RAN Intelligent Controller Market Report Scope & Overview:

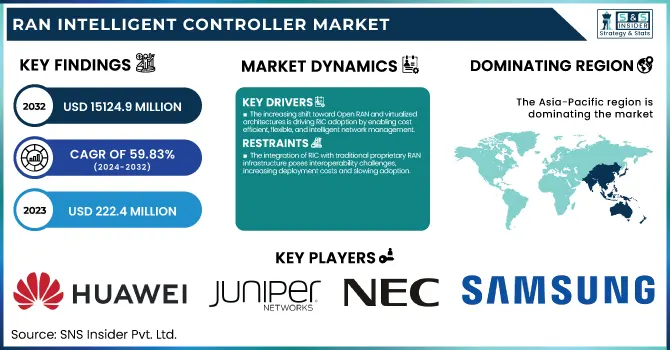

The RAN Intelligent Controller Market was valued at USD 222.4 Million in 2023 and is expected to reach USD 15124.9 Million by 2032, growing at a CAGR of 59.83% from 2024-2032.

To Get more information on Aviation Crew Management Systems Market - Request Free Sample Report

This report consists of key insights into the RAN Intelligent Controller (RIC) Market, considering its growing impact on telecom networks. The adoption of RIC solutions by major network operators is increasing as they seek to enhance automation and efficiency in managing radio access networks. The expansion of Open RAN deployments is gaining momentum, particularly in North America, Europe, and Asia-Pacific, driven by the need for flexible and cost-effective network architectures. RIC implementation is significantly reducing network operational costs by optimizing resource allocation through AI-driven automation. Additionally, AI-powered network optimization is playing a crucial role in predictive maintenance, traffic management, and real-time network adjustments. A key trend observed in the report is the integration of RIC with 5G Standalone (SA) networks, enabling dynamic spectrum sharing and intelligent resource orchestration to enhance overall network performance.

RAN Intelligent Controller Market Dynamics

Driver

-

The increasing shift toward Open RAN and virtualized architectures is driving RIC adoption by enabling cost-efficient, flexible, and intelligent network management.

The increasing shift toward Open RAN and virtualized network architectures is a significant driver for the RAN Intelligent Controller market. Open RAN enables greater interoperability, cost efficiency, and network flexibility, prompting telecom operators to adopt RIC solutions for optimizing network performance. As network disaggregation gains traction, RIC facilitates intelligent automation, dynamic spectrum management, and energy efficiency improvements. Governments and telecom regulatory bodies are also promoting Open RAN to reduce reliance on proprietary solutions, further accelerating RIC adoption. With major telecom operators actively investing in Open RAN-based deployments, the demand for RIC solutions is expected to surge, driving innovation and improving overall network efficiency in the coming years.

Restraint

-

The integration of RIC with traditional proprietary RAN infrastructure poses interoperability challenges, increasing deployment costs and slowing adoption.

Despite the advantages of RIC, integrating it with existing legacy RAN infrastructure remains a significant challenge. Traditional networks rely on proprietary hardware and software, making interoperability with virtualized RAN components complex and time-consuming. Network operators face difficulties in transitioning to Open RAN while ensuring seamless compatibility with legacy systems, leading to increased deployment costs and extended timelines. Additionally, the lack of standardization across vendors can create operational inefficiencies and require substantial technical expertise. These integration challenges may slow down the adoption of RIC solutions, particularly for telecom operators with large-scale legacy infrastructure, limiting the market’s growth potential in certain regions.

Opportunity

-

AI/ML-driven RIC solutions enhance real-time analytics, predictive maintenance, and automated decision-making, improving network efficiency and reliability.

One of the key trends in the RAN Intelligent Controller market is the increasing use of artificial intelligence and machine learning since AI and ML play a crucial role in optimizing the network's performance, thereby generating significant potential that this market can leverage. It uses Artificial Intelligence Machine Learning to provide real-time analytics and prediction of potential outages, making it possible for predictive maintenance and automated decision-making, all of which boost the efficiency and reliability of the network. Therefore, telecom operators are progressively investing in AI-based RIC solutions to manage dynamic spectrum allocation and latency and improve traffic handling, among other things. The increasing maturity of self-optimizing networks and AI-driven automation in 5G Standalone networks further reinforces the argument.

Challenge

-

Open RAN’s software-based nature increases cybersecurity risks, requiring robust security measures and compliance with global telecom security standards.

With the rise of Open RAN and virtualized networks, cybersecurity threats have become a growing concern for telecom operators deploying RIC solutions. Open interfaces and software-based networking increase the risk of cyberattacks, data breaches, and unauthorized access, necessitating robust security measures. The integration of third-party applications into RIC frameworks also introduces vulnerabilities that can be exploited by malicious actors. Ensuring secure orchestration of RIC in multi-vendor environments requires stringent security protocols, threat monitoring, and compliance with global cybersecurity standards. Addressing these security challenges is critical for gaining operator confidence and ensuring the safe and reliable deployment of RIC solutions in next-generation telecom networks.

RAN Intelligent Controller Market Segmentation Analysis

By Component

In 2023, the platform segment dominated the market and accounted for revenue share of more than 64%. The software solutions that comprise RAN intelligent controller facilitate management of RAN to minimize costs and enhance performance. RAN intelligent controller platforms are offered by a wide range of market players such as Telefonaktiebolaget LM Ericsson, VMware, Inc. , and Mavenir.

The services segment is expected to register the fastest CAGR during the forecast period. These consist of solutions across integration, deployment, support efforts and the RIC consulting service. RAN deployment suffers from legacy system integration, high complexity and technological immaturity.

By Function

In 2023, the non-RT RIC segment dominated the market and accounted for the largest revenue share. It optimizes intelligent RAN with model management and information and policy-based support to the Near-RT RIC. With the help of AI, ML, and data analytics, it can decide actions for optimization. A Non-RT RIC manufactured by a Turkey-based company P.I. was launched in February 2023 The company had designed this launch to accelerate the open RAN adoption while simultaneously enhancing network performance. Near-RT RIC is projected to be the fastest-growing segment during the forecast period. Near-RT RIC offers programmatic control in time ranges from 10 milliseconds to 1 second.

By Technology

The 4G segment dominated the market and accounted for 65% of the revenue share, Driven by Continued global deployment, subscriber base, and network improvements. While some telecom operators are still putting their money on 4G investments to provide rural and urban connectivity, taking care of stable revenue flow. Efficient spectrum management, network optimization, and cost reduction propelling RIC in 4G networks

The 5G segment is anticipated to register the fastest CAGR during the forecast period, owing to rising deployments of 5G around the globe and the need for real-time network optimization. As 5G Standalone networks are expanding, telecom operators are looking for RIC solutions to enable better automation, ultra-low-latency and dynamic spectrum allocation.

By Application

The rApps segment dominated the market and held the largest share of the overall RAN intelligent controller market in 2023. rApp is an application that runs on the Non-RT RIC, where sub-second response times are not required.

The xApps segment is expected to grow at the fastest CAGR throughout the forecast period. An xApp is a Near-RT RIC use-case that involves execution from 10 - 100ms. Examples of things xApps might provide out the services or functions of these could include security, mobility management, and radio resource management. For example, xApps would be used for optimizing network handovers, where the algorithm must be executed within a few tens or hundreds of milliseconds to ensure user connectivity to the network. The xApps can also be deployed to implement QoS functions, like congestion or traffic control.

Regional Analysis

In 2023, the Asia-Pacific region dominated the market and accounted for 40% of revenue share, thanks to ample telecom infrastructure, swift deployments of 4G and 5G and robust government efforts to promote Open RAN. With major market players including advanced 5G rollout countries such as China, Japan and South Korea, the demand for AI-based network optimization is on the rise.

North America is expected to record the fastest CAGR in the RAN Intelligent Controller market, due to the rapid roll-out of 5G and Open RAN in this region. Vendors / Service Providers: Leading telecom operators in North America are investing heavily in AI / ML-powered RIC solutions to improve network automation, and spectrum efficiency, and bring down opex costs. Government-backed pushes towards Open RAN along with partnerships with cloud vendors are also speeding up RIC implementation.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

The major key players along with their products are

-

Nokia – Nokia Service Enablement Platform (SEP)

-

Ericsson – Ericsson Intelligent Automation Platform

-

Huawei – Huawei Intelligent RAN Controller

-

Samsung – Samsung vRAN Intelligent Controller

-

NEC Corporation – NEC Open RAN RIC

-

Rakuten Symphony – Symworld RIC

-

Mavenir – Mavenir Open RAN Intelligent Controller

-

Parallel Wireless – Parallel Wireless Open RAN Controller

-

Juniper Networks – Juniper RIC Solution

-

Keysight Technologies – Keysight RIC Test Solution

-

VIAVI Solutions – VIAVI RIC Test Suite

-

Radisys – Radisys Connect RIC

-

Altiostar (Rakuten Group) – Altiostar Cloud-Native RIC

-

Capgemini Engineering – Capgemini Open RAN Intelligent Controller

-

Amdocs – Amdocs AI-Powered RIC

Recent Developments

-

February 2024: Mavenir introduced the Open RAN Intelligent Controller (O-RIC) to enhance 5G network efficiency and flexibility, enabling advanced service differentiation and optimized resource allocation.

-

July 2024: EchoStar Corporation launched the Open RAN Center for Integration and Deployment (ORCID) in Cheyenne, Wyoming, serving as a state-of-the-art testing and evaluation facility to promote Open RAN interoperability and accelerate next-generation wireless network deployment.

-

December 2024: Ericsson secured a multi-billion-dollar contract with Bharti Airtel in India to enhance 4G and 5G coverage through centralized RAN deployment, Open RAN-ready solutions, and software upgrades for existing 4G radios.

|

Report Attributes |

Details |

|

Market Size in 2023 |

US$ 222.4 Million |

|

Market Size by 2032 |

US$ 15124.9 Million |

|

CAGR |

CAGR of 59.83 % From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Component (Platforms, Services) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Nokia, Ericsson, Huawei, Samsung, NEC Corporation, Rakuten Symphony, Mavenir, Parallel Wireless, Juniper Networks, Keysight Technologies, VIAVI Solutions, Radisys, Altiostar (Rakuten Group), Capgemini Engineering, Amdocs. |