Optical Transport Network (OTN) Market Size:

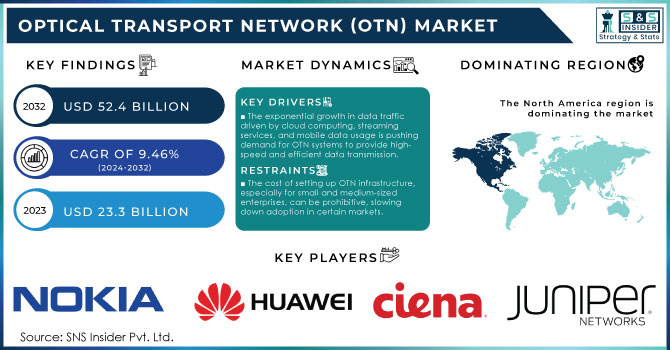

Optical Transport Network (OTN) Market was valued at USD 25.50 billion in 2024 and is expected to reach USD 52.56 billion by 2032, growing at a CAGR of 9.46% from 2025-2032.

Get More Information on Optical Transport Network (OTN) Market - Request Sample Report

Optical Transport Network (OTN) Market growth is driven by rising digital infrastructure and growing investments in high-speed internet services globally. As per the International Telecommunication Union (ITU), 66% of people worldwide used the internet in 2023, which increased by over 5.3 billion users compared to 4.9 billion users in 2022. Governments worldwide have emphasized the need for robust digital infrastructure to support 5G, cloud services, and other high-bandwidth applications. In 2023, the U.S. Federal Communications Commission (FCC) revealed that it would spend another USD 2 billion on expanding rural broadband as part of its own Broadband Equity, Access, and Deployment (BEAD) program. Similarly, the European Commission set a target to achieve 5G connectivity across all urban areas by 2025, under its "Digital Decade Policy." Such initiatives demand highly efficient and scalable network infrastructures, particularly Optical Transport Networks (OTNs), which can handle massive data traffic with lower latency and higher bandwidth efficiency. Additionally, high-speed and low-latency data transmission networks are needed for the increasing adoption of IoT, automotive navigation systems, and AI-enabled servers (for big data processing), which is further driving the demand for optical networks. With smart city initiatives by countries and more cloud computing scenarios, the demand for optical transport networks (OTNs) with high capacity, flexibility, and cost-effectiveness has become significant. The China Academy of Information and Communications Technology (CAICT) reported that China's total internet data traffic surged by 33% in 2023, reflecting the increasing bandwidth needs driving OTN market growth.

Market Size and Forecast

-

Market Size in 2024: USD 25.50 Billion

-

Market Size by 2032: USD 52.56 Billion

-

CAGR: 9.46% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Optical Transport Network (OTN) Market Trends

-

Rising demand for high-capacity, reliable, and scalable optical communication networks is driving the OTN market.

-

Expansion of 4G/5G networks, cloud computing, and data centers is boosting deployment.

-

Integration with DWDM, SDN, and IP transport technologies is enhancing network efficiency and flexibility.

-

Growing need for low-latency, high-speed data transmission in telecom, enterprise, and government sectors is shaping market growth.

-

Adoption of OTN for long-haul, metro, and access networks is increasing globally.

-

Advancements in coherent transmission, forward error correction, and bandwidth optimization are improving performance.

-

Collaborations between network equipment providers, telecom operators, and technology vendors are accelerating innovation and implementation.

Optical Transport Network (OTN) Market Growth Drivers:

-

The exponential growth in data traffic driven by cloud computing, streaming services, and mobile data usage is pushing demand for OTN systems to provide high-speed and efficient data transmission.

-

The global deployment of 5G networks is accelerating the need for robust and scalable OTN infrastructure to handle the increased bandwidth requirements and low-latency communication.

-

With the proliferation of Internet of Things (IoT) devices across industries, the demand for fast and reliable data transfer solutions like OTN is on the rise, supporting seamless IoT communication.

The demand for high-speed connectivity has been driven by the rapid expansion of data-intensive applications, such as cloud computing, video streaming, and social media. According to recent reports, global internet traffic has been growing at an average annual rate of 30%, with projections estimating data traffic to exceed 400 exabytes per month by 2025. Services such as 4K and 8K streaming, typical gaming, virtual reality, and home working are driving this growth.

Optical Transport Networks (OTNs) play a major role in managing this exponential data growth by being capable of transmitting the data high capacity, and low latency over long distances. With critical sectors such as healthcare, finance, and education moving to the cloud (often requiring high connectivity services), this has translated into greater demand for reliable OTN infrastructure which can facilitate seamless inter-cloud connectivity. OTNs are also used by content delivery networks (CDN) such as Netflix and YouTube to handle high data traffic created by millions of users that access the services at once. Increased remote work and use of online collaboration tools e.g. Microsoft Teams, and Zoom have also stimulated the need for OTN solutions to sustain stable and high-quality connections at highspeed levels. Additionally, the Cisco Annual Internet Report predicts that by 2025, 66% of the global population will have internet access, intensifying the need for scalable OTN systems to support the growing volume of data and high-performance applications across the globe.

Optical Transport Network (OTN) Market Restraints:

-

The cost of setting up OTN infrastructure, especially for small and medium-sized enterprises, can be prohibitive, slowing down adoption in certain markets.

-

The complexity involved in managing and maintaining optical transport networks, especially for multi-vendor environments, can be a significant barrier for organizations looking to upgrade their networks.

-

As optical transport networks become critical for carrying large volumes of sensitive data, concerns over the security and vulnerability of these networks to cyberattacks may act as a restraint on the market.

The high initial investment as well as deployment cost is one of the main restraints in the Optical Transport Network (OTN) market. OTN infrastructure involves major capital expenditure on optical fibers, advanced switching technologies, and high-capacity routers. Moreover, high-speed transmission, especially for long-distance networks, demands specialized hardware and software that comes with a sizable expense. While excellent from a spec perspective, these costs are prohibitively high for smaller enterprises or budget-constrained regions, leading to slow adoption and upgrades of OTN systems.

In addition, the installation process is labor-intensive and time-consuming – requiring skilled technicians and engineers to set up and maintain it properly. This increases the operational cost in due course and that might discourage organizations from implementing OTN as there are other solutions to networks with comparatively lower capital required upfront. Therefore, these high costs can impede market penetration and expansion.

Optical Transport Network (OTN) Market Segment Analysis

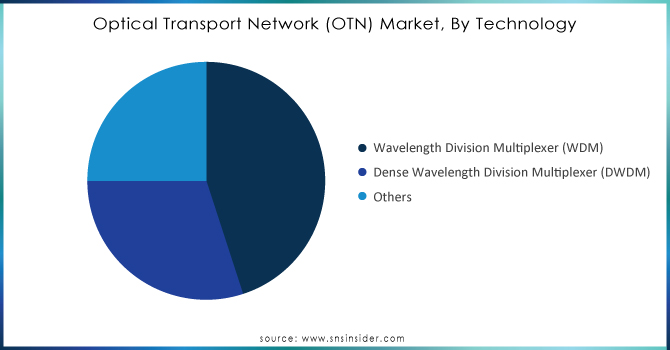

By Technology, Wavelength Division Multiplexer (WDM) dominated in 2023 with 47% revenue share.

In 2024, the optical transport network (OTN) market was dominated by the wavelength division multiplexer (WDM) segment, which accounted for a significant share of 47% in terms of revenue. WDM (Wavelength Division Multiplexing) technology allows a single optical fiber to carry multiple signals simultaneously, each using different wavelengths of light, greatly increasing the capacity of optical networks. This is shaping up to be vital technology for scaling network infrastructure as data demands driven by cloud services, video streaming, and 5G expand. Wavelength division multiplexer technology is the focus of intensive governmental and telecom provider investment for expanded network capabilities. As an example, in 2023 European Union started its "Horizon Europe" project which funded the deployment of WDM-based optical networks with the support of 5G network rollout. Moreover, the Chinese Ministry of Industry and Information Technology (MIIT) stated that in 2023 WDM technology currently constitutes more than 65% of optical networks newly built in cities. This inexpensive approach is crucial as WDM can increase bandwidth capacity without the need to install more fiber that network operators have been using for a long time thus becoming a leader in OTN technology.

Need Any Customization Research On Optical Transport Network (OTN) Market - Inquiry Now

By Service, Network Design services expected to hold major share during forecast period.

The network design segment is expected to hold the major share of the Optical Transport Network (OTN) market by service during the forecast period. Network design services are very important to the optimization of OTN layouts, capacities, and capabilities that enable maximum efficiency with minimum operational costs. As digital services like cloud computing and IoT continue to gain traction, enterprises, and governments require OTN solutions that cater to their specific bandwidth and performance requirements. According to a 2023 report by the U.S. Department of Commerce, 74% of all new IT infrastructure projects incorporated advanced network design services aimed at future-proofing digital infrastructure. In India, investment in network design services for optical networks was driven by a desire among telecom providers to meet rising data demand from the fast-growing base of Internet users in the country, states a report published recently by the Telecom Regulatory Authority of India (TRAI). As modern networks grow in complexity and require improvements to work with legacy systems seamlessly, the need for network design services is proving critical to the ongoing success of optical transport networks, contributing to demand for this segment.

By End User, IT/Telecom dominated in 2024 with highest revenue share, Healthcare expected to grow fastest.

The Optical Transport Network (OTN) market was led by the IT/Telecom segment in terms of revenue share and is anticipated to register a significant CAGR during the forecast period. The OTN market is primarily driven by the exponential increase in internet traffic, 5G network roll-out, and cloud demands, with the IT/Telecom sector being a continuing leading segment. In 2023, ITU data indicates that 55% of global OTN investments were made by the IT/Telecom sector, as telecom operators progressively scale their network infrastructures supported to meet the increasing demand for expanding data transmission.

On the other hand, the healthcare sector is witnessing the fastest growth in OTN adoption, with a significant CAGR over the forecast period from 2025 to 2032. Increased adoption of OTNs for telemedicine, electronic health records (EHRs), and remote diagnostics has been aided by governmental initiatives to digitize the healthcare systems, including the U.S. HITECH Act and A decade-long EU eHealth Action Plan. This, coupled with the ever-growing demand for facilitated high-speed data transfer in healthcare environments is propelling OTN adoption in this sector.

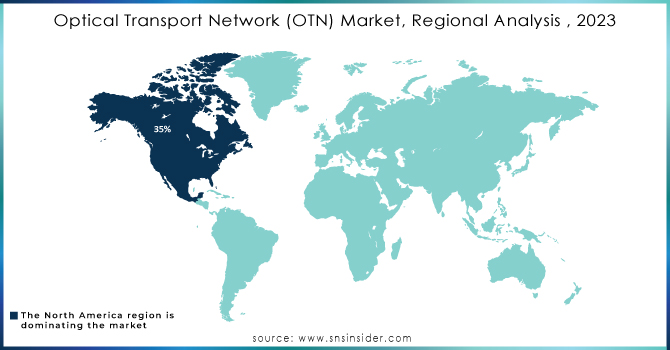

Optical Transport Network (OTN) Market Regional Analysis

North America Optical Transport Network (OTN) Market Insights

North America was the leading region in 2024 with a share of around 35% in the global Optical Transport Network (OTN) market. The investments in digital infrastructure by private companies and the government enable the dominance of this region. As an example, the U.S. government spent more than USD 45 billion to expand broadband infrastructure through the Infrastructure Investment and Jobs Act (IIJA) in 2023 like building an optical network for better connectivity progress. Moreover, telecom operators in North America are getting more aggressive with their 5G deployment announcement schedules (e.g., Verizon and AT&T) that demand advanced optical networking solutions.

Asia Pacific Optical Transport Network (OTN) Market Insights

On the other hand, Asia-Pacific is expected to be the fastest-growing region in terms of CAGR over the forecast period, owing to the increasing urbanization coupled with smart city trends and government initiatives toward digital economies. In 2023, CAICT reported that China’s OTN market grew by 28%, fueled by the country's aggressive 5G and fiber optic deployment programs. Other countries, including India and Japan, are also making significant investments in optical networks, contributing to the region’s rapid growth.

Europe Optical Transport Network (OTN) Market Insights

Europe holds a significant position in the Optical Transport Network (OTN) Market, driven by advanced telecom infrastructure, high adoption of 5G networks, and increasing data traffic. The region benefits from substantial investments in fiber-optic networks and cloud-based services, enabling efficient, high-speed data transmission. Growing demand from enterprises, telecom operators, and government projects further fuels market growth. Continuous technological advancements and strong regulatory support position Europe as a key hub for OTN deployment and innovation.

Middle East & Africa and Latin America Optical Transport Network (OTN) Market Insights

The Middle East & Africa and Latin America are emerging markets in the Optical Transport Network (OTN) sector, driven by increasing digitalization, expanding telecom infrastructure, and rising demand for high-speed connectivity. Investments in 4G/5G networks, cloud services, and data centers are accelerating OTN adoption. Additionally, government initiatives supporting smart city projects and enhanced network coverage are creating growth opportunities, positioning these regions as promising markets for OTN solutions and services.

Optical Transport Network (OTN) Market Competitive Landscape:

Huawei Technologies Co., Ltd.

Huawei Technologies, founded in 1987 and headquartered in Shenzhen, China, is a global leader in telecommunications equipment, ICT solutions, and consumer electronics. The company specializes in 5G networks, optical transport, cloud computing, and AI-driven technologies. Huawei focuses on enabling digital transformation for operators, enterprises, and governments, offering high-performance network infrastructure and innovative solutions to meet the growing demands of connectivity, capacity, and low-latency applications worldwide.

-

September 2023: Huawei launched an OTN solution for 5G transport networks capable of providing up to a 30% increase in capacity and a 25% reduction in latency. This enhancement is expected to strengthen Huawei’s profitability in the OTN market as telecom carriers expand their 5G networks.

Nokia Corporation

Nokia, founded in 1865 and headquartered in Espoo, Finland, is a multinational telecommunications and networking company. It provides high-performance network infrastructure, optical transport solutions, and 5G technologies for operators, enterprises, and governments worldwide. Nokia focuses on digital transformation, connectivity, and scalable network solutions to support growing data traffic and emerging applications, helping countries and organizations enhance broadband, cloud, and mobile networks with sustainable and efficient technologies.

-

January 2024: Nokia secured a contract with the Government of India to deploy WDM-based OTNs across major urban centers as part of India’s “Digital India” initiative. The project aims to improve and support the country’s digital infrastructure in response to growing internet traffic.

Key Players

Key Service Providers/Manufacturers

-

Cisco Systems, Inc. (NCS 5500 Series, ASR 9000)

-

Nokia Corporation (1830 Photonic Service Switch, Wavence)

-

Huawei Technologies Co., Ltd. (OptiXtrans E9600, OptiXtrans D8000)

-

Ciena Corporation (360° Network Management, Waveserver)

-

Juniper Networks, Inc. (PTX Series, MX Series)

-

ZTE Corporation (ZXCTN 6000, ZXCTN 9000)

-

ADVA Optical Networking SE (FSP 3000, FSP 150)

-

Infinera Corporation (XTM Series, DTN Series)

-

Mitsubishi Electric Corporation (ML-7000 Series, MELCO)

-

Fujitsu Limited (FLASHWAVE 9500, 100G Optical Transport Platform)

Key Users of OTN Services / Products:

-

AT&T Inc.

-

Verizon Communications Inc.

-

China Mobile Ltd.

-

Deutsche Telekom AG

-

NTT Communications Corporation

-

Vodafone Group Plc

-

T-Mobile US, Inc.

-

BT Group plc

-

Comcast Corporation

-

Telefónica S.A.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 23.3 Billion |

| Market Size by 2032 | USD 52.4 Billion |

| CAGR | CAGR of 9.46% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Wavelength Division Multiplexer (WDM), Dense Wavelength Division Multiplexer (DWDM), Others) • By Service (Network Design, Network Support, Others) • By Component (Optical Switch, Optical Platform, Others) • By End-user (IT/Telecom, Healthcare, Retail, Government, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Cisco Systems, Inc., Nokia Corporation, Huawei Technologies Co., Ltd., Ciena Corporation, Juniper Networks, Inc., ZTE Corporation, ADVA Optical Networking SE, Infinera Corporation, Mitsubishi Electric Corporation, Fujitsu Limited. |