Online Gaming Market Report Scope & Overview:

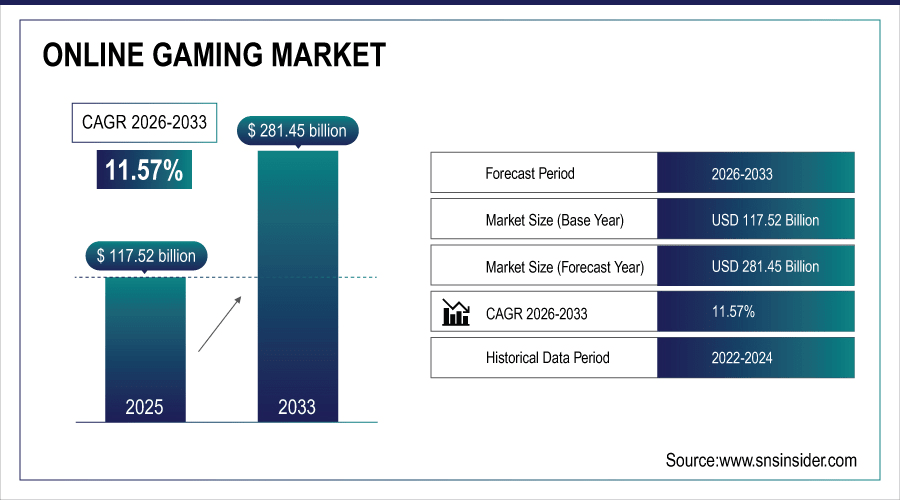

The Online Gaming Market Size was valued at USD 117.52 Billion in 2025E and is expected to reach USD 281.45 Billion by 2033 and grow at a CAGR of 11.57% over the forecast period 2026-2033.

Online Gaming Market is rapidly growing with the boom of smartphones, high-speed internet, and cloud gaming platforms. The vast rollout of 5G networks has drastically lowered latency and made for a much smoother gameplay experience to both be played on and streamed, allowing for players to play multi-player seamlessly and interact with the game remotely. Moreover, improving consumer interest for immersive gaming experiences like AR/VR and eSports has broadened the expansion of user base over generation, from teenagers to young adults. The growth of freemium, in game purchases, microtransactions, and subscription services attracts both casual and hardcore gamers and is driving even more growth of the market. According to study, 5G networks reduce average game latency from ~60–80 ms (4G) to under 20 ms, enhancing real-time multiplayer and cloud gaming adoption.

To Get More Information On Online Gaming Market - Request Free Sample Report

Online Gaming Market Trends

-

Mobile gaming growth drives global engagement and expands active player base.

-

Cloud gaming platforms remove hardware barriers, attracting casual gamers worldwide.

-

5G adoption enables seamless multiplayer, AR, and virtual reality experiences.

-

Free-to-play models and microtransactions significantly boost in-game monetization revenues.

-

eSports league expansions increase competitive gaming participation across multiple regions globally.

-

Streaming platforms generate new revenue opportunities for developers and professional gamers.

-

Cross-platform play encourages longer engagement and wider global audience reach.

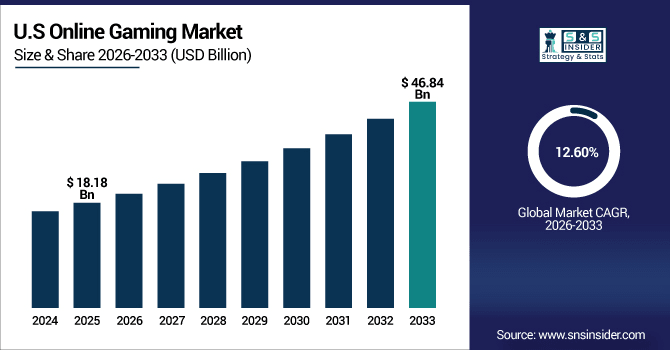

The U.S. Online Gaming Market size was USD 18.18 Billion in 2025E and is expected to reach USD 46.84 Billion by 2033, growing at a CAGR of 12.60% over the forecast period of 2026-2033, driven by widespread smartphone and console adoption, advanced broadband and 5G networks, and strong engagement in esports and multiplayer games.

Online Gaming Market Growth Drivers:

-

Mobile And Cloud Gaming Adoption Accelerates Engagement And Expands Player Base

One of the main factors that have caused the expansion of the Online Gaming Market is the increasing number of smartphone and tablet users and the internet with a higher bandwidth speed. By providing users with the ability to access games anytime and anywhere, mobile gaming facilitates an increase in engagement and a larger player pool. Moreover, cloud gaming services such as Xbox Cloud Gaming, GeForce Now, and PlayStation Now, diminish the acquired hardware, bringing high-quality gaming to the casual user. 5G networks are also reducing latency and play a critical role in allowing for real-time multiplayer interactions, augmented reality/virtual reality experiences, and live streaming experiences. Not only does this driver grow the total available market for active gamers, but it also drives monetization through microtransactions, subscriptions, and in-game purchases.

Players engaging in cross-platform gaming show 15–20% higher session retention compared to single-platform users.

Online Gaming Market Restraints:

-

High Development And Operational Costs Challenge Market Growth Potential Globally

High-quality online games (AAA) require infrastructure, graphics, and content generation. Furthermore, keeping servers running for multiplayer functionality and online-based games means that there are ongoing operational costs, such as for cybersecurity, bandwidth, and data storage. This makes it hard for smaller studios and startups to compete, hindering market entry. Other costs may impede the possibility to have accessible pricing for the end-user. These costs become a primo barrier in areas with poor internet connectivity, or where devices with any performance are quite limited, leading to lower adoption and a slower growth rate compared to the increasing interest in gaming.

Online Gaming Market Opportunities:

-

eSports Popularity Creates Revenue, Engagement, And Competitive Gaming Opportunities

The massive rise in eSports popularity is providing a growing opportunity for the online gaming sector. Professional gaming competitions, live streaming, and sponsorships are also lucrative revenue streams that enhance user engagement and retention. And with Twitch, YouTube Gaming and Facebook Gaming drawing millions of eyeballs, players and creators can offset the expense of the hobby by turning to advertising, subscriptions and sponsorship deals. The growth of eSports into schools, universities and regional leagues creates new audiences for eSports, especially casual players who move into competitive play. This opens the door for game developers to create multi-player and competitive-focussed titles that can maximize merchandise and the internationalisation process of cross-platform engagement.

Platforms like Twitch and YouTube Gaming attract over 200 million monthly active viewers, boosting content creation revenue.

Online Gaming Market Segmentation Analysis:

-

By Gaming Type: In 2025, Massively Multiplayer Online Role-Playing Games (MMORPGs) led the market with share 32.10%, while Battle Royale Games are the fastest-growing segment with a CAGR 13.70%.

-

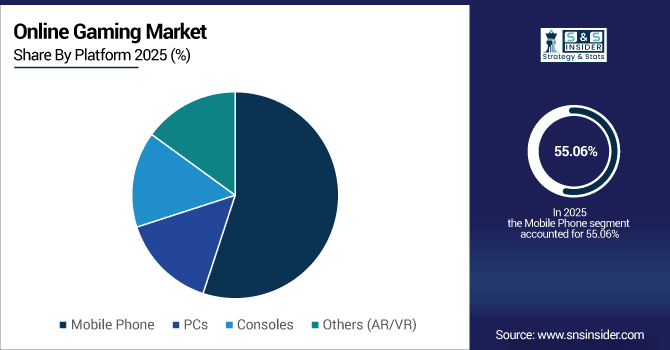

By Platform: In 2025, Mobile Phone the market 55.06%, while Consoles fastest-growing segment with a CAGR 14.40%.

-

By Gamer Type: In 2025, Casual Gamers led the market with share 62.10%, while Multiplayer Enthusiasts the fastest-growing segment with a CAGR 14.10%.

-

By Demographic: In 2025, Young Adults (18-24) led the market with share 56.10%, while Seniors (55+) is the fastest-growing segment with a CAGR 12.8%.

By Platform, Mobile Phone Lead Market While Consoles Fastest Growth

Mobile Phones were the largest segment in 2025 Online Gaming Market, fuelled by high smartphone penetration, low mobile cost, and high access to casual and competitive games. Due to the ease of access and to its free-to-play titles with in-app purchases mobile gaming quickly become a home for wide range of audience groups such as casual and young gamers. On the other hand, Consoles continue to be the fastest-growing segment supported by high-end hardware power, realistic graphics rendering, attractive titles are only available for console, and cross-platform multiplayer functions, which engage the hardcore gamers and are more likely to keep them for a long time, creating one of the most important growth engines for the market.

By Gaming Type, Massively Multiplayer Online Role-Playing Games (MMORPGs) Lead Market While Battle Royale Games Fastest Growth

In 2025, Massively Multiplayer Online Role-Playing Games took over the online gaming world with their emphasis on great worlds, long term play, and group forming tools. Massively Multiplayer Online Role-Playing Games lure in the beer-guzzling casuals and hardcore gamers alike with subscription-based models and microtransactions that only grow to make more money by the month. Battle Royale Games meanwhile is the fastest growing segment, as the highly competitive multiplayer matches, fast-paced nature of typical Battle Royale matches, and streaming popularity, especially among young adults and esports aficionados make it one of the largest and fastest growing contributors to overall market expansion and is a segment increasingly in focus for developers and investors alike.

By Gamer Type, Casual Gamers Lead Market While Multiplayer Enthusiasts Fastest Growth

The Online Gaming Market was largely dominated by Casual Gamers in 2025, seeking casual games that are easy to play, can be played on their mobile snappy devices and by free-to-play games with in-game purchases. The brief-play, relatively social nature of mobile games attracted a larger swath of players and have led developers to produce quick-hitting titles that are easy to pick up. On the other hand, Multiplayer Enthusiasts are the fastest-growing segment, due to multiple facets including competitive gameplay, team-based missions and esports. Increased real-time multiplayer game space, cross-play, and “broadcast” content will help drive higher engagement and spending in investment and consumer-focused games, which will be the primary growth driver of the modern online games market.

By Demographic, Young Adults (18–24) Lead Market While Seniors (55+) Fastest Growth

Young Adults (18–24) were the largest segment engaging in online gaming in 2025, motivated by higher participation in competitive, multiplayer, and immersive gaming, which are growing fast. These users are highly involved in mobile, console, and PC gaming, leading to high retention and spend within games. Lastly, the fastest-growing cohort is Seniors (55+) due to older gamers having more exposure to digital technology, accessibility to casual and puzzle games, and features that facilitate social interaction. Increasing the market reach by senior-friendly gaming platforms & mobile apps is creating new opport.

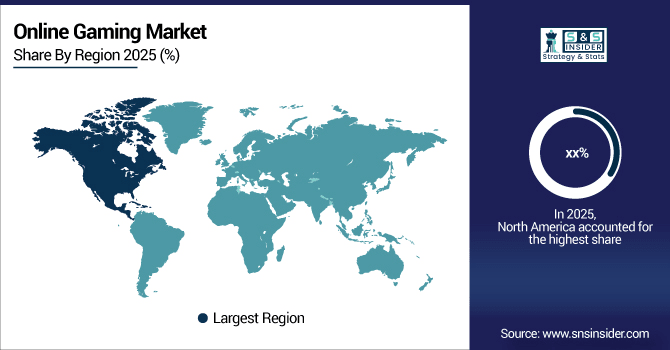

Online Gaming Market Regional Analysis:

North America Online Gaming Market Insights

The North America region is expected to have the fastest-growing CAGR 12.79%, phase boosted by high penetration of smartphones, high penetration of broadband and 5G and high expenditure on gaming subscriptions and in-app purchases. Although mobile and console platforms still dominate, adoption of cloud gaming is also accelerating. Not only does the demographic of young adults help with greater engagement and monetization, but so has competitive gaming and esports. Combined with high-end infrastructure, a robust development base, and some pioneering titles, North America is the fastest growing market on the world online gaming scene.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Dominates Online Gaming Market with Advanced Technological Adoption

U.S. Dominates Online Gaming Market with Advanced Technology, High 5G Penetration, Strong Console and Mobile Gaming Adoption, Esports Popularity, Cloud Gaming Growth, and Increased In-Game Monetization Driving Rapid Market Expansion.

Asia-Pacific Online Gaming Market Insights

The largest Online Gaming Market belongs to the Asia-Pacific region with share 50.02%, supported by widespread smartphone usage, cheap mobile data, and high internet penetration. The region is mainly for mobile and PC gaming, but console is growing. Competitive games, esports, and live streaming are garnering the most interest, with a tech-savvy, young audience. As game developers continue to invest in localized content and new, innovative gameplay experiences, engagement is only getting higher. The region continues to drive global trends in online gaming revenue and adoption, supporting ongoing growth in the market.

China and India Propel Rapid Growth in Online Gaming Market

China and India Propel Rapid Online Gaming Growth with Massive Smartphone Adoption, Expanding Internet Access, Mobile Gaming Popularity, Rising Esports Engagement, In-Game Monetization, and Increasing Investment in Game Development and Digital Entertainment.

Europe Online Gaming Market Insights

European Online Gaming Market needs steady growth driven by high internet penetration, adoption of smartphones and consoles, and a growing interest in competitive and casual gaming. Finally, mobile gaming stays king, buoyed by microtransaction and subscription-based monetization, while console and PC gaming have their loyal users. Esports and live streaming are becoming popular and tapping into the interest of young adults and multiplayer enthusiasts. On the other hand, continuous investments on game development, localized content and cutting-edge technologies are improving user experience which make European online gaming the fastest-growing gaming industry with massive growth per year.

Germany and U.K. Lead Online Gaming Market Expansion Across Europe

Germany and the U.K. Lead Online Gaming Market Expansion Across Europe, Driven by High Smartphone Adoption, Advanced Internet Infrastructure, Console and PC Gaming Popularity, Esports Engagement, and Growing In-Game Monetization Opportunities Fueling Market Growth.

Latin America (LATAM) and Middle East & Africa (MEA) Online Gaming Market Insights

The Online Gaming Market in Latin America & Middle East & Africa has been growing moderately owing to increase in smartphone penetration level, internet penetration, and rise in gaming interest through mobile devices & PCs. Fueled by free-to-play structures, microtransactions, and subscription services, casual and competitive gaming is on the rise. Engagement in various demographic segments is witnessing a boost owing to the rising popularity of esports, live streaming, and multiplayer experiences. Localised content, infrastructure upgrades, and new gameplay experiences propel adoption even further, creating emerging markets in these regions of global online gaming.

Online Gaming Market Competitive Landscape

Sony drives online gaming growth through PlayStation consoles and live-service games. Strategic acquisitions and new studios expand multiplayer and team-based action offerings, while PlayStation 5 sales and exclusive titles enhance engagement, monetization, and global market presence.

-

In May 2025, Sony announced the formation of teamLFG, a new PlayStation studio focused on developing team-based action games inspired by fighting games, MOBAs, and platformers.

Google strengthens the online gaming ecosystem via Android’s Play Games platform, introducing enhanced user profiles, social interaction, and gaming statistics. The company promotes mobile gaming adoption, cloud integration, and community engagement, fostering growth and innovation in casual and competitive gaming worldwide.

-

In September 2025, Google began rolling out an update to its Play Games profiles on Android, introducing new features and gaming statistics to enhance user profiles and social interaction within the gaming ecosystem.

Tencent dominates the Online Gaming Market through a vast portfolio of mobile and PC games. The company focuses on esports, competitive gaming, and anti-cheat technologies, while expanding evergreen titles and live-service offerings, driving high user engagement and consistent revenue growth across global markets.

-

In August 2024, Tencent showcased its Anti-Cheat Expert (ACE) at Gamescom, offering a comprehensive suite of game security solutions for mobile and PC games, including AI-driven anti-cheat measures and content detection capabilities.

Online Gaming Market Key Players:

Some of the Online Gaming Market Companies are:

-

Sony Group

-

Alphabet (Google)

-

Tencent

-

Sega

-

PopReach

-

Bandai Namco

-

Nintendo

-

Square Enix

-

Ubisoft

-

GungHo Online Entertainment

-

Electronic Arts (EA)

-

Capcom

-

Zeptolab

-

Microsoft

-

NEXON

-

Apple

-

Take-Two Interactive

-

GREE

-

NetEase

-

Amazon

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 117.52 Billion |

| Market Size by 2033 | USD 281.45 Billion |

| CAGR | CAGR of 11.57% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Gaming Type (First-Person Shooter Game (FPS), Multiplayer Online Battle Arena (MOBA) Games, Massively Multiplayer Online Role-Playing Games (MMORPGs), Battle Royale Games, Real-time Strategy Game (RTS), Online Casino Games, Others (Player versus Environment (PvE))) • By Platform (Mobile Phone, PCs, Consoles, Others (AR/VR)) • By Gamer Type (Casual Gamers, Hardcore Gamers, Professional Gamers, Social Gamers, Single-player Enthusiasts, Multiplayer Enthusiasts) • By Demographics (Kids (under 12), Teens (13–17), Young Adults (18–24), Adults (25–34), Middle-Aged (35–54), Seniors (55+)) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Activision Blizzard, Electronic Arts Inc., Tencent Holdings Ltd., Sony Corporation, Microsoft Corporation, Nintendo Co. Ltd., Ubisoft Entertainment SA, Take-Two Interactive Software Inc., NetEase Inc., Zynga Inc., Square Enix Holdings Co. Ltd., Bandai Namco Entertainment Inc., Epic Games Inc., Valve Corporation, Sega Sammy Holdings Inc., Nexon Co. Ltd., NCSoft Corporation, Riot Games Inc., Konami Holdings Corporation, Capcom Co. Ltd., and Others. |