI solutions boosts consumer electronics market growth.

-

Edge AI implementation reduces dependency on cloud, improving device privacy and efficiency.

-

Automotive sector increasingly integrates on-device AI for advanced driver-assistance systems.

-

Healthcare wearables leverage on-device AI for instant diagnostics and patient monitoring.

-

Regulatory compliance drives adoption of local AI processing in sensitive data applications.

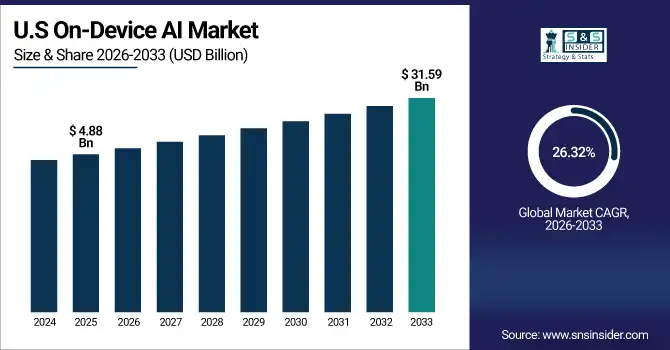

The U.S. On-Device AI Market size was USD 4.88 Billion in 2025E and is expected to reach USD 31.59 Billion by 2033, growing at a CAGR of 26.32% over the forecast period of 2026-2033, driven by increasing demand for real-time data processing and enhanced data privacy. Advancements in AI hardware and edge computing technologies enable efficient local data processing, reducing latency and dependence on cloud services.

On-Device AI Market Growth Drivers:

-

Real-Time Processing Demand Accelerates On-Device AI Market Growth Globally

On-device AI allows devices to process data locally rather than relying on cloud servers. This minimizes latency, allowing for rapid decision-making, which is essential for applications such as self-driving cars, wearable health technologies, and smart home systems. Moreover, local processing reduces the amount of sensitive data that needs to be sent over networks, making it much better for user privacy and meeting global regulations such as GDPR and CCPA. With consumers and enterprises seeking out rapid, secure, and private AI interactions, the shift to on-device AI is accelerating across smartphones, wearables, IoT devices, and automotive systems. This quest for secured speed is one of the important growth factors which driven chip makers and software developers to make low-power, high performance AI solutions specifically for edge devices.

On-device AI can reduce data processing latency by up to 80–90% compared to cloud-based AI, enabling near-instantaneous responses.

On-Device AI Market Restraints:

-

Limited Processing Power And High Costs Hinder On-Device AI Adoption

Despite its advantages, on-device AI faces technical challenges due to limited hardware resources on devices. AI models, especially deep learning algorithms, require significant computational power, memory, and energy to operate effectively. Edge devices like smartphones and wearables have constraints in battery capacity and processing capability, which can limit the complexity and performance of AI applications. This hardware limitation can slow down adoption in certain segments or reduce the functionality of AI models, making cloud-based AI still a necessary complement for heavy computations. Managing power efficiency while maintaining high accuracy remains a key challenge for device manufacturers.

On-Device AI Market Opportunities:

-

Automotive And Healthcare Expansion Offers Huge Potential For On-Device AI

The automotive and healthcare industries present a significant opportunity for on-device AI. In automotive, On-device AI allows new levels of advanced driver-assistance systems (ADAS) alongside in-vehicle voice assistants and navigation analytics in real-time without the reliance on the cloud, keeping drivers and passengers safe and comfortable. In healthcare, on-device AI enables wearables and portable medical devices to monitor vital parameters and alert/feedback on any abnormalities while having sensitive patient data remain local, abiding by privacy regulations. This increasing need for smart, autonomous and privacy-first capable devices in these areas is a high-growth opportunity for on-device AI solution providers.

On-device AI enables instant diagnostics in ~20–25% of portable medical devices, improving patient monitoring efficiency.

On-Device AI Market Segmentation Analysis:

-

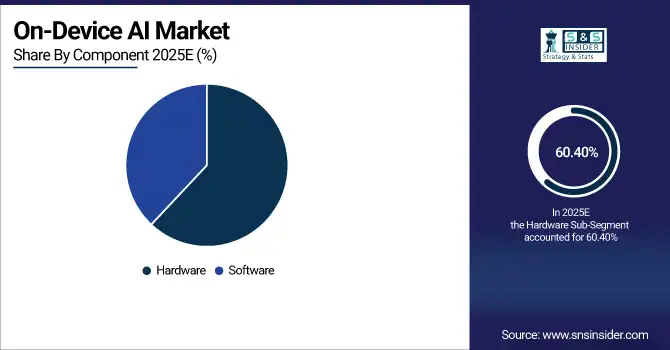

By Component: In 2025, Hardware led the market with a share of 60.40%, while Software is the fastest-growing segment with a CAGR of 31.04%.

-

By Type: In 2025, Smartphones & Tablets led the market with a share of 56.70%, while Wearables is the fastest-growing segment with a CAGR of 25.24%.

-

By Technology: In 2025, Machine Learning led the market with a share of 48.20%, while Natural Language Processing is the fastest-growing segment with a CAGR of 26.40%.

-

By Vertical: In 2025, Consumer Electronics led the market with a share of 41.06%, while Automotive is the fastest-growing segment with a CAGR of 25.30%.

By Component, Hardware Leads Market and Software Fastest Growth

The component segmentation of On‑Device AI Market is led by hardware. This is attributed to the increasing penetration of various AI-enabled processors, sensors, and chipsets used in smartphones, wearables, automotive systems, industrial devices. Hardware is critical to low-latency processing, high computation efficiency and above all real-time AI applied on edge devices. At the same time, software remains the most rapidly growing segment due to increased demand for smart algorithms, AI frameworks, and applications that can operate efficiently on edge hardware. Machine learning model innovations, image software, and natural language processing solutions are fast accelerating software adoption as companies are now striving to imbue their products with intelligent AI capabilities while trying to balance power consumption and user experience.

By Type, Smartphones & Tablets Lead Market and Wearables Fastest Growth

The Smartphones & Tablets held the largest share of the On‑Device AI Market, with a comparatively higher adoption and utilization of on-device AI-integrated functions & features like facial recognition, augmented reality, smart assistants, and camera enhancements. Smartphones and tablets are the biggest driver for low-latency, real-time AI processing due to consumer demand, especially given how many different advanced AI chipsets are being incorporated into flagship and mid-range smartphones. At the same time, wearables is fastest-growing segment, driven by increasing adoption of artificial intelligence–based smartwatches, smart wearables for fitness monitoring, and various devices for healthcare monitoring. Growing demand for personal health insights, intuitive real-time activity tracking, and hands-free voice navigation is accelerating the adoption of wearables, making this segment a leading driver of on-device AI across consumer electronics and healthcare use cases.

By Technology, Machine Learning Leads Market and Natural Language Processing Fastest Growth

In the On‑Device AI Market, Machine Learning continues to lead the technology segment, due to its broad application in smartphones, wearables, automotive systems, and a variety of industrial devices. ML facilitates processing large amounts of data, prediction and making some intelligent decisions right in the edge devices, providing minimum latency and better user experience. The trend is buoyed by rising incorporation of AI chipsets and refined ML techniques that can execute complex operations on-device. Additionally, Natural Language Processing (NLP) is the quickest growing section as a result of growing adoption of voice assistants, chatbots, real-time translation, and speech recognition capabilities on gadgets. The growth of the conversational AI and demand for language translation are driving automatic natural language processing (NLP) that is acting as one of the key growth factors for the on-device AI applications worldwide.

By Vertical, Consumer Electronics Leads Market and Automotive Fastest Growth

The Consumer Electronics is the leading vertical segment in the On‑Device AI Market, largely due to the rapid adoption of AI-integrated smartphones, tablets, smart cameras, wearables, and smart home devices. Using on-device AI, they provide features such as facial recognition and voice assistants, and real-time image processing and augmented reality, offering an improved user experience but also a low-latency performance. Additionally, Automotive vertical is the fastest-growing segment, driven by the ongoing rise in on-device artificial intelligence in advanced driver-assistance systems (ADAS), in-vehicle voice assistants, real-time navigation and autonomous driving solutions. With automotive becoming a key driver of on-device AI solutions in markets around the world, the rising demand for smart, connected, and safety-compliant vehicles is accelerating automotive adoption.

On-Device AI Market Regional Analysis:

North America On-Device AI Market Insights:

The On-Device AI Market in North America held the largest share 38.50% in 2025, due to it is early adopter of advanced AI technologies owing to strong R&D infrastructure, and high consumer awareness. The widespread deployment of AI-enabled smartphones, wearables, smart home devices, and automotive applications is driving the market. It is further supported by investments to strengthen market growth in AI chipsets, data edge computing, and on-device software solutions. Increasing data privacy concerns and processing data on-device creates opportunities for AI solutions that work on the device. This is supported by the rapid advancement of its use in machine learning, natural language processing and computer vision technologies, and high demand across consumer electronics, automotive, and healthcare industries in the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Dominates On-Device AI Market with Advanced Technological Adoption

The U.S. leads the on-device AI market, driven by rapid technological adoption, AI-enabled devices, strong R&D investments, and increasing demand for low-latency, privacy-focused solutions.

Asia-Pacific On-Device AI Market Insights

In 2025, Asia-Pacific is the fastest-growing region in the On-Device AI Market, projected to expand at a CAGR of 27.83%, due to the increasing adoption rate of AI-powered devices such as smartphones, wearables and smart home devices by various industries within the region. The market is growing investments in the AI chipsets, edge computing infrastructure, and local AI software solutions. The need for real-time processing and low-latency applications from consumers, as well as privacy compliance for AI features, also drives the assumption. With advanced capabilities like predictive maintenance, real-time monitoring, and smart assistants, on-device AI is gaining traction in various sectors including automotive, healthcare and consumer electronics. Continuous market growth across Asia-Pacific countries is mainly due to technological innovations, increase in disposable income, and awareness of smart devices.

China and India Propel Rapid Growth in On-Device AI Market

China and India Propel Rapid Growth in On-Device AI Market due to Rapid adoption of AI-enabled devices, increasing investments in edge computing, and rising demand for low-latency, privacy-focused solutions are driving market expansion

Europe On-Device AI Market Insights

The Europe On‑Device AI Market is witnessing steady growth, owing to the growing adoption of AI-enabled smartphones, wearables, smart home devices, and automotive applications. Investment in AI chipsets, edge computing and software solutions is sufficient to facilitate efficient local data processing and low-latency performance. The rise of highly demanded AI applications, which abide by the privacy regulations, is incentivizing processing data on-device, across several industries, such as health, automotive, and consumer electronics. In conjunction with this, the expansion of the market is aided by rapid technological developments such as machine learning, natural language processing and computer vision. In addition, the emphasis on energy-efficient AI solutions and increased consumer knowledge of intelligent devices are alike triggers for acceleration and development in on-device AI throughout the region.

Germany and U.K. Lead On-Device AI Market Expansion Across Europe

Germany and U.K. Lead On-Device AI Market Expansion in Across Europe due to increasing adoption of AI-enabled devices, privacy-focused solutions, advanced chipsets, and technological advancements across multiple sectors.

Latin America (LATAM) and Middle East & Africa (MEA) On-Device AI Market Insights

The On‑Device AI Market in Latin America and Middle East & Africa is witnessing gradual growth, driven by increasing adoption of AI-enabled smartphones, wearables, smart home devices, and automotive applications. The AI processing is being enabled through investment in edge computing infrastructure and AI chipsets that reduce latency and privacy exposure. The market penetration is also being accelerated, to the consumer appetite for real-time and intelligent device features, such as voice assistants, image recognition and health monitoring. From healthcare to automotive, to consumer electronics, industries are enabling on-device AI to improve user experience and productivity. Growth in both regions is expected to continue, driven by technological advancements, increased digital awareness, and the rollout of smart autonomous devices.

On-Device AI Market Competitive Landscape

Google is enhancing on-device AI through its Gemini 2.0 Flash model, integrated into Android devices via the Gemini API. This development enables real-time, multimodal AI experiences, such as the Search Live feature in India, which allows dynamic, conversational interactions, reflecting Google's commitment to advancing on-device AI capabilities

-

In February 2025, Google launched Gemini 2.0 Flash, an on-device AI model offering multimodal input and text output, accessible via the Gemini API and Google AI Studio.

Qualcomm's Snapdragon 8 Elite Gen 5 SoC, featuring a 37% faster Hexagon NPU, powers advanced on-device AI capabilities in Android devices. The company's strategic focus on edge AI supports real-time applications across various sectors, including mobile, automotive, and IoT, positioning Qualcomm as a leader in on-device AI innovation.

-

In September 2025, Qualcomm unveiled the Snapdragon 8 Elite Gen 5 SoC, featuring a 37% faster Hexagon NPU, enhancing on-device AI capabilities in Android devices.

Apple is pioneering on-device AI with its Foundation Models framework, enabling developers to create privacy-centric applications that process data locally. This approach enhances user experience by reducing latency and ensuring data security, aligning with Apple's commitment to user privacy and seamless integration across its ecosystem.

-

In September 2025, Apple introduced the Foundation Models framework, enabling developers to create intelligent, privacy-focused applications using on-device AI, enhancing user experience across iOS, iPadOS, and macOS.

On-Device AI Market Key Players:

Some of the On-Device AI Market Companies are:

-

Apple Inc.

-

Qualcomm Technologies, Inc.

-

Google LLC (Alphabet)

-

NVIDIA Corporation

-

Intel Corporation

-

Samsung Electronics Co. Ltd.

-

Huawei Technologies Co., Ltd.

-

MediaTek Inc.

-

Arm Holdings

-

Microsoft Corporation

-

Baidu, Inc.

-

Synaptics Inc.

-

Broadcom Inc.

-

Imagination Technologies

-

CEVA, Inc.

-

Xilinx (AMD)

-

NXP Semiconductors

-

STMicroelectronics

-

Sony Corporation

-

Infineon Technologies AG

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 17.61 Billion |

| Market Size by 2033 | USD 115.74 Billion |

| CAGR | CAGR of 26.57 % From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software) • By Type (Smartphones & Tablets, Wearables, Smart Home Devices, Automotive, Others) • By Technology (Machine Learning, Natural Language Processing, Computer Vision, Speech Recognition) • By Vertical (Consumer Electronics, Automotive, Healthcare, Retail, Manufacturing, Security & Surveillance, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Apple Inc., Qualcomm Technologies Inc., Google LLC (Alphabet), NVIDIA Corporation, Intel Corporation, Samsung Electronics Co. Ltd., Huawei Technologies Co. Ltd., MediaTek Inc., Arm Holdings, Microsoft Corporation, Baidu Inc., Synaptics Inc., Broadcom Inc., Imagination Technologies, CEVA Inc., Xilinx (AMD), NXP Semiconductors, STMicroelectronics, Sony Corporation, Infineon Technologies AG, and Others. |