IoT Security Market Report Scope & Overview:

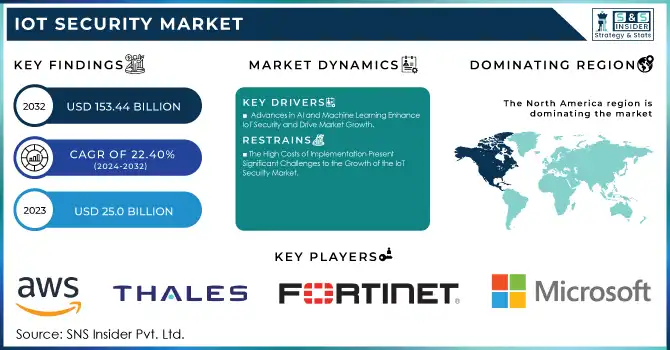

The IoT Security Market was valued at USD 25 billion in 2023 and is expected to reach USD 153.44 billion by 2032, growing at a CAGR of 22.40% from 2024-2032.

To get more information on IoT Security Market - Request Free Sample Report

The IoT Security Market is witnessing significant growth, due to the rapid integration of IoT devices across various industries like healthcare, manufacturing, and smart homes. In 2023, there were about 16.7 billion IoT devices worldwide, a number that continues to rise as businesses and consumers increasingly rely on connected devices. This growing reliance on IoT ecosystems has amplified the demand for advanced security solutions, especially as cyber threats become more sophisticated. 53% of organizations now require cybersecurity clearance before deploying any solution, reflecting a proactive approach to cyber risk management. As the number of IoT endpoints increases, the urgency to safeguard networks and ensure data privacy becomes more critical. Consequently, regions like Asia-Pacific, which accounted for 31% of cyberattacks in 2023, along with Europe and North America, are driving heightened security investments.

The surge in demand for IoT security solutions is particularly noticeable in sectors like healthcare and automotive, where the sensitivity of data makes them prime targets for cyberattacks. In 2024, disruptions to normal operations due to cyberattacks in healthcare businesses averaged USD 1.47 million, a 13% increase from USD 1.3 million in 2023. As the IoT ecosystem grows, enterprises are prioritizing comprehensive security frameworks, which include endpoint protection, network security, and threat intelligence platforms. Additionally, the rollout of 5G technology and the adoption of edge computing create new attack vectors, driving the need for more resilient security structures. In response, IoT security providers are incorporating cutting-edge encryption, authentication protocols, and anomaly detection systems to address these emerging threats effectively.

Looking forward, the future of the IoT security market is poised for continued expansion, with opportunities emerging in areas such as artificial intelligence (AI) and machine learning to automate threat detection and response. As of 2024, 64% of organizations have adopted AI or machine learning in their cybersecurity measures, enhancing their ability to identify and mitigate cyber risks. This advancement will lead to the development of more adaptive, scalable security solutions capable of protecting an ever-growing network of connected devices. In December 2024, CyTwist introduced a patented detection engine capable of identifying AI-generated cyber threats within minutes, significantly enhancing protection against sophisticated attacks. The expansion of smart cities and industrial IoT presents additional prospects for IoT security companies to innovate, providing tailored solutions to secure critical infrastructure.

MARKET DYNAMICS

DRIVERS

-

Growing Need for Data Protection Drives Demand for IoT Security Solutions

-

Advances in AI and Machine Learning Enhance IoT Security and Drive Market Growth

-

Increasing Cybersecurity Threats Fuel IoT Security Market Growth

The growing sophistication of cybersecurity threats is closely tied to the increasing number of IoT devices. As more devices become interconnected across industries and households, they become prime targets for hackers seeking to exploit vulnerabilities in these systems. These security risks range from data breaches and privacy invasions to attacks on critical infrastructure. Cybercriminals often take advantage of weaknesses in devices, networks, and cloud platforms, making it crucial for organizations to implement advanced security measures. With the rising threat landscape, businesses and consumers are increasingly prioritizing IoT security, driving demand for solutions that can protect against these evolving cyber risks.

-

Rising IoT Device Adoption Drives Increased Demand for Strong Security Solutions

The rapid expansion of IoT devices across homes, industries, and cities significantly drives the demand for stronger security solutions. As the number of interconnected devices increases, so does the potential risk of cyberattacks and data breaches. With IoT devices ranging from smart home appliances to industrial machinery, each one represents a potential entry point for malicious actors. The sensitivity of data shared and collected by these devices—such as personal information or operational data—necessitates advanced security technologies to protect against exploitation. As industries and consumers continue to embrace the convenience of IoT, securing these devices becomes a critical priority. This surge in adoption directly fuels the need for reliable, scalable security solutions to safeguard the growing IoT ecosystem.

RESTRAINTS

The High Costs of Implementation Present Significant Challenges to the Growth of the IoT Security Market

Advanced security solutions for IoT ecosystems often come with significant development and implementation costs, posing a barrier to widespread adoption. Small businesses and individual consumers, in particular, face financial challenges when it comes to securing their IoT devices and networks. The high upfront costs of deploying robust security systems, which can include hardware, software, and ongoing maintenance, may discourage these groups from prioritizing IoT security. While larger enterprises may have the resources to invest in cutting-edge solutions, smaller organizations are often deterred by the financial strain. This cost-related concern limits the accessibility of comprehensive IoT security, potentially slowing the overall growth of the market as certain sectors hesitate to adopt or upgrade their security measures.

SEGMENT ANALYSIS

By Security Type

In 2023, the Network Security segment dominated the IoT Security market with the highest revenue share of approximately 38%. This dominance is primarily due to the growing volume of connected devices and the increasing sophistication of cyberattacks targeting IoT networks. Organizations across industries prioritize securing their networks to protect sensitive data, ensuring the integrity of operations and preventing breaches that could disrupt services. As IoT networks expand, the need for robust security measures to safeguard communication channels becomes critical, driving this segment's prominence.

The Cloud Security segment is expected to grow at the fastest CAGR of about 26.03% from 2024 to 2032, fueled by the increasing reliance on cloud-based services for IoT applications. As businesses shift toward cloud platforms for data storage, processing, and analysis, securing these environments becomes essential to mitigate data risks and cyber threats. The rapid adoption of cloud solutions, paired with the need for scalable, flexible security systems, makes cloud security a key focus area. This demand is expected to continue rising as more IoT devices leverage the cloud for seamless integration and data sharing.

By Component

In 2023, the Solutions segment dominated the IoT Security market, capturing the highest revenue share of approximately 65%. This dominance is attributed to the increasing demand for comprehensive, end-to-end security solutions that protect IoT ecosystems. As organizations continue to adopt IoT technologies, they require integrated security frameworks to address vulnerabilities in devices, networks, and data. The ability to provide scalable, customizable security solutions that can meet the diverse needs of businesses across sectors drives this segment’s strong market position.

The Services segment, on the other hand, is expected to grow at the fastest CAGR of about 23.76% from 2024 to 2032, driven by the increasing complexity of IoT security management. As businesses deploy IoT solutions, they increasingly seek expert services for installation, monitoring, and ongoing management to ensure the security of their networks. With the dynamic nature of cyber threats, the demand for managed services, consulting, and real-time monitoring continues to rise, making the services segment the fastest-growing in the IoT security market. This trend reflects the shift toward specialized, hands-on support for optimizing and safeguarding IoT infrastructures.

By Enterprise Size

In 2023, the Large Enterprises segment dominated the IoT Security market, capturing the highest revenue share of approximately 63%. This leadership is driven by the extensive IoT deployments within large organizations that require robust security measures to protect vast networks of connected devices. These enterprises prioritize securing sensitive data and maintaining operational continuity, investing significantly in comprehensive security solutions to safeguard their infrastructures from advanced cyber threats. Their larger budgets and resources enable them to implement cutting-edge IoT security systems, contributing to their dominant market share.

The Small and Medium Enterprises segment is expected to grow at the fastest CAGR of about 23.53% from 2024 to 2032. This rapid growth is fueled by the increasing adoption of IoT technologies among SMEs, who are recognizing the value of connected devices for improving efficiency and competitiveness. As IoT becomes more accessible and affordable, SMEs are seeking cost-effective security solutions to protect their networks from emerging threats. The growing focus on affordable, scalable security options tailored to the needs of smaller businesses positions the SMEs segment as the fastest-growing in the IoT security market.

By Deployment

Cloud segment dominated the IoT Security market with the highest revenue share of about 67% in 2023, and is expected to grow at the fastest CAGR of about 23.18% from 2024 to 2032. This dominance is driven by the widespread adoption of cloud-based IoT solutions that provide scalability, cost-effectiveness, and centralized management, allowing businesses to efficiently secure and monitor a growing network of devices. The cloud's ability to offer real-time data processing, storage, and enhanced security features, such as encryption and threat detection, has made it the preferred platform for securing IoT ecosystems. As businesses continue to migrate their operations to the cloud, the demand for secure, integrated cloud-based IoT security solutions is expected to drive significant market growth, solidifying the cloud segment's leadership in the years ahead.

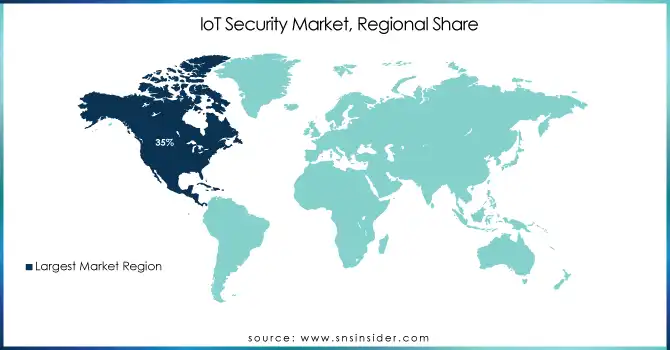

REGIONAL ANALYSIS

In 2023, North America dominated the IoT Security market with the highest revenue share of approximately 35%. This dominance is largely attributed to the region's advanced technological infrastructure and widespread adoption of IoT solutions across industries such as healthcare, manufacturing, and smart cities. The presence of major technology companies, coupled with stringent data privacy regulations and a strong focus on cybersecurity, drives the demand for comprehensive IoT security solutions in North America, solidifying its leadership in the market.

The Asia Pacific region is expected to grow at the fastest CAGR of about 24.15% from 2024 to 2032. This rapid growth is driven by the increasing digital transformation and IoT adoption across emerging markets, particularly in countries like China, India, and Japan. As these nations scale up their IoT infrastructure for smart cities, industrial automation, and consumer electronics, the need for robust IoT security solutions becomes more critical. The rising awareness of cybersecurity risks, combined with government initiatives supporting IoT development, positions Asia Pacific as the fastest-growing market in the IoT security sector.

Get Customized Report as per Your Business Requirement - Enquiry Now

KEY PLAYERS

-

Microsoft (Azure IoT, Microsoft Defender for IoT)

-

Fortinet (FortiGate, FortiSIEM)

-

AWS (AWS IoT Device Defender, AWS IoT Core)

-

IBM (IBM Security QRadar, IBM Watson IoT)

-

Intel (Intel vPro, Intel Secure Device Onboard)

-

Cisco (Cisco IoT Threat Defense, Cisco Edge Intelligence)

-

Thales Group (Thales CipherTrust, Thales Cloud Security)

-

Infineon (OPTIGA Trust X, OPTIGA TPM)

-

Allot (Allot SmartConnect, Allot Service Gateway)

-

Atos (Atos Codex IoT, Atos Security Management)

-

Checkpoint (Check Point IoT Security, Check Point SandBlast)

-

Palo Alto Networks (IoT Security, Cortex XSOAR)

-

Mobileum (Mobileum IoT Security, Mobileum Fraud Management)

-

Entrust (Entrust Identity, Entrust PKI)

-

NXP Semiconductors (NXP EdgeLock, NXP Secure IoT)

-

Kaspersky (Kaspersky IoT Security, Kaspersky Embedded Systems Security)

-

MagicCube (MagicCube IoT Security Platform, MagicCube IoT Authentication)

-

Claroty (Claroty Platform, Claroty Remote Access)

-

Ordr (Ordr IoT Security, Ordr Asset Discovery)

-

Armis (Armis IoT Security, Armis Device Management)

-

Nozomi Networks (Nozomi Networks SCADAguardian, Nozomi Networks Vantage)

-

Keyfactor (Keyfactor Command, Keyfactor IoT Security)

-

Particle Industries (Particle IoT Platform, Particle Device Management)

-

Karamba Security (Karamba Carwall, Karamba IoT Security)

-

Forescout (Forescout Platform, Forescout IoT Security)

Recent Developments

-

In 2024, Vodafone and Microsoft signed a 10-year strategic partnership to enhance IoT security, generative AI, and cloud services for over 300 million businesses and consumers in Europe and Africa.

-

In September 2024, Belden integrated its CloudRail software with AWS IoT SiteWise Edge, enabling streamlined connection of industrial assets to the cloud for efficient data acquisition, processing, and analysis.

-

In August 2024, IBM launched a generative AI-powered cybersecurity assistant, integrated into its Threat Detection and Response Services. Built on IBM's watsonx platform, it enhances threat detection, investigation, and response capabilities, streamlining security operations for organizations.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 25 Billion |

| Market Size by 2032 | USD 153.44 Billion |

| CAGR | CAGR of 22.40% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solutions, Services) • By Security Type (Network Security, Endpoint Security, Application Security, Cloud Security, Others) • By Deployment (Cloud, On-premise) • By Enterprise Size (Small and Medium Enterprises, Large Enterprises) • By End Use (Energy and Utilities, Manufacturing, Automotive, Transport, Consumer Electronics, Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Microsoft, Fortinet, AWS, IBM, Intel, Cisco, Thales Group, Infineon, Allot, Atos, Checkpoint, Palo Alto Networks, Mobileum, Entrust, NXP Semiconductors, Kaspersky, MagicCube, Claroty, Ordr, Armis, Nozomi Networks, Keyfactor, Particle Industries, Karamba Security, Forescout |

| Key Drivers | • Increasing Cybersecurity Threats Fuel IoT Security Market Growth • Rising IoT Device Adoption Drives Increased Demand for Strong Security Solutions |

| RESTRAINTS | • The High Costs of Implementation Present Significant Challenges to the Growth of the IoT Security Market |