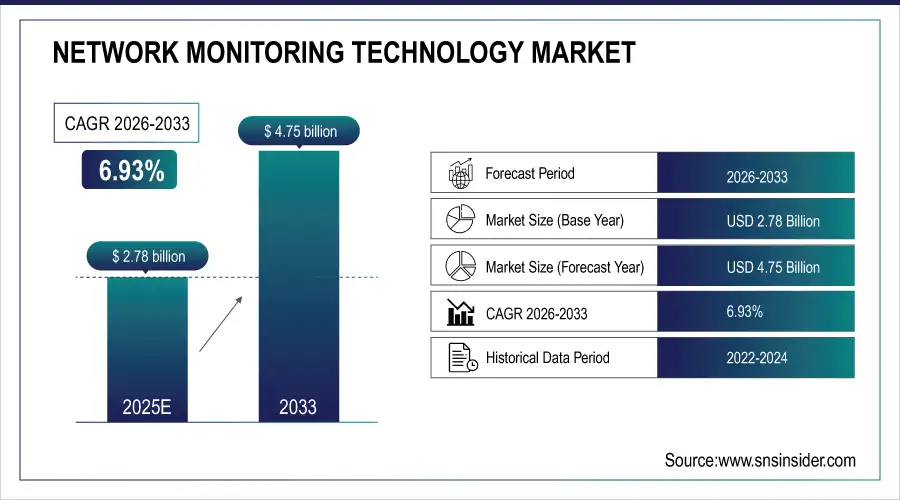

Network Monitoring Technology Market Size:

The Network Monitoring Technology Market was valued at USD 2.78 billion in 2025E and is expected to reach USD 4.75 billion by 2033, growing at a CAGR of 6.93% from 2026-2033.

The Network Monitoring Technology Market growth is driven by increasing adoption of cloud services, IoT devices, and digital transformation initiatives. Enterprises require real-time network performance monitoring, traffic analysis, and anomaly detection to ensure seamless operations and minimize downtime. Rising demand for enhanced cybersecurity, AI-driven analytics, and automated network management tools improves efficiency and reduces operational costs. Growing emphasis on high-speed connectivity, remote work infrastructure, and data-driven decision-making further accelerates market expansion globally.

Network Monitoring Technology Market Size and Forecast

-

Market Size in 2025E: USD 2.78 Billion

-

Market Size by 2033: USD 4.75 Billion

-

CAGR: 6.93% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Get more information on Network Monitoring Technology Market - Request Sample Report

Network Monitoring Technology Market Trends

-

Rising demand for reliable, high-performance IT infrastructure is driving the network monitoring technology market.

-

Growing adoption of cloud computing, IoT, and 5G networks is boosting monitoring requirements.

-

Expansion of AI-driven analytics and real-time performance monitoring is enhancing network visibility and fault detection.

-

Increasing need to ensure cybersecurity, compliance, and service quality is shaping market trends.

-

Focus on reducing downtime, optimizing traffic, and improving end-user experience is fueling adoption.

-

Advancements in software-defined networking (SDN) and network function virtualization (NFV) are supporting modern monitoring solutions.

-

Collaborations between network equipment providers, software vendors, and enterprises are accelerating innovation and deployment globally.

The U.S. Network Monitoring Technology market size was valued at an estimated USD 1.05 billion in 2025 and is projected to reach USD 1.80 billion by 2033, growing at a CAGR of 6.27% over the forecast period 2026–2033. Market growth is driven by increasing adoption of cloud computing, IoT devices, and enterprise networks that require continuous monitoring to ensure performance, security, and reliability. Rising demand for real-time network analytics, anomaly detection, and automation in network management is accelerating market expansion. Additionally, advancements in AI and machine learning integration, growing emphasis on cybersecurity, and increasing investments by enterprises in digital infrastructure further support the steady growth outlook of the U.S. network monitoring technology market during the forecast period.

Network Monitoring Technology Market Growth Drivers:

-

The surge in cyberattacks and data breaches is driving network monitoring technology market

The growing adoption of remote work, cloud computing, and Internet of Things (IoT) devices has significantly expanded the attack surface, making networks more vulnerable to breaches. In response, organizations are increasingly investing in robust network monitoring technologies equipped with artificial intelligence (AI) and machine learning (ML) capabilities. These advancements allow systems to analyze vast amounts of data, identify anomalies, and predict potential threats, thereby enhancing cybersecurity resilience. However, the rising threat landscape also brings challenges to the market. The accelerated adoption of these technologies may lead to higher competition among solution providers, driving the need for continuous innovation. Additionally, smaller organizations may face financial constraints in implementing sophisticated monitoring systems, limiting their ability to respond effectively to threats. Despite these hurdles, the critical need for network security will continue to drive growth in the market.

Network Monitoring Technology Market Restraints:

-

High initial costs can restrict the adoption of advanced network monitoring solutions, particularly among SMEs, limiting market growth and inclusivity.

High initial costs significantly impact the growth trajectory of the network monitoring technology market, particularly in the context of small and medium enterprises (SMEs). Advanced network monitoring solutions often involve substantial upfront investments in hardware, software, and skilled personnel. For SMEs, which typically operate on tighter budgets, such expenditures can be a deterrent to adoption. These organizations often prioritize cost-efficiency over long-term benefits, leading them to opt for less sophisticated tools or delay the adoption of network monitoring altogether.

This challenge is further compounded by the ongoing costs associated with maintenance, upgrades, and employee training, which can strain financial resources. The high initial costs also limit the accessibility of cutting-edge features, such as AI-driven analytics, predictive monitoring, and automated threat detection, to larger enterprises with robust IT budgets.

Network Monitoring Technology Market Segment Analysis

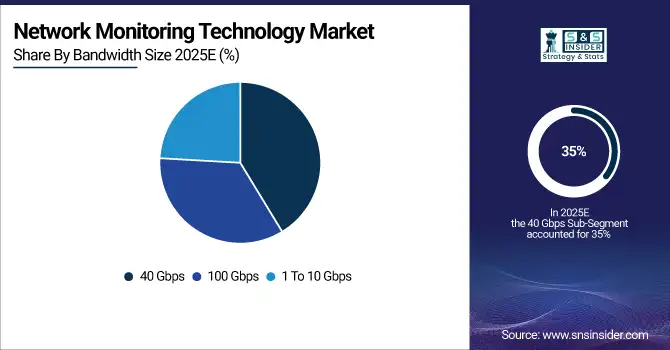

By Bandwidth, 40 Gbps segment dominated the Network Monitoring Technology Market

The 40 Gbps segment dominated with the market share over 35% in 2025, driven by the rising demand for high-speed data transfer in modern networks. With the proliferation of cloud computing, the Internet of Things (IoT), and the expansion of enterprise networks, there is a significant need for faster and more reliable network monitoring solutions. The 40 Gbps networks provide an optimal blend of performance and affordability, making them ideal for a wide range of organizations. These networks can efficiently handle large volumes of data traffic, ensuring minimal latency and downtime, which is crucial for businesses relying on seamless connectivity. Furthermore, the 40 Gbps segment offers scalability and flexibility, accommodating the evolving demands of businesses as they grow.

By Technology, Ethernet segment led the Network Monitoring Technology Market

Ethernet segment dominates with the market share over 39% in 2025, due to its widespread use and cost-effectiveness in large-scale networking applications. It supports high-speed data transmission, making it essential for businesses seeking stable and scalable networking solutions. Ethernet is known for its reliability and robustness, ensuring continuous and uninterrupted communication, which is crucial for industries like telecommunications, healthcare, and finance. Its ability to seamlessly integrate with various network devices has made it the standard for local and wide area networks (LANs and WANs). Despite the rise of newer technologies like fiber optics, Ethernet maintains its lead because of its established infrastructure, affordability, and ongoing improvements that meet evolving business needs in networking and monitoring.

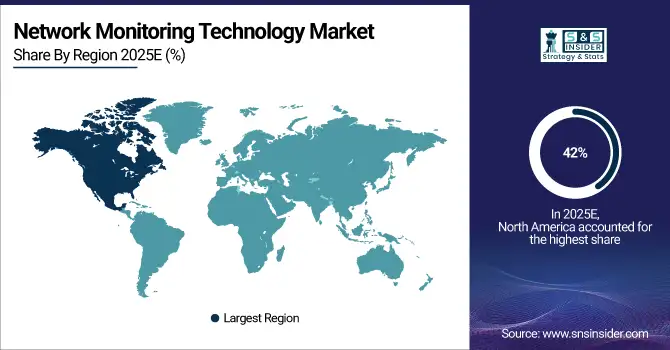

Network Monitoring Technology Market Regional Analysis

North America Network Monitoring Technology Market Insights

In 2025, North America region dominated with the market share over 42%. This growth is primarily fueled by the rising adoption of cloud computing, an escalating need for robust network security, and the growing demand for real-time monitoring of network performance. Key trends in the North American market include the widespread shift toward cloud-based network monitoring solutions, which offer enhanced scalability and flexibility. Additionally, artificial intelligence (AI) and machine learning (ML) are increasingly integrated into network monitoring tools, allowing for more efficient and predictive analysis.

Need any customization research on Network Monitoring Technology Market - Enquire Now

Asia Pacific Network Monitoring Technology Market Insights

The Asia Pacific region is poised to experience the highest growth rate during the forecast period 2026-2033, driven by an expanding presence of network monitoring companies. Key countries like China, Japan, and India are expected to play pivotal roles in this market’s growth. Additionally, the increasing number of small and medium-sized enterprises (SMEs) in the region, along with their growing adoption of digital technologies, is further fueling the demand for network monitoring solutions. The surge in internet penetration and the growing population of internet users in Asia Pacific generate vast amounts of data, creating a rising demand for cloud-based services.

Europe Network Monitoring Technology Market Insights

Europe’s Network Monitoring Technology Market is growing due to increasing enterprise adoption of cloud services, IoT, and digital transformation initiatives. Organizations are investing in AI-driven network performance monitoring, traffic analysis, and automated management solutions to ensure seamless operations and reduce downtime. Rising cybersecurity concerns, regulatory compliance requirements, and the need for real-time analytics are driving demand. Additionally, growth in remote work infrastructure and high-speed connectivity adoption supports market expansion across European countries.

Middle East & Africa and Latin America Network Monitoring Technology Market Insights

The Middle East & Africa and Latin America Network Monitoring Technology Market is expanding as enterprises adopt cloud services, IoT devices, and digital transformation strategies. Growing demand for real-time network performance monitoring, traffic management, and anomaly detection enhances operational efficiency. Rising cybersecurity concerns, need for regulatory compliance, and investment in high-speed connectivity and remote work infrastructure are driving market growth. These factors collectively support the adoption of advanced network monitoring solutions across these regions.

Network Monitoring Technology Market Competitive Landscape:

Gigamon Inc.

Gigamon is a leading network visibility and analytics company, providing solutions that enable enterprises to monitor, secure, and optimize their hybrid and multi-cloud infrastructures. Its platforms collect and analyze network-derived telemetry, delivering actionable insights for IT and security teams. By combining advanced analytics, encryption-aware visibility, and AI-driven guidance, Gigamon helps organizations detect threats, troubleshoot performance issues, and maintain robust observability across complex network environments.

-

2025: Unveiled Gigamon Insights, an AI-powered observability app delivering instant guidance based on network telemetry, helping IT and security teams detect threats and troubleshoot performance across hybrid-cloud environments.

-

2023: Launched Gigamon Precryption technology (GigaVUE 6.4), providing plaintext visibility into encrypted network traffic across VM/container workloads, enabling threat detection without manual decryption.

Datadog, Inc.

Datadog is a cloud-scale monitoring and observability platform that provides real-time insights into infrastructure, applications, and security across hybrid and multi-cloud environments. It integrates telemetry from servers, containers, and cloud services to enable performance optimization, incident detection, and AI-driven observability. Datadog’s extensive integrations and advanced AI capabilities allow enterprises to monitor complex workloads, including modern AI infrastructures, ensuring operational reliability and visibility in fast-evolving digital ecosystems.

-

2025: Released a major platform update at DASH 2025, expanding infrastructure, cloud-network monitoring, and AI/observability features, including deeper telemetry, LLM workload monitoring, and integrated stacks for cloud and hybrid networks.

-

2025: Announced 1000+ integrations across AI infrastructure and tooling, including GPU monitoring, LLM services, and vector databases, demonstrating expansion into AI-heavy workloads.

VIAVI Solutions Inc.

VIAVI Solutions provides network test, monitoring, and assurance solutions for service providers, enterprises, and government agencies. The company’s offerings enable performance validation, proactive troubleshooting, and security monitoring across physical, virtual, and cloud networks. By integrating advanced software, observer platforms, and analytics capabilities, VIAVI helps organizations maintain reliable, secure, and high-performance network infrastructures while supporting continuous innovation in network observability and testing.

-

2025: Updated its Observer platform with integration into a major SIEM solution and enhanced network-test and monitoring capabilities, strengthening enterprise network observability and operational intelligence.

Some of the major key players of Network Monitoring Technology Market

-

Viavi Solutions Inc. (Observer Platform, GigaStor)

-

Juniper Networks, Inc. (Junos Telemetry, Mist AI)

-

Datadog (Network Performance Monitoring (NPM) Module)

-

Broadcom Inc. (DX NetOps, AppNeta)

-

Kentik (Kentik NPM Analytics)

-

Gigamon (GigaVUE Visibility Platform)

-

Apcon (INTELLAPATCH Series, TitanXR)

-

Cisco Systems, Inc. (Cisco ThousandEyes, Meraki Insight)

-

Garland Technology (Packet Broker, TAP Solutions)

-

NETSCOUT Systems, Inc. (nGeniusONE, Arbor Sightline)

-

SolarWinds Corporation (Network Performance Monitor)

-

Riverbed Technology (SteelCentral NPM Solutions)

-

LogicMonitor, Inc. (LM Envision)

-

Paessler AG (PRTG Network Monitor)

-

Nagios Enterprises, LLC (Nagios XI, Nagios Core)

-

ManageEngine (Zoho Corporation) (OpManager)

-

Dynatrace (Network Path Monitoring)

-

Ixia (Keysight Technologies) (IxChariot, CloudLens)

-

Micro Focus International Plc (Network Node Manager i)

-

SevOne (Network Data Platform, SevOne NPM)

Suppliers for Comprehensive visibility into wired and wireless networks of Network Monitoring Technology Market

-

Cisco Systems, Inc.

-

SolarWinds Corporation

-

Paessler AG

-

Broadcom Inc.

-

Netscout Systems, Inc.

-

Keysight Technologies, Inc.

-

Dynatrace, Inc.

-

Juniper Networks, Inc.

-

Zabbix LLC

-

ManageEngine (Zoho Corporation)

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 2.78 billion |

| Market Size by 2033 | USD 4.75 billion |

| CAGR | CAGR of 6.93% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering (Equipment, Network TAPs, Data Monitoring Switches, Software & Services) •By Bandwidth (1 To 10 Gbps, 40 Gbps, 100 Gbps) •By Technology (Ethernet, Fiber Optic, InfiniBand) •By End User (Enterprises, Telecommunications Industry, Government Organizations, Cloud Service Providers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Viavi Solutions Inc., Juniper Networks, Inc., Datadog, Broadcom Inc., Kentik, Gigamon, Apcon, Cisco Systems, Inc., Garland Technology, NETSCOUT Systems, Inc., SolarWinds Corporation, Riverbed Technology, LogicMonitor, Inc., Paessler AG, Nagios Enterprises, LLC, ManageEngine (Zoho Corporation), Dynatrace, Ixia (Keysight Technologies), Micro Focus International Plc, SevOne. |

| Key Drivers | • The surge in cyberattacks and data breaches is driving increased demand for advanced network monitoring solutions, compelling providers to innovate while challenging smaller organizations with financial and integration barriers. |

| Restraints | • High initial costs can restrict the adoption of advanced network monitoring solutions, particularly among SMEs, limiting market growth and inclusivity. |