5G Network Slicing Market Report Scope & Overview:

Get More Information on 5G Network Slicing Market - Request Sample Report

The 5G Network Slicing Market Size was valued at USD 396.2 Million in 2023 and is expected to reach USD 9815.9 Million by 2032, growing at a CAGR of 42.9% over the forecast period 2024-2032.

The growth of the 5G network slicing market is driven by the rapid development of network technologies and the increase in digitalization initiatives implemented by governments. Nowadays, government bodies around the world are actively supporting the increase in 5G infrastructure deployment to be able to handle emerging technologies like the Internet of Things, connected vehicles, and smart cities. The recent information from the U.S. Federal Communications Commission implies that the U.S. government has recently decided to allocate an additional amount of $20 billion within the Rural Digital Opportunity Fund until 2023 to increase the network slicing deployment rates in rural areas. Similarly, the European Commission aims to achieve full 5G coverage on the continent by 2030 with an initial investment of over €1.8 billion in the deployment in industry-related sectors. These trends suggest that 5G slicing demand is constantly growing because it allows network providers to create dedicated virtual networks that can be adapted to the needs of each industry. As businesses continue to adopt their own 5G networks, the demand for network slicing that can support these connections is also growing. In addition, it is important to note that as the 5G deployment is intensifying, telecommunications companies and network providers are becoming more interested in improving their network performance through slicing solutions. At the same time, resource allocation, efficiency, and security improvements can only be managed with the help of AI and ML software that analyze real-time data.

The rising demand for AR and VR applications within the gaming sector is one of the main drivers of 5G slicing. In June 2021, for example, Ericsson, Samsung, and Deutsche Telekom collaborated to implement 5G slicing for cloud VR gaming. The rising adoption of the Internet of Things (IoT) is expected to significantly increase the demand for 5G network slicing. By providing dedicated network slices for IoT devices, service providers can ensure these devices have the necessary resources and quality of service (QoS) for efficient operation. As the number of IoT devices continues to grow, service providers will need to scale their networks accordingly. 5G network slicing offers a flexible and cost-effective solution, allowing for the creation of new slices and resource allocation as needed. This growing demand for IoT devices and applications is anticipated to drive the growth of the 5G network-slicing market in the coming years.

5G Network Slicing Market Dynamics

Drivers

-

Growing need for high-speed internet and seamless connectivity across sectors like entertainment and VR.

-

Increased use of connected devices and smart applications in sectors like healthcare and industrial automation.

-

Enterprises in industries like manufacturing and logistics are adopting network slicing for dedicated, secure connections.

The rise of the Internet of Things and Industry 4.0 has been the crucial driver for 5G network slicing. More and more industries have adopted connected devices and smart technologies, resulting in an increased demand for specialized network capabilities. By 2025, more than 30 billion IoT devices are expected to be connected worldwide, and their applications cover such areas as healthcare, manufacturing, logistics, and agriculture. In its turn, Industry 4.0 relies on devices and processes that are connected and data-driven with real-time data processing. The machinery used in manufacturing industries has special sensors that generate various types of data, requiring its transfer and processing to conduct predictive maintenance and production tracking and planning using real-time analytics.

Such applications require the creation of dedicated ultra-reliable low-latency communication for industries. Many applications in the healthcare sector require high-speed and secure connections in real-time. For instance, wearable sensors transfer data to the healthcare provider, remote monitoring systems transfer patients’ data, etc. In this line, healthcare providers can develop their private networks to convey information quickly and without any failures to guarantee proper functioning applications like telemedicine or emergency services. A recent study conducted by IoT Analytics proved that IoT market growth will accelerate with an 11.8% CAGR from 2023 to 2032. To support those diverse and mission-critical applications of different industries, it is essential to provide them with the use of a tailored 5G network slicing approach that addresses the demand for IoT systems.

Restraints:

-

Managing multiple virtual slices adds operational complexity in monitoring, security, and resource allocation.

-

Significant initial investment for 5G infrastructure and slicing technology may deter adoption in emerging markets.

-

The lack of standardized protocols leads to compatibility issues across different vendors' 5G slicing solutions.

In the 5G network slicing market, one of the major restraints is the challenge of interoperability. Different vendors provide their solutions, there are no established common protocols and frameworks. Naturally, each developer creates proprietary technologies and standards, making it more difficult to ensure that different parts of the network are compatible. As such, operators face substantial technical difficulties when they try to design slices that would fit with a variety of network infrastructures, such as in a case when they utilize hardware and software developed by different vendors. Moreover, this issue also slows down the implementation of slicing, especially for operators willing to deploy it within its existing 4G or even hybrid networks. Without a universally acknowledged standard, ensuring that all components operate as intended shifted the focus from creating new-generation applications to solving operational compatibility issues. This leads to increased investments into operational costs to ensure efficiency and substantial delays. Finally, these problems become far more pronounced in multinational deployments or other larger implementations where network elements differ from region to region or partner to partner, making it difficult to create uniform high-performance slices.

5G Network Slicing Market Segmentation Overview

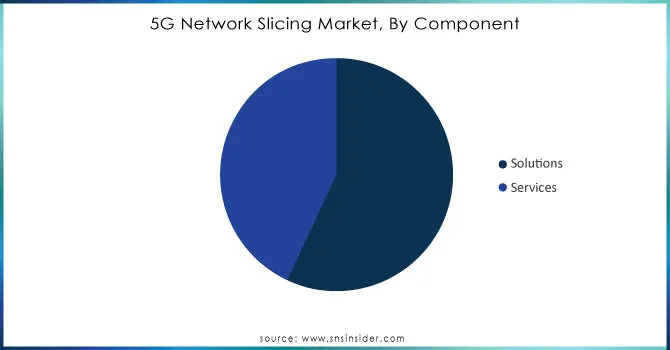

By Component

The solutions segment dominated the market with a revenue share of above 58.0% in 2023. The increasing demand for advanced network management solutions resulting in the adoption of tailored network slices is driving the growth of the segment. Software-defined networking and network function virtualization has been an integral component of the disaggregation and virtualization architectures to provide the scalability and operability required to deliver tailored services across various industries. Government initiatives aimed at improving network infrastructure have further driven the adoption of slicing solutions. Several government initiatives to improve the network infrastructure, thus driving the adoption of slicing solutions, are also fuelling market growth. In India, the “Digital India” initiative has allocated USD 30 billion in 2023 to enhance the nation’s 5G infrastructure. In addition to infrastructural developments, providing network-slicing capabilities to support smart city projects is also supporting market growth. The increasing focus of the solution providers to deliver advanced networks corresponding to the specific IT requirements of the end users is expected to play a major role in driving the market, as enterprises are in need to receive integral solutions to manage their integrated networks efficiently and reduce operational complications. Integration of AI-driven solutions is also supporting segment growth by ensuring the efficient management and allocation of resources by the networks with lower human intervention.

Need Any Customization Research On 5G Network Slicing Market - Inquiry Now

By Network Architecture

In 2023, the non-standalone (NSA) segment generated more than 69% of the total market revenue. The popularity of this architecture is due to its capacity to provide a smooth transition from existing 4G to new 5G networks without having to scrap existing infrastructure. In essence, the NSA form allows operators to take advantage of their 4G LTE networks while gradually incorporating 5G functionalities. This means that 5G services are initially provided within the structure of the already-in-place 4G networks. The use of this hybrid approach is widespread, as it allows telecommunication companies to unite the 4G and 5G networks rather than scrap the existing ones. There are numerous instances of such an undertaking around the globe. According to the Chinese Ministry of Industry and Information Technology, more than 2.3 million NSA 5G nodes were launched throughout China as of December 2023. In addition, government policies are supportive of the widespread use of NSA architecture. For example, the U.S. Federal Communications Commission 5G FAST Plan prescribes leveraging the existing infrastructure for the rapid deployment of 5G. While NSA networks are not as optimized as standalone (SA) 5G networks for specific applications, they offer a practical solution for operators looking to deploy 5G services quickly and cost-effectively.

By Type Insights

In 2023, the end-to-end slicing segment dominated the market with 46% of the 5G network slicing market revenue share. End-to-end slicing solutions allow operators to build highly specialized networks spanning the entire infrastructure from the core to the edge. In turn, companies get the possibility to achieve complete control over the offered services’ quality, minimal latency, and security. Especially for certain industries, such as healthcare, manufacturing, and automotive, low-latency, and high-reliability connections are indispensable. The opportunities related to end-to-end slicing are acknowledged by several governments. Through the Horizon Europe program, the European Union in 2023 invested €600 million in 5G projects, considering end-to-end slicing a key solution for creating next-generation communication services. Despite occupying the leading market position, the end-to-end slicing segment will not experience such a boost in demand as the standalone slicing segment. The growth of the latter results from the mounting number of telecom operators striving to shift to full 5G deployments. Compared to either application or RAN slicing, standalone slicing solutions offer a higher level of efficiency and versatility. Telecom operators will use these technologies to accommodate emerging applications, such as AR and industrial automation, as well as integrate virtual and non-standalone deployments.

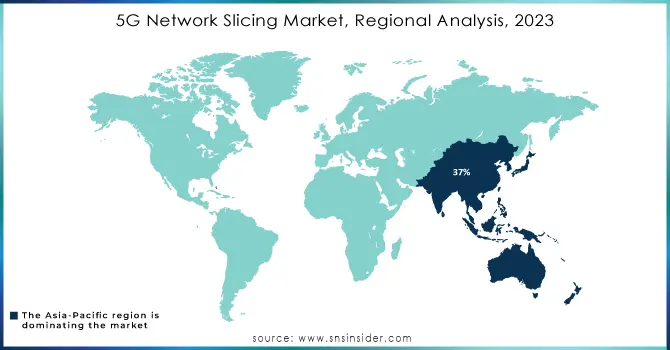

5G Network Slicing Market Regional Insights

In 2023, the Asia-Pacific region has the largest market share of 37% in the 5G network slicing market due to notable investments in 5G infrastructure in China, South Korea, and Japan countries have made significant investments in 5G infrastructure, resulting in the development and deployment of 5G network slicing services. According to the Ministry of Industry and Information Technology of the People’s Republic of China, In APAC 40% share of 5G network development is attributed to China. The growth of the 5G slicing market is the result of the Chinese government's focus on building smart cities and implementing the Industry 4.0 strategy. Additionally, the Asia Pacific region has the largest mobile subscriber base globally, which is driving the demand for 5G network slicing to accommodate the growing number of connected devices and services.

North America accounted for significant share of the market and is projected to grow with significant CAGR, due to the virtualization of radio access networks and the development of 5G in the U.S., which is the primary region of network slicing. The Middle East and Africa market is the most rapidly growing region with significant CAGR in the period. MEA makes notable investments in digital infrastructure, and the UAE and Saudi Arabia are examples of the launch of ambitious 5G deployment strategies to accelerate digital transformation. Particularly, at the end of 2023, the UAE reached, according to the Telecommunications and Digital Government Regulatory Authority, 85% of the geography of the state with the area of 5G services.

Recent News and Developments

-

In September 2023, Nokia revealed its cooperation with China Mobile on the development and deployment of advanced 5G network slicing solutions in China. In the framework of this project, experience sharing on the usage of end-to-end slicing technology to further improve performances of industry-specific 5G apps, particularly in manufacturing and logistics, will be provided.

-

Ericsson has also introduced its 5G RAN slicing solution in November 2023. Thus, now telecommunication operators have an opportunity to provide optimized network slices for the healthcare and automotive industries. This development is a crucial tool that allows operators to deliver differentiated services through an increase in the efficacy of resource usage under their 5G networks.

Key Players in 5G Network Slicing Market

Key Service Providers/Manufacturers

-

Ericsson (Dual-mode 5G Core, Ericsson Cloud RAN)

-

Nokia (Nokia 5G Core, Nokia AirScale)

-

Huawei (Huawei 5G Core, CloudFabric)

-

Cisco (Cisco Ultra 5G Core, Cisco Cloud Services)

-

Samsung (Samsung 5G RAN, Samsung vRAN)

-

Intel (Intel 5G Network Platform, Intel FlexRAN)

-

Juniper Networks (Juniper 5G Assurance, Juniper Contrail)

-

Mavenir (Mavenir Cloud-Native 5G Core, Mavenir Open RAN)

Users of Services/Products

-

Verizon

-

AT&T

-

T-Mobile

-

Deutsche Telekom

-

SK Telecom

-

China Mobile

-

Vodafone

-

NTT Docomo

-

Bell Canada

-

Rogers Communications

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 396.2 Million |

| Market Size by 2032 | USD 9815.9 Million |

| CAGR | CAGR of 42.9% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solutions, Services {Managed Services, Professional Services}) • By Network Architecture (Standalone, Non-standalone) • By Type (RAN Slicing, Edge Slicing, End-to-End Network Slicing) • By Vertical (Manufacturing, Healthcare, Smart Cities, Transportation & Logistics, Energy & Utilities, Media & Entertainment, Retail, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Ericsson, Nokia, Huawei, ZTE, Cisco, Samsung, Intel, Qualcomm, Juniper Networks, Mavenir |

| Key Drivers | • Growing need for high-speed internet and seamless connectivity across sectors like entertainment and VR. • Increased use of connected devices and smart applications in sectors like healthcare and industrial automation. |

| RESTRAINTS | • Managing multiple virtual slices adds operational complexity in monitoring, security, and resource allocation. • Significant initial investment for 5G infrastructure and slicing technology may deter adoption in emerging markets. |