SaaS-based Business Analytics Market Report Scope & Overview:

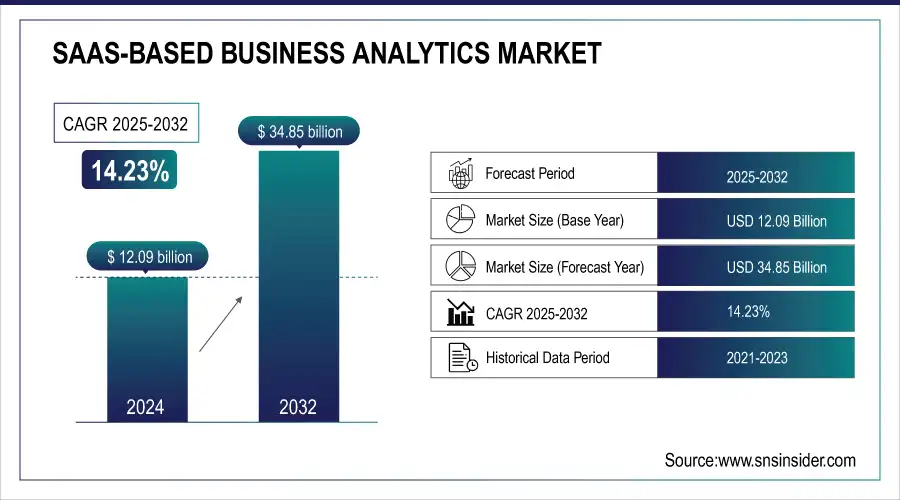

The SaaS-based Business Analytics Market size was valued at USD 12.09 billion in 2024 and is expected to reach USD 34.85 billion by 2032, growing at a CAGR of 14.23% from 2025-2032.

The SaaS-based Business Analytics Market growth is driven by increasing demand for real-time data insights, cost-effective cloud deployment models, and the rising adoption of data-driven decision-making across enterprises.

To Get more information on SaaS-based Business Analytics Market - Request Free Sample Report

In the U.S., over 60% of firms in the information sector and 30–40% of manufacturing firms already use cloud services, underscoring the widespread shift toward SaaS platforms. Organizations are increasingly leveraging SaaS analytics tools to enhance operational efficiency, customer engagement, and predictive planning without heavy infrastructure investments.

A recent Oracle ESG survey found that 91% of respondents consider SaaS consumption models essential for deploying AI, IoT, and financial/operational automation. Supporting this, Oracle whitepapers report that 93% of Fortune 1000 CIOs view AI as a critical transformative technology, enabled by the vast scale of cloud infrastructure.

The integration of AI, ML, and automation into analytics solutions further accelerates market growth. Additionally, the surge in remote work and digital transformation initiatives across industries has amplified the need for scalable, flexible, and collaborative analytics tools, positioning SaaS-based platforms as a preferred choice for both SMEs and large enterprises.

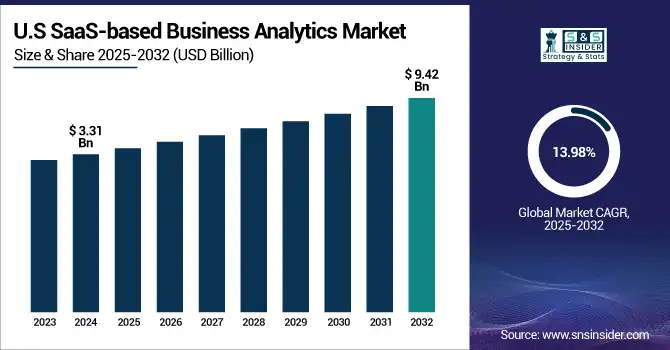

U.S. SaaS-based Business Analytics Market size was valued at USD 3.31 billion in 2024 and is expected to reach USD 9.42 billion by 2032, growing at a CAGR of 13.98% from 2025-2032.

Growth in the U.S. SaaS-based Business Analytics Market is fueled by increasing cloud adoption, demand for real-time insights, AI integration, and the need for agile decision-making tools across industries, especially amid expanding digital transformation and remote work environments.

SaaS-based Business Analytics Market Dynamics

Drivers

-

Growing need for data-driven decisions is boosting the adoption of user-friendly SaaS-based business analytics platforms across industries.

Data-driven strategies have become a top concern for firms looking to boost operational efficiency and gain a competitive edge. What these analytics solutions offer that meets this demand are a combination of user-friendly interfaces, embedded AI/ML capabilities, and easy integration with existing systems. Such platforms minimize reliance on IT and empower the users of a business to be self-sufficient in accessing actionable insights. SaaS analytics help reshape processes in real time- predictive sales modeling, customer behavior analysis, organizations are not looking back. This is enabling data analytics tools through a SaaS model to unlock value across the enterprise, particularly for mid-sized organizations which often lack the resources for sophisticated IT solutions.

Reflecting this trend, Microsoft reports over 60,000 Azure AI customers a 60% year-over-year increase indicating broad adoption of AI analytics tools by organizations of all sizes, including mid-sized firms.

However, while 58% of organizations are focused on increasing Power BI adoption, surveys show that 84% still have under 25% adoption across employees highlighting both the growing demand and the need for more intuitive self-service tools to support broader enterprise engagement.

Restraints

-

Integration complexity with legacy systems is limiting the seamless deployment of SaaS-based business analytics in traditional enterprises.

SaaS solutions are flexible, but major integration roadblocks arise for older enterprises with legacy ERP, CRM or data warehouse systems. The variety of data formats, incompatible APIs, and fragmented infrastructures are likely to block data from flowing into modern SaaS analytics platforms painlessly. Which then creates more configuration costs, longer implementation time, and dependence on third-party middleware. Transition to SaaS models at organizations with deep-rooted IT architectures is slow-moving since they are not very enthusiastic to just break away their core operations. Legacy-heavy firms may delay or forgo full-blown SaaS adoption, hindered by the absence of streamlined migration paths and robust integration support.

Opportunities

-

AI and machine learning integration in SaaS analytics tools is creating new opportunities for advanced predictive business intelligence solutions.

The Move towards Automation & Forecasting While enterprises scale the levels of automation and forecasting, AI/ML integration with SaaS analytics is opening the gates for hyper-personalised insight generation and predictive decision-making. These tools provide strategic value, from churn prediction to dynamic pricing that goes beyond basic dashboards. The key competitive advantage lies with intelligent algorithms that the providers bake into their integrated solutions and which keep learning continually. Organizations are not only looking for platforms that visualize but also understand and predict the data outcomes in real-time, which is a trend that is fuelling data democratization and self-service analytics.

Supporting this shift, a Microsoft survey found that 78% of IT professionals already have AI deployed or in pilot stages demonstrating widespread internal adoption.

Additionally, the IDC-sponsored Responsible AI survey reports that 91% of organizations are using AI, with expectations of over a 24% improvement in operational efficiency, customer experience, and business resilience.

Further emphasizing this trend, over 21,000 customers including approximately 70% of the Fortune 500 are using Microsoft Fabric, a unified data-AI platform that supports real-time data preparation, generative AI integration, and continuous model training.

Challenges

-

Managing data interoperability across multi-cloud and hybrid environments challenges seamless analytics in SaaS-based business intelligence ecosystems.

Using cross-cloud or hybrid cloud models increases the data pipelines' complexity towards the interoperability and consistency with which they pass data between different cloud providers. Different cloud platforms tend not to share standards, storage formats and governance models. All this fragmentation impacts the quality and reliability of analytics outputs. Integration continuity will require SaaS vendors to build more solid APIs and cross-platform data connectors. In multi-IT landscapes, the lack of standardized data propagation mechanisms lead to data silos, latencies and compromised accuracy of insights all of which reduce the returns from SaaS-based analytics investments.

SaaS-based Business Analytics Market Segmentation Analysis

By Organization Size

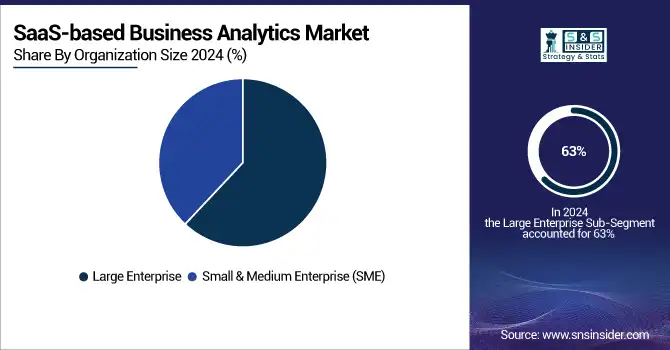

Large enterprises dominated the SaaS-based Business Analytics Market in 2024 with a 63% revenue share due to their considerable IT budget, complex data ecosystems and the demand for advanced analytics capabilities. These are high-performing organizations where strategic insights from data are prioritized at the global operations, customer and process optimization levels. Perfectly positioned to drive higher value spend and market penetration, their existing infrastructure and willingness to pay for fully scalable SaaS solutions allows for quick deployment and adoption across departments.

Small and Medium Enterprises (SMEs) are expected to grow at the fastest CAGR of 15.65% from 2025 to 2032, driven by increasing digitalization, cost-effective SaaS adoption, and demand for real-time insights without large IT teams. They are typically cloud-based tools that most businesses would prefer simply for their flexibility, low upfront cost, and user-friendliness. With data-driven decision-making being the need of the hour, SMEs are turning to analytics at a faster pace to gain a competitive edge along with operational effectiveness.

By End Users

The BFSI segment led the SaaS-based Business Analytics Market in 2024 with a 25% revenue share, due to the sectors high dependence of real-time data to identify potential frauds, customer profiling and risk management. On the other hand, financial institutions need advanced, scalable analytics tools to satisfy regulations, improve personalization, and maximize services. This puts them in a stronger position for the sector thanks to early cloud adoption and continued investment in advanced analytics.

The retail and e-commerce segment is projected to grow at the fastest CAGR of 15.61% from 2025 to 2032, owing to growing need for customer-based insights, inventory prediction, and customized marketing. SaaS analytics provides retailers highly agile and data-driven strategies to track consumer behaviour, set right pricing and enhance digital engagement. This rapid adoption path is fuelled even further by the transition to omnichannel retail and the demand for real-time decision making.

By Architecture Type

The multi-tenant segment dominated the SaaS-based Business Analytics Market in 2024 with a 74% revenue share and is projected to grow at the fastest CAGR of 14.86% from 2025 to 2032. This dominance and rapid growth are driven by its cost-efficiency, scalability, and ease of deployment across industries. Multi-tenancy allows multiple users to access a single software instance, reducing infrastructure costs and enabling quicker updates. It appeals to both large enterprises and SMEs seeking collaborative analytics environments. Vendors favor this model for streamlined maintenance, enhancing customer reach while ensuring consistent performance and security.

By Analytics Type

Descriptive analytics dominated the SaaS-based Business Analytics Market share in 2024 with a 44%, due to its foundational role in helping organizations understand historical data patterns and performance. It offers easy-to-use dashboards and visualizations that support basic reporting and decision-making. Its widespread use across industries for tracking KPIs and operational efficiency makes it the most adopted analytics type, especially among enterprises beginning their data analytics journey.

Prescriptive analytics is expected to grow at the fastest CAGR of 16.78% from 2025 to 2032, driven by increasing demand for actionable, real-time decision recommendations. Organizations are leveraging prescriptive models to optimize operations, predict future outcomes, and automate decision-making using AI and machine learning. As businesses mature in analytics adoption, they seek solutions that go beyond insights to deliver proactive strategies, fueling strong growth for prescriptive analytics platforms across sectors.

SaaS-based Business Analytics Market Regional Analysis

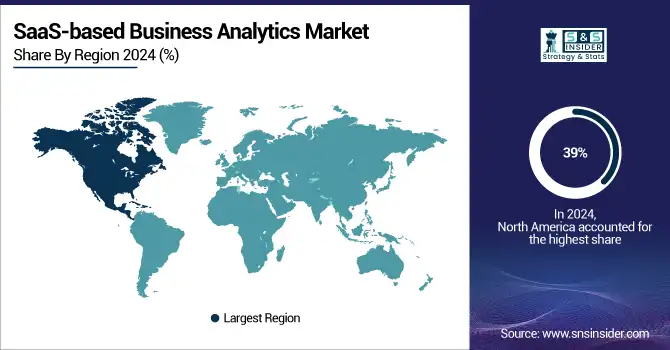

North America dominated the SaaS-based Business Analytics Market in 2024 with a 39% revenue share due to early cloud adoption, advanced IT infrastructure, and a high concentration of tech-savvy enterprises. The region's strong presence of major SaaS vendors, focus on data-driven decision-making, and increasing investments in AI and analytics platforms further contribute to its leadership, supported by mature regulatory frameworks and enterprise readiness for digital transformation.

Get Customized Report as per Your Business Requirement - Enquiry Now

North American public agencies including over 215 federal and 18,000 municipal bodies—have widely deployed cloud solutions, underlining both enterprise and institutional readiness for analytics platforms.

Additionally, North America especially the U.S., which hosts more than 5,381 data centers possesses the largest global data center infrastructure. McKinsey projects this capacity will grow to 35 GW by 2030, reinforcing the region's strong foundation for enterprise-scale analytics.

The United States is dominating the SaaS-based Business Analytics Market due to early cloud adoption, strong enterprise demand, and the presence of major SaaS providers and tech innovators.

Asia Pacific is expected to grow at the fastest CAGR of 16.18% from 2025 to 2032, driven by rapid digitalization, expanding startup ecosystems, and increasing cloud penetration in emerging economies like India and Southeast Asia. AWS, for instance, plans to invest over USD 16.4 billion in India by 2030 including the Hyderabad region cloud to support both public and private sector workloads, reinforcing the region’s cloud infrastructure.

Additionally, 60% of small and medium enterprises in Southeast Asia use cloud services, with SaaS spending topping USD 12 billion in 2023, supported by a USD 40 billion regional cloud computing sector highlighting strong adoption among SMEs seeking affordable, scalable analytics solutions. Government-led digital initiatives, along with growing awareness of data-driven strategies, further accelerate adoption, making Asia Pacific a key driver of the next phase of intelligent SaaS analytics growth.

China leads the SaaS-based Business Analytics Market trends in Asia Pacific, driven by its vast enterprise base, strong digital policies, and rapid cloud adoption. Major players like Alibaba Cloud and Huawei Cloud are accelerating AI-powered analytics deployment. Notably, 58% of Chinese manufacturers use AI for predictive maintenance, cutting downtime by 30% and boosting productivity by 18%. Guizhou Province, China’s “Big Data Valley,” operates 39 data centers, contributing 23% of its GDP and creating over 450,000 data-driven jobs.

Europe is witnessing steady growth in the SaaS-based Business Analytics Market, driven by rising cloud adoption, digital transformation, and supportive regulations. As of 2023, 69% of UK firms had adopted cloud-based systems and applications, reflecting strong enterprise readiness. In Germany, national electronic patient records (ePA) became accessible to all statutory-insured individuals in January 2025, showcasing the healthcare sector’s rapid digitalization and increasing reliance on cloud-enabled analytics platforms.

The United Kingdom is dominating the SaaS-based Business Analytics Market in Europe, driven by high cloud adoption, digital transformation in enterprises, and strong presence of analytics service providers.

The Middle East & Africa are emerging SaaS-based Business Analytics markets, fueled by digital adoption, rising cloud investments, and growing demand for insights across finance, retail, and government.

About 68% of Middle Eastern firms plan major cloud migration within two years. Bahrain’s Cloud First policy has enabled 70% of government services to operate on the cloud, cutting costs and infrastructure.

These initiatives, backed by strategies like Saudi Vision 2030 and UAE Centennial 2071, are accelerating regional SaaS analytics deployment and adoption.

Latin America is rapidly emerging in the SaaS-based Business Analytics space, driven by cloud expansion, digital transformation, and demand for analytics in banking, retail, and public sectors.

AWS is investing USD 4 billion in its first Chilean data center its third in the region while Microsoft has pledged USD 2.7 billion to build an AI/cloud data center in Limeira, Brazil. These sovereign cloud initiatives are advancing government-backed digital infrastructure, creating a fertile environment for scalable SaaS analytics adoption across Latin America’s growing urban and enterprise ecosystems.

Key Players

SaaS-based Business Analytics Market companies are Microsoft, Qlik, Salesforce.com, Oracle, TIBCO Software Inc., GoodData Corporation, SAS Institute, OpenText Corporation, IBM, SAP, Planful, Teradata, Zoomdata.

Recent Developments:

-

In 2025, Microsoft and CrowdStrike announced a strategic collaboration to align threat-actor taxonomies, enhancing cross-platform cybersecurity intelligence and streamlining threat detection across shared enterprise ecosystems.

-

In 2025, SAP and Microsoft launched SAP Business Data Cloud and SAP Databricks on Azure, featuring zero-copy data sharing connectors to enhance seamless, real-time analytics across integrated enterprise environments.

-

In June 2025, Qlik introduced new write-back functionality in Qlik Cloud Analytics, enabling users to directly edit data within the application, enhancing interactivity, collaboration, and real-time decision-making.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 12.09 Billion |

| Market Size by 2032 | USD 34.85 Billion |

| CAGR | CAGR of 14.23% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Architecture Type (Multi-Tenant, Single-Tenant) • By Organization Size (Large Enterprise, Small & Medium Enterprise (SME)) • By Analytics Type (Descriptive Analytics, Predictive Analytics, Prescriptive Analytics) • By End Users (BFSI, Retail and E-commerce, Manufacturing, Media, Telecom and IT, Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Microsoft, Qlik, Salesforce.com, Oracle, TIBCO Software Inc., GoodData Corporation, SAS Institute, OpenText Corporation, IBM, SAP, Planful, Teradata, Zoomdata |