Event Industry Market Report Scope & Overview:

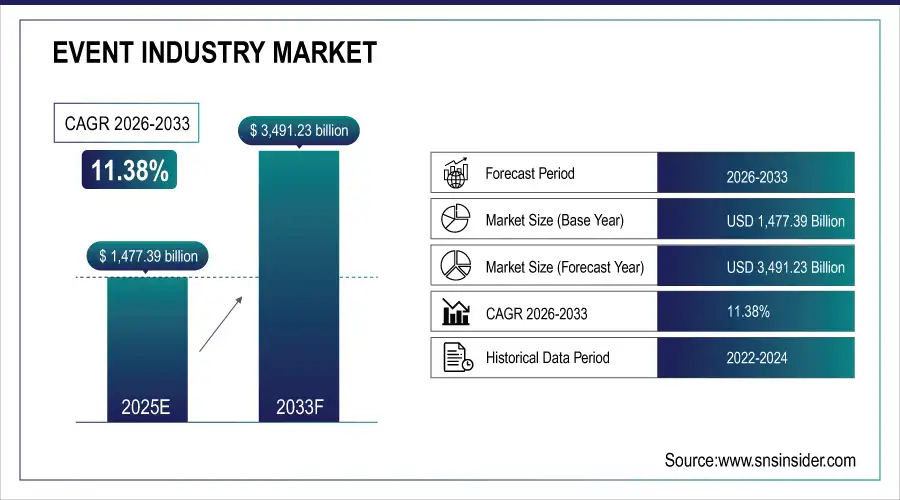

The Event Industry Market Size was valued at USD 1,477.39 Billion in 2025E and is projected to reach USD 3,491.23 Billion by 2033, growing at a CAGR of 11.38% during the forecast period 2026–2033.

This Event Industry analysis offers a comprehensive study of event types, formats, and revenue models to understand market trends. The market is split by event type, source of revenue, organizer type, end user and mode. An increasing acceptance of hybrid events and corporate sponsorship is fueling growth in the business, entertainment and educational realm.

Corporate and entertainment events accounted for over 620 million events in 2025, driven by rising corporate branding activities.

Market Size and Forecast:

-

Market Size in 2025: USD 1,477.39 Billion

-

Market Size by 2033: USD 3,491.23 Billion

-

CAGR: 11.38% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Event Industry Market - Request Free Sample Report

Event Industry Market Trends:

-

The rapid urbanisation and the increase in disposable incomes are spurring demand for corporate, entertainment and lifestyle events of a more comprehensive scale including Offline or Hybrid.

-

Innovative event formats and technologies, such as VR experience, hybrid streaming and immersive thematic set ups promote engagement with the attendees.

-

A trend for bespoke and tailored experiences, boutique festivals, private concerts or niche workshops, is indicative of the evolving demands of consumers.

-

Digital platforms and event apps are increasingly primary sources for all things ticketing, promotions, networking but also visit interactions.

-

Sustainable and environmentally sound practices such as green events, zero-waste catering and energy-efficient set ups are driving planning decisions and attendee choices.

U.S. Event Industry Market Insights:

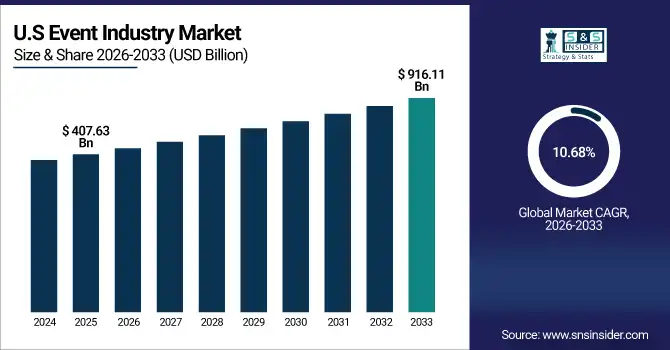

The U.S. Event Industry is projected to grow from USD 407.63 Billion in 2025E to USD 916.11 Billion by 2033 at a CAGR of 10.68%. The expansion is fueled by corporate gatherings, entertainment extravaganzas, hybrid formats, experiential marketing and the growing use of digital platforms in businesses, social affairs and festivals everywhere.

Event Industry Market Growth Drivers:

-

Increasing demand for immersive, hybrid, and personalized experiences is driving rapid growth in the event industry.

The growth of Event Industry is driven by rising demand for immersive, hybrid, and personalized experiences. There were more than 620 million events in 2025 and the figure is projected to reach almost 1.15 billion in 2033. It is driven by corporate investment in branding, massive entertainment events, and experiential marketing. Wider use of digital platforms, participation virtually and new event formats drive further growth in both maturity and emerging markets.

Rising adoption of virtual and hybrid event formats facilitated 480 million attendee-driven events globally in 2025, fueled by corporate programs, concerts, and experiential festivals.

Event Industry Market Restraints:

-

Rising operational costs and logistical complexities are restricting growth, particularly for large-scale and international event organizers.

The growth of the Event Industry is constrained by rising operational costs and logistical challenges. By 2025, more than 30% small and medium-sized event planners were hosting lesser events due to high cost of venues, staff and technology. International and major events have even more to overcome with permits, safety guidelines and restrictions that transcend borders. These cost and administrative barriers restrict market development particularly for new entrants and SMEs even as there is growing international demand for immersive & hybrid event experiences.

Event Industry Market Opportunities:

-

Growing adoption of hybrid and virtual events offers lucrative opportunities for technology-driven, scalable, and accessible experiences.

Increased need for hybrid and virtual experiences is driving huge growth in the events industry. In 2025, more than 180 million hybrid and virtual events took place, a figure expected to more than double to over 420 million by the year 2033. Corporates, entertainers and educational institutions are increasingly getting into technology-driven formats, providing scale and reach. Advancements in virtual technology, immersive event formats and interactive experiences are driving proliferation throughout the developed and developing world.

Hybrid and virtual events accounted for 22% of all world events in 2025, driven by corporate demand, digital engagement, and wider audience reach.

Event Industry Market Segmentation Analysis:

-

By Event Type, Corporate Events & Seminars held the largest market share of 38.76% in 2025, while Music Concerts are expected to grow at the fastest CAGR of 13.67%.

-

By Revenue Source, Ticket Sales dominated with a 45.31% share in 2025, while Sponsorship & Branding is projected to expand at the fastest CAGR of 14.28%.

-

By Organizer Type, Corporate events accounted for the highest market share of 51.44% in 2025, and Individual / Private Organizers are projected to record the fastest CAGR of 15.12%.

-

By End User, Enterprises held the largest share of 49.67% in 2025, while Educational Institutions are expected to grow at the fastest CAGR of 13.89%.

-

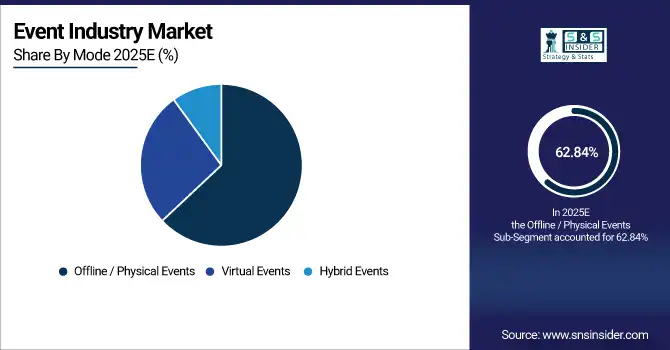

By Mode, Offline / Physical Events dominated with a 62.84% share in 2025, while Hybrid Events are projected to record the fastest CAGR of 16.05%.

By Event Type, Corporate Events & Seminars Dominates While Music Concerts Expand Rapidly:

Corporate Events & Seminars sector dominated the Event Type segment in 2025, with a high number of events being organized to proliferate company products, for employee education and training, or seminars in developed economies and developing nations. This segment continues to retain the highest value and volume due to its business-driven requirement. The Music Concerts sector is the fastest growing Event Type segment, with more than 90 million events in 2025 driven by increasing demand for urban entertainment, festival culture and popularity of large-scale hybrid and live concert experiences.

By Revenue Source, Ticket Sales Dominates While Sponsorship & Branding Expands Rapidly:

The Ticket Sales sector dominated the Revenue Source segment in 2025, accounting for over 280 million revenue generating events owing to consumer predilection toward concerts, sports and festivals. It is still the core of industry revenues particularly in cities and mature markets. Sponsorship & Branding sector is the fastest-growing Revenue Source segment, with more than 110 million revenue-earning instances in 2025; driven by brands’ heightened interest in experiential marketing, influencer relationship building, and integrated programs for music/sports/corporate events.

By Organizer Type, Corporate Organizers Dominate While Individual/Private Organizers Expand Rapidly:

Corporate organizers sector will dominate Organizer Type segment with 320 million events in the year 2025, owing to business conferences, internal seminaries and branded experiences across. They're too big, they repeat too frequently and they have the resources behind them to own any market. Individual/Private Organizers is the fastest growing Organizer Type segment with 75+ million events in 2025, driven by increased demand for weddings, private parties and boutique experiential events, particularly among urban dwellers and digitally promoted platforms.

By End User, Enterprises Dominate While Educational Institutions Expand Rapidly:

Enterprises sector dominated End User segment and registered 290 million events in 2025 owing to high number of corporate meetings, conferences and brand activations across markets. They are the most dependable and profitable area for organizers. Educational Institutions become the fastest-growing End-User segment, booking over 65 million events by 2025 driven by growing campus events, digital/hybrid seminars and workshops and student engagement programs especially in developing areas and highly connected cities.

By Mode, Offline Events Dominate While Hybrid Events Expand Rapidly:

Offline Events sector dominated the Mode segment with 385 million events in 2025, led by traditional meetings and conventions, mega concerts & music festivals, trade shows and exhibitions across mature and emerging regions. They are, however the predominant format, familiar and widely accessed. The Hybrid Events sector is the fastest growing Mode segment, with more than 123 million events in 2025 due to technological adoption, audience outreach, corporate need for flexible formats and the rising popularity of virtual participation with in-person attendance.

Event Industry Market Regional Analysis:

North America Event Industry Market Insights:

North America dominated the Event Industry with 33.42% market share in 2025, with over 200 million events, primarily driven by business events such as corporate meetings, conferences, and trade shows. The US represented the majority at 170 million events and Canada contributed with 30 million of these. Robust corporate demand, mass-centric entertainment events and eagerness for experiential marketing are also fueling growth. With increasing hybrid / digital formats and urban audience engagement, event businesses across verticals also see uplift in event participation.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

U.S. Event Industry Market Insights:

In 2025, the U.S. had more than 335 million events, including 220 million corporate and another 115 million social and entertainment gatherings. Such growth is fueled by hybrid genres, experience marketing, pan-commercial festivals and corporate branding activities combined with digital platforms and the urban convergence of audience in culture businesses, education and social sector across the nation.

Asia-Pacific Event Industry Market Insights:

Asia-Pacific is the fastest Growing region in the Event Industry Growing at a CAGR of 13.53% due to increasing disposable incomes, urbanization & rising demand for corporate, entertainment & hybrid events. China hosted more than 150 million events and India did 65 million events in 2025. A growing embrace of virtual formats and experiential marketing exhibits, large-scale concerts, and festivals, and further aggressive corporate and education participation are driving strong growth in the region.

-

China Event Industry Market Insights:

China held more than 150 million events in 2025, of which about 110 million were corporate and business meetings and some 40 million for entertainment, socializing or festival celebrations. Growth fueled by accelerating urbanization, middle-class income growth, greater hybrid attendance and proliferation of virtual formats, large concerts and immersive experiences with support from digital platforms, corporate and social involvement.

Europe Event Industry Market Insights:

There were over 290 million events in Europe in 2025, led by Germany (85 million), France (75 million) and the UK (60 million). There were 160 million corporate events, and there were even more gatherings for entertainment events, festivals and social gatherings at 130 million. Growth is propelled by the increasing corporate branding, hybrid formats, experiential marketing and big cultural & music festivals in developed and emerging markets throughout Europe.

-

Germany Event Industry Market Insights:

In 2025, there were more than 85 million events held in Germany, of which 50 million were business/corporate and 35 million private/social/festival. Corporate events dominated the market. Growing demand from young professionals, emergence of hybrid formats, and large-scale concerts and experiential marketing & increasing penetration of digital platforms is propelling the growth across business, cultural festivals and social gatherings.

Latin America Event Industry Market Insights:

The Latin America region counted with more than 55 million events in 2025, Brazil being the leading country with 22 million following Argentina and Chile with16 and 9 million events respectively. Corporate and entertainment events represented 35 million, and social held at 20 million. Hybrid models, experiential festivals and digital engagement are boosting business, cultural events and socializing across the region.

Middle East and Africa Event Industry Market Insights:

The Middle East & Africa accommodated 15 million events in the year 2025 of UAE was leading contribution with around 5 million events, followed by South Africa contributing 4 million events. Corporate and entertainment events were 9 million, with social and festival events coming in at 6 million. Just as hybrid formats, experiential marketing and big cultural events are fuelling growth throughout business, festivals and social occasions.

Event Industry Market Competitive Landscape:

Informa PLC dominates the event industry, organizing over 500 events annually, spanning B2B exhibitions, conferences, and trade shows. Its events, attended by millions of industry professionals each year are more than a trade-show. They also feature networking and knowledge sharing between attendees in addition to business opportunities. Combining live and digital trading platforms, Informa provides targeted networking opportunities. Strategic acquisitions complement this organic growth which extends the Group’s influence by introducing new products into markets and enhancing these projects with editorial content.

-

In March 2025, Informa announced a strategic collaboration with Ascential to integrate the prestigious Cannes Lions International Festival of Creativity into its events portfolio. This move significantly strengthens Informa’s position in the creative, marketing, and media sectors.

Reed Exhibitions organizes over 350 large-scale trade and consumer events across the world each year. Its exhibitions and conferences attract millions of professionals annually. RX drives the next generation of experience by connecting communities, allowing clients to achieve business success through integrated offerings including hybrid and virtual events, networking tools and technology, and actionable data solutions. RX’s ability to offer compelling, quality content in multiple markets along with having strong reach has built its strength.

-

In June 2025, Reed Exhibitions successfully hosted INTERPHEX 2025, collaborating with leading pharmaceutical and biotechnology companies to showcase innovations, strengthen industry partnerships, and promote advancements in manufacturing, quality control, and supply chain solutions.

Clarion Events operates over 125 events and media brands across, from breakouts to regional shows. It draws visitors and exhibitors numbering in the thousands from across the globe. Clarion can lead its sector by ambitious event designing, niche-market focusing with the best quality attendees to do business. With a strong, presence with over 150 events in 52 countries consisting of 16 brands, its successful networking platforms such as the FMBs and SVBs are leaders in their respective industries.

-

In February 2025, Integrated HYDROVISION International into POWERGEN International in Dallas, collaborating with hydropower industry leaders to provide specialized content and networking opportunities.

Event Industry Market Key Players:

Some of the Event Industry Market Companies are:

-

Informa PLC

-

Reed Exhibitions

-

Clarion Events

-

MCI Group

-

GL Events

-

UBM

-

Comexposium

-

Freeman Company

-

Live Nation Entertainment

-

Cvent

-

Eventbrite

-

Maritz Global Events

-

PRA Business Events

-

BCD Meetings & Events

-

Meetings & Incentives Worldwide (M&IW)

-

Opus Agency

-

GES (Global Experience Specialists)

-

George P. Johnson Experience Marketing (GPJ)

-

Jack Morton Worldwide

-

XING Events

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 1477.39 Billion |

| Market Size by 2033 | USD 3491.23 Billion |

| CAGR | CAGR of 11.38% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Event Type (Corporate Events & Seminars, Conferences, Exhibitions & Trade Shows, Music Concerts, Festivals, Sports Events, Private Parties, Others) • By Revenue Source (Ticket Sales, Sponsorship, Merchandise, Catering Services, Advertising & Promotion, Others) • By Organizer Type (Corporate, Government, NGO, Individual) • By End User (Enterprises, Individuals, Educational Institutions, Sports Organizations, Others) • By Mode (Offline, Virtual, Hybrid) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Informa PLC, Reed Exhibitions, Clarion Events, MCI Group, GL Events, UBM, Comexposium, Freeman Company, Live Nation Entertainment, Cvent, Eventbrite, Maritz Global Events, PRA Business Events, BCD Meetings & Events, Meetings & Incentives Worldwide (M&IW), Opus Agency, GES (Global Experience Specialists), George P. Johnson Experience Marketing (GPJ), Jack Morton Worldwide, XING Events |